Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 2 March 2020 00:59 - - {{hitsCtrl.values.hits}}

From left: ICC Sri Lanka Secretary Shanil Fernando, Tax and Regulatory Principal Suresh R.I.Perera, Access Engineering PLC Managing Director Christopher Joshua, The Hotels Association of Sri Lanka President Sanath Ukwatte, DFCC Bank CEO Lakshman Silva, Commercial Bank CFO Nandika Buddhipala, Inland Revenue Dept. Deputy Commissioner D.R.S.Hapuarachchi, Tax and Regulatory Director Rifka Ziyard, and Daily FT Editor Nisthar Cassim

The KPMG Academy, together with the International Chamber of Commerce Sri Lanka (ICCSL) and the Daily FT, organised presentations and a panel discussion on ‘Demystifying the Latest Tax Reforms’ to delineate the changes which are taking place in the Sri Lankan tax regime.

The forum was held on 25 February at the Hilton Colombo Residences where the presentations were delivered by Tax and Regulatory Principal Suresh R.I. Perera, and Tax and KPMG Regulatory Director Rifka Ziyard.

The presentation covered all taxes that have been subjected to reforms in the past three months, such as Income Tax, Value-Added Tax, Nation Building Tax, Debt Repayment Levy (DRL), Economic Service Charge, Port and Airport Development Levy. Suresh Perera, in his opening remarks during the presentation, mentioned that the first notice in relation to the tax reforms was issued on 29 November 2019, and as of the date of the event, a total of 32 web notifications and circulars have been issued, which are being administratively followed although none of the tax reform proposals have been passed into law as yet. In addition to the 32 notifications, there are five tax bills (i.e. VAT, NBT, ESC, Finance Act, and PAL) that have been published but are still pending legislation. However, the Income Tax Bill is yet to be issued.

The key changes introduced were discussed at length during the presentation delivered by Suresh Perera and Rifka Ziyard. The main focus was on the web notification published on 18 February in relation to Income Tax proposals for both individuals and corporates. Rifka Ziyard explained the mechanisms of the withholding regime in Sri Lanka and stated that it is three folds, i.e. withholding on employment income, withholding on investment returns, and withholding on service fees.

She mentioned that post the tax reforms, the withholding of taxes under investment and service fees has been fully removed for a ‘tax resident’ other than withholding for winnings on betting, gaming and lottery and the sale of gems. The withholding on employment has also been removed for a resident, however the retention by the employer of terminal benefits will continue.

The web notice of 12 and 18 February stated: “WHA is not required to deduct WHT on the above payments and taxpayers are required to declare the income from above sources also in their income tax return and make the income tax payment in quarterly instalment basis subject to the provisions of the IRA. Those who have not registered for tax are required to register with IRD for this purpose.”

Suresh Perera pointed out that as per the Income Tax law, there is a provision which states that where the withholding agent fails to withhold , the withholdee (recipient of the stream of income) is liable to pay his/her own taxes before the 15th day of the end of the calendar month the payment was received. He pointed out that Section 86 (4) should be amended in order to ensure a withholdee is not considered a tax defaulter.

Withholding on employment income

The withholding on employment on a resident employee is removed with effect from 1 January. The web notices indicate that any tax withheld for the month of January to be returned to the employee. Rifka Ziyard, in the presentation, pointed out that by advancing the WHT removal from April to January, an additional complexity has arisen in computing the annual Income Tax liability for the Year of Assessment 2019/20 (period from 1 April 2019 to 31 March 2020). As taxes have already been paid for nine months – ending December 2019 – in computing the taxes for the year, the computation will have to be segregated into nine months and three months (from 1 January to 31 March). She further added that a resident, who is now not under the employer withholding scheme, will have to carry out the obligations stemming from the Inland Revenue Act. These obligations include registration for a TIN, filing of Statement of Estimated Income Tax Payable, process quarterly payments, filing a Return of Income, etc.

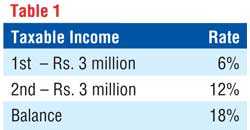

The withholding by employer will continue for a non-resident employee. The non-resident employee, if a citizen, will be entitled to a tax relief of Rs. 3 million per annum. While a non-resident/non-citizen will not be entitled for such relief. The slab rates provided in Table 1 will be applicable for non-resident employees.

Individual Taxation

An individual filing an Income Tax return, who maybe self-employed or a person who is a resident employee not subject to employer withholding, will be entitled to a Rs. 3 million tax relief for an annum. Further, their income will be taxed as per Table 1.

Further, a resident individual is entitled to a qualifying payment relief up to Rs. 1.2 Million for a Year of Assessment from:

(a) health expenditure including contributions to medical insurance;

(b) educational expenditure incurred locally, for such individual or on behalf of his children;

(c) interest paid on housing loans;

(d) contributions made to an approved pension scheme;

(e) expenditure incurred for the purchase of equity or security.

Investment Returns

Further to the tax reforms, a resident will not be subject to withholding tax on payments of dividend, interest, discount, charge, natural resource payment, rent, royalty, premium or retirement payment received and or on service performed by such individual.

The presenters explained that the withdrawal of withholding tax is only the removal of a mechanism but each individual is liable to pay taxes by self-declaring their income and filing the Return of Income. There are instances in relation to interest where some may have to pay higher taxes since under the withholding scheme, the interest was subject to 5% tax and an individual was not called upon to pay any further tax.

A non-resident will continue to be subject to withholding on sources other than dividends. Dividends paid to a non-resident is exempt while interest paid to a non-resident is taxed 5% (subject to the threshold of Rs. 250,000 a month or Rs. 750,000 for the three-month period, ending 31 March). Any other payments, such as royalty or rent to a non-resident person, will be subject to 14% withholding.

Interest Exemptions

The proposals seeks to exempt the interest accruing to or derived by any person outside Sri Lanka on any loan granted to any person in Sri Lanka or to the Government (with effect from 01 April 2018) and the interest on foreign currency accounts opened by any person, in any commercial bank or in any specialised bank, with the approval of the Central Bank (CBSL).

Further interest or a realisation gain received by any non-resident person (other than a Sri Lankan permanent establishment) on any sovereign bond denominated in local or foreign currency is exempt. Furthermore, an exemption is granted to any person who receives interest/discount on any sovereign bond denominated in foreign currency, including Sri Lanka Development Bonds, issued by or on behalf of the Government. Both above exemptions are with effect from 1 April 2018.

Exemptions on Dividends

Dividends paid by a resident company which is engaged in certain activities, such as entrepôt trade, offshore business, front-end service, logistics services and certain headquarter operations, and with an agreement entered into with the Board of Investment (BOI) are exempt.

Dividend exemptions from and gains on the realisation of shares in a non-resident company has been extended to any person (with substantial participation).

In addition to the above, dividends paid by a resident company to a member who is a non-resident person are also exempt.

Service fees

Withholding on service fees paid to a resident has been fully removed from 1 January. Hence an individual who receives service income will have to file the Return of Income if such income is beyond the tax relief threshold of Rs. 3 million per annum.

An exemption has been made available for gains and profits received by any person for any service rendered in or outside Sri Lanka to any person, to be utilised outside Sri Lanka, where the payment for such services is received in foreign currency and remitted through a bank to Sri Lanka.

However, the payment of service fees or management fees to a non-resident will continue to be subject to withholding tax of 14%. Payment made to a non-resident person in respect to land, sea or air transport or telecommunication service is subject to WHT at 2% of the payment. Any withholding of taxes from a payment to non-resident will be subject to the provisions of relevant DTAA.

Corporate Income Tax

The Corporate Tax Rates in Sri Lanka can be divided in to 4. The standard Corporate Income Tax rate is 24% (has been brought down from 28%); the manufacturers enjoy an 18% rate and the concessionary rate of 14% is extended to certain activities. The sin industries, such as betting, gaming, liquor and tobacco, will now be taxed at 28%.

Certain activities, such as information technology and enabled services and agro-farming, have been granted an exemption from Income Tax.

Value-Added Tax

Suresh Perera explained the recent VAT reforms in relation to the VAT rate changes and the threshold. He explained the reasons as to why a price reduction was not experienced although VAT rate was reduced, taking the example of the stocks purchased by paying a VAT rate of 15% prior to December 2019.

The zero rating provided to the hotel industry currently has been issued as a Gazette notification under Section 2 A of the VAT Act. He further added it is important that the zero rating status should be granted through Section 7 of the VAT Act, and in drafting the law, the same needs to be considered. Other areas in relation to VAT exemptions, such as voluntary registrations, SVAT inactivation, etc., were also discussed.

Abolition of taxes

Certain taxes have been removed from the tax system in Sri Lanka post the reforms. Nation Building Tax, which was introduced in 2009 for a limited period of two years, has now been abolished with effect from 1 December 2019 after almost 10 years. While the Debt Repayment Levy, which was a charge on the VAT on FS basis, has also been removed from 1 January. The DRL was introduced in October 2018 and the duration of the tax was three years, and it was expressly embedded in the law that the tax would cease to operate automatically, end December 2021. However, it has now faced a premature death, effective from 1 January.

Further, Economic Service Charge, which is a percentage tax on the turnover, has also been abolished with effect from 1 January.

Rifka Ziyard, in her presentation, stated that the banks and financial institutions were faced with additional compliance burden when NBT was extended to financial services in 2014 and DRL was also introduced in 2018. On the same Value-Added Tax basis calculated for financial services, a bank or financial institution was paying VAT at 15%, NBT at 2%, and DRL at 7% with separate returns, computations and payments, etc.

The collection of NBT on financial services and DRL for the nine months, ending 30 September 2019, from five large listed banks amounted to Rs. 11.1 billion approximately as per the interim financials. The removal of NBT and DRL will provide major relief to banks and financial institutions.

The presentation was followed by an intellectual and interactive panel discussion with the audience posing multiple questions to the panellists. The panel comprised eminent personalities from key industries, including Inland Revenue Department Deputy Commissioner General D.R.S. Hapuarachchi, ICC Sri Lanka Secretary and World Express CEO of Shanil Fernando, DFCC Bank Chief Executive Officer Lakshman Silva, Access Engineering Managing Director Christopher Joshua, Hotels Association of Sri Lanka President Sanath Ukwatte, and Commercial Bank CFO Nandika Buddhipala. Suresh Perera and Rifka Ziyard also joined the panel. The panel session was moderated by Daily FT Editor Nisthar Cassim.

In his opening remarks pertaining to the reforms, Hapuarachchi said the reforms, which take the nature of a significant tax cut, focus on the long-term economic policy of the Government as opposed to short-term Government revenue.

He further added that although there may be a sudden drop in revenue, these tax cuts would eventually result in the creation of jobs as well as an improvement of the economy. In addressing a question in relation to the number of press notices issued by the DIR, he said that while the Government does have a policy for the development of the economy and the country, the proposed changes are initially approved by the Cabinet prior to being shared with the DIR. Hence the DIR needs to be ready for implementation as and when required.

Joshua, in speaking on his observations, welcomed reforms introduced by the Government, particularly the reduction in the Income Tax rate for the construction industry from 28% as per the Inland Revenue Act to 14%.

He elaborated on the history of the Income tax rate of the construction industry, stating that prior to 2018, the industry was taxed at the rate of 12%. He also addressed the removal of withholding tax on the payments made to contractors and stated that measures, such as the removal of NBT, WHT and the reduction of the corporate Income Tax rate, would all help to drive prices down, resulting in an upturn in the construction industry. Joshua expressed his gratitude to the Government and also added that companies would now be encouraged to venture overseas and engage in foreign investments.

Sanath Ukwatte expounded on impact the tax concessions would have on the tourism industry and concluded that the reforms were a positive move but stressed that a gestation period of approximately five years would be required in order to observe the intended result of the changes. He further mentioned that the tourism industry has been hit hard by the recent coronavirus scare and that the Government has been continuously supporting the tourism industry.

Ukwatte stated that with the reforms, Sri Lanka has become increasingly investor-friendly and the ease of doing business has improved. “The Government must manage expenditure and maintain consistency for a period of five years in order to observe significant positive response to the changes implemented,” he added.

Lakshman Silva also stated that the abolishment of the withholding tax on interest has eased the administrative hassle as well as costs involved in complying with the regime. He further mentioned that prior to the changes, the average tax rate of the finance and banking industry was 62%, which was similar to that of the construction industry. However, he requested for consideration to be paid to other provisions of the IRA 2017 in order to bring them in line with the provisions and regulations of the CBSL and maintain consistency across the board.

He mentioned that banks and financial institutions have adopted IFRS at the request of the CBSL from 2018 and have therefore presented financial statements and declare dividends on the basis of IFRS 9. However, for the purposes of taxation, institutions are required to revert back to provisioning as per the CBSL methodology. In order for the benefit to be wholly passed on to the financial sector, the IRA methodology for computing Income Tax for financial institutions must be revised. He welcomed all the tax changes subject to the revision of certain IRA provisions.

Nandika Buddhipala, in reasoning to a question raised by the moderator on the impact to the banking sector, stated that the events in an economy directly impact the banking sector. The construction and consumption industries are the driving forces of the economy and any concessions offered to these industries would have a positive impact on the performance of the banking industry.

He echoed the sentiments expressed by Lakshman and stated that the disparity between the requirements of the IRA and the CBSL as well as the excessive taxes imposed are negatively impacting overall activity of the banking sector. He mentioned that it obvious to see that the Government has jumped into the deep end in increasing the attractiveness of Sri Lanka as an investment opportunity but that consistency must be maintained in order for policies to remain a success.

Shanil Perera mentioned that although the Government is heading in the right direction, most companies do experience a learning curve. He also suggested that with the implementation of OECD rules worldwide, a moratorium in relation to foreign exchange in order to enable foreign funds to be brought back into the country would be a timely need.

Rifka Ziyard, in responding to a question from the audience, mentioned that there is a need to establish a national tax council so that the tax policies are designed based on long-term perspective.

Lakshman Silva, speaking on the exemption of pass-through dividends from Income Tax, raised the question of having to issue two separate dividend counterfoils at the time of declaring pass-through dividends and dividends over the value of pass-through dividends. He added that the DIR must issue a clarification or direction as these are pressing matters that would be raised by shareholders during the upcoming annual general meetings.

The audience raised multiple questions to the panellists, who helped to dispel misinformation as well as provide clarity to those in attendance. In fielding a question from the audience, Suresh Perera stressed the importance of introducing a tax ombudsman who would provide solutions to the taxpayer while considering the equity and justice of both the taxpayer and the Commissioner General. He further added that although Sri Lanka did have an ombudsman in previous years, the office, unfortunately, died a natural death.

Pix by Indraratna Balasuriya