Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 21 February 2024 00:00 - - {{hitsCtrl.values.hits}}

From left: The Sri Lanka-Thailand Business Council President Dushyantha Basnayake, International Trade Office Chief Negotiator K.J. Weerasinghe, Ceylon Chamber of Commerce Chairman Duminda Hulangamuwa, President’s Senior Economic Advisor Dr. R. H. S. Samaratunga, Finance Ministry Director-General Trade and Investment Policy K.A. Vimalenthirarajah and Daily FT Editor/CEO Nisthar Cassim (moderator)

The Sri Lanka-Thailand Business Council Founder and Past President Rizan Nazeer

By Charumini de Silva

By Charumini de Silva

The Sri Lanka Thailand Business Council (SLTBC) in collaboration with the Daily FT last week held the first public forum to highlight the extensive opportunities available for the private sector under the Sri Lanka-Thailand Free Trade Agreement (SLTFTA) inked on 3 February.

Following nine rounds of thorough negotiations between the two countries since 2018, Sri Lanka and Thailand finalised the FTA covering trade of goods and services, investments, joint ventures and economic collaboration across various sectors.

The forum featured several Government officials making comprehensive presentations including President’s Senior Economic Advisor Dr. R.H.S. Samaratunga, International Trade Office Chief Negotiator K.J. Weerasinghe and Finance Ministry Director-General Trade and Investment Policy K.A. Vimalenthirarajah. These officials and the Ceylon Chamber of Commerce Chairman Duminda Hulangamuwa later participated in a panel discussion moderated by Daily FT Editor-in-Chief and CEO Nisthar Cassim, followed by an interactive Q&A session providing participants with valuable insights and clarity.

Following the opening remarks by Project Chairman Rizan Nazeer, the Sri Lanka-Thailand Business Council President Dushyantha Basnayake in his welcome speech spoke of the importance of strengthening the bilateral trade between the two countries and the advantage of now having an FTA between Sri Lanka and Thailand.

Highlighting the potential for strengthened economic collaboration and expanded trade prospects resulting from the FTA, he emphasised the trade pact anticipates to yield positive outcomes for both countries’ economies.

“The SLTFTA sets the stage for boosting mutually advantageous partnerships and strengthening sustainable development,” Basnayake added.

Dr. Samaratunga during his presentation, delved into an in-depth analysis of the historical context and underlying factors contributing to preferential trading arrangements.

He explored the evolution of preferential trade agreements, tracing their origins and development over time.

“Sri Lanka had been under preferential trading during the British colonial period. British Imperial Preferences were determined as follows; home producers first, empire producers second and foreign producers last agreed at the Ottawa Conference in 1932,” he said.

He also noted that the post-independent Sri Lanka had not been a party to any preferential trade agreement till 1975, during which the country had relied on multilateral and unilateral external trade policies.

Dr. Samaratunga provided insights into the economic, political and social dynamics that have shaped the landscape of preferential trading, shedding light on the motivations driving countries to enter into such agreements.

Dr. Samaratunga provided insights into the economic, political and social dynamics that have shaped the landscape of preferential trading, shedding light on the motivations driving countries to enter into such agreements.

Additionally, he examined the implications of preferential trading for various stakeholders, including Governments, businesses, and consumers, highlighting both the opportunities and challenges associated with these arrangements.

Overall, Dr. Samaratunga’s presentation offered a comprehensive understanding of the background and significance of preferential trading, enriching participants’ knowledge and facilitating informed discussions on the subject.

Unlocking trade potential with Sri Lanka-Thailand FTA

Weerasinghe addressed attendees on the topic of ‘Unlocking Trade Potential with Sri Lanka-Thailand FTA’. During his presentation, he outlined the Government’s vision to integrate with the largest economies in Asia as part of its strategy for export diversification, whilst protecting and promoting existing major export markets and attracting investment.

“The objective is to connect with the key markets through the global value chain to improve our economy and enhance the living standards of the people of the country,” he said.

Weerasinghe reflected on a period lasting four to five years when trade negotiations with India, Singapore, and Thailand came to a halt due to the adoption of protectionist policies by the administration. He characterised this period as one marked by ‘missed opportunities’ in trade diplomacy.

“However, upon assuming office, President Ranil Wickremesinghe immediately instructed to recommence all stalled trade negotiations with all countries,” he stressed.

He said sustained economic growth requires productivity enhancement which is driven by competition and competitiveness. “With a relatively small internal market, FTAs create predictability and certainty that allows global value chain participation and will be crucial to create an effective market for Sri Lanka to attract investment at scale,” he described why FTAs are important for the country.

Detailing the rationale behind selecting Thailand for a Free Trade Agreement (FTA), he highlighted its position as the world’s 30th largest economy, boasting a GDP of $ 512 billion in 2023. Additionally, he emphasised that Thailand’s market of 69.9 million serves as a competitive gateway to the Regional Comprehensive Economic Partnership (RCEP) market comprising 2.3 billion individuals.

In addition, Thailand is the second largest outward investor in terms of outward foreign direct investment (OFDI) stock in ASEAN, surpassing that of Malaysia and OFDI stocks as a share of GDP reached 25% in 2018.

He also highlighted that Thai businesses are expanding their operations into neighbouring ASEAN markets and venturing further beyond regional boundaries.

He also highlighted that Thai businesses are expanding their operations into neighbouring ASEAN markets and venturing further beyond regional boundaries.

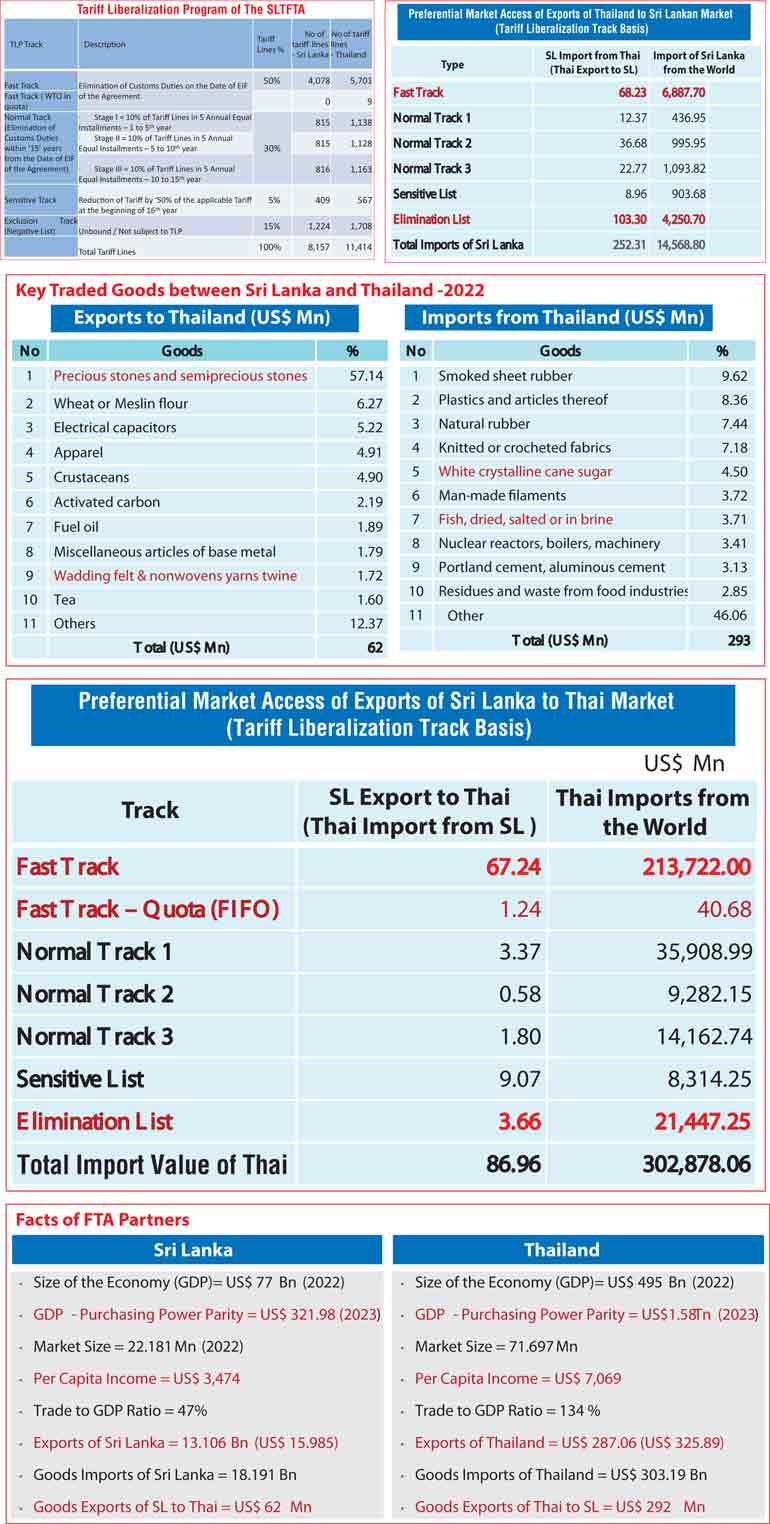

“Scope of the SLTFTA include; trade in goods, services, opportunities in investment and economic cooperation facilitated by rules of origin, Custom procedures and trade facilitation, sanitary and phytosanitary (SPS) and technical barriers to trade (TBT), trade remedies, intellectual property, dispute settlement, general and final provisions,” he explained.

Accordingly in 2023, Sri Lanka exported $ 46.77 million worth goods including diamonds, gems and jewellery, apparel and textiles, engineering products, food, feed and beverages, fish and fisheries products, coconut and coconut-based products, base metal products, tea, rubber and rubber-based products; whilst Thailand exported to Sri Lanka $ 253.10 million worth goods including rubber and rubber-based products, apparel and textile, chemicals and plastic products, food, feed and beverages, engineering products, non-metallic mineral products, fish and fisheries products and base metal products.

Thailand is Sri Lanka’s 39th export destination and 15th sourcing destination.

“I disagree with many arguments on bilateral balancing when it comes to trade agreements. Bilateral trade balancing is not what is important in international trade, but the overall balance. One classic example is our trade to the US. Sri Lanka exports over $ 3 billion, while we import less than 400 million worth of goods. However, the US never asks Sri Lanka about the huge trade gap because in multilateral trade what is fundamental is the overall balance and not bilateral balance,” Weerasinghe stressed.

He said the duration of the tariff liberalisation via SLTFTA is 16 years effective from January 2025 and it will follow the WTO definition of the Custom duties (Article III of the GATT 1994).

“Tariff liberalisation of 80% of the HS codes are within 15 years in three stages on sequential basis and partial liberalisation of 5% of HS codes as a single point removal at the beginning of 16th year from the date of implementation of the trade liberalisation program. The remainder of 15% of the HS codes in the Negative Schedule of Sri Lanka,” he said.

Sri Lankan products with early market access in Thailand will see fast track (FT) existing MFN duty rate will become 0% from the first day entry into force of the FTA.

Some of products include; cinnamon (MFN rate 20%), silk products printed by traditional batik process (MFN rate 17.5%), textile carpets/rugs, floor covering, floor mats (MFN rate 30%), volcanised rubber products, special woven fabric products such as fishing nets, net bags and textile products suitable for industrial use such as tracing cloth, painting clots, adhesive tape (MFN rate 10%), fishery products of crab, prawn, shrimp, processed food, rubber and plastic products and other agricultural and industrial products (MFN rate 1-5%), gems, diamond and jewellery although the existing (MFN duty rate of 0%, it will be bound under FTA under fast track), fishery products, process food, plastic products, apparel, rubber products, tea and desiccated coconut.

Sri Lanka is also given duty free early market access for intermediary and industry inputs among other products from Thailand.

Sri Lanka is also given duty free early market access for intermediary and industry inputs among other products from Thailand.

Weerasinghe said products to qualify for duty concessions should meet Rule of Origin criteria. “The two countries will have market access in each other’s market complying with agreed rules of origin criteria which were negotiated considering stakeholder requirements among other factors.

The rules are also expected to promote the global value chain and restrict third country goods coming into the country with insufficient processing,” he explained.

For non-originating materials, he said criterion has been agreed on the basis of both General Rule as qualifying value content of not less than 40% or change in tariff classification at four-digit level of the HS which is flexible. A product specific criterion has also been agreed for selected products as mutually beneficial to both the countries. This will be an added advantage to Sri Lanka for RCEP accession procedure.

Regarding trade in services, Weerasinghe highlighted that Sri Lanka stands to gain market access opportunities in Thailand across various sectors. These include professional services, computer and related services, research and development services, rental or leasing services without operator, other business services, as well as communication services such as telecommunications services and audiovisual services. Additionally, opportunities extend to construction and related engineering services like construction work for buildings, construction work for civil engineering, installation and assembly work, building completion and finishing work, and other related services. Distribution services, including commission agents’ services and franchising, are also included, along with educational services, environmental services, tourism and travel related services, and transport services, all subject to specific conditions under the service liberalisation program.

Thailand has market access in Sri Lanka for the following services sectors subject to certain conditions broadly linked into investment, professional services, computer and related services, research and development, rental/leasing services without operator, other business services, communication services, audiovisual services, construction and related engineering services, distribution services, educational services, environmental services, tourism and travel related services and transport services. “On movement of natural persons, independent professionals will not be able to move freely to the country. However, a certain number of categories of contractual suppliers and corporate transferees of high level of professional categories under the services link to the Thai investment will be allowed to the country,” he added.

With regard to investments via the FTA, Weerasinghe said, the objective is to facilitate, promote and protect Thai investments and promote joint ventures with Sri Lankan partners.

More Thai investments in Sri Lanka

FDI inflows is at $ 92 million, with 10 investment projects in commercial operation and over 600 employment opportunities. Potential sectors for manufacturing include; electrical and electronics, auto components, processed food, apparel and pharmaceutical; while services include tourism, ICT and logistics. “Under the SLTFTA it is expected to attract more Thai investment into Sri Lanka in the manufacturing sectors of electrical and electronic, auto components, processed food, apparel and pharmaceuticals and services sectors of tourism, IT and logistics. In addition, third country investment can also be promoted into Sri Lanka with the SLTFTA which will open a large market to the country,” he said.

Accordingly, Thailand’s outward investment in 2021 was $ 17.3 billion and key destinations for Thailand’s outward investments during the period 2006-2021 were Hong Kong, Singapore and Netherlands in the sectors of financial and insurance, food and beverage, wholesale and retail trade, and mining and quarrying.

Economic cooperation between the two countries in the identified 11 sectors. These include; trade and investment promotion (including export development), infrastructure (including transport and port sector), agriculture and agro industry, fisheries, gems and jewellery, tourism, Small and Medium Enterprises (SMEs) and MSMEs, financial cooperation, packaging industry, ICT and technical and vocational education and training.

Weerasinghe also highlighted areas coming under the Dispute Settlement and Joint Commission. “Under the agreement disputes arising between the parties could be settled through a consultation process failing which could resort to arbitration, through the Dispute Settlement Mechanism. A Joint Commission will be established which will meet annually to monitor Implementation of the agreement,” he added.

SL-Thai FTA: Promising export market for

Sri Lanka characterised by broad opportunities

Vimalenthirarajah delivered an extensive presentation on ‘Enhancing Awareness of Preferential Market Access under SLTFTA.’ He emphasised that to revitalise Sri Lanka’s economy within the global context, both the public and private sectors must engage in unilateral, bilateral and multilateral efforts.

Vimalenthirarajah delivered an extensive presentation on ‘Enhancing Awareness of Preferential Market Access under SLTFTA.’ He emphasised that to revitalise Sri Lanka’s economy within the global context, both the public and private sectors must engage in unilateral, bilateral and multilateral efforts.

According to him, key criteria for Sri Lanka’s request list include; ensuring that trade promotion does not lead to ‘trade diversion’ from high-end niche markets to middle-range markets like Thailand, entrepreneurs and enterprises should actively promote ‘trade criterion’ to leverage the Thai Preferential Market for net benefits, strategies such as product differentiation and price discrimination are crucial for penetrating and sustaining emerging Thai markets, such as those for tea, gloves, and auto parts. Sri Lanka’s possession of 48 HS Codes (08 Digits), compared to Thailand’s eight HS Codes, serves as an example of product differentiation through factors like packing, origin, and flavoured-based differentiation.

Moreover, the increase in both the variety and quantity of goods in Sri Lanka’s export basket is essential for effectively utilising preferential market access. Additionally, efforts to attract Thai investment into Sri Lanka for manufacturing and re-export, including to the Thai market, are vital components of this strategy.

Regarding strategies to expand Sri Lanka’s export portfolio, Vimalenthirarajah noted that Trade in Goods should not be viewed in isolation within the SLTFTA framework. He advocated for exploring the interconnected benefits of trade, investment and economic and technical cooperation. This includes leveraging the nexus to attract investment, drawing on Thailand’s success in joint ventures, and fostering technology cooperation, particularly in areas such as agro value addition and reduction of post-harvest losses. Furthermore, Vimalenthirarajah stressed the importance of collaborative efforts to maximise the utilisation of preferential market access. He proposed an approach of inviting, producing, and re-exporting or exporting goods, targeting both the EU market and the South Asian market.

Regarding strategies to expand Sri Lanka’s export portfolio, Vimalenthirarajah noted that Trade in Goods should not be viewed in isolation within the SLTFTA framework. He advocated for exploring the interconnected benefits of trade, investment and economic and technical cooperation. This includes leveraging the nexus to attract investment, drawing on Thailand’s success in joint ventures, and fostering technology cooperation, particularly in areas such as agro value addition and reduction of post-harvest losses. Furthermore, Vimalenthirarajah stressed the importance of collaborative efforts to maximise the utilisation of preferential market access. He proposed an approach of inviting, producing, and re-exporting or exporting goods, targeting both the EU market and the South Asian market.

Additionally, he highlighted the necessity for regulatory authorities to enforce standardised standards and quality certification to prevent the influx of substandard goods through preferential market access. Such measures are crucial for safeguarding local production from adverse impacts.

He underscored economic and technical collaboration within the SLTFTA covering various sectors, including but not limited to trade and investment promotion, infrastructure (including transport and port sector), agriculture and agro industry, fisheries, gems and jewellery, tourism, Small and Medium Enterprises (SMEs) and Micro, Small, and Medium Enterprises (MSMEs), financial cooperation, packaging industry, Information and Communication Technology (ICT), and Technical and Vocational Education and Training (TVET).

To implement the economic and technical cooperation initiatives established by the SLTFTA, he stressed the necessity of boosting Government-to-Government (G2G) collaboration and nurturing Business-to-Business (B2B) relationships facilitated through G2G cooperation. “Any private enterprise or chamber is encouraged to collaborate with the pertinent Government entity to partake in collaborative endeavours aimed at reaping benefits from this cooperation. The relevant Government entity, in conjunction with the Office for International Trade, will facilitate bilateral cooperation. It is incumbent upon the Government entity and/or the interested enterprise or chamber to mobilise resources for such initiatives within Sri Lanka,” he added.

Highlighting the next steps for businesses, he said the emergence of a promising export market for Sri Lanka, characterised by relatively broad opportunities. He noted the opening of two doors with preferential access to an active regional market, underscoring the importance of strategic initiatives such as product differentiation and price discrimination, necessity of fostering trade creation through enhanced capacity utilisation and new investment for expansion or diversification of product lines.

Additionally, Vimalenthirarajah advocated for mobilising sector agencies to facilitate technical cooperation for the development of value-added agro-based products and importance of mobilising investment to enable businesses to compete effectively in utilising other preferential markets and accessing duty-free raw materials and intermediate goods.

The next steps for the Government and Chambers involve market research and facilitation provided by the Export Development Board (EDB), investment facilitation including specialised zone establishment by the Board of Investment (BOI), standard equalisation and mutual recognition through the Sri Lanka Accreditation Board, mutual accreditation of quality certification through the same board, mobilisation of technical cooperation with interested business enterprises, enactment of regulations to activate anti-dumping and countervailing duties alongside bilateral safeguards and implementation of a market access program tailored for SMEs and MSMEs.

Ceylon Chamber of Commerce Chairman Duminda Hulangamuwa said the Chamber is always for greater trade hence welcome the Sri Lanka-Thailand FTA. “The only way Sri Lanka can achieve high 5-6% growth is via greater external trade,” he said.

“There is immense potential to increase exports provided Sri Lanka enhances standards and competitiveness. The SL-Thai FTA gives greater market access in Thailand for Sri Lanka and also to Southeast Asia via Thailand. This is important at a time when our traditional exports markets in the West are going through a recession,” he added.

During the Q&A, participants sought further clarity in terms of implementation of the FTA from 1 January 2025 and how ready were the line ministries and public institutions under them. It was explained that the Office of International Trade Chief Negotiator will spearhead implementation oversight and coordination along with the Department of Commerce and relevant agencies such as the Sri Lanka Customs, the Board of Investment, etc. It was agreed further efforts will be made to enhance awareness of the SL-Thai FTA both within the public and private sectors. Specific questions were also posed about investment opportunities and investment protection agreements. Officials from the Board of Investment and Sri Lanka Standards Institutions also responded to some of the questions raised by the participants.

Principal sponsor of the forum was INSEE Cement