Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 16 October 2018 00:15 - - {{hitsCtrl.values.hits}}

KPMG Sri Lanka has come out with its second report on the country’s banking sector incorporating the performance up to June 2018. This is a follow up to the first report which captured performance and challenges up to March 2018.

KPMG Partner and Head of Banking Services Ranjani Joseph notes in the report that the banking industry is undergoing a time of significant change.

She said from disruption caused by fintech and other digital challenges to an ever increasing regulatory burden and changing customer attitudes, bankers are under pressure on multiple fronts. Added to this, the changing dynamics of saving in high yielding deposits, financial and business implications of Sri Lanka Financial Reporting Standard 9 (SLFRS 9) and the volatility of the currency have thinned the margin for error to non-existent levels on re-pricing strategy and increased the pressure on getting the product mix correct for bankers. In this light, KPMG in the September 2018 report focuses on addressing some of the more pertinent implications of SLFRS 9 and how best to prepare for it as well as the importance of an effective Fraud Risk Management framework.

Joseph also pointed out that fraud occurs every day all over the world and banks lose a lot of money due to fraud. Fraud Risk Management (FRM) is an ongoing process that provides a bank with the tools to manage fraud risk in a manner consistent with the regulatory requirements as well as the bank’s needs. A focused FRM scope should provide services that are aimed at helping clients prevent, detect, and respond to fraud and misconduct. It is done by working with the clients to assess, design, implement, and evaluate effective controls.

The September 2018 report discusses in detail the key issues which KPMG Sri Lanka feels could affect the sector in the second half (2H) 2018 of the year and have analysed the industry performance through a challenging first half (1H) 2018. Following is the executive summary and key highlights of the KPMG’s Sri Lanka Banking Report:

We see the banking sector this year gearing up to strike a balance between meeting the new capital and leverage ratios imposed by Basel III regulation, incorporating Sri Lanka Financial Reporting Standards (SLFRS 9) while continuing with moderate loan growth.

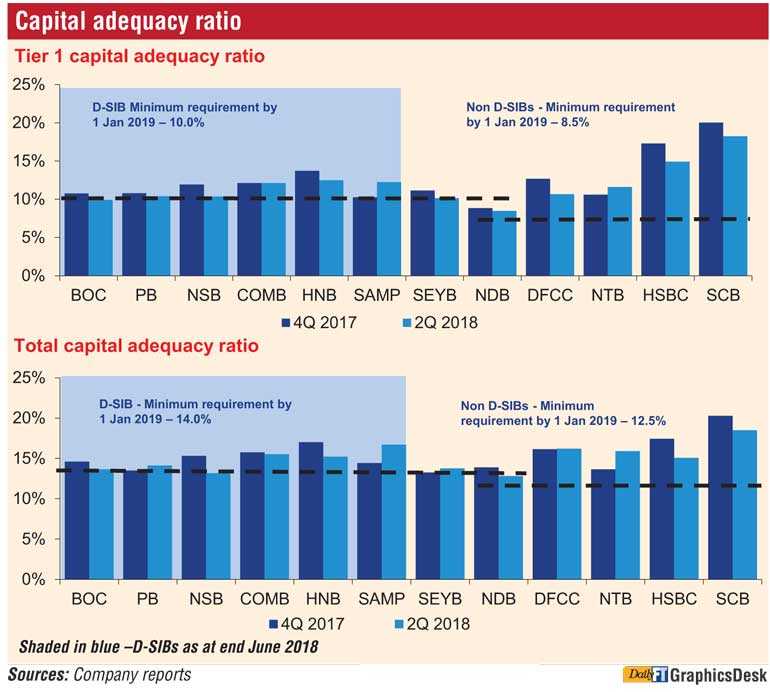

As mentioned in our last update, Basel III regulation introduced last year, fully effective beginning of 2019, led to more stringent regulation in capital, liquidity and leverage. In the past year, banks went for rights and subordinate debt issues to raise and strengthen the capital base.

During the quarter, we have seen banks in the path of refining their understanding and processes with respect to SLFRS 9. The new standard requires higher provisioning due to introduction of the expected credit loss model compared to the current incurred loss model. Hence the migration from LKAS 39 to SLFRS 9 is estimated to impact the total equity by 3% to 5%.

Hence we expect 2018 to be a transition year with the future years absorbing the effect gradually in line with the quality of loan disbursements.

The banking sector was seen recording a moderate loan growth despite a challenging business environment, sustained by the tightened monetary policy and fiscal policy coupled with political uncertainty. However, we continue to expect the mid to large banks to move into sustainable loan growth in the backdrop of increasing regulation, competition and the present economic environment.

Furthermore the challenging business conditions also led to significant provisions being made for impairment which in turn had pressure on the bottom line. Moreover, we expect a further negative impact on capital base due to increasing non-performing loans (NPLs). We expect pressure on impairment charges to continue in 2H 2018 as the business environment will continue to remain bleak.

The major contributor in funding loans continued to be deposits in the first half (1H) 2018, despite equity and debt being raised in the recent past. However, low yielding CASA levels of banks are being witnessed to be on a short and long term downward trend with the shift towards high yielding fixed deposits. The local banks and foreign banks under review in the 1H 2018 recorded CASA levels in between 20.0% to 34.1% and 47.7% to 51.8% respectively.

The effects of the Inland Revenue Act No 24 of 2017 (IRA) which became effective from 1 April 2018 had implications on the banking profits in the second quarter (2Q) 2018. This was mainly due to some tax exemptions being removed on various interest income sources such as USD denominated bonds, professional loans and SMEs and the removal of notional tax credit on treasury bills and bonds. Furthermore, the Government of Sri Lanka (GoSL) recently proposed a 7% Debt Repayment Levy on financial institutions. This levy effectively increases the VAT on financial services from 15% to 22%.

We observe that globally a wave of new fintech players have emerged with solutions covering most of the complex aspects of the banking value chain. Domestically, we see banks continuing to strengthen their resources and scale in the fintech space, by launching data analytics driven products and services to enhance customer experience and data security. The banks will continue to face competition not only from peer banks and large finance companies but other fintech players, which may not be as highly regulated as the banks are. Moreover with high capital requirements to be met with scarce high quality capital, the smaller banks performance will be threatened over the medium term. Hence we expect consolidation in the sector to further strengthen the banking sector.

Key highlights

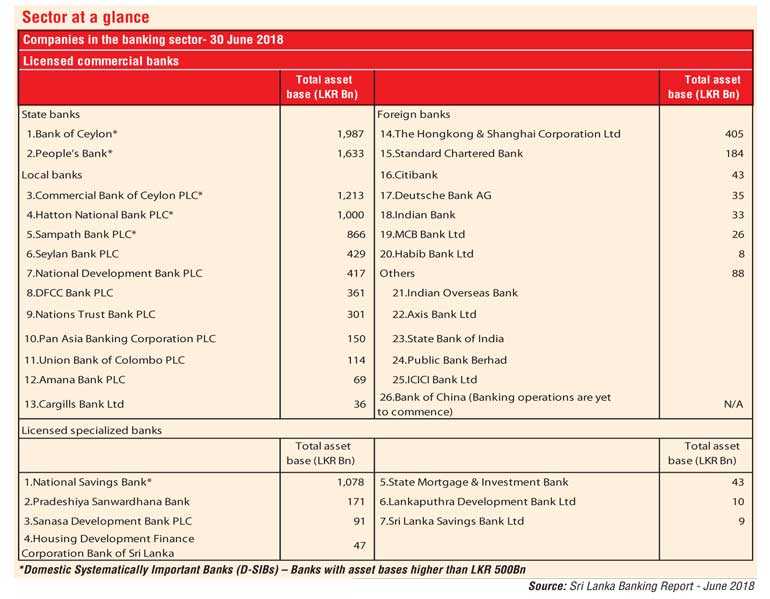

The banking sector consisted of 25 Licensed Commercial Banks (LCBs), including 12 branches of foreign banks, and seven Licensed Specialised Banks (LSBs) by end of June 2018.

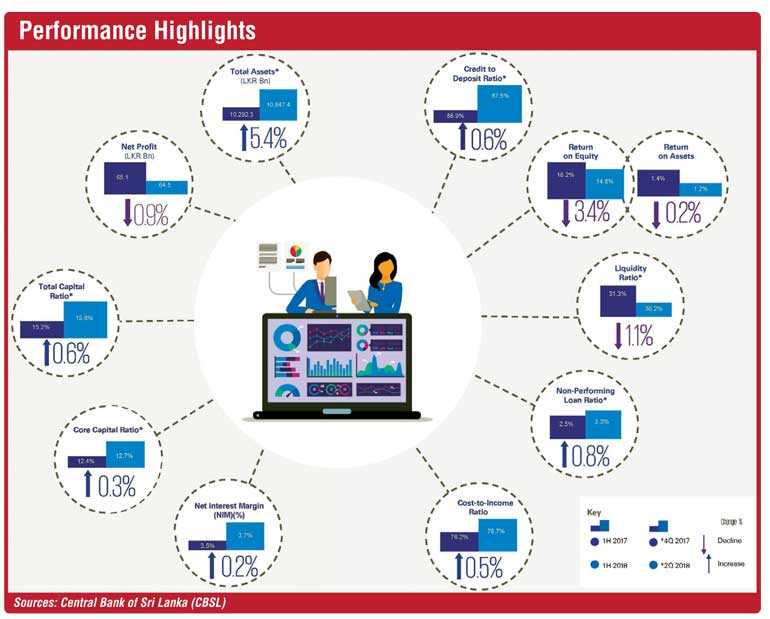

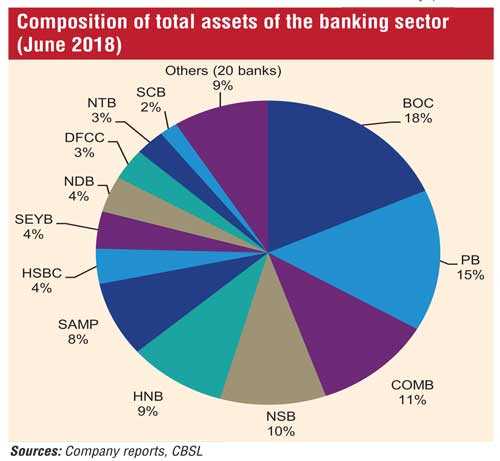

The total asset base of the banking sector was recorded at Rs. 10.8 t by end of 2Q 2018 compared to Rs. 10.3 t by end 4Q 2017. The total asset increase recorded was 11.1% during the 1H 2018. The report further analyses banks that currently account for total assets of more than Rs. 175 b.

Loans and advances

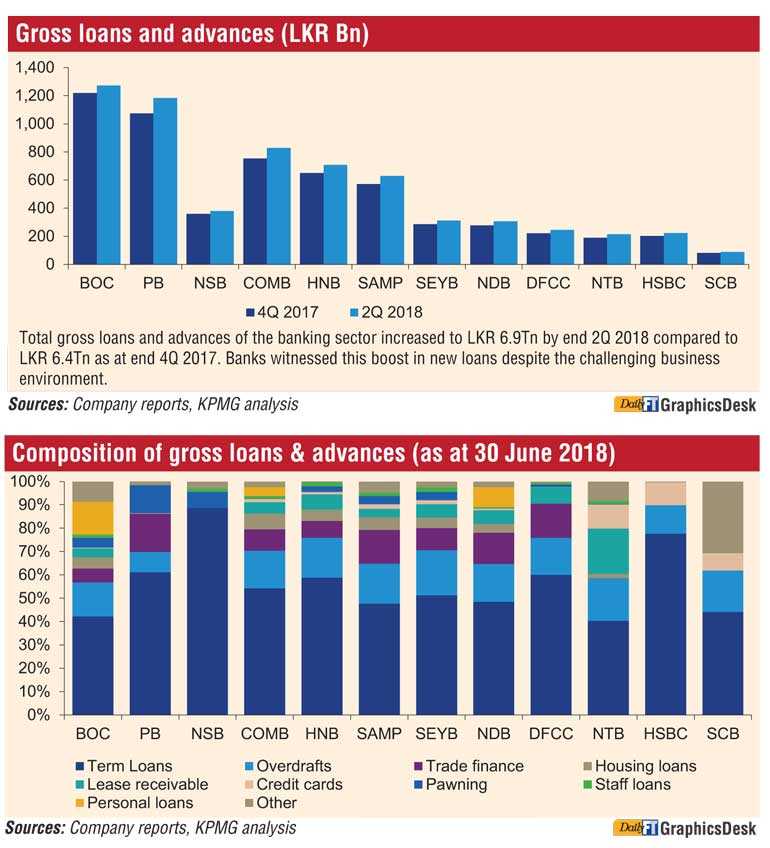

Total gross loans and advances of the banking sector increased to Rs. 6.9 t by end 2Q 2018 compared to Rs. 6.4 t as at end 4Q 2017. Banks witnessed this boost in new loans despite the challenging business environment. The composition of the gross loans and advances in the banking sector showed moderate changes in terms of term loans and overdrafts during 1H 2018. However, the recent credit demand from the new construction developments impelled the gross loans and advances to increase, thus posing the risk of over exposure to the sector. Credit cards played a similar role in aiding the growth of the asset portfolio, as many banks increased the number of credit cards issued over the past few years, which was a major contributor for non-interest income. The growth in credit cards is expected to continue as banks aggressively promote credit cards to customers with different levels of income. In the light of SLFRS 9 this is a risky move as the repayments would need to be managed carefully not to incur higher provisioning.

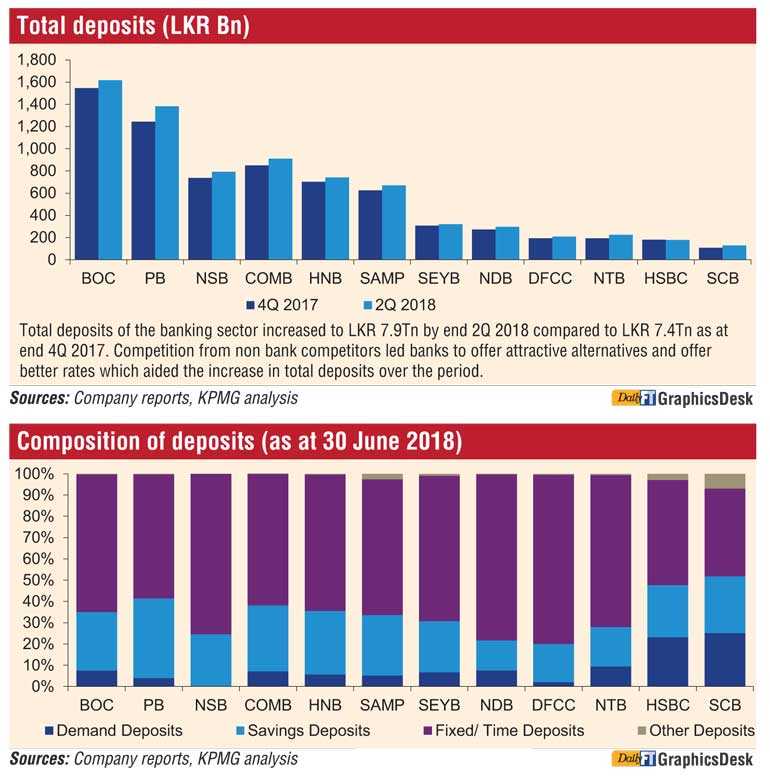

Deposits

Total deposits of the banking sector increased to Rs. 7.9 t by end 2Q 2018 compared to Rs. 7.4 t as at end 4Q 2017. Competition from non-bank competitors led banks to offer attractive alternatives and offer better rates which aided the increase in total deposits over the period. The sector witnessed a 9.6% YTD growth in time deposits, owing to attractive rates offered by the banks during the period as well as customers shifting towards bank deposits in the light of recent finance company failures and the adverse publicity surrounding them. Therefore the CASA ratio showed a slight decline over the sector.

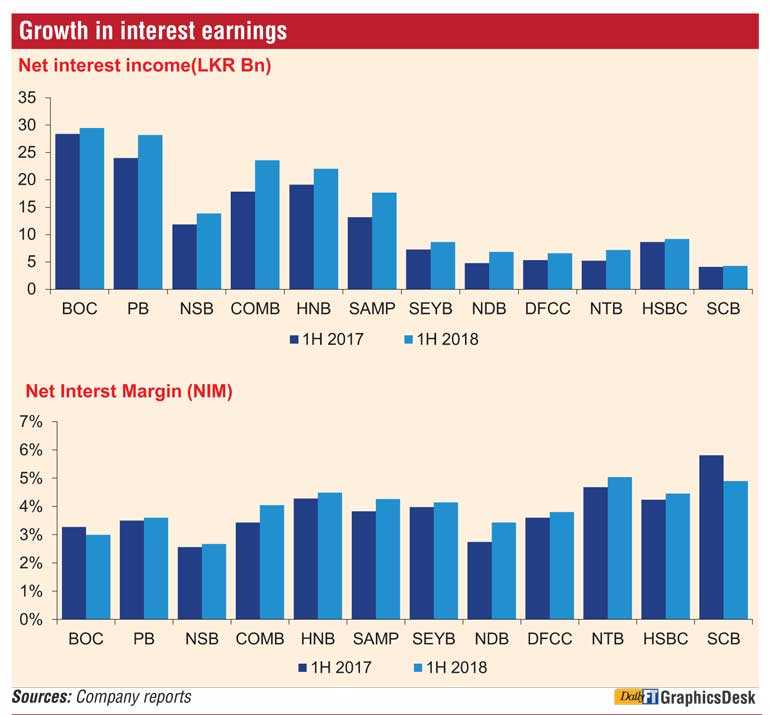

Interest earnings

A 15.1% YoY growth in interest income along with a slower 13.7% growth in interest expense in 1H 2018 helped banks record a 17.8% YoY growth in net interest income (NII) over 1H 2018. This growth was fuelled by the growth in loans and advances coupled with high interest rates that prevailed during the period. However, the interest income was affected the removal of notional tax credit of treasury bills and bonds with effect of the IRA from 1 April 2018 onwards.

Overall NIMs in the banking sector improved to 3.7% in 1H 2018 compared to 3.5% in 1H 2017. The upward movement witnessed in the interest rates over the period coupled with the timely re-pricing strategies implemented by banks enabled banks to achieve the said growth in NIMs. It was observed that the larger portion of the NIMs is NII and we expect this trend to continue in the mid to long term. The NII is expected to moderately grow with interest rate pressure coming in towards the latter part of the year.

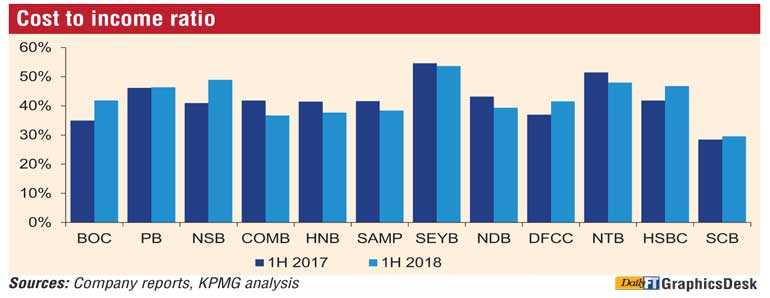

Cost to income ratio

Most banks managed to maintain their cost to income ratios supported by growth in total operating income, amidst increasing operating expenses due to new staff recruitments and annual remuneration increments for the staff. Increase in costs of maintaining the branch network also contributed to growth in operating expenses. We expect banks to focus on forming alternative digital banking channels which will ease the cost to income ratios going forward.

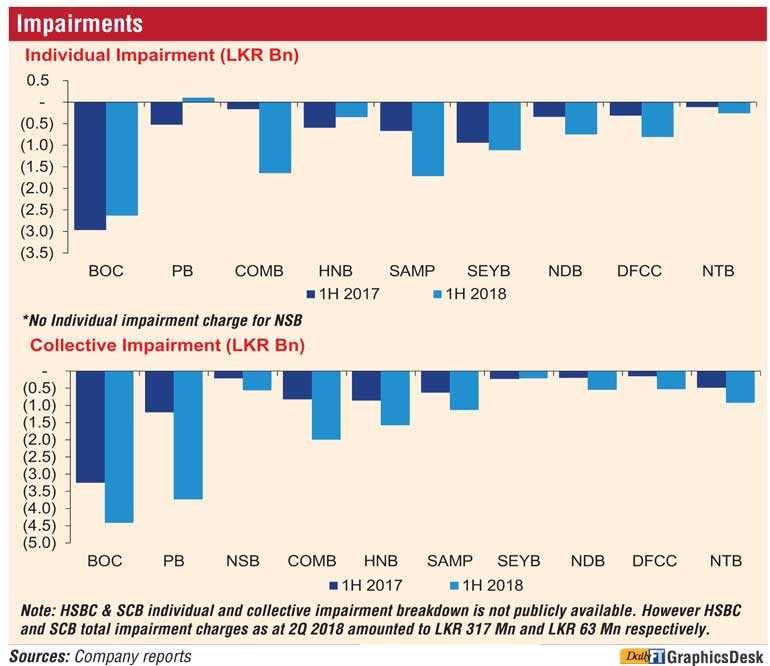

Impairments

Impairment charges of the banking sector increased drastically over 1H 2018 compared to 1H 2017 as banks made hefty provisions amidst deteriorating asset quality of the loan book. Higher NPLs recorded in agriculture, construction and SME sectors affected both individual and collective impairments. The implementation of SLFRS 9 which introduces the expected credit loss (ECL) model replacing the incurred loss model of LKAS 39 is expected to increase the total impairment provision. It is estimated that the increase in impairment provision based on ECL model due to transition will account to 3% to 5% of total equity. However, with respect to foreign banks under review, we do not expect significant consequences to occur due to their parent backing. Furthermore, we expect their migration to the new standard to be along with their regional peers, where timelines are expected to be confirmed by the end of this year.

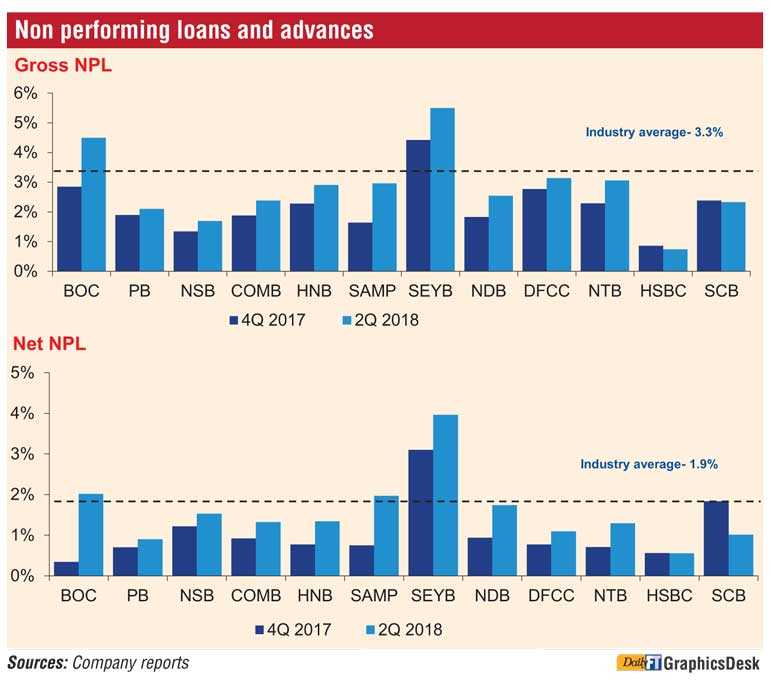

Non performing loans and advances

The overall gross NPL ratio of the banking sector increased to 3.3% in 2Q 2018 compared to 2.5% as at end 4Q 2017, recording a 3 year high. However, it is to note that the gross NPLs were at a 10 year low in 4Q 2017. NPLs have significantly risen due to adverse weather conditions throughout the period under review, which hampered the performance of the agricultural sector. The construction sector was also affected due to the GoSL lagging on loan payments for most of the undergoing construction projects. We expect the NPLs to continue to follow the rising trend due to the challenging business environment, consumption related loan exposure and regulatory implications.

Porfitability

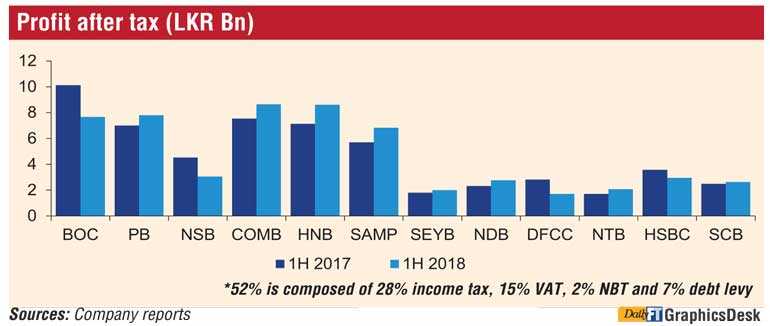

Net earnings of the banking sector deteriorated 0.9% YoY in 1H 2018 to Rs. 65.1 b. Higher impairment charges coupled with a higher income tax expense recorded over the period contributed towards this decline. Inland Revenue Act No 24 of 2017 (IRA) effective from 1 April 2018 also negatively affected the banking profits in the 2Q 2018. The removal of tax exemptions on various interest income sources such as USD denominated bonds, professional loans and SMEs enjoyed by banks under the previous IRA saw the industry undergo a statutory income tax rate of 28%. Further the VAT and NBT on financial services coupled with the proposed debt levy of 7% would see the direct and indirect tax rate on banks increase from 45% to 52%. (52% is composed of 28% income tax, 15% VAT, 2% NBT and 7% debt levy). In addition SLFRS 9 will require banks to recognise losses early as it will no longer be suitable for banks to wait for an incurred loss event to maintain higher provisions, ultimately affecting their profitability.

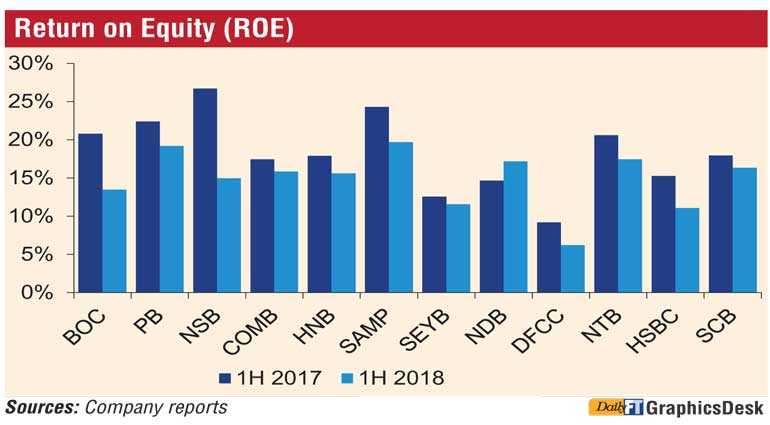

Banking sector ROE decreased 341bps from 18.2% in 1H 2017 to 14.8% in 1H 2018. Due to the introduction of BASEL III, several banks raised rights issues in the recent past which impacted their ROEs during 1H 2018 compared to 1H 2017. Banking sector ROA affected by the largest bank, BoC declined by 18bps from 1H 2017 to 1.2% in 1H2018.

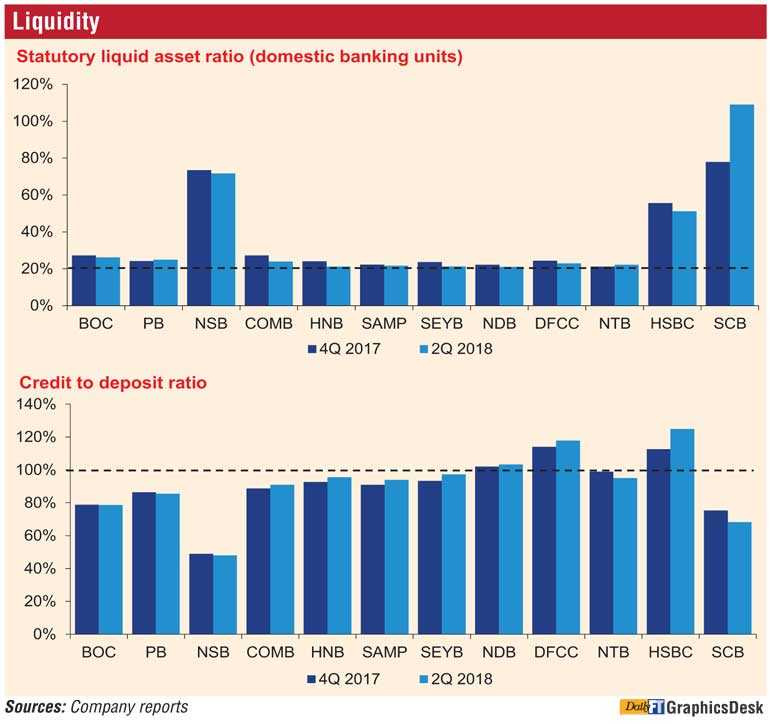

The Statutory Liquid Asset Ratio (SLAR) of domestic banking units reduced to 30.2% as at end 2Q 2018 compared to 31.3% as at end 4Q 2017. However the SLAR of the banking sector was significantly higher than the regulatory minimum of 20.0%. The credit to deposit ratio of the banking industry increased to 87.5% as at end 2Q 2018 compared to 86.9% as at end 4Q 2017. Local banks excluding NDB and DFCC (which transformed from being development banks into LCBs) maintained credit to deposit ratios below 100%.

Capital adequacy

Capital adequacy requirements were introduced by the CBSL under Basel III with effect from 1 July 2017. The implementation is taking place where the full requirement will come into effect by 1 January 2019. To comply with Basel III, most banks have raised capital through rights issues over the period. This will further strengthen the equity base of the banks and thereby help achieve the required capital adequacy ratio. To maintain and fulfil the Tier II capital requirement, banks have issued debentures during the reported period. However, implementation of SLFRS 9, increasing impairment charges and tax increments are expected to put pressure on capital adequacy ratios, going forward.