Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 11 September 2017 00:00 - - {{hitsCtrl.values.hits}}

Key changes to the Bill:

Salient features of new law

The sources of income have been condensed and re-classified under four heads - employment, business, investment and other.

Enforcement and basis of liability

The new act is to come into force from 1 April 2018.

A resident person is liable to income tax during a year of assessment on his global income from employment, business and investment or from any other source.

A non-resident is liable to tax on income from employment, business, investment and other sources, arising in or derived from a source in Sri Lanka.

Determination of residency

An individual is considered a resident for a year of assessment, if such an individual:

a) Resides in Sri Lanka

b) Is present in Sri Lanka for a period of 183 days or more, in any 12-month period which commences or ends during that year of assessment.

A company is considered a resident for a year of assessment if:

a) It is incorporated or formed under the laws of Sri Lanka, or

b) Its registered or principal office is in Sri Lanka

c) Management and control of the affairs of the company are exercised in Sri Lanka at any time during a year of assessment.

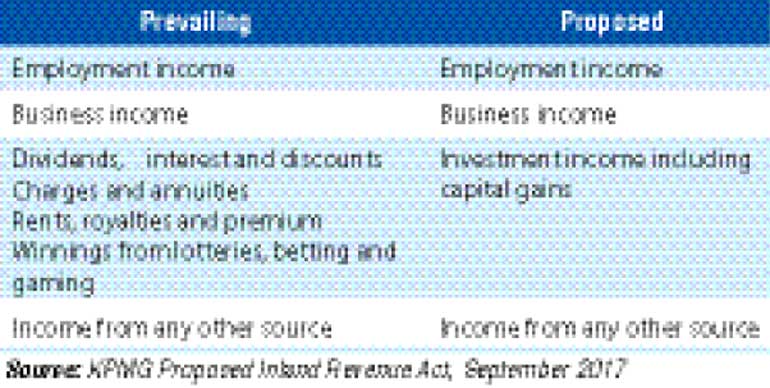

Income liable to tax

Presently, the law prescribes eight sources of income liable to tax and the same has been condensed to four in the proposed act. However, it appears that all sources of income which are currently liable to tax, continue to be liable to tax and coverage has been expanded to cover capital gains.

We should note that previously sums received by a Non-Governmental Organization as grants, donations or contributions, etc. were considered income liable to tax. Whilst the intention seems to be to continue to tax the same, it has been omitted from coverage. Hence, the same would have to be incorporated into this section.

Employment income

Employment income is to be taxed on a cash basis, i.e. on receipt.

The following benefits received or derived from employment are taxable as income from employment:

- Salary, wages, leave pay, overtime pay, fees, pensions, commissions, gratuities, bonuses, and other similar payments;

- Personal allowance, including any cost of living, subsistence, rent, entertainment or travel allowance;

- Payments providing discharge or reimbursement of expenses incurred by an individual or an associate of the individual;

- Payments for an individual’s agreement to conditions of employment;

- Payments or transfers to another person for the benefit of an individual or an associate person of the individual;

- The fair market value of benefits received or derived by virtue of the employment by an individual or an associate person of the individual;

- Other payments, including gifts, received in respect of the employment;

- The market value of shares, at the time allotted, under an employee share scheme, including shares allotted as a result of the exercise of an option or right to acquire the shares, excluding the employer’s contribution for such shares;

- Payments for redundancy or loss or termination of employment;

- Retirement contributions made to a retirement fund on behalf of the employee and retirement payments received in respect of the employment, other than contributions made by the employer to a pension fund, provident or savings fund/society, approved by the Commissioner General of Inland Revenue;

The following benefits are excluded:

- Benefits identified as exempt and benefits subject to final withholding tax

- A discharge or reimbursement of expenses incurred by the individual on behalf of the employer

- A discharge or reimbursement of an individual’s dental, medical or health insurance expenses where the benefit is available to all full-time employees on equal terms

- Payments made to or benefits accruing to employees on a non-discriminatory basis that by reason of their size, type and frequency, are unreasonable or administratively impracticable for the employer to account for, or to allocate to the individual

- The value of a right or option to acquire shares at the time such shares are granted to an employee under an employee share scheme

Business income

Business income is to be accounted for, on an accrual basis, unless approval has been obtained from the Commissioner General of Inland Revenue to adopt a cash basis. For this purpose, “business income” includes gains and profits from conducting a business consisting of:

- Service fees

- Consideration received with respect to trading stock

- Gains from the realisation of capital assets and liabilities of a business

- Gains on realisation of depreciable assets of a business

- Amounts derived as consideration for accepting a restriction on the capacity to conduct a business

- Gifts received by a person in respect of the business

- Amounts derived that are effectively connected with a business and that would otherwise be included in calculating a person’s income from an investment

- Other amounts to be included under the Act.

However, business income does not include exempt amounts and final withholding payments.

Adjustment to profits

The proposed law permits deduction of expenses which have been incurred for the production of income during a year of assessment, when ascertaining profits from business. Such expenses can be claimed subject to restrictions and conditions stipulated in the law.

Unless specifically mentioned, profits from business or investment, liable to Income Tax, should be ascertained according to generally accepted accounting principles.

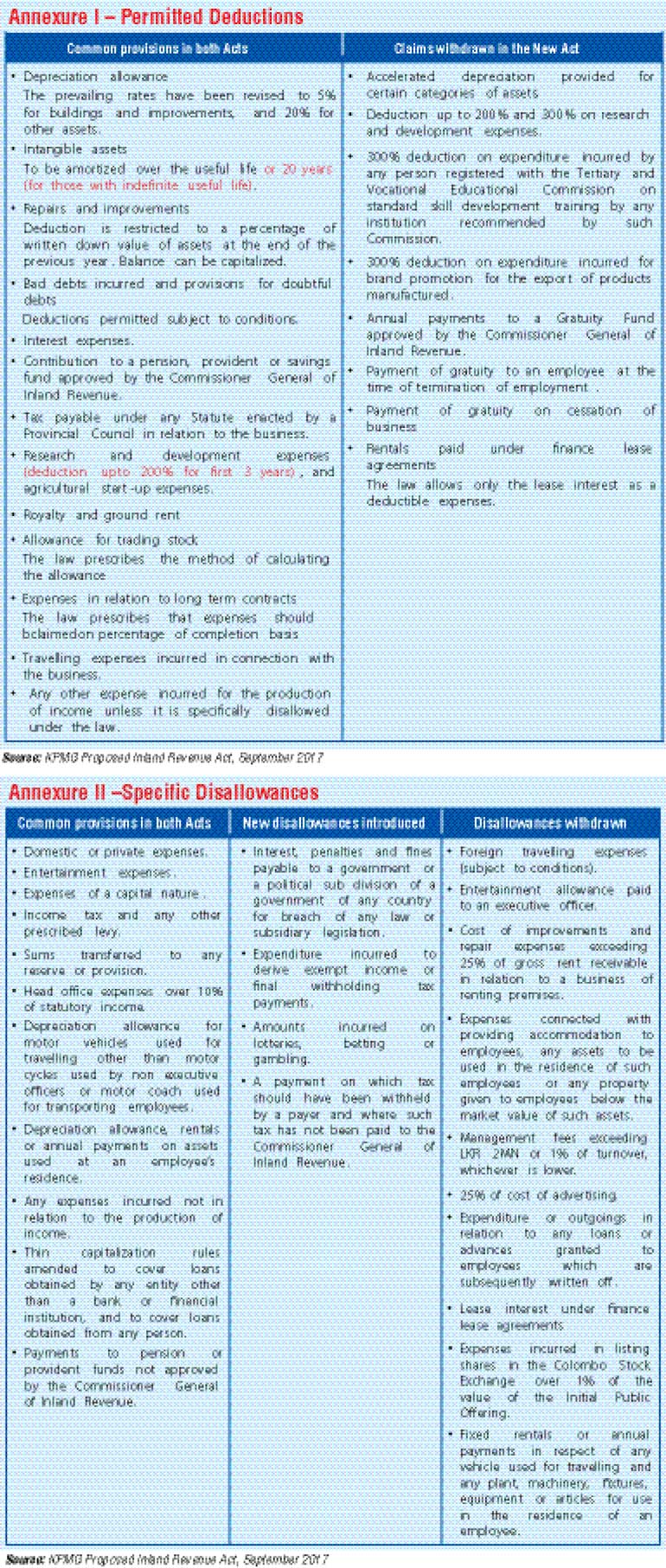

An analysis of the status of the prevailing permitted deductions under Section 25 of the Inland Revenue Act No. 10 of 2006 (as amended), as well as new provisions introduced under the proposed law, have been provided at Annexure I.

The status of the prevailing disallowances specified under Section 26 of the Inland Revenue Act No. 10 of 2006 (as amended), as well as new provisions introduced under the new law, have been provided at Annexure II.

Investment income

Investment income must be accounted for by an individual on a cash basis, unless approval has been obtained from the Commissioner General of Inland Revenue to adopt accrual accounting. An entity could select the most appropriate method (i.e. cash or accrual basis) to account for investment income.

The term “investment income” includes gains and profits from investment consisting of:

- Dividends, interest, discounts, charges, annuities, natural resource payments, rents, premiums and royalties

- Gains from the realisation of investment assets

- Amounts derived as consideration for accepting a restriction on the capacity to conduct the investment

- Gifts received by a person in respect of an investment

- Winnings from lotteries, betting or gambling

- Other amounts required to be included under the act

However, the term “investment income” does not include:

- Profits identified as exempt

- Profits which have been subject to final withholding tax

- Amounts included under business income.

The term “investment asset” has been defined to mean the following assets held as part of an investment excluding trading stock or a depreciable asset:

a) Land or buildings

b) A membership interest in a company, partnership or trust

c) A security or other financial asset

d) An option, right or other interest in an asset referred to in the foregoing paragraphs.

Further, the scope of an investment asset excludes the principal place of residence of an individual provided.

Investment income

Capital gains – Basis of chargeability

Capital gain is calculated as the difference between the consideration received and the cost of the investment asset at the time of realisation.

The cost of an investment asset held as at 30 September 2017 is equal to the market value of the asset at that time.

The draft law provides for the ascertainment of a deemed gain in circumstances, other than on death or on transfer of ownership of an asset by an individual to an associate or charitable institution, where a transfer has taken place for no consideration.

Capital gains - tax rate

10% on the gain on realisation of an investment asset.

Capital gains - payment of tax and return filing

A tax due on a capital gain has to be settled within one month of the realisation of the asset.

The taxpayer is also required to file a tax return within the same time period.

Other income

A person can select the most appropriate method (i.e. cash or accrual basis) to account for other income.

Other income consists of gains and profits from any other source, excluding profits of a casual and non-recurring nature.

However, other income does not include income which is identified as exempt or profits subject to final withholding tax.

Exemptions

The proposed act seeks to reduce the exemptions provided under the current statute and such exemptions have been limited to the following:

Realisation of investments:

Interest income

Employment income

Exemptions:

Dividend income:

Other exemptions:

Final withholding payments:

Taxes withheld for the following payments will be considered to be final withholding taxes and hence, such payments will not form part of taxable income.

Employment income has not been included as income being subject to final withholding tax. It is very likely that same will be considered under this category.

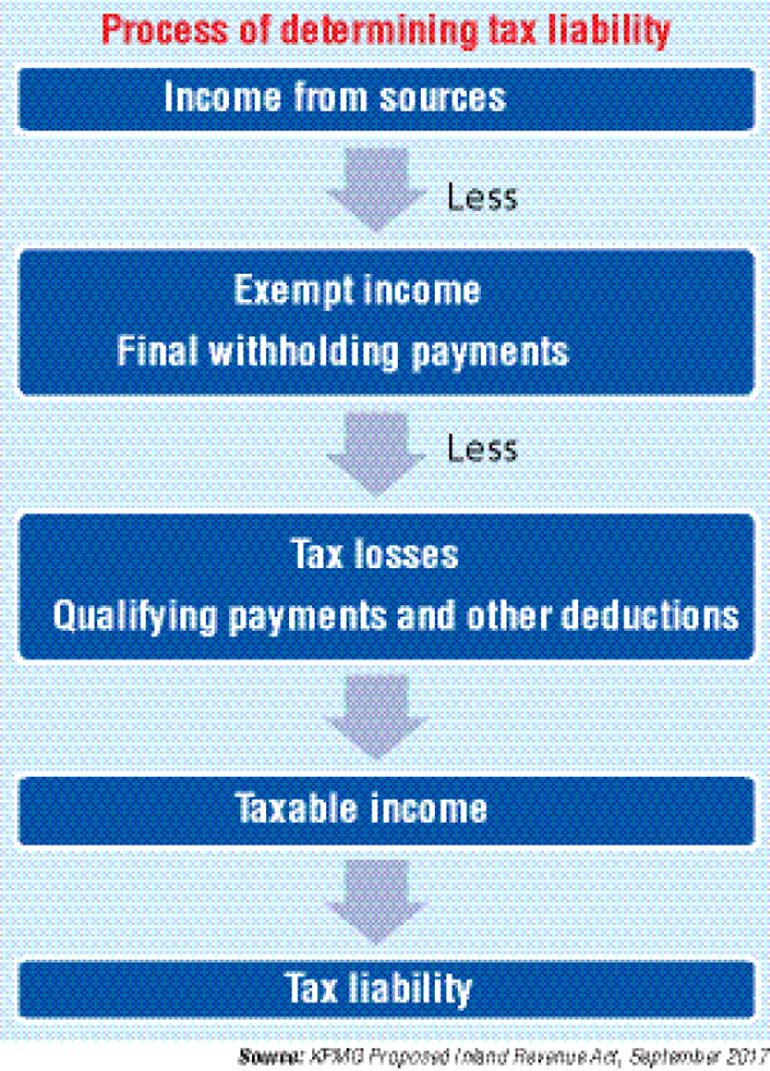

Utilisation of losses

The current provisions in relation to utilisation of losses have been revised, and two categories of losses have been identified, namely:

– Business losses

– Investment losses

Losses incurred from business during a year of assessment could be set off against income from business activities or against income from investment activities. However, losses incurred on the realisation of investments could only be set off against income from investments.

Any unutilised losses can be carried forward and set off in the same manner over a period of six years. If the loss has been incurred due to enhanced depreciation allowance claimed during a year of assessment, the carry forward period for set off has been extended to 10 years or 25 years.

If the loss has been incurred in a business activity which is subject to tax at a reduced rate, such a loss can be utilised only in calculating income which is taxed at the same rate, lower rate or exempt profits.

Losses incurred in an exempt activity can be set off only against a profit which is exempt from tax.

The current restriction on the annual utilisation of losses which is limited to 35% of total statutory income has been withdrawn.

Presently, losses arising from carrying out a business of leasing and life assurance can only be set off against profits from the same business. This limitation is being withdrawn.

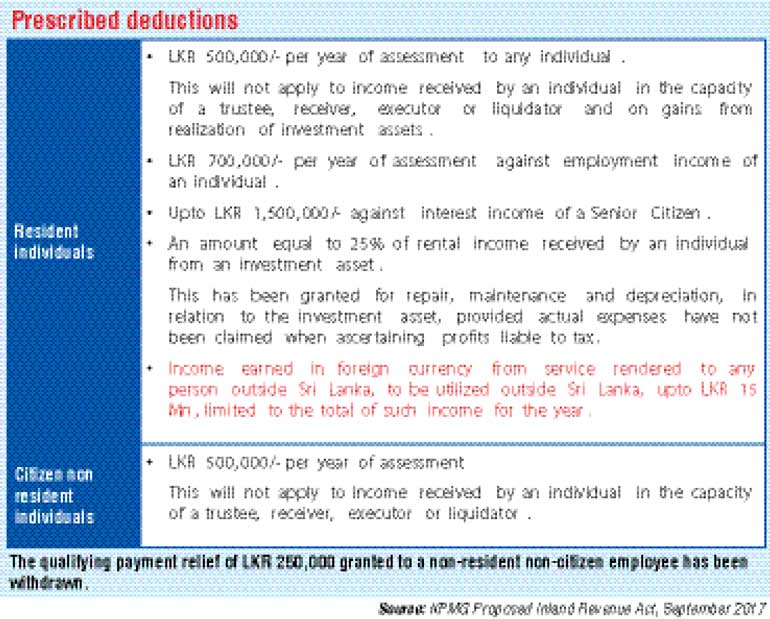

Other deductions

Qualifying payment relief available under the current law has been reduced and restricted to donations made to prescribed institutions.

Deductibility of donations to an approved charity has been limited to:

– One-third of taxable income or Rs. 75,000, whichever is less in the case of an individual.

– One-fifth of taxable income or Rs. 500,000, whichever is less, in the case of an entity.

Deductibility of donations to any other prescribed institution could be claimed up to the limit of taxable income of that year of assessment and no provisions available to carry forward any excess payments over the taxable income, to subsequent years of assessment. A list of other prescribed institutions is provided in Annexure III.

The qualifying payment relief of Rs. 250,000 granted to a non-resident non-citizen employee has been withdrawn.

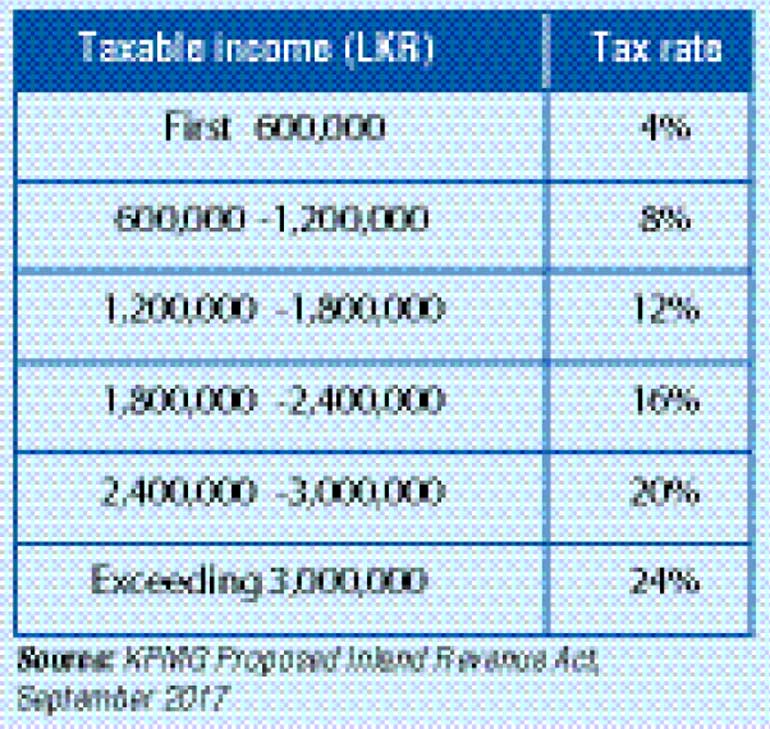

Tax rates

The current tax slabs applicable for an individual have been revised as follows:

1. The maximum tax rate of 16% applicable on employment income has been withdrawn.

2. Gains on realisation of investment assets will be taxed at 10%.

3. Income from the business of betting and gaming, liquor and/or tobacco will be taxed 40%.

4. The prevailing reduced rates of tax on retirement benefits (gratuity, ETF etc.) will continue.

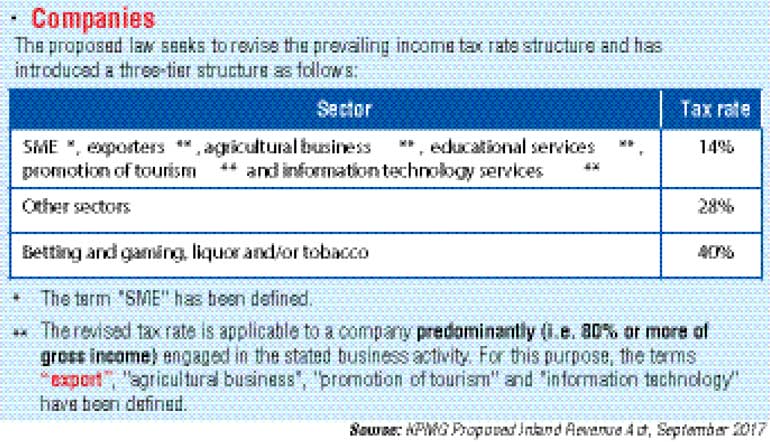

The proposed law seeks to revise the prevailing income tax rate structure and has introduced a three-tier structure as follows:

Gains on realisation of investment assets will be taxed at 10%. Deemed dividend tax has been

withdrawn.

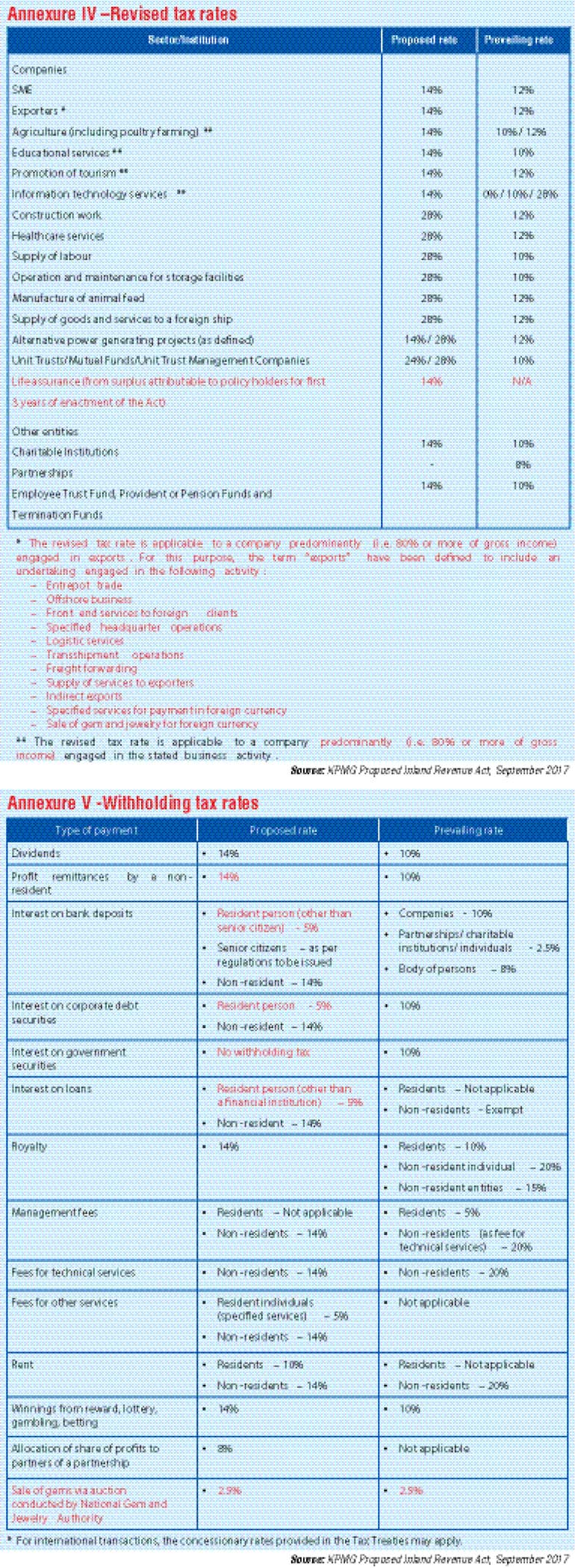

A synopsis of revised tax rates applicable to companies and other entities has been provided at Annexure IV.

Withholding taxScope

The scope has been expanded to cover the following payments which are currently not subject to withholding tax:

The prevailing withholding tax imposed on interest on government securities at the rate of 10% and on management fees paid to a resident at the rate of 5% have been withdrawn.

Withholding tax rates: The withholding tax rates applicable for various payments have been revised. A comparison of the new withholding tax rates with the prevailing rates is provided at Annexure V.

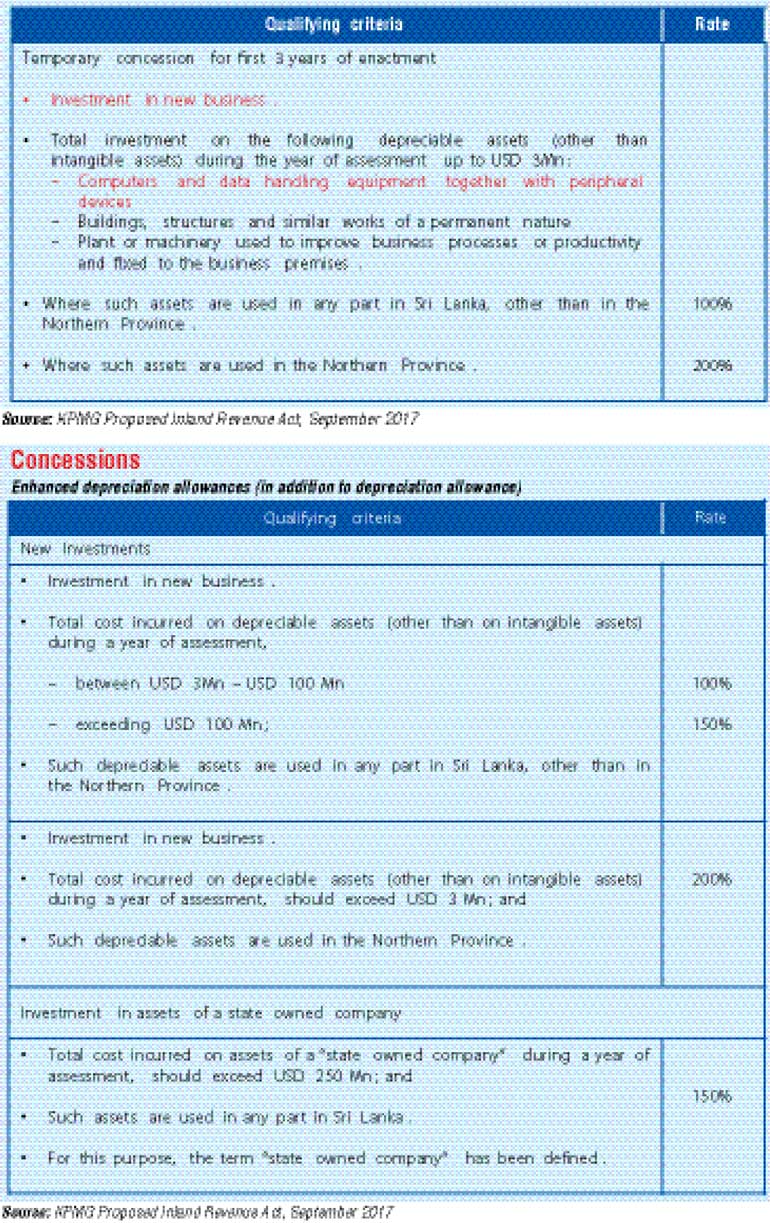

Concessions

Enhanced depreciation allowances (in addition to depreciation allowance)

Enhanced depreciation allowances (in addition to depreciation allowance)

Extended period for claiming losses:

Withholding tax exemption on dividends paid to a non-resident

Exemption on employment income of expatriate employees

Industry-specific provisions

Life Assurance:

The gains and profits liable to tax from the business of Life Assurance, whether mutual or proprietary, is the aggregate of the following, subject to the deduction of any unrelieved loss from business specified in the act:

a) The surplus distributed to shareholders from the life insurance policyholders fund as certified by the Appointed Actuary, and

b) The investment income of the shareholder fund less any expenses incurred in the production of such income.

The surplus distributed to a life insurance policy holder who shares the profits of a person engaged in life insurance business shall be deemed as profits from business of that person and be liable to tax accordingly.

Current restriction on utilisation of losses from Life Assurance business against profits from other sources has been withdrawn.

Temporary concession has been granted via a reduced rate of tax of 14% on the surplus distributed to life insurance policyholders who shares profits, for three years of assessment from the commencement of the proposed act.

Information Technology

A company engaged predominantly in the business of providing information technology services is eligible to claim a deduction equal to 135% of the total amount paid to its employees (other than a director), where such payments are to be included in computing the taxable income of such employees, subject to the following conditions:

a) The company should have at least 50 employees during the whole of the year,

b) Such employees are subject to tax under the PAYE tax scheme

A company entitled for the above deduction shall not be entitled to an enhanced depreciation allowance granted as temporary concessions for first three years of enactment.

Furthermore, if the above deduction results in a loss, such loss cannot be carried forward and deducted in any succeeding year of assessment.

Industry-specific provisions

Banking

Income or loss from the business of banking should be computed separately from other business activities. For this purpose, the term “banking business” means “the banking business of a financial institution”.

The prevailing restriction on the claim of doubtful debts (i.e. up to a maximum of 1% on aggregate debts outstanding at the end of a year of assessment) has been withdrawn.

Furthermore, debts written off and doubtful debts can be claimed as long as the person has taken reasonable steps in pursuing payment and the person reasonably believes that such debt will not be recovered.

In the event a bank opts to claim doubtful debts based on provisions made in line with regulations established by the Central Bank of Sri Lanka, the amount deductible will be limited to the extent specified by the Commissioner General of Inland Revenue.

Finance Leasing

Finance lease agreements to be considered loan granted by the lessor to the lessee.

Accordingly, the current method of calculating the profits from the business of finance lease may change and the leasing business would be subject to tax on profits derived from such operations being the lease interest less expenses.

Current restriction on utilisation of losses from lease business against profits from other sources has been withdrawn.

Other provisions

The definition of the term ‘dividends’ has been revised to include:

– Payments received by shareholders in the course of repurchase of shares, reduction of capital or the liquidation process or reconstruction.

– Capitalisation of profits by way of bonus issue or increase in paid up capital or otherwise whether an amount is distributed or not.

The following will not be considered as distribution of a “dividend”:

– Any amount debited to a capital account or matched by a payment made by a shareholder to a company.

– Any amount which constitutes a final withholding payment or included in calculating the income of a shareholder.

Definitions of ‘royalty’ and ‘service fees’

The prevailing statute does not contain definitions for the terms ‘royalty’ and ‘service fees’.

The same has been defined in the proposed act as follows:

A payment derived as a consideration for –

a) The use of or right to use a copyright of literary, artistic or scientific work, including cinematograph films, software or video or audio recordings, whether the work is in electronic format or otherwise; or

b) The use of or right to use a patent, trade mark, design or model, plan, or secret formula or process; any industrial, commercial, or scientific equipment; information concerning industrial, commercial or scientific experience.

c) The rendering of or the undertaking to render assistance ancillary to a matter referred to in paragraph (a) or (b) above; or

d) A total or partial forbearance with respect to a matter referred to in paragraph (a), (b) or

(c) above.

A payment to the extent to which, based on market values, it is reasonably attributable to services rendered by a business of a person, but excludes interest, rent or a royalty

Other provisions

Foreign tax credit

A resident person (other than a partnership) could claim a tax credit for any tax paid in a foreign jurisdiction in relation to any of his assessable foreign income earned during a year of assessment. Foreign tax credit should be calculated separately for each year of assessment and separately for each source and further, separately for each gain from the realisation of investment asset.

Permanent establishment

The new law has introduced the concept of ‘Permanent Establishment’. Any payment made to a non-resident, which is subject to withholding tax, becomes final tax to such non-resident unless same is derived through a Sri Lankan Permanent Establishment of such non-resident.

Non-Governmental Organisations

The current basis of calculating income tax liability will continue. Accordingly, 3% of funds received by way of grants, donations or contributions would be subject to tax at 28% in addition to tax on other sources of income. Currently, the law provides for exclusions on certain donations received, when calculating the tax liability on funds received. The current exclusion granted for money received from the Government of Sri Lanka, has been withdrawn.

Gains from the realisation of investment assets will also be subject to tax at 10%.

Partnerships

The new law excludes a partnership from chargeability to income tax, other than withholding tax and tax on gains from realization of investment assets, and seeks to make only the partners liable to tax in respect of their share of income from the partnership.

Allocation of profits to partners will be subject to withholding of tax at 8%.

Gains from the realisation of investment assets of the partnership will be taxed at 10% to the partnership. Gain on disposal of an interest of a partner in a partnership would be treated as business income of the partner and liable to tax.

Unit trusts

The tax rate on taxable income of unit trusts has been increased from 10% to 24%/28% depending on its status. However, any gains from realization of investment assets will be subject to tax at 10%.

The exemptions available under the current law on dividends distributed by a unit trust and dividends distributed to a unit trust have been withdrawn.

Administrative provisions

A year of assessment is a 12-month period ending 31 March. Companies and Trusts are permitted to change the year of assessment with the approval of the Commissioner General of Inland Revenue.

Payment of tax

Tax liability for a year of assessment should be settled in four quarterly instalments if a person derives or expects to derive assessable income from business, investment or employment which has not been subject to tax under the PAYE Tax Scheme.

The payments are required to be made based on the estimated tax liability for a year of assessment. A statement of estimated tax liability for a year of assessment should be filed with the Revenue Authorities at the time of making payment of the first instalment. Once the tax liability for a year of assessment is finalised, any outstanding tax is required to be settled on or before 30 September of the succeeding year of assessment.

Tax due on gains from realisation of an investment asset needs to be settled within one month after realisation of such asset.

Filing of tax return

An income tax return is required to be filed on or before 30th November of the succeeding year of assessment.

A capital gains tax return needs to be filed within one month after the realisation of an investment asset.

At the request of the taxpayer, the Commissioner General of Inland Revenue may grant an extended time period to file a tax return.

In the event a tax return is prepared by a third party (other than a full time employee of the taxpayer), for a reward, such party should also sign the tax return.

Provisions have been introduced for a taxpayer to amend a tax return within four years of the date of filing such return.

Time bar for assessment

The time bar provisions for raising of the first assessment has been extended to 30 months from the date of filing the return, in the event a taxpayer has filed the tax return by due date. If an assessment has been issued, there is further provision for additional assessments to be issued within four years of the filing of the original return.

Time bar provisions will not apply in the event of non-filing of a tax return or for fraud or wilful evasion of taxes.

Hearing of appeal

The taxpayer should appeal for an assessment within thirty days from the receipt of such assessment. The appeal shall be determined within 90 days.

Tax avoidance scheme

Provisions have been introduced to prevent tax payers implementing tax avoidance schemes.

A scheme is considered as being for tax avoidance if the sole or dominant purpose of same is to obtain a tax benefit.

If a tax avoidance scheme has been carried out as per the opinion of the Commissioner General of Inland Revenue, an assessment could be raised to adjust the tax liability within five years from the end of the year of assessment to which such adjustment relates.

Review of transactions between Associated Persons

Provisions have been introduced for the Commissioner General to review re-characterise/disregard any transaction between the following associated persons, if it cannot be established that the said transactions have been concluded in line with the arm’s length standard.

Advanced ruling system

Provisions have been introduced to strengthen the current advanced ruling system.

Accordingly, rulings will be issued under two categories as follows;

The Commissioner General of Inland Revenue may issue public rulings setting out the Commissioner General’s interpretation of the application of tax law. A public ruling is binding on the Commissioner General until same is withdrawn. However, same is not binding on a taxpayer.

A taxpayer can request for a private ruling seeking the view of the Commissioner General of Inland Revenue on the application of tax law with regard to a transaction. A reasonable fee may be charged for this purpose. The ruling must be issued within 90 days from the date of request. A private ruling will be binding on the Commissioner General of Inland Revenue as against the taxpayer identified, but shall not be binding on the Commissioner General of Inland Revenue as against other taxpayers. Furthermore, a private ruling shall not be binding on a taxpayer.

Transitional provisions

Transitional provisions concerning depreciation allowances, tax exemptions, etc. have not been fully covered and will have to be further clarified.

Transfer pricing

A “permanent establishment” has been deemed to be independent from its head office. Currently, transactions of a permanent establishment which may operate in Sri Lanka in the form of a branch or other overseas office and have transactions with the head office is not covered by transfer pricing provisions, since it is one legal entity. The proposed law is to view a permanent establishment separate from its head office.

Introduction of Safe Harbour Rules

Safe Harbour Rules are to be introduced to simplify transfer pricing compliance requirements. Under safe harbour provisions, the Revenue Authorities generally prescribe comparable prices/margins so as to determine an arm’s length price.

Audit procedure

The draft law details the audit procedure that needs to be complied with prior to an assessment being issued on a taxpayer. The following additional procedures have been introduced:

Penalties:

Any tax adjustments made on account of transfer pricing will not be entitled to tax benefits.

The following penalty provisions are to be introduced to both international and domestic transactions.

[Add table]