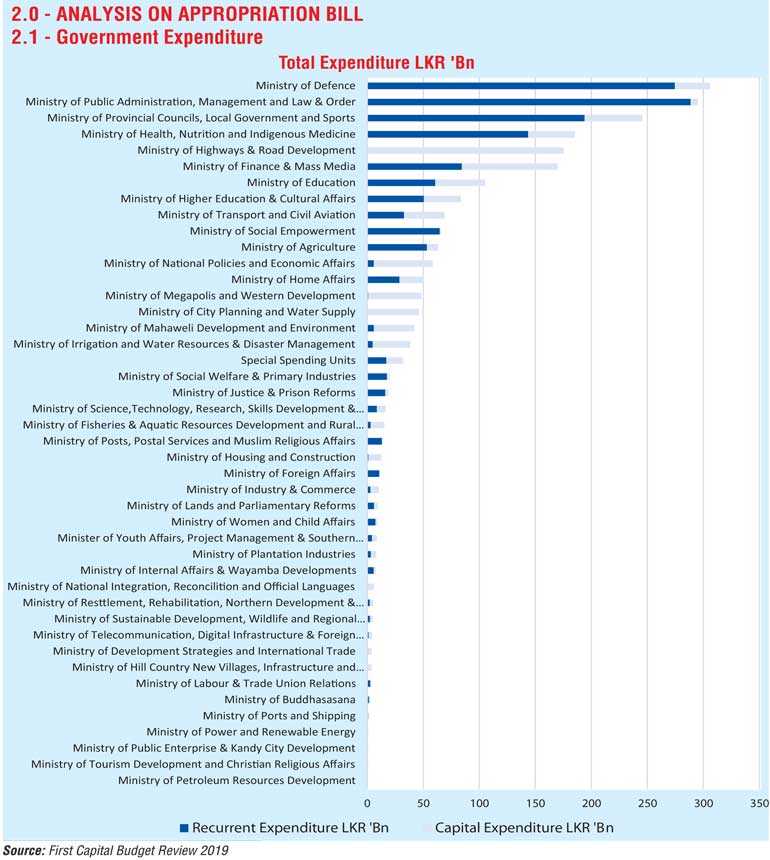

The Budget for 2019 focused on continuing its reform agenda though with a much slower liberalisation policy framework while taking measures to revive and strengthen the local entrepreneur. Heavy focus has been laid on promoting tourism together with investing in transportational infrastructure, education and housing whereas improving revenue collection and mobilisation remained priority.

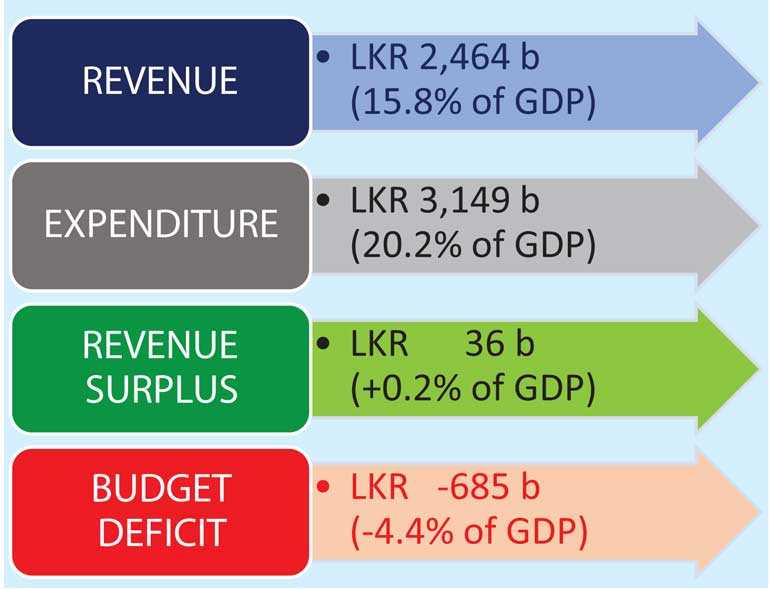

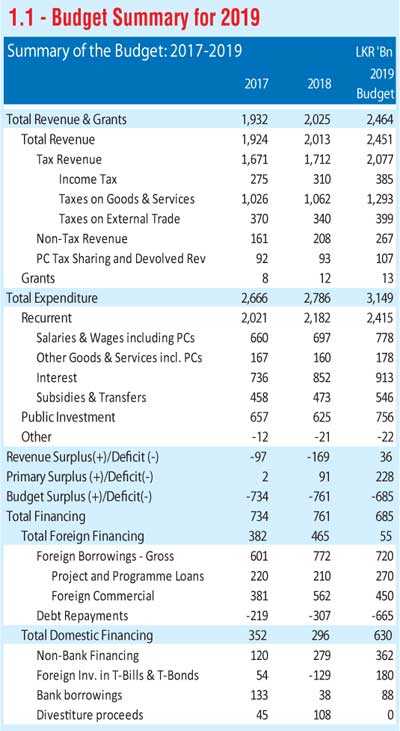

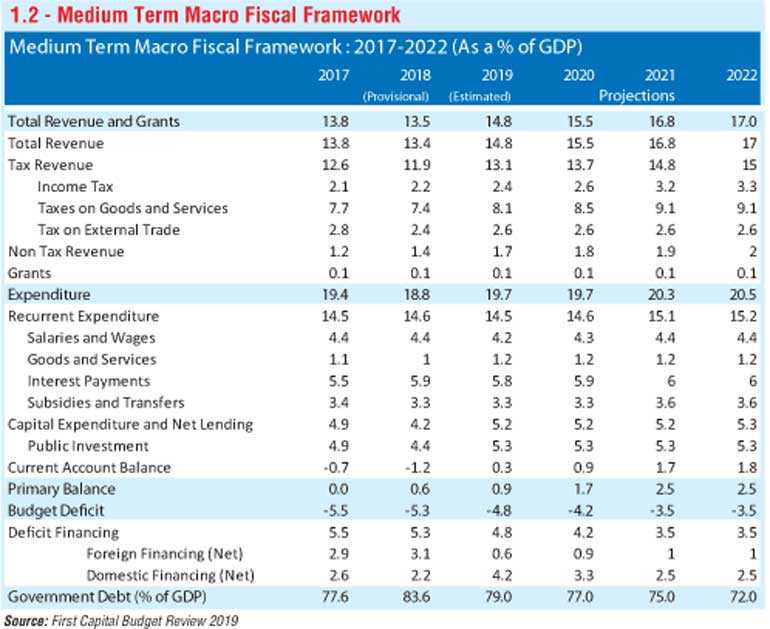

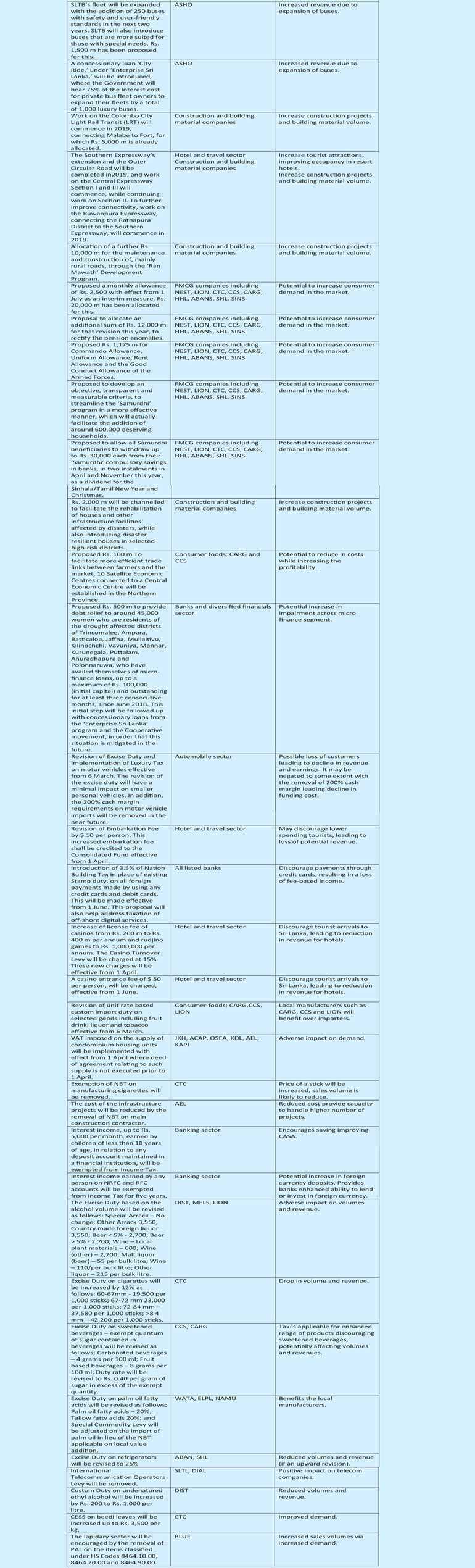

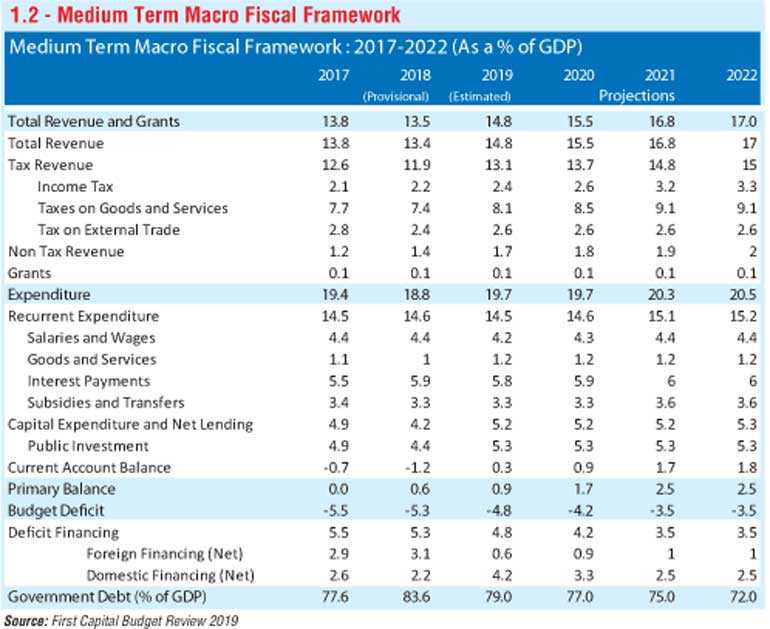

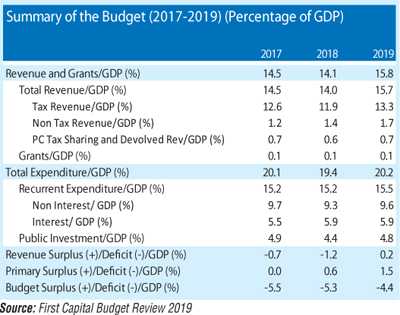

The Government plans on a sustained path of fiscal consolidation as it aims to enhance the revenue surplus it achieved in 2018 and reduce the budget deficit to 4.4% of GDP for 2019 while the Debt to GDP ratio is expected to improve to 77%.

- The Government continues with its plans to remove para-tariffs in its process of liberalisation but has laid down a strategy for its implement at a slower pace of three to five years. Reviving local industries especially construction has been targeted with measures to promote local construction and lower construction costs. The Government also expands its existing ‘Enterprise Sri Lanka’ program with enhanced loan schemes at concessionary rates supporting start-up entrepreneurs.

- The Budget has a special focus on investing on infrastructure with funds being allocated to initiate the Light Rail project and complete the expressways while continuing and expanding urban housing projects. Human capital development has also been recognised with educational loans for tertiary education and foreign education programs for local university candidates among others.

- Capital market development measures are at a minimum within the Budget, only limited to promoting female participation in the boardroom.

1.0 Fiscal strategy

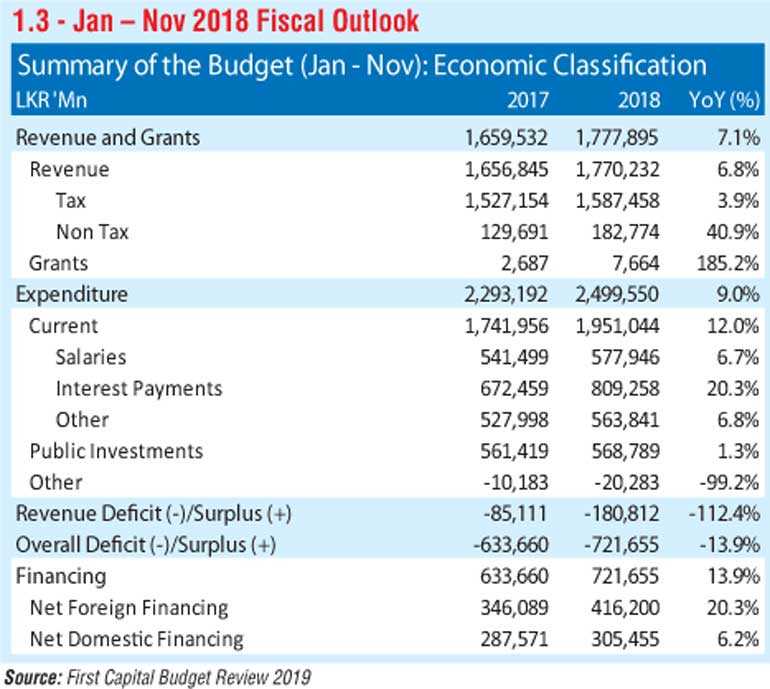

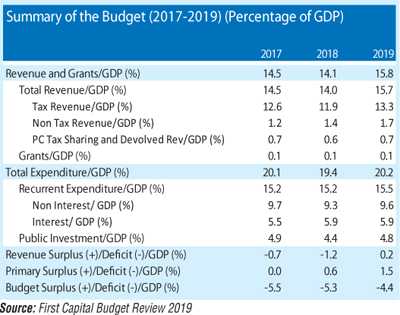

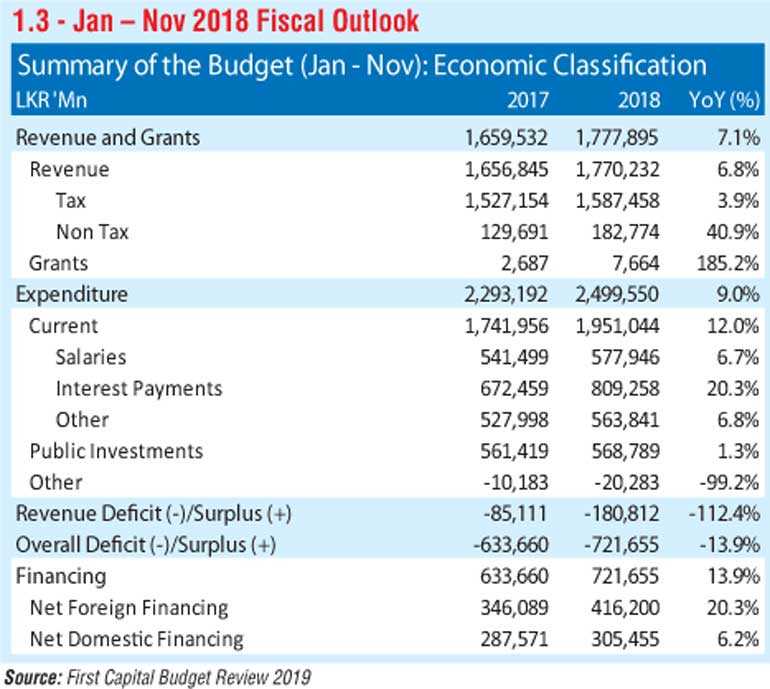

The Government’s fiscal strategy is on fiscal management with priority provided for sustained reduction of fiscal deficit and outstanding public debt via enhanced revenue mobilisation. Since 2015 revenue has regained upward momentum while deficit reduction is currently planned at a slower pace.

In previous years budget deficit of 3.5% was targeted as at 2020, but expectations have been reduced to 4.2% deficit in 2020 and finally reaching 3.5% in 2021. Nevertheless fiscal consolidation has continued with utmost focus despite 2019 being an election year.

2019 Budget tax increases are more widespread for the retail market while higher taxation has been targeted from cigarettes, alcohol and tobacco industries while vehicle taxation has also been increased. Though para tariff removal continues to be a focus point, it proposed to be implemented in staggered mode within a three to five year period.

The Government is expected to register a revenue surplus of 1.5% of GDP in 2019. Further, the budget deficit is anticipated to be reduced to 4.4% with Debt to GDP ratio expected to fall to 77.0%.

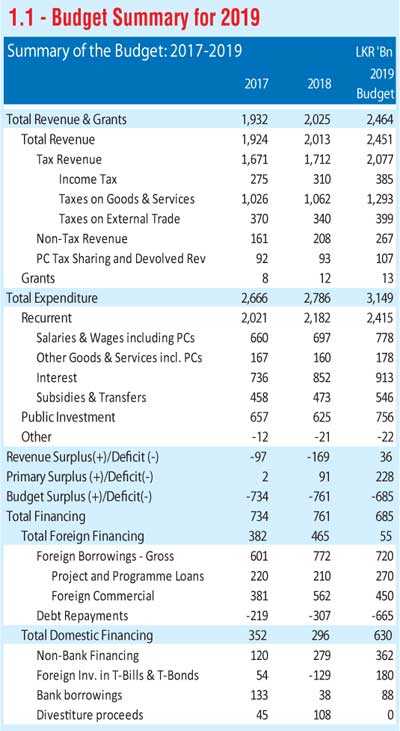

- The Government plans to grow total revenue and grants to 15.8% of GDP to Rs. 2,464 b for 2019 with 84% of the revenue expected through taxes, while Taxes on Goods & Services continuing to take the top slot contributing 62.3% of tax revenue and 52.5% of total revenue and grants. Nontax revenue is forecasted to be 10.8% of the total expected Government revenue.

- The total planned expenditure for 2019 is Rs. 3,149 b, resulting in 20.2% of GDP, growing from 19.4% of GDP in 2018. Recurrent expenditure is forecasted to be controlled at 76.7% of total expenditure constituting 15.5% of GDP higher 2018 figure of 15.2% of GDP. Salaries and interest payments are expected to be the largest components of recurrent expenditure amounting to 32.2% and 37.8% of recurrent expenditure respectively.

- Government plans on spending public investments at 4.8% of GDP amounting to Rs. 756 b growing from a low of 4.4% of GDP in 2018.

2.0 Analysis on Appropriation Bill

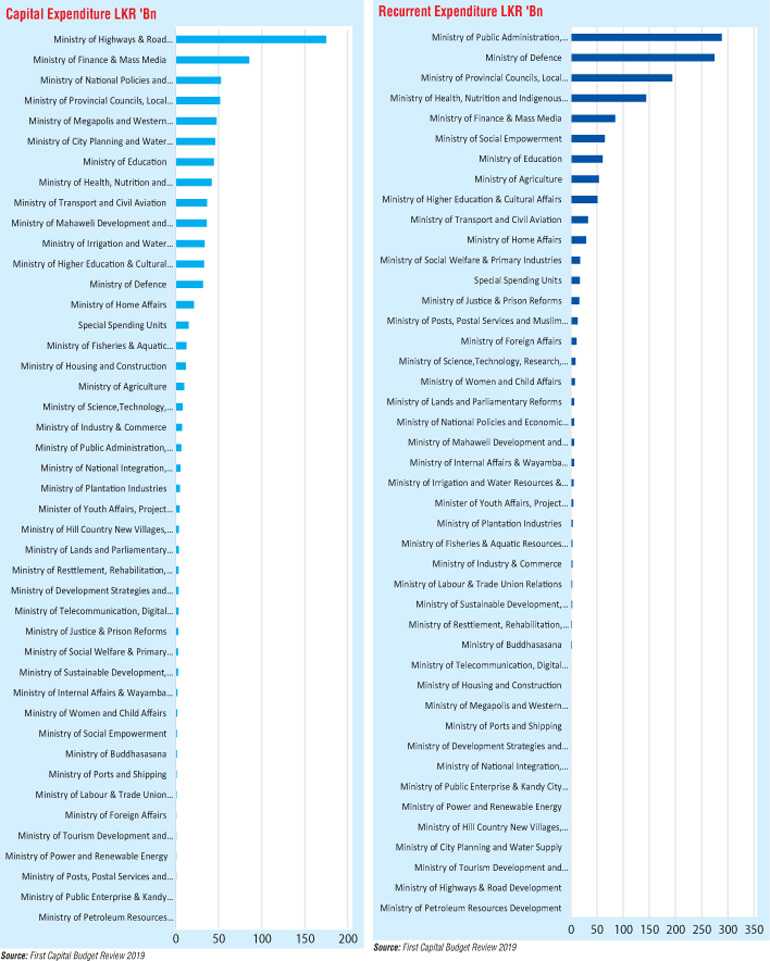

2.1 Government expenditure

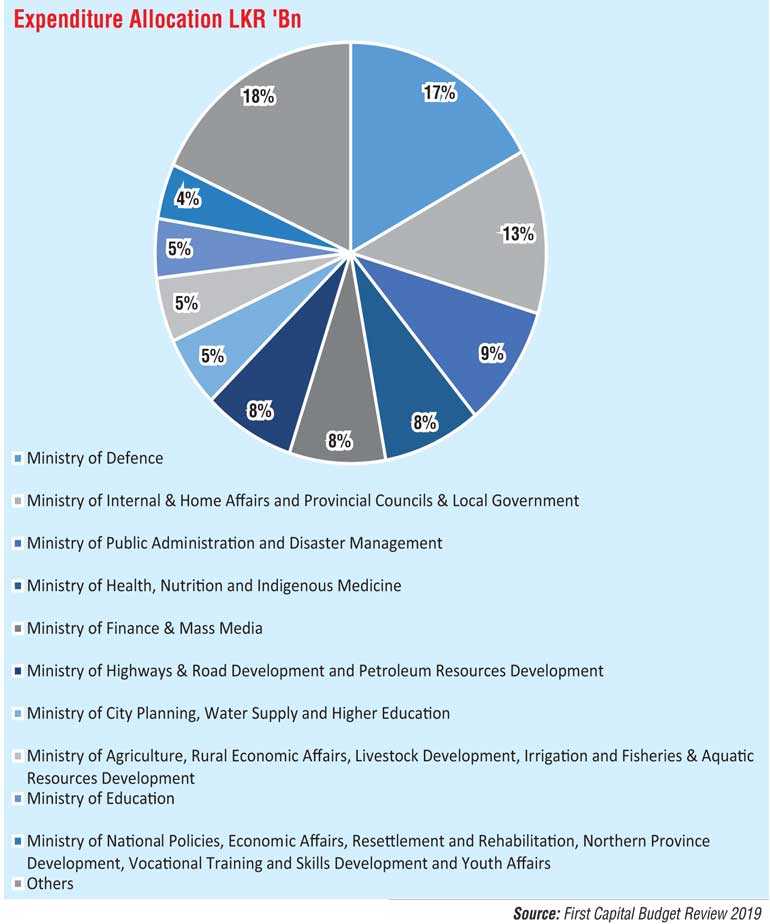

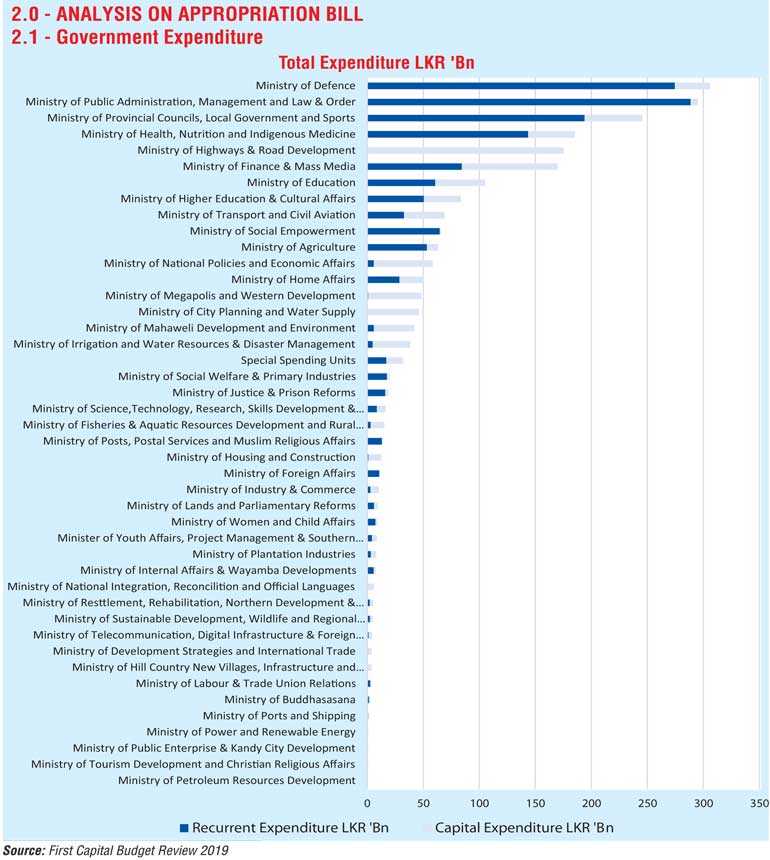

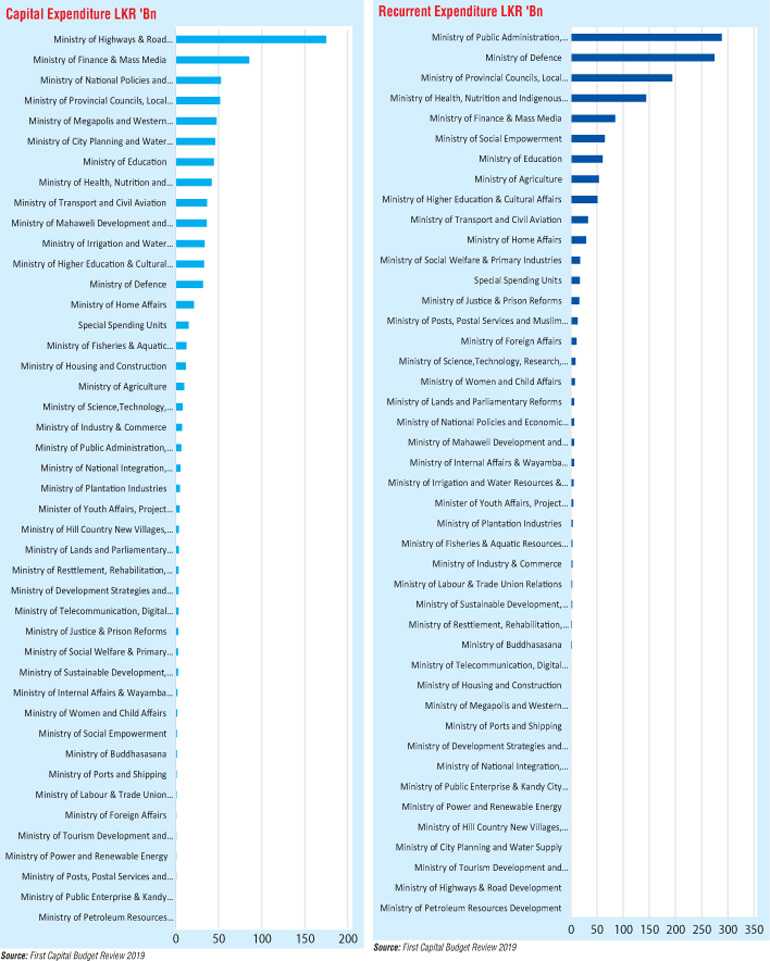

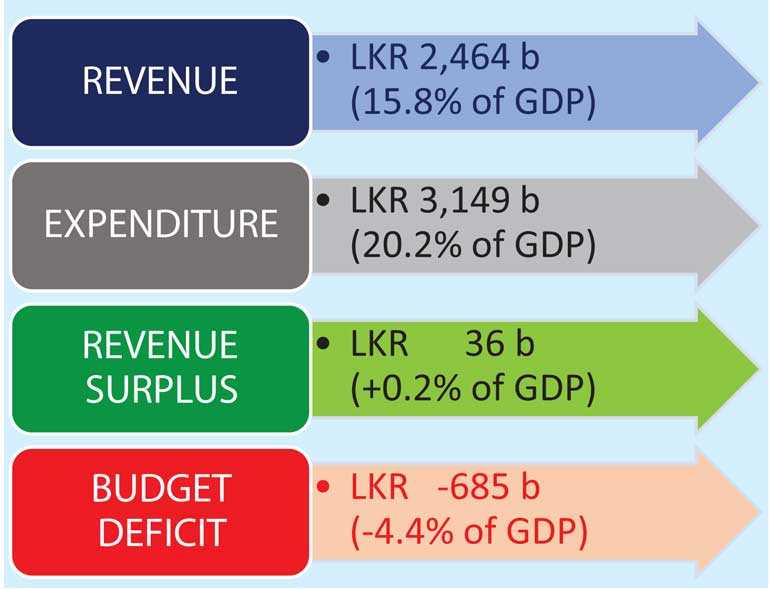

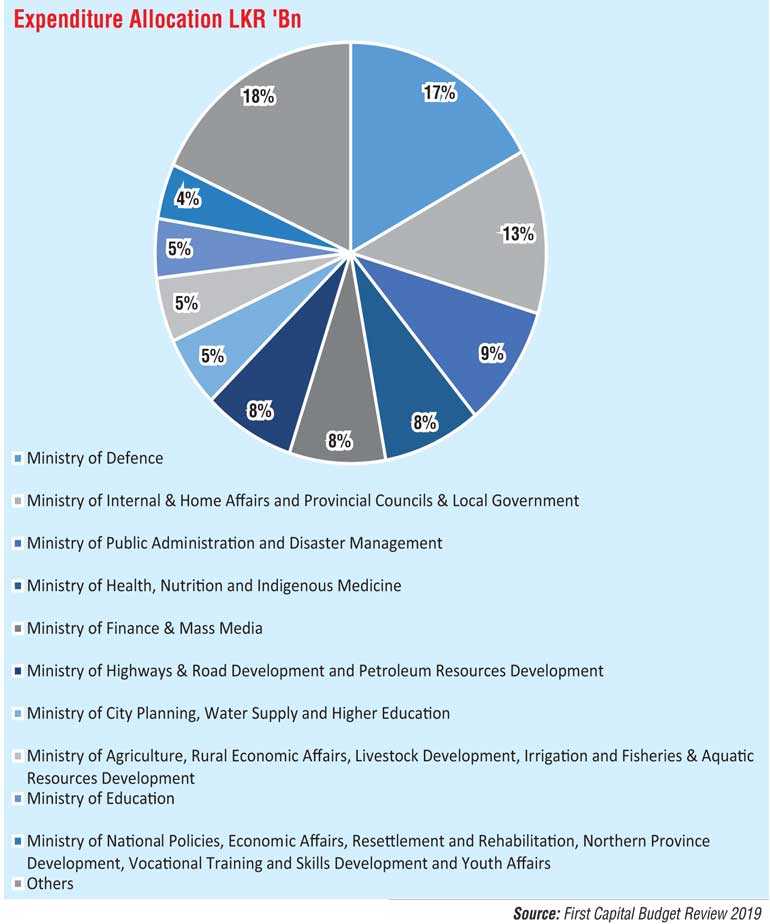

- With the aim of narrowing the budget deficit the Appropriation Bill for 2019 projected a total Government expenditure for 2019 to be Rs. 3.1 t (20.2% of GDP) as opposed to Rs. 2.8 t for 2018. The highest allocation of expenditure in the 2019 Budget is for the Ministry of Defence which is Rs. 393.1 b, of which 91% is recurring expenditure (Rs. 356.4 b).

- The bulk of the Budget’s total expenditure is allocated for recurrent expenditure, amounting to Rs. 1.4 t (15.5% of the GDP). 38.0% of the recurring expenditure reflects interest payments (Rs. 913 b) while 32.0% is allocated for salaries and wages (Rs. 778 b).

- Total capital expenditure stands at Rs. 877 b, which is surprisingly less than the interest payments. The highest capital expenditure allocation is for Ministry of Highways and Road Development and Petroleum Resources Development which is allocated Rs. 175 b of capex, which represents 99.7% of its total allocated expenditure. The Finance Ministry has been allocated a sum of Rs. 183.8 b while the Ministry of Provincial Councils and Local Government was allocated Rs. 292.4 b, of which bulk of the expenditure still reflects recurring expenditure.

2.2 Government revenue changes for 2019

- Introduction of Nation Building Tax on manufacture of cigarettes effective from 1 June 2019. Accordingly, Excise Duty on cigarettes which are more than 60 mm will be increased by 12%, resulting in an increase of Rs. 5 per stick on average.

- Revision of Excise Duty and implementation of Luxury Tax on motor vehicles effective from 6 March. In addition, the 200% cash margin requirements on motor vehicle imports will be removed in the near future.

- Revision of Cess Duty on importation of tendu leaves (beedi leaves) from Rs. 2,500 to Rs. 3,500 per Kg, effective from 6 March.

- Introduction of 3.5% of Nation Building Tax in place of existing Stamp Duty, on all foreign payments made by using any credit cards and debit cards.

- Increase of Excise Duty on hard liquor manufactured locally by 8% and malt liquor by 12%.

- Piece based VAT rate on disposal of garments by BOI approved enterprises will be revised from LKR 75 to LKR 100 on the basis on inflation indexation.

- 15% increase of all fees and charges which have not been revised since 2016.

- Increase of toll on expressways by Rs. 100 during peak hours effective from 1 April.

- Increase of license fee of casinos from Rs. 200 m to Rs. 400 m per annum and rudjino games to Rs. 1 m per annum. The Casino Turnover Levy will be charged at 15%.

- A casino entrance fee of $ 50 per person, will be charged.

- Excise Duty on refrigerators will be revised to 25%.

- Duty rate will be revised to 40 cts per gram of sugar in excess of the exempt quantity.

- Rate of the levy on gross collection will be revised to 15%.

- Embarkation Levy will be increased by $ 10 to $ 60 per passenger.

- Unit rate of the Custom Import Duty will be increased by 10% on importation of selected goods.

- Custom Duty on undenatured ethyl alcohol will be increased by Rs. 200 to Rs. 1,000 per litre.

3.0 Budget and the capital market

3.1 Capital market developments – bills, bonds, corporate debt, equity

- Introduce script-less Sri Lanka Development Bonds (SLDBs) and enable coupon stripping of Treasury bonds.

- Proposal on encouraging more women representation on corporate boards. The proposed sequencing of introducing mandatory representation of women on corporate boards is as follows;

i. SEC will introduce a voluntary target of 30% of women in director boards of companies listed on the CSE. All listed companies shall disclose the percentage of women on their boards in their Annual Report.

ii. ii) By 31 December 2020 all listed companies that are unable to meet the 30% voluntary target will be required to disclose reasons for being unable to do so.

iii. By 31 December 2022 all listed companies shall have at least 20% of board seats occupied by women.

iv. By 31 December 2024 all listed companies shall have at least 30% of board seats occupied by women.

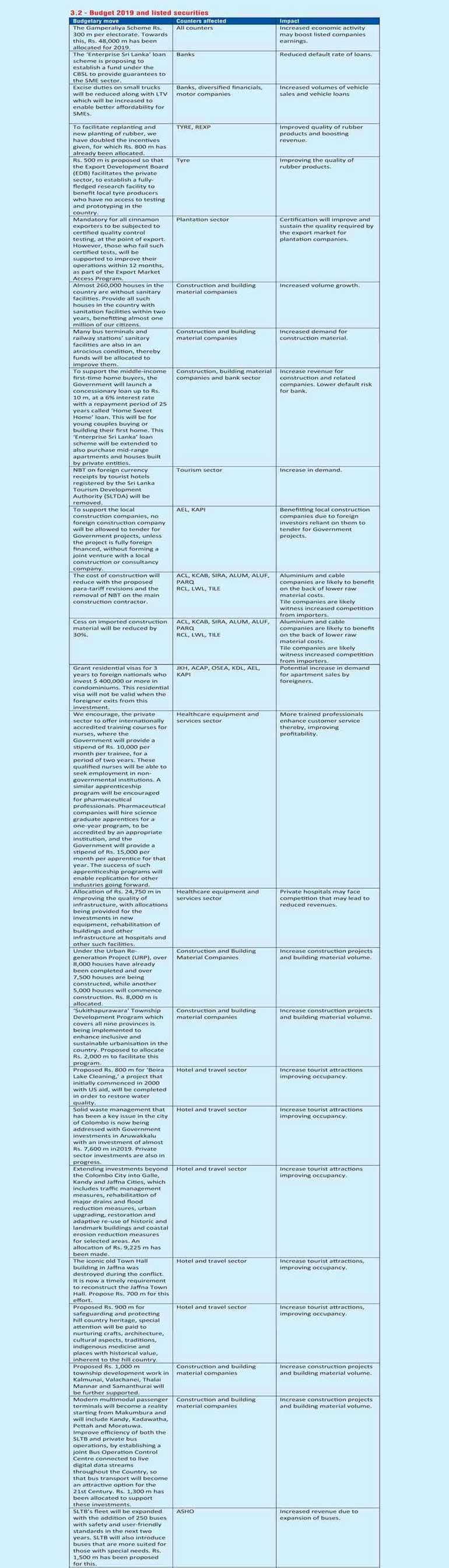

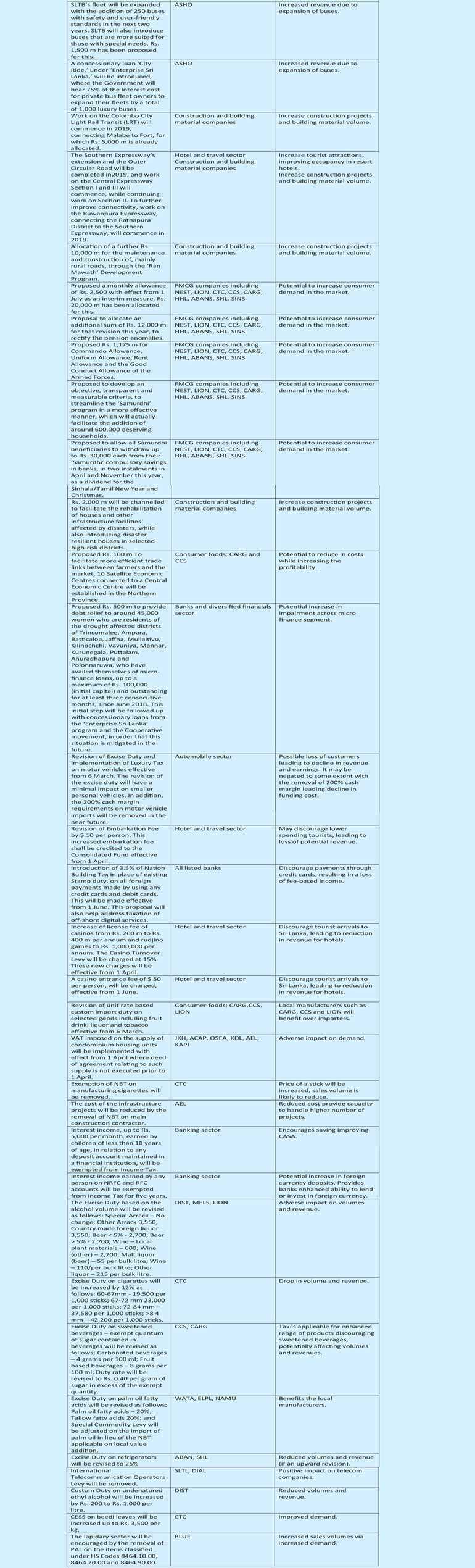

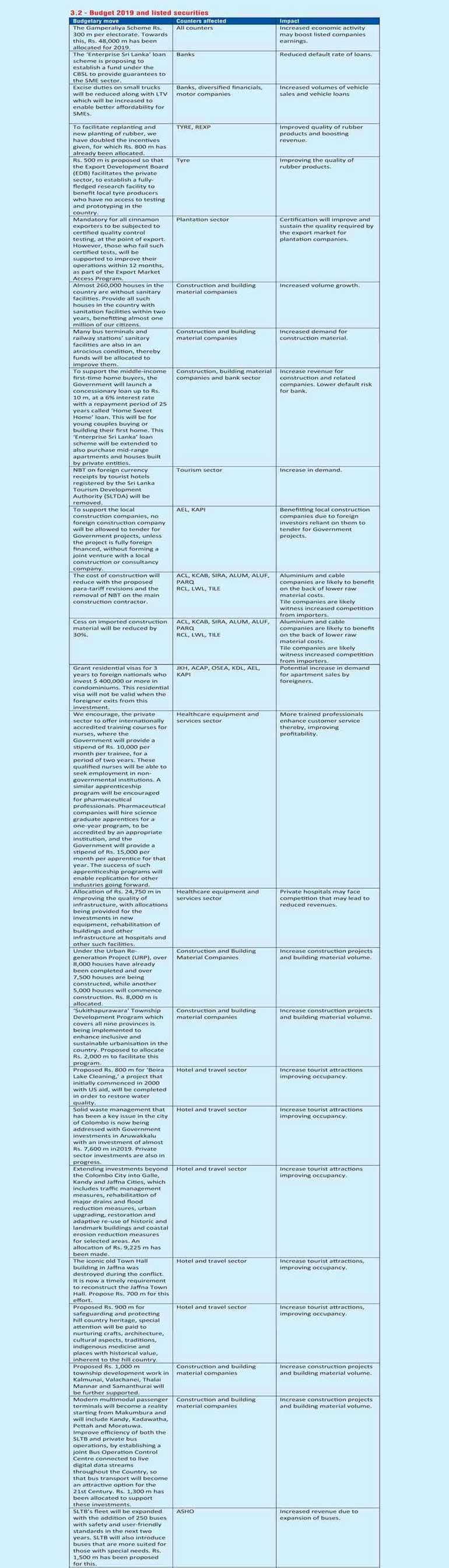

3.2 Budget 2019 and listed securities