Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 1 February 2021 00:00 - - {{hitsCtrl.values.hits}}

MTI’s Thought Leadership team. From left: Dr. Jason Cordier (New Zealand), Naush Beg (Dubai), Jananga Piyadasa (Sri Lanka), Christine Fernando (Sri Lanka), and Teshan Gunasekara (Sri Lanka)

For the 10th consecutive year, MTI Consulting (via their Corporate Finance practice), in partnership with Daily FT, Daily Mirror and Sunday Times, has concluded the MTI CEO Business Outlook Study, collectively outlining the Sri Lankan business community’s perception of the state of business in 2021.

Supplemented by MTI’s experience as a thought leadership-oriented organisation, the annual survey collated and analysed the perceptions of over 100 Sri Lankan business leaders with regard to their business’ past and expected performance, their predictions regarding the state of the local and global economy in 2021, and the main challenges that they believe Sri Lanka and Sri Lankan companies will face in 2021.

The results of the survey, including its supplementary analysis, will assist organisations in streamlining their strategic decision-making for 2021, effectively enabling them to gear their operations in accordance with the economic sentiments of their peers — especially in the face of unprecedented challenges and uncertainty that prevailed in 2020.

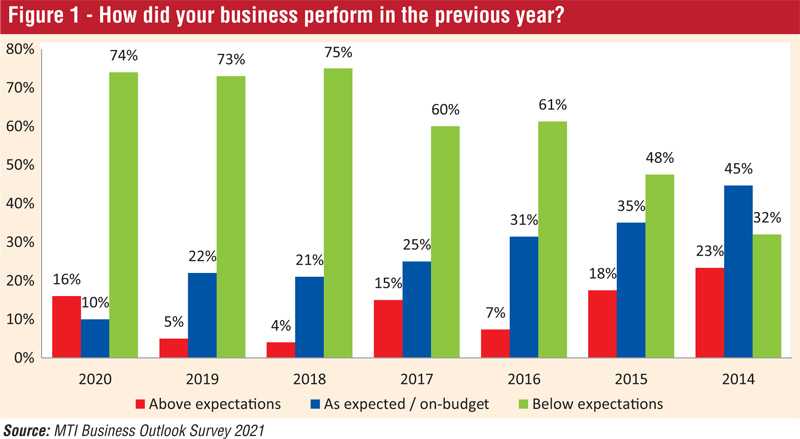

Nearly a third of the surveyed Chief Executives indicate that their businesses performed below expectations in 2020 – indicating a similar trend to this sentiment as shown in 2019 and 2018.

However, it is notable that 16% of the surveyed CEOs have seen their businesses perform above expectations – an indication that despite the global pandemic, some businesses have performed well.

Macroeconomic Performance

To supplement the CEO perceptions in 2020, MTI has analysed the key macroeconomic indicators of Sri Lanka.

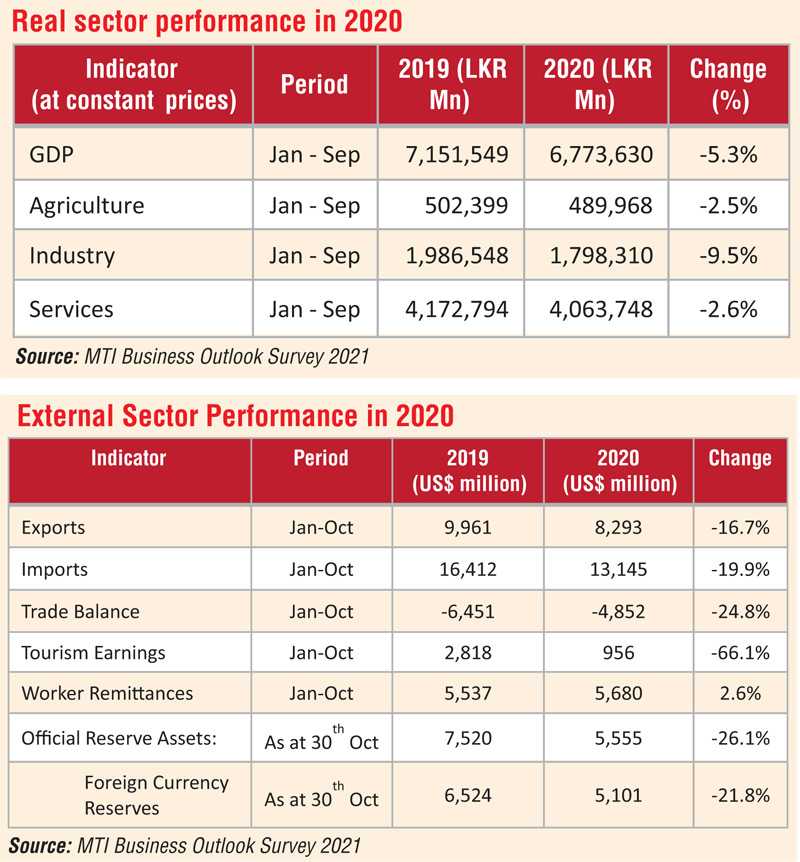

GDP for the first nine months of 2020 contracted by 5.3% compared to the same period in 2019. The local economy was hit hard with the COVID-19 pandemic, resulting in Sri Lanka experiencing its largest-ever quarterly GDP contraction of 16.3% in Q2 of 2020, as noted by the Department of Census and Statistics.

The Agriculture and Services subsectors recorded a decline of 2.5% and 2.6%, respectively, in the first nine months of 2020, compared to 2019. During the first nine months of 2020, the highest decline in GDP was seen in the Industry sub-sector as seen by the 9.5% drop in GDP for the January-September 2020 period. With the slowdown in economic activities from the immediate impact of the pandemic in early 2020, the manufacturing sector had to overcome many challenges to resume operations and conduct business operations under the new normal.

The island-wide lockdown imposed starting March 2020, resulted in a sharp decline in Merchandise Exports for April 2020, which recorded a historical decrease of nearly 64.0% to $ 277 million, compared to April 2019. The highest export earnings decline from January-October 2020 were seen in Apparel and Textiles (21.3%), Electrical and Electric Components (17.6%), Rubber and Rubber-based products (11.5%) and Tea (9.4%) sectors. However, the export of Coconut and Coconut-based Products, Spices and Concentrates and Other Export Crops recorded positive growth during the first 10 months of 2020.

Expenditure on imports decreased during the 10 months ending October 2020 mainly due to reduced expenditure in all major import categories. The highest reductions were seen in Personal Vehicles (56.7%), Fuel (34.3%) and Textiles (21.7%) import subcategories as a result of the Government restrictions to curtail the import of non-essential goods and minimise foreign currency outflow amidst the pandemic.

The trade balance deficit showed an improvement by 24.8% during the first 10 months of 2020 due to the slowdown in imports outpacing the decline in exports, compared to the same period in 2019.

The country’s Tourism Earnings saw a sharp decline by 66.1% from January to October 2020 on account of tourist arrivals coming to a standstill during the period of April-October 2020 due to travel restrictions imposed.

Official Reserve Assets declined by 26.1% during the first 10 months of 2020, compared to the same period in 2019. Major inflows to gross official reserves during this period included the receipt of a foreign currency term financing facility of $ 500 million from the China Development Bank (CDB), foreign currency banking unit loans of $ 670 million, and the receipt of $ 400 million from the Reserve Bank of India (under the SAARCFINANCE swap facility). Utilising gross official reserves, the CBSL facilitated the repayment of the matured International Sovereign Bond (ISB) of $ 1 billion in October 2020.

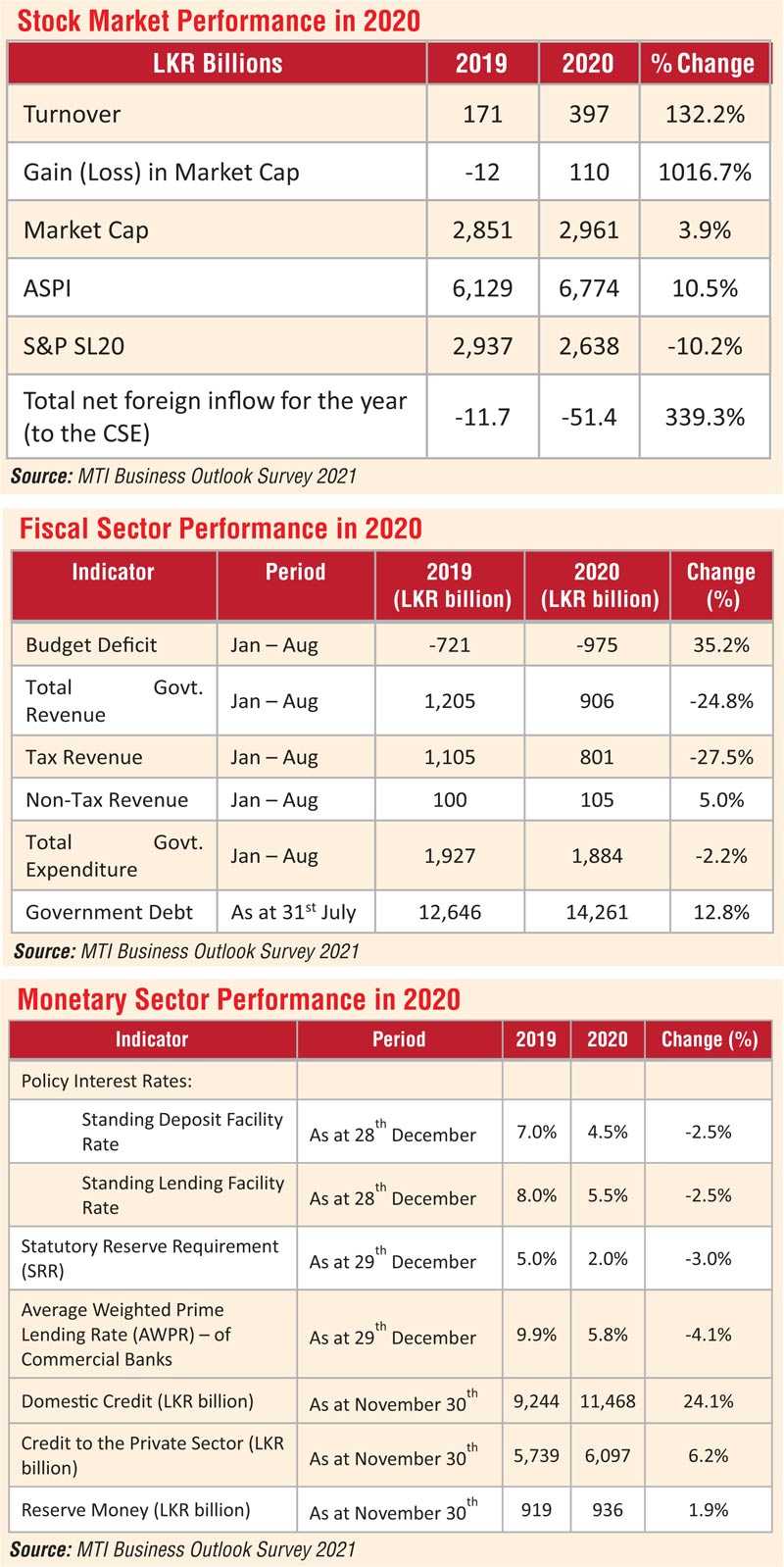

The budget deficit expanded to Rs. 975 billion (35.2% increase) from January-August 2020. The deficit was mainly financed through domestic sources consisting of substantial borrowings from the banking sector, including the CBSL.

Total Government Revenue reduced by 24.8% during the period of January-July 2020, owing to major tax revisions stemming from the Presidential elections in November 2019 and the pandemic in 2020.

Government debt increased to Rs. 14,261 billion (12.8% increase) from January to the end of July 2020. In 2021, outflows are estimated to be $ 5 billion while the next ISB repayment of $ 1 billion is due in July 2021. The State Minister of Finance stated that the country is in a position to settle its external debt obligations, with measures such as currency swaps and increased FDIs expected to ease debt concerns in 2021.

In order to minimise the fallout from COVID-19 on the local economy, the Central Bank continued its accommodative monetary policy stance in 2020. Policy rates were reduced to a historic low level in early July 2020 with the SDFR declining to 4.5% and SLFR at 5.5% as of December 2020. Further, the SRR was reduced to 2% from 5.0% in 2019, resulting in an injection of liquidity into the domestic money market during the year. On this background, the AWPR declined to an all-time low of 5.8% as of December 2020.

Overall domestic credit rose by 24.1% as of November 2020, driven by the substantial increase in credit to the public sector.

How have the major industries performed?

The year 2020 marked a significant milestone for the CSE with the benchmark ASPI index growing 10.5% to 6,774 points. This is 12th time that the index has posted a double-digit performance in the CSE’s 35-year history.

Furthermore, the ASPI was the best performing index globally in the month of September with an index growth of 12%. Overall, the market capitalisation of the CSE grew by 3.9% YoY to Rs. 110 billion.

The positive performance of the stock market was largely attributable to renewed local investor interest on the back of a low-interest-rate environment – as evidenced by their share of trading amounting to 79% of the total market turnover in 2020.

The daily market turnover on this background amounted to Rs. 1.9 billion, which was the highest daily turnover recorded since 2011.

Despite local interest, however, the CSE recorded a net foreign outflow of Rs. 51.4 billion – a 4.4x increase from 2019, as foreign investors grappled with the effects of the pandemic on frontier and emerging markets.

Global Economy and Trade 2020

In the backdrop of economic uncertainty fuelled by a global pandemic, the IMF forecasts a state of continued deep recession worldwide with global GDP projected to drop by 4.4% in 2020. For emerging and developing countries (excluding China), the IMF has projected growth to be a negative 5.7% in 2020.

With the emergence of COVID-19, the global economy was severely impacted as countries over the world implemented lockdowns to stop the spread of the virus. Oil prices in April 2020 declined as fuel demand plunged due to the pandemic and as a result of a price war between oil giants Saudi Arabia and Russia. Global demand for oil in 2020 declined by 9.8 million barrels per day to average 90 million barrels per day.

World in 2021

IMF has projected growth in emerging and developing countries (excluding China) to recover to 5% in 2021. Advanced economies are forecasted to record negative growth of 5.8% in 2020 with a 3.9% growth expected in 2021.

While there are signs of recovery in the New Year, governments all over the world will be faced with tough challenges in terms of debt management, public health and safety, budget policies and monetary policies to reshape the economy whilst dealing with the fallout from the pandemic.

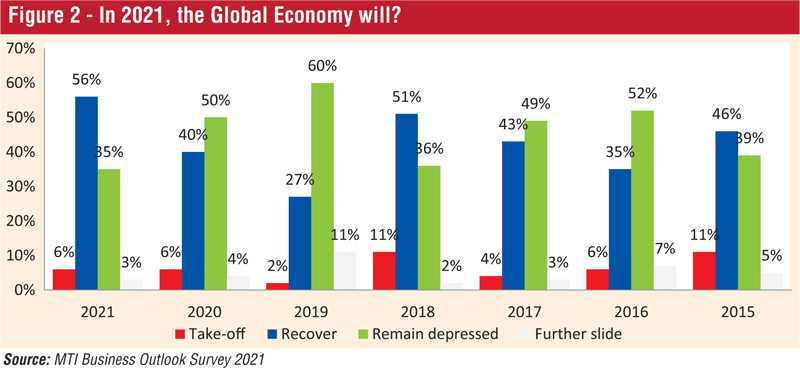

A combined 62% of the surveyed CEOs are optimistic of recovery under the new normal, with 56% of the CEOs expecting the global economy to recover and 6% are hopeful of a take-off in 2021.

About 38% of the surveyed CEOs are of the view that the global economy will continue to see a depression state or worsen in 2021, in light of the pandemic that is prevalent across many parts of the globe.

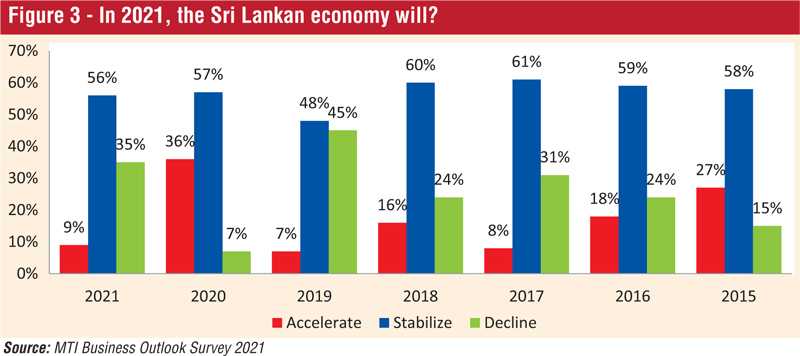

More than half of the surveyed CEOs expect that the economy will stabilise in 2021, following a similar optimistic trend as in the previous years. This year, only 9% of the CEOs expect that the economy will accelerate compared to 36% in 2020 while 35% of the respondents believe that the economy will decline in 2021 mainly due to the implications from the on-going COVID-19 pandemic.

Sri Lanka in 2021

The country’s economic activity, like many other economies, was severely dampened in 2020 as a result of strict social distancing measures and mobility restrictions imposed as a response to limit the spread of COVID-19, affected key revenue-generating industries, such as tourism and apparel.

According to the World Bank, Sri Lanka’s economic growth is estimated to contract by 6.7% in 2020 and is expected to recover to 3.3% in 2021. However, the Government maintains a much more positive outlook as outlined in the budget, with a forecasted growth rate of 5.5% in 2021 – reflecting confidence in its initiatives taken towards developing domestic industries, creating an investor-friendly environment and expected recovery of external demand from major markets.

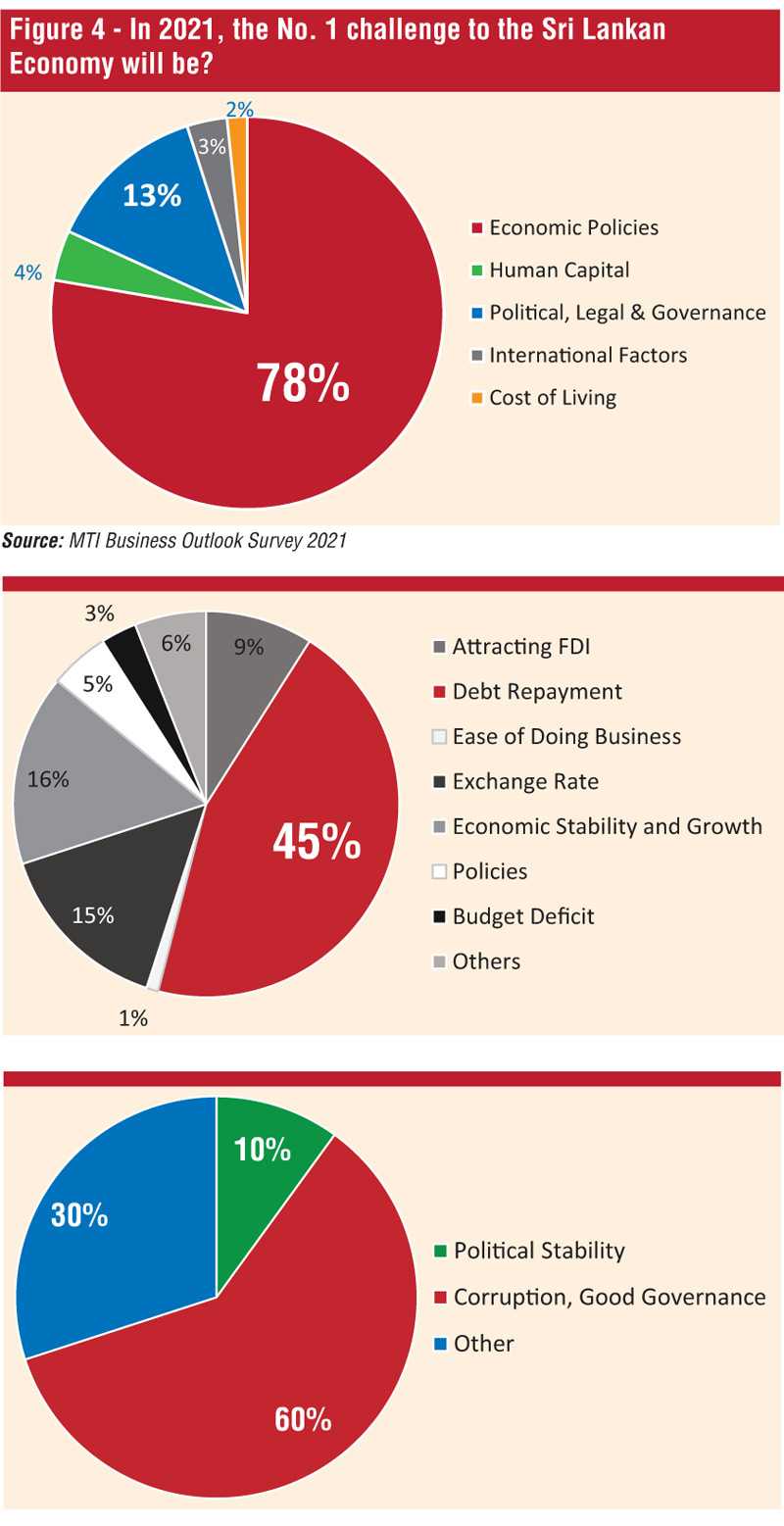

About 78% of the CEOs have identified Economic Policies as the number one challenge to the Sri Lankan economy this year, followed by Political, Legal and Governance Issues (13%).

Concerns over the two challenges highlighted follow a similar trend when compared to the previous year’s survey which leads to the assumption that CEOs have not witnessed major improvements in areas related to Economic Policies and Political, Legal and Governance issues. Other challenges cited by a minority of CEOs include Human Capital (4%), International Factors (3%) and Cost of Living (2%). Debt repayment concerns are expected to continue in 2021

A closer analysis of CEO responses citing Economic Policies as the key challenge revealed that Debt Repayment (45%) is viewed as the main cause of concern for business leaders in 2021. This is essentially driven by the public concern of the country’s substantial external-debt stock amounting to $ 35.3 billion (as at August 2020). Furthermore, the downgrading of Sri Lanka’s sovereign rating by international rating agencies last year over uncertainties surrounding the country’s ability to honour its debt obligations is also a concerning factor.

Economic Stability/Growth (16%) and Exchange Rate Fluctuations (15%) were seen as the second and third most challenging economic factors for 2021, which were mainly attributable to pandemic-induced uncertainties on the recovery of key sectors and the depreciation of the rupee.

Some CEOs also cited concerns over attracting FDIs (9%) as a result of negative sentiments created over the years in the international business community with regards to governance, policy consistency and the country’s financial situation. At present, measures are underway to expedite investor relations including a pipeline of investments for the Port City Project – with the Government setting an FDI target of $ 2.5 billion for 2021.

Governance-related concerns in 2021

Further analysis of Political, Legal and Governance issues reveals that, notably, 60% of the surveyed CEOs expressed alarm over Corruption and Good Governance-related issues in the country, compared to only 25% of CEOs stating the same last year. Meanwhile, a significant improvement is observed with regard to Political stability – where only 10% of the surveyed CEOs expressed concerns this year compared to a staggering 60% in the previous year’s survey.

Some of the key issues that were highlighted as part of Corruption and Good Governance related issues include worries of political leadership, certain ministerial appointments and COVID-19 related concerns

Positive Business Outlook for 2021

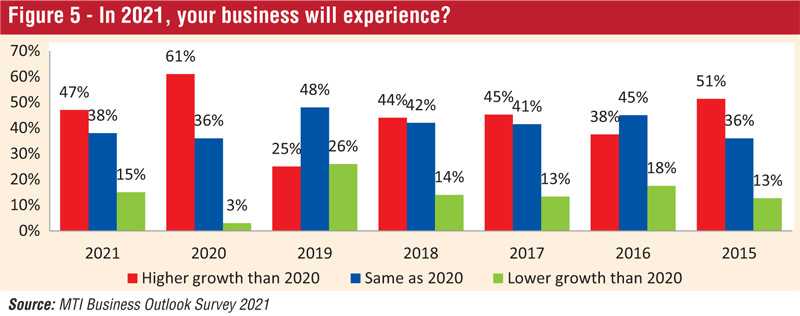

Despite the pandemic, 47% of the surveyed CEOs are optimistic of higher growth than the year 2020. However, this was a considerable drop in CEO confidence for the New Year, compared to a record high of 61% in the previous year.

Moreover, 38% of the CEOs anticipate that their business will achieve the same level of growth this year compared to that of 2020 followed by 15% of respondents expecting lower growth than 2020.

Overall, a positive outlook is apparent in terms of business performance due to expectations of local and global economic recovery.

External challenges dominate

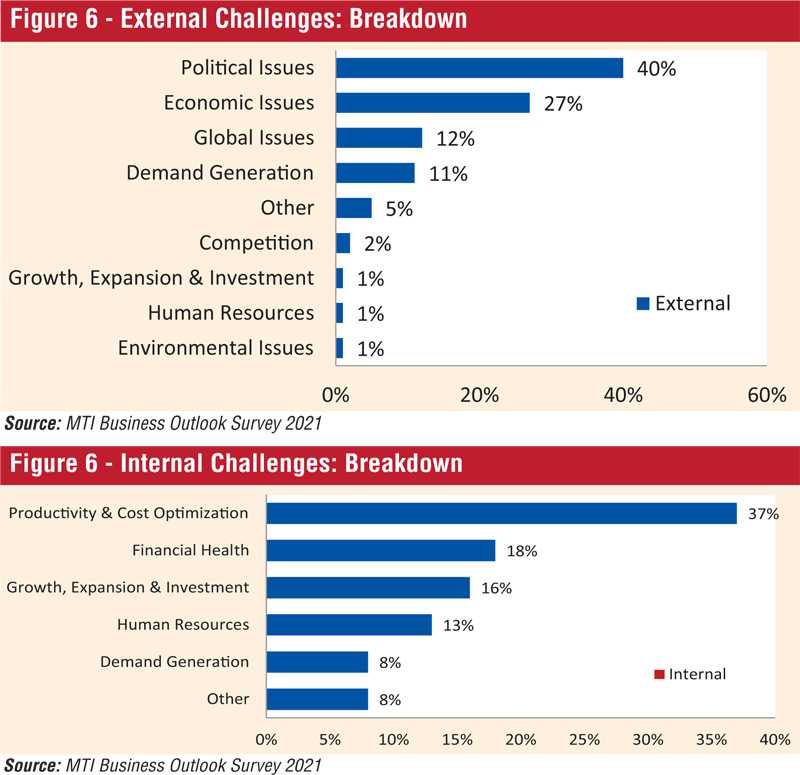

According to the surveyed chief executives, 70% are certain that the challenges they will face in 2021 will be factors that are external to their businesses while 30% believe they will take the form of controllable (internal) factors – following the same trend as in the previous years.

The key external challenge that concerned CEOs this year were Political Issues (40%). Some of the main political issues that were frequently highlighted include regulatory concerns with regards to imports, policy inconsistencies and pandemic response.

27% of CEOs cited Economic Issues as the second biggest external challenge where issues surrounding debt repayment, inflation, exchange rate and implications of sovereign rating downgrade were stressed.

This was followed by Global Issues and Demand Generation which were believed to be the top external challenges in 2021 by 12% and 11% of the respondents, respectively, due to implications from the COVID-19 pandemic on the consumer and the highly uncertain global economic environment.

Meanwhile, Competition (2%), Growth, Expansion and Investment (1%), Human Resources (1%) and Environmental Issues (1%) were the least cited external challenges.

Internal challenges

About 37% of CEOs have identified Productivity and Cost Optimisation as the key internal challenge for the year as the pandemic has forced many businesses to trim the fat and switch to survival mode.

Ensuring healthy financials was cited as the second biggest internal challenge with 18% of the CEOs expressing concerns over maintaining profitability during these tough times.

Furthermore, Growth, Expansion and Investment and Human Resource issues were pointed out by 18% and 16% of the CEOs, respectively, with a smaller percentage highlighting concerns over Demand Generation as well.

Conclusion

Based on the analysis of the responses, Sri Lanka’s Top Business Leaders appear to be optimistic and hopeful for 2021, despite the disruptions to lifestyle, livelihood and the economy during the COVID-19 pandemic in 2020.

Growth forecasts for the country per the World Bank remain subdued due to issues ranging from expected slower recovery of key industries, and concerns regarding the debt situation of the country. However, the Government remains confident and positive of Sri Lanka’s growth prospects in 2021.

The long-term trend of the business environment performing below expectations continued in 2020 where 74% of CEOs witnessed lower than expected performance of their businesses and industries in 2020 due to the nation-wide lockdowns and strict social distancing measures imposed to contain the spread of the COVID-19 virus.

CEOs believe that 2021 will be a year of recovery and largely expect both the local and global economies to stabilise instead of exploring or betting on high growth. Furthermore, CEOs also indicated that economic policies will be the key challenge that the Sri Lankan economy will face in 2021. Similar to the previous year’s survey results, CEOs believe that challenges their businesses will face in 2021 are external and out of their control, thereby emphasising the importance of being proactive and thinking outside the box in order to be resilient and adapt to the new normal in the new year.

MTI Corporate Finance

MTI Corporate Finance is the corporate finance arm of MTI Consulting, a boutique strategy consultancy with a network of associates across Asia, Africa and the Middle East. MTI Corporate Finance provides a comprehensive range of services, including due diligence, feasibility studies, funding new businesses or capitalisation of existing ones – from IPOs to private placement facilitation, M&A facilitation, and advisory on governance, compliances and risk management.