Thursday Feb 26, 2026

Thursday Feb 26, 2026

Thursday, 1 February 2018 00:00 - - {{hitsCtrl.values.hits}}

For the seventh consecutive year, MTI Consulting, via their Corporate Finance practice, in partnership with Daily FT, Daily Mirror and Sunday Times, has concluded the MTI Business Outlook Study, collectively outlining the Sri Lankan business community’s perception of the state of business in 2018.

Supplemented by MTI’s experience as a thought leadership-oriented organisation, the annual survey collated and analysed the perceptions of over 150 Sri Lankan business leaders with regard to their business’ past and expected performance, their predictions regarding the state of the local and global economy in 2018 and the main challenges they believe Sri Lanka and its companies will face in 2018.

The results of the survey, including its supplementary analysis, will enable organisations to streamline their strategic decision-making for 2018, effectively enabling them to gear their operations in accordance with the economic sentiments of their peers.

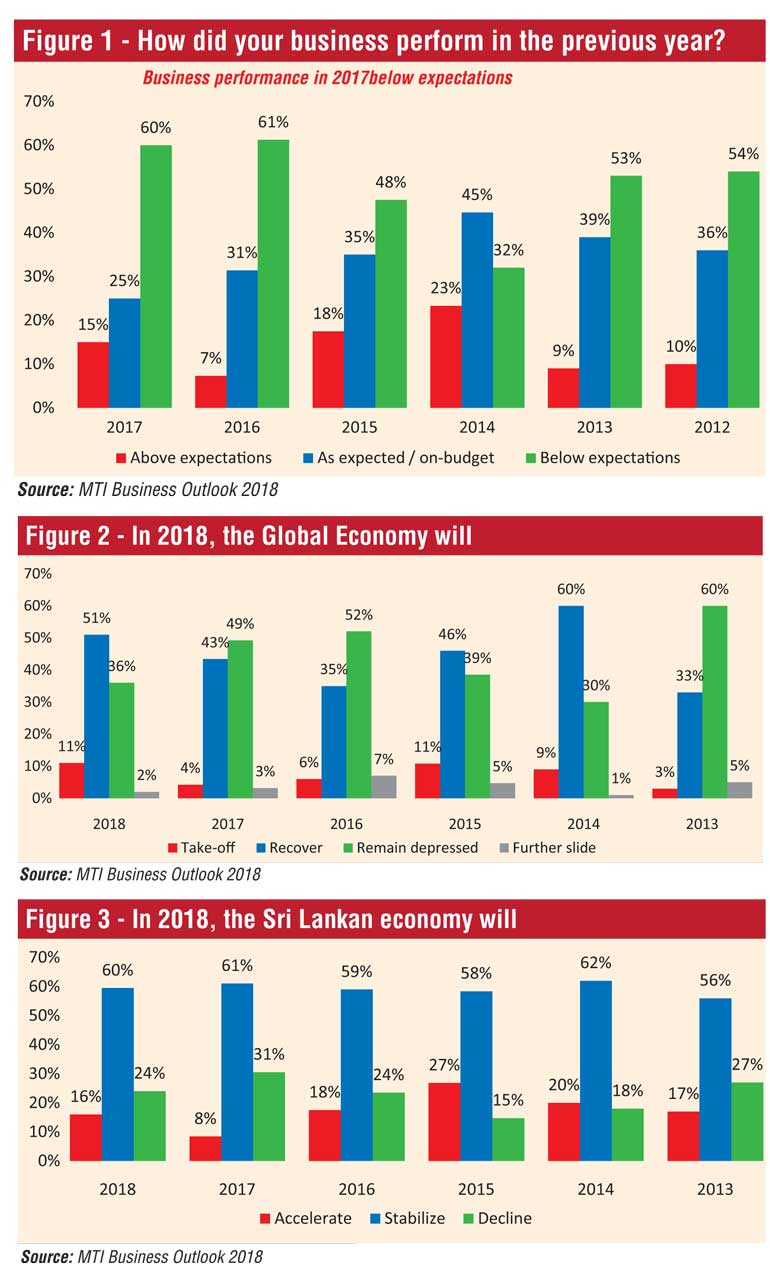

Business performance in 2017 below expectations

Following a similar trend of the previous year, 60% of CEOs reported that their businesses performed below expectations in 2017. Notably, in comparison to the previous year, 15% of the CEOs believe that their businesses have performed above expectations in 2017, which shows an 8% increase in this sentiment when compared to 2016.

Banking and constructions drives growth, while agriculture decelerates

To supplement the CEO perceptions in 2017, MTI analysed the key macroeconomic indicators of Sri Lanka for 2017.

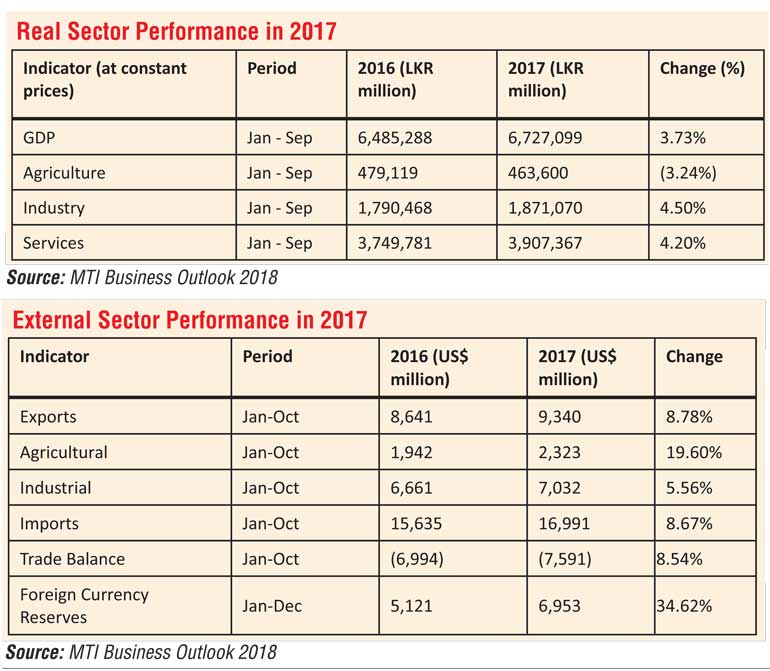

Real sector performance in 2017

The agriculture sector has continued to decelerate marking seven consecutive quarters of contraction attributed to adverse weather conditions in Q1 and Q2 of 2017. Through the first three quarters of 2017, the industrial sector displayed the strongest growth of 4.5%, mainly driven by 9.6% growth in the construction sector.

However, the manufacturing sector of the economy performed poorly in the first three quarters with the gross value added contracting by 7.2%. Services sector growth was driven by strong performances in the Banking and Financial Services and IT service sectors, which displayed growth rates of 15.9% and 8.9% respectively.

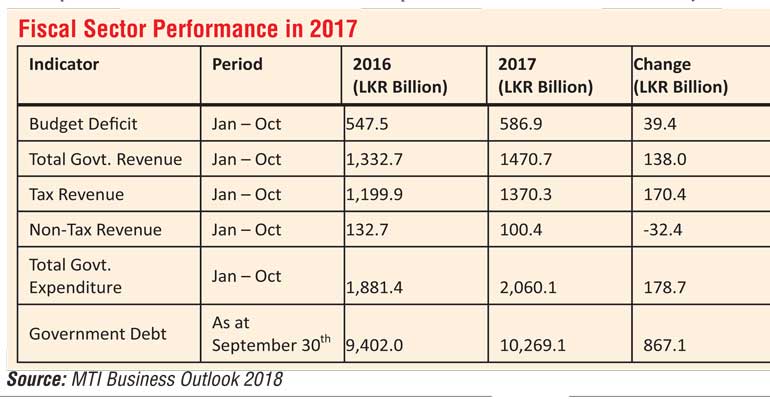

External sector performance in 2017

Improved foreign currency reserves – but big debt payments coming up

A strong export performance was witnessed during the first three quarters of 2017, driven by the strong external demand in the US, the UK and the EU due to favourable economic conditions in those regions. The large increase in agricultural exports has been attributed mainly to higher tea prices at global auctions and increased global demand for Sri Lankan rubber due to suppressed Thai rubber supply. There has been significant strengthening of foreign currency reserves due to assistance from the International Monetary Fund (IMF) and the China Merchant Port deal for the Hambantota harbour. Compared with 2016, foreign direct investments in Sri Lanka have increased, which has contributed to the further strengthening of the forex position. However, with major debt payments due in the 2019-2022 period, further strengthening is vital to minimise sovereign insolvency risk.

Fiscal sector performance in 2017

A 14.2% increase in tax revenue was recorded during the first 10 months of 2017, attributed mainly to VAT measures and the recently legislated Inland Revenue Act. These measures are set to increase government revenue in line with the IMFs Extended Fund Facility (EFF) Program.

The above measures have led to a surplus in the primary account for the first time in 63 years. However, the budget deficit is expected to expand mainly due to large government expenditure on relief and higher interest payments.

The 9.22% increase in government debt has raised the total debt level further. By end 2017 it is expected that the debt-to-GDP ratio will be higher than at end 2016 (at which time it stood at 79.3%). This rise is attributed to continuously high budget deficits and relatively slow GDP growth.

Private sector lending cools down – Government focuses on inflationary pressures

Policy interest rates were changed from the December 2016 levels to the current levels in March 2017. Further tightening of the policy rates was seen as a move to counter build-up of adverse inflation expectations and the possible acceleration of demand side inflationary pressures through excessive monetary and credit expansion.

The Average Weighted Prime Lending Rate (AWPR) reached a maximum of 12.26% in August 2017, thus slowing down aggressive lending in the private sector observed over the past few years. Increased rates alongside new capital adequacy requirements leading up to implementation of Basel III has decelerated private sector credit growth compared with 21.13% growth in 2016 and 27.01% growth in 2015.

The growth in reserve money too has reduced and stood at 14.10% in 2017 compared with 22.71% in 2016 and 17.99% in 2015. This lower growth is mainly attributed to the deceleration in private credit growth mentioned above, which has reduced growth in the broad money supply.

How have the major industries performed?

Net Foreign Inflows – the only standout features of the stock market

The All Share Price Index (ASPI) rose from 2.26% to 6,369 points in 2017 - its first annual increase in three years. The S&P SL 20 index was up 5.7% to 3,672 points in the same period from a decline of 2.8% in the previous year. The market recorded a daily average turnover of Rs. 915.3 million in 2017, up from Rs. 737 million in 2016.

Notably, the Bourse experienced a net foreign inflow of Rs. 17.7 billion within the year, a significant increase from Rs. 383.5 million in 2016. Foreign investors continued to dominate the market with a contribution of 47.1% in 2017.

Market Capitalization stood at $ 18.9 billion compared to $ 18.7 billion in the previous year, with activity limited to 2 equity IPOs, 1 equity introduction and 5 debt issues in 2017.

Listed corporates saw earnings decline marginally by 1.4% YoY in Q3 of 2017, compared with the same period in 2016. This was on the back of earnings falling in the banking, finance and the insurance sector and the beverage, food and tobacco sector, despite the diversified sector growing 62% YoY in Q3 of 2017.

2017 Global Economic Growth – highest since 2011

2017 ended on a high note reaching 3.7% global economic growth, up from just 2.4% in 2016, making it the highest rate of global growth recorded since 2011. There was a pickup in activity and strong growth in Canada, Euro region and Japan and as a result advanced economies have seen a stronger rebound in 2017 (2.2% versus 2.0% forecasted in April).

Strong growth is also evident in emerging Asia and emerging Europe. Growth in Asia is primarily owing to a stronger growth projection from China, whereas stronger growth in Turkey and other countries in the region have led to higher growth in emerging Europe.

According to several sources, this improved global growth was made possible through enhanced trade and a pickup in investment, industrial production and consumer and business confidence around the world.

Optimism for global growth in 2018 – but watch out for trade wars and over-hyping

In line with the predictions of the CEOs for the global economy in 2018 (above), the World Bank and the IMF forecast the real value of goods and services produced globally to grow by 3.0% and 3.7% respectively in 2018 – indicating a slow and steady recovery of the global economy in 2018.

Recent course adjustments in major trade relationships, such as Brexit and the US’s decisions to renegotiate the North American Free Trade Agreement and to re-evaluate the terms of its other existing trade agreements, have raised concerns over a potential escalation in trade barriers and disputes which could be amplified if met by retaliatory measures by other countries.

The IMF expects growth to rise in emerging markets and developing economies, supported by improved external factors—a benign global financial environment and a recovery in advanced economies. Emerging economies in 2018 will see strong growth for an extended period before they slow down due to tightening financial conditions, protectionism and political strife.

Sri Lankan business

leaders more hopeful

over the economy in 2018

More than three-fourths of the CEOs expect the Sri Lankan economy to display an improvement in 2018, with 60% of the CEOs stating the local economy will stabilise while 16% believed that it will accelerate.

Only 24% of the CEOs expect the local economy to decline, compared to 31% in 2017, which shows a more positive outlook for the Sri Lankan economy in 2018.

So are the World Bank and ADB

Both the World Bank and the Asian Development Bank (ADB) expect a slight increase in Sri Lanka’s real GDP growth rate from 4.6% and 4.5% respectively, up to 5% in 2018.

The World Bank has projected the Sri Lankan economy to grow by 4.6% in 2017 and marginally exceed 5% in the medium term, driven by private consumption and investment. The positive outlook is attributed to the commitment of the Government to implement an ambitious medium-term reform agenda aimed at improving competitiveness, governance and public financial management that would achieve long-term benefits.

The forecast for 2018 by ADB has been maintained at 5.0% in light of an economic adjustment program agreed with the International Monetary Fund.

Political stability and

policy inconsistency

are what CEOs worry about

Notably in the previous year, Political, Legal and Governance issues which stood at 47% as a challenge in 2017 have risen further to 59% in 2018 - rightfully highlighted as seen by the increase in scandals, corruption and misuse of public funds in 2017.

The other main challenges identified by the CEOs for 2018 include issues in Human Capital, the increasing Cost of Living and International Factors which amount to 5% of the overall challenges.

The lack of Political Stability and the difficulties in attracting foreign direct investments given the challenges in repayment of loans over the next few years have been cited as the main challenges for the local economy in 2018.

Ensuring good governance and consistency in policy-making have been highlighted as essentials for a more conducive local business environment in 2018. Closer analysis of the responses citing economic policies as a challenge revealed the rising issues related to debt repayment and inflation as the main causes for concern for business leaders in 2018.

National debt has become a cautionary tale going forward due to high government debt and the large cost of servicing debt, with several CEOs highlighting the need to meet the expectations of the IMF to keep to the three-year program of reducing the impending fiscal deficit in Sri Lanka.

Less frequently cited issues were ensuring economic stability and growth, improving net trade, stability of monetary policy and the need to improve and regain business confidence to get the economy moving in 2018.

n Exchange Rate: Sri Lankan Rupee (LKR) depreciated 2.3% during the first six months of 2017. Compared to 2016, the currency was not as volatile. It commenced at the Rs. 150 range in January and ended at Rs. 152 per $ 1 at the end of the year, leading to nearly 2% depreciation.

n Interest Rates: The Central Bank of Sri Lanka kept the standing deposit facility rate (SDFR) at 7.25% and standing lending facility rate (SLFR) at 8.75% unchanged (up 0.25% points since its last revision in 2016). Prime Lending Rates in Sri Lanka saw an increase to 11.55% in December from 11.43% in November of 2017.

n Tax Revisions: A number of tax revisions and new policies were proposed such as motor vehicles excise duty, luxury tax revisions, duty revisions on VAT and NBT and the introduction of a Debt Repayment Levy by the Government with the aim of increasing overall tax revenues.

No significant changes to income tax except that backward integrated activities related to agriculture will be taxed at the concessional Income Tax rate of 14%. The corporate income tax rates will be revised to a three-tier structure comprising a lower rate of 14%, a standard rate of 28% and a higher rate of 40%. Withholding Tax (WHT) on interest income is at 5% for residents and 14% for non-residents for 2018/19 (down 0.1% points from 2017/18).

Business leaders still optimistic that 2018 will see higher growth

Similar to 2017, 44% of the surveyed chief executives are optimistic with regards to achieving higher business growth in 2018 compared to the previous year, with 42% of the CEOs expecting their businesses to record the same growth levels as in 2017.

As a whole, there appears to be an optimistic outlook for business performance with the expectancy for the global economy to recover and the stabilisation of the local economy in 2018.

CEOs think the problem

is largely out there, not in here!

As highlighted in the previous year’s results, over three-fourths of the surveyed CEOs believe that the success of their businesses in 2018 will be primarily affected by factors external to their businesses.

In contrast, less than a quarter of the CEOs have identified internal factors as the root cause of business challenges that is within their control in 2018.

External challenges

The surveyed CEOs have identified economic issues as the main external challenge for 2018 with local business leaders stating that the increase in inflation, increased taxation, including the unfavourable duty structure, will have an impact on their businesses in 2018.

Political and regulatory issues relating to policy inconsistency and implementation, political stability and the presence of red tape hindering positive business performance has been ranked at no. 2 on the list of external challenges for the local economy in 2018. Issues in growth, expansion and investment within the local economy is another leading issue that will continue in 2018 due to the lack of a proper strategy to attract investors and grow the economy, as reflected by the surveyed CEOs.

Environmental issues are expected to be a major challenge in 2018 due to the agricultural sector being subject to severe weather patterns affecting production and profits in the previous year.

Though less cited, the implementation of BASEL III, SLFRS 9 within the banking sphere and the impact of the new Inland Revenue Act has been highlighted as areas for caution and concern moving into 2018.

Enabling organic growth is the key focus

The major internal challenge for 2018 comprised concerns over the ability to attract further investment, achieve organic growth and the prospect of securing government bids for proposed projects in 2018.

The need to improve labour productivity, attract the right calibre of staff and increase levels of motivation were cited as internal human resource challenges for 2018.

Productivity and cost optimisation have also been cited as another challenge with the need to improve business processes and reduce the cost of production in the coming year.

Finally, challenges in demand generation and the need to identify new strategies to attract more customers, new markets and increase business profitability were highlighted among the internal challenges entering the new year.

Conclusion

While the outlook of the CEOs for 2018 appears to be positive (for both the local and the global economy) compared with the previous year, their outlook on the performance in the past year appears to be pessimistic – though perhaps slightly less so than in the previous year.

However, considering the long-term trend (since the 2012 MTI CEO Business Outlook Survey), business performance being below expectations for two consecutive years is a cause for concern. While on average, since the 2012 survey, 49% of CEOs have stated that their businesses have performed above expectations or as expected, for 2016 and 2017 this figure stands at 38% and 40% respectively. Hence, it is important to note that despite there being an improvement, business performance in 2017 is still below the long-term average as per the CEOs – indicating pessimism.

With the CEOs clearly indicating that the major challenge to their businesses are external factors and assuming this to be the case in reality, the Government clearly has a key role to play in improving the overall business performance of the country. In this light, recent friction between the key parties in the ruling coalition and the upcoming Provincial Council elections (which could further increase such friction) are causes for concern.

However, despite the above, the expected improvements in the local and global economy in 2018 are likely to present new opportunities to the CEOs and their respective organisations.

MTI Corporate Finance

MTI Corporate Finance is the corporate finance arm of MTI Consulting, a boutique strategy consultancy with a network of associates across Asia, Africa and the Middle East. MTI Corporate Finance provides a comprehensive range of services, including due diligence, feasibility studies, funding new businesses or capitalisation of existing ones – from IPOs to private placement facilitation, M&A facilitation and advisory on governance, compliances and risk management.