Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 14 November 2023 00:00 - - {{hitsCtrl.values.hits}}

Honourable Speaker, The Lord Buddha has elucidated on a concept called “Samjeewikatha” (balance living). He explained this concept in the Vyagghapajja Sutta. The concept elaborates on how to balance our budget. The Buddha has advised against leading a pompous and extravagant life, while receiving a low income. He explains that a mindful person would lead his life in a way that his income is aligned with expenditure. We should spend according to the income we receive. That is what the Buddhist economic philosophy demonstrates to us. But, for the majority of the 75 years following the independence, our spending has often diverged from our generated revenue.

When I say this, one might think that the Governments of this country spent lavishly and wasted money. Not just Governments. The country as a whole has lived beyond its means. We resorted to borrowing or printing money to provide jobs, increase salaries, distribute free rice, offer relief, and maintain state-owned enterprises. We won elections by making promises about giving Government jobs, safeguarding public resources, delivering relief packages, reducing commodity prices, and increasing salaries. We became indebted to the country as well as to the world to lead pompous and extravagant lives by not aligning revenue to our expenditure.

When I say this, one might think that the Governments of this country spent lavishly and wasted money. Not just Governments. The country as a whole has lived beyond its means. We resorted to borrowing or printing money to provide jobs, increase salaries, distribute free rice, offer relief, and maintain state-owned enterprises. We won elections by making promises about giving Government jobs, safeguarding public resources, delivering relief packages, reducing commodity prices, and increasing salaries. We became indebted to the country as well as to the world to lead pompous and extravagant lives by not aligning revenue to our expenditure.

In the Samajjapala Sutta, the Lord Buddha has emphasised that we should borrow for investment rather than for consumption. But we borrowed for consumption. Ina Sutta in Anguttara Chakka Nipatha specifically points out that it is very dangerous to borrow and pay interest in this manner. After 75 years of independence, we now find ourselves in a dire situation as a result of ignoring Samajeewikatha and the Buddhist economic philosophy.

Our economy collapsed completely, leading us to a status of bankruptcy. We fought over meagre litres of petrol. Conflicts emerged over obtaining a gas cylinder. We remained in darkness for 10 to 15 hours a day. Our supermarkets began to sell firewood. Businesses collapsed. The tourism industry crumbled. Jobs were lost. Essential goods became scarce. There were queues everywhere. All public transport failed. Schools were closed. We could not conduct examinations. There was a food crisis due to the lack of fertiliser. The situation reached a point where we felt as if we were left not with a country but we were in a state akin to hell.

No one stepped up to accept the challenge of rescuing the country in the face of this challenge. Instead, they gave up offering various excuses similar to those given by Andare when confronted with the task of lifting the rock. Some individuals turned to astrology for guidance, while others imposed conditions that could not be constitutionally accommodated. It is under these circumstances that I assumed the responsibility of leading this nation. At the time, I took over a patient who was dying. A country that resembled a living hell. A derailed economy that had been brought to its knees. We began to work day and night following a formal and systematic plan despite numerous obstacles and challenges. We strived to rescue the country from the hellish conditions it was facing. Government employees demonstrated dedicated hard work, contributing to our endeavours to salvage the nation. All our friendly nations took care of us and offered relief.

At this juncture, I openly communicated to all of you that I will work hard to revive the economy through a comprehensive reform program and to liberate the people from the economic hardships. I was not the only one who contributed to this hard work and commitment. Every citizen of this country strived for this. They were committed to achieve this. There were also certain segments who were not a part of this collective effort and who tried to pull the country further backward. But, we have now been able to stabilise the country to a certain extent, dampening their hopes. We successfully redirected the economy, which was derailed and collapsed, to get back on track. Several temporary measures were implemented, including the temporary suspension of imports, to achieve this.

However, it is not advisable for the economy to sustain such restrictions indefinitely. This is the moment to implement enduring and sustainable actions. To propel the economy forward, these actions must be undertaken. It is through these measures that we can fully rejuvenate the economy, rescuing it from the brink of collapse. This is not an easy task. But we can do it. We can overcome this challenge by embracing new concepts and following the path we have already embarked upon.

History has demonstrated that seeking solutions solely for political advantage, deviating from the principles of “Samajeevikatha,” is not a successful approach. Why would we continue to do so when we are aware that such actions would be unsuccessful? You might tell fairy tales, but the progress of a country cannot be achieved through such narratives. A country cannot be developed by making false promises. The country moved backward because of the electoral promises made by political parties throughout time. We have witnessed that the ultimate result of this is the country becoming bankrupt. Unfortunately, many segments of the population have not come to realise this yet. I beseech you that we should stop propagating lies for political motives. Let’s be honest with ourselves. Let’s think about the country rather than about our politics. Let’s get together to uplift the country. Let’s think about the political agendas when our country is strong.

History has demonstrated that seeking solutions solely for political advantage, deviating from the principles of “Samajeevikatha,” is not a successful approach. Why would we continue to do so when we are aware that such actions would be unsuccessful? You might tell fairy tales, but the progress of a country cannot be achieved through such narratives. A country cannot be developed by making false promises. The country moved backward because of the electoral promises made by political parties throughout time. We have witnessed that the ultimate result of this is the country becoming bankrupt. Unfortunately, many segments of the population have not come to realise this yet. I beseech you that we should stop propagating lies for political motives. Let’s be honest with ourselves. Let’s think about the country rather than about our politics. Let’s get together to uplift the country. Let’s think about the political agendas when our country is strong.

Our country’s situation is now better than what it was before one year. I am not saying that the economy has completely recovered. It has become comparatively better. We have attained that position by facing difficulties, making sacrifices and enduring various hardships. We can certainly create a more favourable economic environment in the near future if we gradually move forward in this difficult terrain.

When we look back at the past year, it is 100% confirmed that we are on the right track. The people in the country, who once struggled to obtain petrol, can now buy it without being in a queue or without any limitations. The people who had to wait in queues for weeks to obtain a gas cylinder can now purchase it with a single phone call. People who endured power cuts for 10 to 12 hours can now enjoy uninterrupted power supply. The country where firewood was sold from supermarkets to retail shops has now completely transformed. This all means that we are on the right track. Our plans are sound. Our strategies are effective. Hence, let’s continue the rest of the journey even amidst difficulties. As we progressed along this path, there were certain mistakes. We have acknowledged this. We will humbly rectify those deficiencies and mistakes.

The economy which was derailed was put back on track. But this achievement alone is not satisfactory. Just by this, we would not feel great relief or comfort. Our difficult times have not ended. The entire country continues to grapple with various hardships in different aspects. As we were able to reduce inflation up to a single-digit level, we could rescue the country from the high inflationary pressures. But, we still could not correspondingly increase salaries and income to match the high cost of living which increased due to this severe crisis. The increase in prices of fuel and electricity adversely impacted all households. The increase in tax rates has also shaken up individuals and businesses, both small and large. Production costs have also escalated. We are well aware of the difficulties faced by the people of this country. The path toward a stable and developed economy is not beautiful. It is difficult, hard and challenging.

Reviving an economy in a state of bankruptcy is a formidable task. However, if we successfully navigate through this challenging period, we can create a free and decent society. Instead, if we continue to build sand castles by giving relief to the people based on political motives, the country will again be bankrupt. The success of the path that we have undertaken thus far lies on the economic reform program that we commenced. This reform program has laid the foundation to progress, steering us away from economic turmoil such as the one experienced in 2022.

Reviving an economy in a state of bankruptcy is a formidable task. However, if we successfully navigate through this challenging period, we can create a free and decent society. Instead, if we continue to build sand castles by giving relief to the people based on political motives, the country will again be bankrupt. The success of the path that we have undertaken thus far lies on the economic reform program that we commenced. This reform program has laid the foundation to progress, steering us away from economic turmoil such as the one experienced in 2022.

Since 2013, the practice of revising the electricity bill in accordance with the Government expenditure on electricity generation has not been followed. Due to this, the Ceylon Electricity Board suffered enormous losses. Until 2022, loans were obtained from the two state banks to offset these losses. Similarly, the Ceylon Petroleum Corporation which suffers unbelievable losses offsets its losses through the two state banks. This escalated to a critical situation where the balance sheets of the two state banks are now in a very weak state. Government has to provide funds to strengthen these banks. Where would we get such funds from? The tax revenue levied from the public is used for this purpose. Loans are obtained from state banks to offset the losses of the state-owned enterprises. Hence, the Government provides funds to the banks when they become weak to prevent them from collapsing. To find such funds, the Government will need to increase the tax burden on the people.

Some groups protest demanding a salary increase. Not only the public servants, but the whole country suffers nowadays. We have to move forward day by day, step by step toward a recovery from this difficult situation. It’s a tough journey. On one hand, the strikes deteriorate the country’s way forward. On the other hand, the majority of the people are suffering.

I wish to mention about the salary increments. Salary increments cannot be done on an ad-hoc basis. 35% of the Government revenue is spent to pay salaries for the public servants. To increase salaries, the revenue of the Government also has to be increased. Even without increasing the revenue, salaries can be increased. But how? We have to print money. Or else, borrow from a foreign country. Or else, impose new taxes. That is against the “Samajeewikatha” principle. Such actions may again drive the country downwards.

The Ceylon Electricity Board spends a significant amount on power generation. Therefore, we lifted all legal barriers to add low-cost mega-scale renewable energy generation to its main grid network. The legislation process is ongoing to restructure the inefficient Ceylon Electricity Board, as an efficient institution. Upon implementing the institutional changes to generate power efficiently, the cost of power to the people will be eased. Some political groups are against restructuring the Ceylon Electricity Board as an efficient institution. They demand to reduce the power tariff at any cost. This will lead us again to be trapped in the same vicious cycle. It is against the “Samajeevikatha” concept.

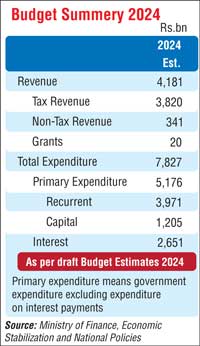

There are criticisms over increasing the Government taxes. Why were we supposed to increase taxes? We neglected to change tax structures and tax restructuring for ages. This made the fiscal sector weak. To strengthen the fiscal sector structural changes in the tax system were necessary. Rs. 93 billion is spent each month to finance the salary bill of the Government. Rs. 70 billion is required to for the social Welfare Schemes such as Aswesuma, Elders allowance, Pensions, etc.

Meanwhile, Rs. 220 billion is spent to settle loan interest payments. The public expenditure spent on these requirements is Rs. 383 billion per month. The Government revenue collected within the first 9 months of the year 2023 is Rs. 215 billion. The shortage is Rs. 168 billion. To meet this shortage, it is compelled to obtain more loans. How was this shortage financed so far? Through foreign loans. Through bank overdrafts. When it is not possible to meet the shortage through these methods, through money printing. Until the Foreign Debt Restructuring is completed, the foreign financing and loans we can obtain are constrained. Bank overdrafts amounting to Rs. 900 billion have been obtained in the year 2021. Currently, the total overdrafts are brought to a lower level of Rs. 70 billion.

According to the new Central Bank Act, money printing is not allowed. Therefore, if we can’t increase the Government revenue by 10% to 15% we will end up with an economic hell again. If the taxes are reduced, that gap has to be filled with something else. This issue cannot be resolved by simple and sweet promises, as some groups are proposing. Our revenue target for this year is Rs. 3,415 billion. Out of that, we have collected Rs. 2,410 billion so far. This represents that we have failed to generate the targeted revenue. We have to work hard to collect the targeted revenue.

We requested several times from the people who earn higher incomes, to open a tax file. However, the majority of them did not proceed. The main reason is they believe that there will be unnecessary troubles if they open a new tax file. Yes, it is true. There are unnecessary complexities in tax collection. Taxpayers have to obey the unnecessary influences of some officers.

There are payment methods that make the payment of taxes a headache. Likewise, we have identified several critical issues in our tax system. At present the burden of taxes is placed only on a few slices of the society. Tax evasion happens due to the long-lasting weaknesses and negligence of the tax collection systems. We have included several proposals to this Budget to rectify these issues. These proposals cannot be implemented overnight. They should be implemented gradually. We will be able to provide more tax concessions in the future when the Government revenue is increased through these proposals.

Some people state that the burden of taxes on the people can be reduced by reducing the Government revenue. However, the major portion of the Government revenue, 35% is spent on public servant salaries and social welfare. The workforce in the public sector is 1.3 million. We cannot remove them from their jobs even though the number is excessive. If we do so it will lead to a social issue. Therefore, these issues have to be confronted sensitively and carefully. However, we have to stop unnecessary expenditure.

How much money is wasted at the Government institutions? How much time is wasted? We have to avoid these wastages. How much time, effort, and money are wasted when an ordinary citizen goes to a Government institution for their necessity? We have to rectify these deficiencies also.

The public suffers due to the loss-making state-owned enterprises. The loss of these institutions is borne by the public. The political groups that call them national treasures are piling up the burden of these loss-making state-owned enterprises and pulling the whole nation backward.

Meanwhile, corruption and fraud are spread everywhere over the country like cancer. We have introduced the laws and acts that avoid stealing the wealth of the nation. There are allegations on some persons claiming that they have stolen the wealth and resources of the Nation.

However, we have to rethink the people who stole the wealth and resources of the nation as well as the future of the nation. Several political groups stole the future of the nation by nationalising successful enterprises. Some groups stole the future of the nation by protesting against the leasing out of unutilised properties such as Trincomalee Oil Tanks. Some groups stole the future of the country by protesting against the apparel industry. The future was stolen by developing the port. The list is lengthy. Remember. They also steal.

The political groups who protested against every development project did not allow the development of the Trincomalee Oil Tank Complex. They wanted to allow the Nuwara Eliya Post Office to crumble down in the same manner they allowed the oil tanks to corrode and crumble down. Allocation of Nuwara Eliya Post Office for the tourism industry is not an isolated incident. It’s a part of the Nuwara Eliya Development Plan. The establishment of a university in Nuwara Eliya is also a part of the same Development Plan. There are several massive projects being implemented in Nuwara Eliya.

They did the same thing for the old post office located inside the Galle Fort. Now that building has crumbled down. If we allocated that building for the tourism industry at the right time, we would still have that historic landmark building. And we earn foreign exchange. I would like to quote a recent post on Facebook, posted by Mr. Susantha Ariyarathne, an Economic Analyst. The formula to protect national treasures is none other than harnessing the maximum benefit out of them. Not protesting “Don’t touch National Treasures”. Then these resources will not become a burden to the others. So far what we have done was hide behind the slogan “Protect National Treasures” and avoid utilising them. Making them a burden that the country could hold. Think. The political and economic concepts that we implemented in our country have been failed. Please understand that. Make your neighbour understand that.

They did the same thing for the old post office located inside the Galle Fort. Now that building has crumbled down. If we allocated that building for the tourism industry at the right time, we would still have that historic landmark building. And we earn foreign exchange. I would like to quote a recent post on Facebook, posted by Mr. Susantha Ariyarathne, an Economic Analyst. The formula to protect national treasures is none other than harnessing the maximum benefit out of them. Not protesting “Don’t touch National Treasures”. Then these resources will not become a burden to the others. So far what we have done was hide behind the slogan “Protect National Treasures” and avoid utilising them. Making them a burden that the country could hold. Think. The political and economic concepts that we implemented in our country have been failed. Please understand that. Make your neighbour understand that.

We have no journey ahead if we do not construct a fresh political and economic system. The political and economic system that prevailed in the country has to be completely upended. I pointed out this during my previous budget speech. As Sugathapala de Silva wrote in his play “Marat/Sade”, we must have a fresh perspective. The social convention deep-rooted in the country was the Government has to do everything. This is why the Government intermediates in every enterprise by making them weak and taking them over. However, it is confirmed that the said social convention is failed and outdated. We have to construct our own economic and political system considering past experiences, global trends, and future challenges. A new social convention has to be constructed.

The economy is being healed due to the correct procedures and methodologies we followed during the past year, building the foundation of this system. The essential commodities are now available in abundance. Interest rates declined from 30% p.a. to 15% p.a. Continuous power supply is ensured. There is no shortage of fertiliser. The primary deficit of the year 2021 was 5.7% of the Gross Domestic Product (GDP). During the first half of the year, we were able to achieve a primary surplus. Amid the deep economic crisis, we were able to increase the tax revenue by 50% in the first six months of the year. The inflation which was skyrocketed up to 70% in September 2022, declined to 1.5% in October 2023. Foreign reserves increased to $ 3.5 billion from zero. The confidence placed in us by foreign countries was restored. However, we have a long way to go.

We were able to achieve increasing progress during the past year because of the honest sacrifices made by the majority of our people. Because of their courage against various difficulties. The Government will gradually set the background to ease these difficulties. We are devoted to providing more facilities and benefits as our economy recovers and our economy stabilises. We cannot put ourselves back in the hell that our country was in 2022. Some groups are trying day and night to put the country in that place and achieve their political targets. We do not have any political target. The only target we have is uplifting the country.

Some people denote this budget as an Election Budget. The reason is the Presidential Election and the General Election is scheduled in the next year. Such a Budget is designed to provide various concessions and salary increments aiming at an election victory. This is what happened during the past 75 years since the independence. However, this Election Budget is different. This is a Budget that constructs the future of the country. This is a budget that was prepared for the victory of the county. A Budget that was prepared according to the Buddhist philosophy. Several proposals have been included in this budget, based on the concept of “Samajeewikathaa” to ensure victory for the country and the country’s future. I will now present the 2024 Budget proposals to this Parliament.

Public sector salaries

Government employees have not received a salary increase since 2015. Therefore, I propose to increase public sector salaries without affecting the fiscal balance. There are about 1.3 million (1,300,000) public sector employees. Their families have more than five million members. These Government employees are currently receiving a Cost of Living Allowance of Rs. 7,800. We propose to increase their Cost of Living Allowance to Rs. 17,800 by Rs. 10,000 from January, 2024. The General Treasury begins to receive Government revenue typically by February and March. Therefore, we can only add this allowance to the monthly salary from the month of April. We will take steps to pay the balance accumulated from January to March 2024 in instalments within a six-month period, starting from October 2024.

Public pensions

There are about 730,000 public pensioners. Currently, they are only receiving a Cost of Living Allowance of Rs. 3,525 per month. We will increase the monthly Cost of Living Allowance of public pensioners to Rs. 6,025 by Rs. 2,500. This increase will be implemented from April, 2024. Rs. 386 billion will be spent on public pensions in 2024.

Widows’ & Widowers’ and Orphans’ Pensions (W&OP) scheme

The W&OP scheme is a contributory pension scheme in which employees contribute 6-7% of their basic salary. The Government spends Rs. 65 billion annually for the payment of the W&OP scheme. The total annual contribution from employees for W&OP scheme is Rs. 38 billion. Hence, the contribution from the public employees is not sufficient for the payment of the same. Therefore, I propose to revise the deduction percentage from the salary for this pension contribution to 8% for all service categories from April 2024 onward. With this adjustment, an additional Rs. 9 billion can be collected annually, and it will ensure the continuity of the pension scheme for widows, widowers and orphans.

Food and lodging allowances

The allowance provided to police officers who travel long distances to attend duties does not match with the current situation. Hence, instead of the allowance that is paid at present, I propose to pay a food and lodging allowance with food and lodging allowance with appropriate adjustment for three groups of officers in the Police Department.

Distress loans

Due to the economic hardships that prevailed in the country, several measures were taken to carefully manage public expenditure. In that process, the entitlement of Public Servants for the Distress Loan given during unexpected and unprepared hardships faced by them was subjected to some limitations. Hence, I propose to provide the Distress Loan facility for all the public servants effective from 1 January 2024 as previously done.

Aswesuma program

We started providing Aswesuma benefits with the support of development partners including the World Bank. However, in the next year we will provide benefits to the people from our own funds. In the previous years, we have spent Rs. 60 billion for this program. Now, it has been increased to Rs. 183 billion. In the year 2024, it is expected to spend three times the amount spent on the social security programs in the previous years for the Aswesuma program. This will provide relief for two million families. Aswesuma program is based on objective selection criteria. The delays in implementation when transitioning in to the new program is being addressed. A program is implemented to provide justice to families who face injustice. Retroactive payments will be made to eligible recipients who faced payment delays. We will use the knowledge and experience of Samurdhi officers to empower beneficiaries of the Aswesuma program.

About 130,000 persons with disabilities and kidney patients are paid a monthly allowance of Rs. 5,000. I propose to increase the payment up to Rs. 7,500. It is a 50% increase. The present monthly payment of Rs. 2,000 for elderly citizens will also be increased to Rs. 3,000. Around 530,000 persons will benefit from this. The beneficiaries who were on the waiting list and are already receiving financial assistance will be entered into the list of beneficiaries from 2024. For this purpose, a total of Rs. 138 billion will be allocated for this. 153 Some families may face sudden calamities. The breadwinner of the family may die or meet with an accident. Or he may lose his job. In such situations, the whole family becomes helpless. Such families need to wait for a long time to get Aswesuma relief according to the current system.

However, in future, we will review the Aswesuma beneficiaries once in every six months. This will allow new families to be added to the beneficiary list without a delay. I will increase the allocation for cash transfers provided through Aswesuma and allowances provided to persons with disabilities, kidney patients and the elderly to Rs. 205 billion in next year. We have identified many shortcomings and weaknesses in the system of providing a monthly allowance of Rs. 4,500 to pregnant mothers. Rs. 10 billion has been allocated to resolve such issues and make this program more systematic.

Small & Medium Enterprises (SMEs)

SMEs have been badly affected by the economic crisis and COVID-19 pandemic. A recent survey revealed that about 20% of such enterprises have either temporarily or permanently closed down. The survey also revealed a decrease in the performance volume of the currently operating enterprises. We want to fast track the journey towards a production economy. Therefore, SMEs should be further strengthened, encouraged and facilitated. For this purpose, we are introducing a concessionary loan scheme of around Rs. 30 billion with the support of the Asian Development Bank. This program is the first phase of action which will collectively provide a major impetus to the SMEs.

In addition to concessionary credit facilities, capacity development programs are implemented for the participating institutions. Steps will be taken to link SMEs with the value chains of large companies in the industrial sector. The required provisions have already been included in the Budget 2024. Accordingly, the total amount allocated for the development of SMEs is Rs. 50 billion. As a result, a financial space worth around Rs. 250 billion is created.

“Urumaya” program

Waste Land Ordinance was passed in 1897. The British government acquired thousands of acres of rural land across the country under that Ordinance. 154. Afterwards, in 1935, under the Land Development Ordinance, those land slots were distributed among farmers under the license system. But although around hundred years have passed, the ownership of these farmlands has not been handed back to the farmers who own them. As mentioned in the drama “Chalk Circle”, “farmers with good conduct; should win the land and villages.” We are handing over the lands to farmers who lost the ownership of their traditional lands during the British colonial era. We expect to commence this task in 2024 and complete it within another few years. Two million (2,000,000) families will get the ownership of land and farmland. I allocate Rs. 2 billion for this purpose.

Urban home ownership

Houses constructed under various urban development programs have been rented to low-income families. A monthly rent of around Rs. 3,000 is obtained from those families. I will completely stop collecting rent from these families. Not only that, the full ownership of these houses will be given to those families. In 2024, nearly 50,000 families will be given the ownership of these houses. By the completion of the program of providing land and housing rights to the people, about 70% of the people of this country will become the owners of land and houses.

Estate housing

Estate dwellers are not owners of lands. We will take steps to grant land ownership and build houses for them. As the initial step, I expect to allocate Rs. 4 billion.

Bimsaviya program

Under the Bimsaviya program which commenced in 1998, one million land plots have been covered out of the total number of land plots of 12 million. In order to provide the necessary facilities to expeditiously complete this program, I allocate Rs. 600 million.

Decentralised budget

Due to the difficult situation in the country and the lack of funds under the decentralised budget program in the past, regional development programs could not be implemented. As these programs were temporarily suspended, public representatives could not contribute to the rural development activities. We will recommence the decentralised budget program. I will provide Rs. 11,250 million through the district coordination committees for this purpose. This program will be implemented under the supervision of the Department of National Planning using a methodical and standard approach.

“Kandurata Dhashakaya”

The public infrastructure and services available in the hill country are relatively underdeveloped due to disparities in the distribution of resources for various reasons. This disparity is also reflected in the living standards of the people. The Government has recognised the importance of giving priority to rural development in the hill country. A 10-year multipurpose rural and community development program from the year 2024 including all the 89 Divisional Secretariat divisions that belong to the hill country areas of Sabaragamuwa and Central Provinces as well as Badulla, Matara, and Kurunegala districts. I propose to allocate Rs. 10 billion for the year 2024 for this purpose.

Approving development project proposals

We have already introduced a new mechanism to approve development projects. A Government Committee has been established to review new projects. As per recommendations of the Committee, the Minister of Finance will grant approval for projects. Government will not allocate funds for projects that deviate from this procedure. This will enable to allocate capital expenditure to give a higher contribution to the economic growth. This is very important for fiscal and debt sustainability. To achieve this objective, I will increase the expenditure capital expenditure to Rs. 1,260 billion. This is equal to 4% of the Gross Domestic Product (GDP). The implementation of number of projections have been temporarily suspend due to the economic crisis.

I will allocate another Rs. 55 billion to recommence and complete these projects and to provide necessary provisions for the capital expenditure proposals mentioned in this Budget Speech. We will allocate this by transferring Rs. 55 billion from the Vote of the National Budget Department to Capital Expenditure Vote. Thus, we would allocate Rs. 1,260 billion for the development activities of next year. Further, a number of projects that was implemented under foreign loans and grants have been temporarily suspended. We will have the opportunity to recommence these projects after the completion of foreign debt restructuring activities. It is observed that the project management committees have been unable to achieve expected objectives for the development projects. Hence, I propose to establish a unit for this purpose under each Ministry from 2024 onwards, to include project related activities to the duty list of the permanent staff and to procure human resources under contract and duty basis only when related specialists are not available in the public sector.

Rural roads

Since the last few years, it has not been possible to carry out the maintenance and management of rural roads properly, I propose to allocate Rs. 10 billion for the year 2024 for the renovation of such roads which have become dilapidated.

Natural disasters

We had to face adverse weather conditions during the last few months. Roads and bridges were damaged due to floods and landslides. I allocate Rs. 2,000 million to rehabilitate damaged rural roads.

Drinking water

There are issues with regard to drinking water in all provinces of the country. We will prioritise drinking water projects when allocating the decentralised budget and obtaining foreign loans.

Education

The future of a country can be enriched by introducing an education system that is suitable for this era. Our country has an outdated education system. It is an education system that produces memorisers. Creative people are not generated under this system. Also, the benefits of free education are not fully available to the people. Therefore, we are implementing a series of comprehensive education reforms. We appointed a group of 25 experts to prepare this new national education policy framework. Those proposals were further polished through the direction of a Cabinet Committee headed by me. This policy framework has now been adopted by the Cabinet.

I would like to inform this House about several key institutions that will be established under these reforms. These are the Higher National Council on Education, National Higher Education Commission, and the National Skills Commission. The detailed information in this regard will be informed to this House by the Minister of Education in the next two weeks. Recently, this post written by Ajana Ranagala on Facebook has taken my attention. “My child is suffering not just for days, weeks, months, but for years due to his decision to do A/Ls in the national curriculum as he wanted to gain admission to a local university. His friends who studied the international stream are going abroad for higher education.” This is the real situation. Hence, we will provide the opportunity to obtain higher education without delay to every child who passes A/Ls.

Expansion of science and technology education in universities

We will take steps to establish four new universities considering the current trends for the technical sector.

Seethawaka Science and Technology University (Lalith Athulathmudali Post Graduate Institute will be incorporated to this University)

Kurunegala Technology University under the Kotelawala Defence University.

Management and Technology University

International University of Climate Change

Also, I propose that the rules and regulations should be adopted to convert the following private higher education institutions that are currently in operation into universities.

NSBM

Sri Lanka Institute of Information Technology (SLIIT)

Horizon Campus

Royal Institute

As per the 13th Amendment, provincial councils have been empowered to establish universities. We expect that provincial councils will also establish universities in the future.

National Education University

I propose to establish an Education University focused on education by integrating 19 Colleges of Education. Bachelor of Educational Degrees will be offered to students who complete a four-year program under an existing College of Education in accordance with the relevant standards. This program will be implemented step by step and I propose to make a Rs. 1 billion budgetary provision for the year 2024 for this program.

New Technology University

A new Technology University will be established in Kandy under the guidance of IIT University in Chennai, India. India will fully support us in this endeavour.

State universities

A program to enhance State universities to suit the modern era will be implemented. This program will be commenced at Peradeniya University. Rs. 500 million will be allocated for the initial development activities of this program aimed at the centenary celebrations of Peradeniya University in 2042. Department of Allergy and Immunology, University of Sri Jayewardenepura will be upgraded as the National Institute of Allergy and Immunology. For this purpose, Rs. 40 million will be allocated for the next year as per the work plan to develop laboratories and other required facilities required. After that, our focus will be shifted to the Universities of Colombo, Kelaniya and Moratuwa. I request these universities to prepare and submit a formal plan for this purpose.

Non-State universities

We will allow any recognised educational institution in the world to establish universities in Sri Lanka once a set of powerful rules and regulations for the regulation of non-state universities are put in place. This will create opportunities for every student who passes G.C.E (Advanced Level) to obtain university education and earn foreign exchange through the admission of foreign students. Loan facilities will be provided to students studying in these non-state universities. In addition to the existing interest-free student loan scheme, I propose to implement a subsidised student loan scheme through commercial banks. Arrangements will be made to repay the loan after getting a job.

National Higher Education Commission

A National Higher Education Commission will be established to integrate the University Grants Commission (UGC) and Tertiary and Vocational Education Commission (TVEC). This Commission will be granted decision-making powers and regulatory for strengthening and expanding higher education.

National Skills Commission

A National Skills Commission will be established which is suitable for the prevailing challenges. Under this Commission, Vocational Training Authority, National Apprenticeship and Industrial Training Authority will be integrated.

Vocational Education for Provincial Councils

I propose to hand over the vocational education institutions that are currently operating under the central government to the nine Provincial Councils. Provincial Boards of Vocational Education will be established to develop and modernise the skills development sector. In the future, only the necessary guidance will be provided by the central government to regulate vocational education activities, while all education and training functions and services will be implemented through the provincial councils. As such, the necessary arrangements will be made to establish a Fund to enhance technical vocational skills. Discussions have already commenced with the Asian Development Bank for this purpose. In addition to the allocation made to these institutions already, Rs. 450 million is allocated for the coming year for these institutions.

Training in Information Technology

A training program will be launched for job-seeking graduates in association with private institutions related to information technology. These graduates are given training and work experience for a minimum period of six months. I allocate Rs. 750 million for this purpose. Such an apprenticeship training programs will be implemented other skill shortage areas such as construction, care giving and tourism services.

Youth and adult education

The youth who are not eligible for university education should be given opportunities to obtain local and foreign jobs. Also, it is needed to create opportunities for adults working in the public and private sectors to obtain new knowledge. I propose to allocate Rs. 150 million to the Sri Lanka Foundation for the necessary technical and physical modernisation projects for conducting training courses and to deliver services.

English for all

It is necessary to develop a national program to enhance English literacy in Sri Lanka. The aim of this program is to provide English literacy to all by 2034. I allocate Rs. 500 million to start this 10-year program.

Suraksha

I propose to reintroduce the Suraksha Student’s Insurance Scheme, which was introduced in the year 2016 but is currently not in operation. Accordingly, all school students will be entitled to this insurance coverage.

Health services

We are committed to maintaining the quality of health services. We will take actions to identify deficiencies, weaknesses and crises and take measures for the advancement of the field.

Drug procurement guidelines

Our focus has been on issuing specific guidelines for the procurement of medicines and setting up a separate institution for that purpose. We are taking this step after conducting a detailed study of the Government’s medicines procurement process.

Medical and health research

I expect to increase the investment in medical and health research to bring Sri Lanka’s medical research output on par with the rest of the world. The strengthening of the infrastructure and laboratory facilities of the Medical Research Institute is being implemented in several phases. For this, for the year 2024, Rs. 75 million will be allocated. I propose to allocate Rs. 25 million for the next year under a three-year plan to upgrade the facilities of the National Drugs Quality Assurance Laboratory.

A cardiopulmonary resuscitation unit for Badulla

There is no cardiopulmonary resuscitation facility in any hospital in Uva Province. We are filling this gap. I allocate Rs. 300 million for the establishment of a resuscitation unit at the Badulla Teaching Hospital and for the purchase of necessary equipment.

Promotions for medical officers

I propose to expedite the arrangements to adopt a promotion scheme that is applicable to both specialists and graded doctors. In addition, we will explore the possibility of paying an allowance for the additional work done by the specialists instead of the existing paying method.

Postgraduate opportunities

With the aim of upgrading the careers of medical doctors, we proposed to expand the postgraduate opportunities available for doctors under 2023 Budget. In addition to the universities in which the program is currently implemented, Universities of Kelaniya, Jayewardenepura, and Rajarata University will also be included to the program.

Indigenous medicine

We will take action to strengthen and popularise Indigenous medicine.

Sri Lankan wellness

There is an international demand for indigenous medicines, food supplements, medicinal cosmetics and herbal ingredients made from traditional medicinal recipes. If we use this opportunity properly, we will be able to further expand the international market. I propose to provide necessary facilities for such investments under the supervision of the Indigenous Medicine Section of the Ministry of Health and the Ayurvedic Drug Corporation. In order to provide local and Ayurvedic wellness to tourists, a plan will be launched to establish wellness centres in tourist hotels and resorts in accordance under the concept of “Sri Lankan Wellness”.

Rs. 100 million will be allocated for this purpose.

Modernisation of agriculture and fisheries industries

Agriculture needs to be uplifted to a competitive level. Value added agri products need to be produced. Agriculture needs to be modernised focusing on exports. Provisions will be made by this budget for agricultural modernisation projects, smallholder agribusiness partnership initiatives, and crop diversification. Further, work plans will be launched to uplift and nurture the fishing industry and to utilise new technology and knowledge for fisheries industry.

Agricultural and fisheries modernisation boards

I will establish provincial agricultural and fisheries modernisation boards to assist in development of agricultural and fisheries sectors. All Agrarian Service 163 Centres will be upgraded as Agriculture Modernisation Centres. For this purpose, a joint program consisting of the government, private sector, farmers and agronomists will be implemented from the 2023/24 Maha season. For these activities, I propose to allocate Rs. 2,500 million. The purpose of this is to increase the paddy production from 3.5 metric tonnes to 8 metric tonnes per hectare. This would give us the opportunity to utilise the uncultivated paddy fields to other useful cultivation activities while improving the productivity of the paddy production of the dry sector.

The productivity of paddy cultivation in wet zone is very low. The law does not permit to grow any other crop instead of paddy cultivation. I propose to remove legal impediments to grow other crops in such bare uncultivated land. In addition, I propose to allocate 300,000 acres from other government lands including State Plantation Corporation, Mahaweli A and B Zones, and Land Reform Commission for large scale agriculture activities.

Fisheries sector

Increasing the productivity of the fisheries sector is the most sustainable way to improve fishermen’s livelihoods and incomes. For this purpose, the Government is starting to cooperate with the private sector in the management of fishing ports. In this way, the necessary infrastructure including warehouses can be developed to reduce wastage and optimise productivity. About 35% of the country’s total fish harvest comes from the North Sea. To improve the facilities necessary for those functions, Rs. 500 million will be allocated. 29% of Sri Lanka’s total fish harvest comes from the freshwater fisheries and aquaculture sector. There are about 12,000 permanent and temporary reservoirs in Sri Lanka.

The total size of the reservoir is about 260,000 hectares. For the development of the freshwater fishing industry, I allocate Rs. 200 million. To maintain the sustainability of this program in the future, I further propose to prepare a program to encourage the fishing community by establishing a revolving fund through community participation.

Rehabilitation of small tanks

Small tanks play a crucial role in irrigation and agriculture in the country. This becomes more important with the effects of climate change. I propose to assign the responsibilities of rehabilitating small tanks to the farmer organisations of the respective areas. We will provide the necessary authority and support to the farmer organisations. Then they can work together with the private sector to rehabilitate small tanks. Our aim is to increase agricultural production through these measures.

Dairy products

The majority of dairy farmers are currently engaged in the industry as a means of livelihood. However, we need to raise it to the status of a profitable industry and create the necessary background for dairy farmers to earn high income. Towards this, it is important to increase capital investment and establish medium-scale milk production units that make profits. For this purpose, I propose to implement a re-finance loan scheme to meet the financial needs of those engaged in the dairy value chain.

A special program will be implemented to increase milk production by 53% in five years with the contribution of the private sector by effectively using all the farms owned by the National Livestock Development Board. When this project is completed, the daily milk production will increase to 20 million litres per day. That’s a five-fold increase. Ambewela farm has obtained successful results under this program. The daily dairy production which was 1,600 litres in Ambewela farm, has now increased to 50,000 litres of milk. It is our aim to increase this up to 75,000 litres of milk.

Support for the construction sector

The construction sector can be identified as one of the most depressed sectors in the recent past. Due to various reasons like COVID-19 pandemic, economic crisis, import restrictions, etc., the construction sector underwent a huge crisis. Considering this situation, we expect to conduct a new experiment to support them. Government agencies will provide free lands. We will allow construction companies to construct buildings on those lands according to the plans of the respective Government agencies. After construction, these institutions will pay 165 monthly rent to the construction company. Upon recovering the construction cost and receiving corresponding dividends, the full ownership of the building will be handed over to the government agency.

The construction of the new building complex of the Ministry of Foreign Affairs will be implemented as the first pilot project. We hope to implement a new program aimed at uplifting the living conditions of the people living in urban estate housing in Colombo and the developing of the construction sector. We will give the construction industry the responsibility of building large houses and shopping malls in urban estates in Colombo city. We will give those lands to them for free. The only condition they will have to fulfil is to provide new houses to the people residing in that estate. If these families ask for houses in that housing complex, they should be given a house in these urban estates. If these families ask for houses in another place, the construction company should fulfil that request.

National branding of Sri Lanka

Sri Lanka has many untapped potentials to emerge as a strong country. To capitalise on these potentials, it is essential to implement national branding efforts by re-engaging with government agencies, businesses, citizens, cultural institutions and international organisations to realign Sri Lanka’s direction and reclaim the country’s status as a top tourist destination and attractive investment hub. I allocate Rs. 100 million for this purpose.

Logistics

There is enormous economic value in leveraging Sri Lanka’s strategic location and positioning the country as a supply hub. However, many steps have to be taken to realise this long-term dream. As the first step, the government will work together with all stakeholders to develop and implement a national supply policy. We expect to initiate land connectivity between Sri Lanka and India. We expect to utilise Colombo Port to meet the supply needs of South West India and Trincomalee Port to meet the supply needs of South East India. The capacity of the Colombo Port will improve after the construction of the West Terminal and the expected Colombo North Port after the year 2030. Trincomalee port will also be developed. This will enable Sri Lanka to harness the benefits of rapid growth and industrialisation in the South Indian region. Our ultimate goal is to elevate Sri Lanka as a regional logistics hub.

Women empowerment

I propose to introduce gender-based budgeting and make related legislation. We are also working to introduce laws for the empowerment of women.

Handloom

I propose to allocate Rs. 300 million to implement a special program for economic empowerment of women and youth engaged in the handloom industry.

Housing for internally displaced people

Although 14 years have passed since the end of internal conflict in the North and Eastern provinces, some families are still homeless in those areas. Rs. 2,000 million has been allocated from this year’s Budget to meet the needs of resettling these people. However, I propose to allocate Rs. 500 million as an additional provision to speed up the housing program and provide essential relief to the families remains homeless.

Compensations for missing persons

Compensations have been provided to 181 missing persons and victims affected by the internal conflict in the Northern and Eastern Provinces. Compensations will be provided to another 170 by the end of 2023. Preliminary work has been completed for more than 6,300 incidents out of the submitted requests, and Rs 1,500 million has already been allocated by the Appropriation Act. To expedite the payment of these compensations, I propose to allocate Rs. 1,000 million.

Water issue in Jaffna

There are serious issues regarding drinking water in Jaffna. Even after many years, this problem is still not solved. The pre-feasibility study to provide a solution to this complex water problem has now been completed. Accordingly, the best solution for us is to implement the Pali-Aru Water Project. I expect to commence the initial work of this project in the first half of 2024. Rs. 250 million will be granted for the year 2024 for the preliminary activities of this program.

Punareen City development

Punareen is a very important town for tourism, located near the Sangupiddy Bridge on the Jaffna-Mannar main road. We will provide Rs. 500 million for the development of Punareen City.

Galle District Auditorium

The construction of the Galle District Auditorium which started in 2019 has been halted midway due to the recent crisis. A considerable amount of money has been invested so far on this and a public-private partnership is required to take this project forward. Therefore, Rs. 500 million will be allocated as its Government contribution.

Bandarawela Economic Centre

I propose to establishment an Economic Centre in Bandarawela and provide necessary infrastructure as a project with equal economic contribution by the Bandarawela Municipal Council and the Government. We will allocate Rs. 250 million as the government contribution for this purpose.

Lower Malwathu-Oya project

In addition to the budgetary provision which has already been made, I propose that Rs. 2,500 million to be allocated to this project in order to expedite the rest of the work of this project.

Culture

Our culture has been subject to limitations for years. Most people think that culture is only about holding State award ceremonies. There are hardly any formal procedures in place to nurture the nation’s culture and pass on its historical legacy to future generations. Despite various difficulties and challenges, we will implement a number of cultural projects through this budget.

Maha Vihara University Anuradhapura

Maha Vihara languished for centuries without much attention until the latter half of the 19th Century. A major role was played by the Maha Vihara in preserving and maintaining Theravada Buddhism as well as propagating Buddhism in the World. Considering these facts, I propose to establish Maha Vihara University incorporating all the aspects of Mahavihara’s history and roles. It is expected to complete the initial work on this during the next decade. A Performance Committee will be appointed under the Presidential Secretariat in order to commence the work within a six-month period. Rs. 400 million will be allocated for the initial works of this program.

International Buddhist Library in Anuradhapura

As a complementary work to the establishment of the Maha Vihara University, I propose to establish a modern international library in Anuradhapura. The objective of this library is securing archaic documents from international Buddhist countries and provide facilities to scholars who want to use them for their research purposes. It is expected to implement this program within the three-year timeframe and Rs. 100 million will be allocated for the next year.

Buddhist Culture Museum in Kandy

Focusing on the Buddhist civilisation of Sri Lanka, I expect to establish a Sri Lankan Buddhist Museum for research activities as well as for cultural promotion activities. There are such Museums in different countries related to different civilisations. They are utilised for research and tourist attraction. Rs. 200 million will be allocated in the next year to establish the museum, which is expected to be built in several phases. Our ambition is to make Sri Lanka a Buddhist tourist centre through these activities.

Development of cricket

We know that cricket in Sri Lanka is currently facing an institutional crisis and a shortage of talent. Rs. 1.5 billion will be allocated from this budget for the development of school cricket and for providing necessary facilities to cricket players at the provincial level. Schools and provinces with less facilities are given priority in providing this allocation.

Transport sector

The Department of Motor Traffic will be digitised in 2024. A pilot project of running 200 electric buses will be started jointly with the Sri Lanka Transport Board in the Western Province. The Kandy multi transport centre project will be started in January 2024 under the loan support of the World Bank to remove the vehicle and passenger traffic in the historic city of Kandy and integrate train, bus and other taxi services. Rs. 1.5 billion will be allocated for the development of the access roads of this centre. The Department of Railway will complete the renovation of the railway track from Anuradhapura to Mihintala in January 2024 and I allocate Rs. 200 million rupees to setup a large city base on the station premises of Mihintale with transport, economic, container and storage facilities with the financial assistance of the private sector.

We also hope to call for proposals from local and foreign investors to establish Station Plaza or Railway Station Towns as mixed development projects on the basis of Public Private Partnership focusing on railway stations in metropolitan areas such as Pettah, Galle, Matara, Anuradhapura, Jaffna and tourist destinations.

Public service delivery

Our focus should be on both responsibility and accountability in providing public services. It is essential to maintain strict financial discipline while implementing the Government budget.

Responsibility on matters relating to the budget

I propose to consider Provincial Councils as special spending units for budgetary purposes. Accordingly, the Chief Secretaries of Provincial Councils should act as the Chief Accounting Officers as practiced by Secretaries to other line ministries. The Provincial Council is responsible to the Parliament for the money spent for budget purposes. When preparing the budget based on the Sustainable Development Goals, the necessary guidelines have been issued to fulfil the above goals to all ministries, departments and institutions, and they should act in accordance with those guidelines.

Provincial revenue

I propose that the revenue collected from the provincial councils should not be limited to cover recurrent expenses but should also be used as capital expenditure for the development of the province. However, in order to avoid the practical difficulties of suddenly changing the ongoing process, I propose to only use 50% of the provincial council income from the year 2025 as recurrent expenses and to use the additional income as capital expenditure.

Promotion of export industries by Provincial Councils

Under the Industrial Promotion Act No. 46 of 1990, the powers of the provincial councils regarding industries have been limited. They have no powers to permit export industries. They can only permit factories with a capital investment of less Rs. 4 million and less than 50 permanent employees. We will cancel these provisions. The annual turnover limit will be increased to Rs. 600 million. This enables the provincial councils to promote export-oriented industries. We are also taking steps to establish an industrial service centre in every province.

Encouraging the self-financing of Municipal Councils

Although the local government bodies have been empowered to collect revenue and manage the necessary activities for the well-being of the local people, the Government bears the expenses for the salaries and other development works of those entities. Given the existing financial constraints, Local Government Authorities (LGAs) should be encouraged to provide their services efficiently under a self-financing model. As a first step, I propose to provide only 80% of financing for the payment of salaries to Municipal Councils from 01.01.2024 and gradually allow LGAs to intensify their efforts to increase self-revenue generation. I also propose to reduce the amount given to Urban Councils from 01.01.2025 and gradually encourage self-financing within the next five years.

National Janasabha

Under the Janasabha system, it is expected to implement the process of resource allocation at the national level by identifying the unsolved development needs at the rural level and giving priority to them, with the coordination of the public representatives representing the respective areas. This will provide an opportunity for the people of the village to collectively decide their development priorities, allocate resources, and submit those development priorities directly to the government, regardless of party, race, and religion. Also, everyone from public representatives to ordinary villagers can contribute to this program. Especially the young people of the village have the opportunity to directly contribute to this. I propose to allocate Rs. 700 million to establish the National Janasabha Secretariat to coordinate these activities.

Hingurakgoda International Airport

Although there have been discussions on various scales for some time, the construction of the Hingurakgoda International Airport has not been implemented. Therefore, for its basic activities Rs. 2 billion will be allocated for 2024.

Central Expressway

As soon as the foreign debt restructuring process is completed, the second phase of the Central Expressway, i.e. the section from Kadawatha to Mirigama, will be started jointly with China. We hope to get the support of Japan for the construction of the section from Kurunegala to Galagedara. We are planning to find out whether it is possible to build the highway up to Katugastota.

Program for youth development

Many programs are implemented by various ministries and government agencies focusing on the development of the youth. But an integrated youth development program should be implemented by coordinating all these programs and it should include new programs that suit the new economic and social conditions. It is proposed to implement this joint youth development program by the President’s Office and allocate a provision of Rs. 1 billion for this purpose.

Gem industry

Sri Lanka’s gem industry has not yet reached full capacity and no generally agreed program has been implemented. A common program should be prepared for the development of gemstones from foreign countries and considering the existing problems in the gem industry in this country. In the medium term, the government, the private sector and all relevant parties should implement the program together. A framework plan for that is proposed to be prepared and implemented in the next three months.

Trincomalee suburban development

The Government’s desire is to develop Trincomalee as a major economic centre of the country. Especially, various development activities related to the port can contribute greatly to the development of the country. This is a long-term 172 development program. It also includes large-scale agricultural programs and a coastal tourism zone. It is proposed to launch this development program together with Indian investors and to establish a presidential task force for these activities.

Flood control in Galle District

The Gin Ganga water management program should be implemented as a measure to prevent floods in Galle district. It is our expectation to implement this as a medium-term program. I propose to allocate Rs. 250 million for its basic work.

Restructuring of debt

Due to the space created by the debt restructuring process, the Government was able to find resources for relief measures. Under the debt restructuring supported by the International Monetary Fund, Sri Lanka’s public debt as a percentage of GDP is expected to be reduced from 128% in 2022 to 95% in 2032. People will get the benefits of these savings. After the completion of the debt restructuring process, the overall macroeconomic stability and stability of the financial sector will be further strengthened. We have now been able to achieve significant progress in the debt restructuring process. Key aspects of Domestic Debt Optimisation are completed.

As part of the restructuring of International Sovereign Bonds under the External Debt Restructuring Process, Sri Lanka’s net debt is reduced to its present value. USD denominated new financial instruments should be issued to settle existing international sovereign bonds. Accordingly, for the settlement of existing International Sovereign Bonds, budget allocations are required to record the transaction in the Government book of accounts. Accordingly, for the implementation of foreign debt restructuring and settlement of International Sovereign Bonds under foreign debt restructuring, I propose to allocate Rs. 3,000 billion through this budget.

Stabilisation of financial sector

The Government is keen to ensure that all prudent measures are taken for long-term banking stability. To this end, for systemically important banks, an independent asset quality review supported by the IMF program was conducted. The preliminary results of this asset quality review indicate the need to build additional capital accumulation on a prudent basis. Accordingly, I propose to allocate Rs. 450 billion to support the capital improvement process in the banking system. The proposed provision to improve the capital of the banking sector will ensure the stability of the banking sector in the long run. I propose that 20% of the shares of the two large State-owned banks should be given to strategic investors or the public to improve capital and support the future growth of the two State-owned banks to reduce the burden on taxpayers’ funds.

In parallel, a number of reform measures are being implemented, including stricter rules on credit risk, such as stricter rules on the appointment of chief officers and state bank board members, and restrictions on individual borrowers, to prevent future financial deterioration of State-owned banks. Amendments to the Banking Act will provide the legal framework for these reforms and are expected to be passed in early 2024.

Increase in the borrowing limit

Bank recapitalisation and external debt restructuring will require the issuance of new debt instruments with longer maturities. Therefore, budget allocations are needed to settle the existing debt and the borrowing limit needs to be increased. Accordingly, I propose to increase the borrowing limit from Rs. 3,900 billion to Rs. 7,350 billion by Rs. 3,450 billion.

Law reforms

The Microfinance and Credit Regulatory Authority Bill and the Secured Transactions Bill have already been tabled in Parliament, and the new Microfinance Bill will provide more secure legal powers for clients. The new Secured Transactions Act will enable SMEs to leverage more of their assets and access loans for growth. The Ministry of Finance is introducing new laws to further improve the principles of good governance in Public Financial Management. The Public Debt Management Act, Public Financial Management Act, Public Asset Management Act, Public Enterprise Reform Law have already been finalised and are scheduled to be tabled in Parliament in December or in the first quarter of 2024.

We initiated the introduction of the new Investment Law and Public Private Partnership Law to create an investment-friendly legal environment. The Government is introducing a new land law with new institutional changes to maximise the use of land for economic development. In addition to the above mentioned laws, we have already started the process of introducing a number of new laws and introducing amendments to the existing outdated laws to support the progress of the country. In this way, we are introducing 60 new laws and amending laws.

Governance reforms

In contributing to the economic crisis, the Government has recognised the significant contribution made by weaknesses in economic governance and especially financial governance. The first step to solving an issue is acknowledging the issue. Our Government invited the International Monetary Fund to conduct an independent assessment of the weaknesses in Sri Lanka’s governance structures. This is the first time that a Sri Lankan Government has conducted such a review. Also, this is the first time that the International Monetary Fund has conducted an analysis of governance in Asia.

Sri Lanka has suffered from governance-related structural issues. The Government has already identified many of the issues raised in the review and we are already taking steps to address them. For example, measures to improve the procurement process, addressing corruption weaknesses in revenue collection authorities, and addressing issues related to investment incentives are high priorities on the Government’s agenda. Legislations are being prepared to address these issues. New legislation is being drafted in the form of the Public Financial Management Bill.

New growth model

For several decades, Sri Lanka relied on debt-financed economic development and welfare distribution. This was not a sustainable economic structure, and with the restructuring of the country’s debt, we have an opportunity to change this model. Sri Lanka needs a new social consensus to decide, whether we want a low-tax country with limited public services? Or do we need a country with more Government involvement with more taxes? Either way, there must be productivity growth and shareable surplus for the development of the country. This new growth model should be based on a digitalised social market economy with more effectiveness, equitability and green growth.

Sri Lanka Revenue Authority

While many efforts have been made recently to increase Government revenue, several recent reform measures have failed. Accordingly, considering international experience to increase the effectiveness of revenue administration, expedite reforms, provide solutions to human resources-related issues by avoiding obstacles such as outdated Government regulations, and prepare a modern, efficient, and uninterrupted revenue administration system, I propose to establish a new revenue authority. Further, it is proposed to establish a special project team under the Ministry of Finance to coordinate the establishment of this revenue authority. I propose to establish a special project committee to coordinate matters in relation to the establishment of the revenue authority.

Global economic relations

The international market should be expanded for exports. And, we have to create a competitive economy. For this, we are working to establish extended trade agreements with our main partners in the region. We are working to establish free trade agreements with Thailand, Indonesia, Bangladesh, and China. We are taking steps to expand India’s free trade agreement into a comprehensive economic and technological cooperation agreement. On the one hand, we are entering a Regional Comprehensive Economic Partnership (RCEP). On the other hand, we link with the common system of trade preferences of the European Union. Therefore, our country gets opportunities to enter all major global markets at competitive levels.

As a primary step to improving Sri Lanka’s deeper connectivity with foreign trade and global markets, we are taking steps to eliminate non-tariff import taxes, including import CESS, Port, and Airport Levy. Easing of these taxes will be phased out through 3 to 5 years. Sri Lanka’s trade facilitation obligations of the World Trade Organization are lower than many less developed countries. Several Government institutions have not reached those goals while the selected trade facilitation measures such as accepting electronic payments and accepting digital documents are to be completed. Therefore, the National Trade Facilitation Committee will be established under the chairmanship of the Treasury to the Secretary.

We also hope to include some other stakeholders in the committee. Steps will be taken to further modernise the customs laws to prepare the customs laws of Sri Lanka according to global best practices. The National Committee for Effective Trade Facilitation is important for speedy implementation of the National Single Window. It can have a positive impact on internal trade and investment. The National Single Window will bring all border management agencies into a single digital platform and facilitate trade-related regulatory documentation in a seamless and timely manner.

An amount of Rs. 200 million has been allocated for those works. Registering trademarks in several countries is costly in terms of time and money. We are working to accede to the Madrid Convention which will make the registration quickly and easily. This is crucial to increase the competitiveness of Sri Lankan brands and increase the value of Sri Lankan export products.

Investments

As proposed in last year’s budget, the Government has taken steps to reform the institutional and legal framework to promote and facilitate investment and trade in the country. Accordingly, a new joint investment law has been drafted establishing a National Economic Commission that oversees the institutional framework that integrates the functions of the Investment Development Board, Export Development Board, Industrial Development Board, and National Enterprises Development Authority. For the establishment of the Infrastructure Corporation, I propose to allocate Rs. 250 million.

We expect to facilitate the investors by enhancing the automation of functions of all Government agencies providing services to investors and linking with relevant approval or licensing authorities through simplification of relevant procedures, interoperability, reduced cost, and time-consuming procedures. Rs. 100 million has been allocated for this purpose in 2024. I propose to establish new investment zones centred in Hambantota, Jaffna, Trincomalee, Bingiriya, and Kandy. I also propose to control these specific investment promotion zones through the Infrastructure Corporation.

Improving productivity and steering production economies

As I mentioned in the 2023 Budget speech, the legislation to set up a National Productivity Commission has already been drafted and finalised. This commission is to be established by 2024. For this a provision of Rs. 150 million will be allocated in 2024.

Towards a digital economy

I propose to restructure the organisational structure related to information technology in the public sector to facilitate the digital economy by the year 2030. Accordingly, efforts are being made to establish a digital authority with full powers to provide the necessary leadership and direction for the digitisation of the public sector. In addition, I also propose to establish a technological innovation council to encourage technological innovation in coordination with the public sector, expert institutions and civil society.

Also, steps will be taken to establish a National Centre for Artificial Intelligence to ensure an economic and social transformation, based on the latest trends in digital technology, and artificial intelligence. An amount of Rs. 3 billion is allocated to implement these activities for the next year. A critical backbone for this infrastructure will be the development of Sri Lanka’s digital identity. Steps have been taken to reach this goal and it is expected to be completed in the year 2024.

National policy for research in Sri Lanka

Research and development, technological advancement and innovation, play an important role as a catalyst in promoting economic growth and supporting economic progress and social well-being. I propose to formulate a national research policy based on those facts. I propose to allocate Rs. 8 billion for this purpose.

Tourism industry