Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 24 August 2016 00:05 - - {{hitsCtrl.values.hits}}

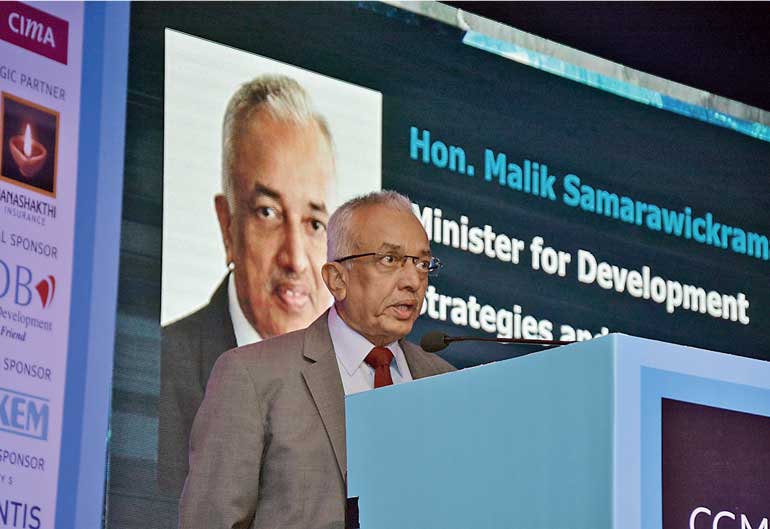

Minister of Development Strategies and International Trade Malik Samarawickrama last night reiterated that the Government was committed to ensuring Sri Lanka achieved inclusive growth while modernising the economy for the benefit of all segments of society, a process which required difficult decisions to be made.

He made this observation during his speech as the Chief Guest at the inauguration of the CIMA Business Leaders Summit at the Cinnamon Grand.

In an impressive presentation, the Minister articulated the challenges faced by the country and the world, the measures being taken by the Government to overcome these obstacles and the steps the public and private sectors need to take to ensure inclusive socioeconomic growth while also charting emerging international developments.

Following are excerpts.

Today our Government has to make extremely difficult economic policy decisions. Over the past so many years the total expenditure has been in excess of revenue, requiring borrowing abroad year after year; a continued failure to raise Government revenue adequate to meet Government expenditure.

There has been a rampant rise in Government expenditure pushed by competitive populist measures espoused by the main political parties at elections; the consequent recourse by Government to debt financing, borrowing in both domestic and foreign markets to pay for rising expenditure and servicing the accumulated debt of the Government absorbing a large and rising proportion of Government receipts and denying resources to undertake both rising current expenditure and to continue with current investment projects, leave aside new investments.

The rupee cost of servicing foreign debt rises with the devaluation of the rupee and worsens domestic public finance problems.

‘Unpleasant situations’

International economic conditions now and in the near years do not hold prospects of rapid growth in the principal economies of the world as in the previous decade or so, to enable the Sri Lankan economy to grow faster, pulled by export demand.

It is probable that interest rates in world capital markets may rise after several years of very cheap money and that rise will make the refinancing of Government foreign debt far more expensive. Remittance earnings overseas by Sri Lanka nationals did not rise in 2015 and that may worsen the problem in the Balance of international payments.

Slow growth in the economy enforced by these circumstances will reduce the increase in living standards and cut growth in employment opportunities. It is imperative that whatever mix of policies is chosen that mix includes measures to minimise the adverse effects on those least able to bear them. To make an understatement, these are unpleasant situations for any Government to handle. This unfortunately, is what we have inherited.

To face these circumstances, our society and Government have a small number of options to choose from, none of them easy to implement. The temporarily pleasant choice is to go on regardless and finance increased Government expenditure by printing money and extending credit to the private sector on easy terms to expand private expenditure in the hope of growing out of economic difficulties. It is as temporarily pleasant as it is in the longer run impracticable.

Boosting domestic demand in that manner will soon create a crisis in international payments, raise domestic prices rapidly, depreciate the rupee against all currencies and lead to other nasty consequences which have the potential to destabilise society, both economically and politically.

The other choices are likely to cause hardship in the short term but may bring back stability to the economy and give wise policies to a long-term growth path. Hardship will come because easing the severity of the current crises in the economy will require restraining the growth of total domestic demand bringing down rates of growth, with little expansion in export demand.

The Government will need to review seriously incentive structures and institute fundamental reforms in Government finance and administration.

The Central Bank has the responsibility to bring the financial system to sound health. The severity of hardships can be mitigated, but by no means eliminated, with the help of the international community, whose goodwill to the people of Sri Lanka has been high since January 2015. However, no amount of goodwill on the part of the international community will help the economy without discipline and the domestic will to reform.

Globalisation

Globalisation has created the conditions for international capital to seek the highest rates of return at the most competitive locations. Asia, particularly China, has benefitted from this. This increased cross-border mobility of capital has reduced the bargaining power of labour, making Trade Unions weaker.

This has contributed to the decline in the share of labour in GNI over the last three decades in the advanced world while the share accruing to capital has increased sharply. This places an added responsibility on businesses to look for ways and means of addressing the increasing inequality through innovative interventions, including PPPs, which generate decent jobs and build the human resource base to fill them.

Rapidly advancing technology

Sri Lanka has to take due cognisance of the rapid advances in Artificial Intelligence (AI), robotics and 3D-printing which enable substantial productivity improvements and threaten the existing job market. While the world has already experienced a sharp decline in blue-collar manufacturing jobs, the elimination of unskilled jobs is now spreading to the services sector as well.

There are also technological advances in other areas such as 5G communications, nanotechnology, biotechnology, digital health, material science, energy storage, quantum computing, the internet of things, the use of commercial drones and autonomous vehicles. The ‘velocity’ of change is exponential rather than linear. Taken together these multiple technologies are generating unprecedented paradigm shifts in the economy, business, society and individually. It is changing not only the ‘what’ and the ‘how’ of doing things but also ‘who’ we are. It is bringing about a transformation of systems within and across countries, companies, industry and society as a whole.

Fourth Industrial Revolution

Professor Klaus Schwab, Founder and Chairman of the World Economic Forum, has said that we are at the beginning of the Fourth Industrial Revolution - the first being the construction of railroads and the invention of the steam engine, which ushered in mechanical production.

The Second Industrial Revolution, which started in the 19th Century and into the early 20th Century, made mass production possible, fostered by the advent of electricity and the assembly line.

The Third Industrial Revolution began in the 1960s. It is usually called the computer or digital revolution. The Fourth Industrial Revolution builds on the digital revolution. It is characterised by a much more ubiquitous and mobile internet by smaller and more powerful sensors that have become cheaper, and by Artificial Intelligence and machine learning.

This combination of rapid technological change and job destruction makes it necessary for us to question the way societies organise work patterns.

Historically, technological advances have led to a reduction in working hours. Carlos Slim has suggested we may need to move to a three-day week. The productivity gains from technological advances can yield decent wages for less working hours. This is a phenomenon observed when a step-jump in technology occurred with the steam engine, electricity and automation.

Off-shoring to on-shoring

We are likely to see qualitative change in the shape of future production systems from ‘off-shoring to on-shoring. The last 25 years have been characterised by ‘off-shoring’ and ‘production sharing networks’. This is changing and the future of manufacturing is likely to involve ‘on- shoring’ i.e. the growth of manufacturing capacity in the advanced countries and less dependence on cross-border value chains.

This process is already gathering momentum. It’s being driven by the major technological changes mentioned above and the energy revolution brought about by the ‘fracking’ technology.

The upshot is that the competitive advantage deriving from lower wages is becoming less important with the growth of the knowledge economy. There are also economies of agglomeration associated with the new technologies that are likely to have a dampening effect on the growth of cross border value chains at the global level.

Clearly, these technologies offer unprecedented opportunities for wealth creation. The question before us is how can societies maintain social and political stability by making sure that the benefits of these technologies are shared.

In addition, it is important that these technologies are absorbed in a manner that does not dehumanise our societies by alienating people from the meaning to life provided by work through human history.

Achieving inclusive growth in developing countries, like Sri Lanka, poses a number of challenges. Employment is the transmission mechanism for sharing the benefits of technological change. It is therefore necessary to ensure people have the human capital to participate effectively in a modernising economy.

Embrace the change and get prepared

Sri Lanka will have to embrace this dramatic change happening around us and be ready to face the challenges it may result in while getting fully prepared to take advantage and reap whatever benefits that it may offer.

In this connection, high priority needs to be attached to education, training and skills development to empower people to participate in rapidly evolving opportunities for work in a world where we are seeing an exponential increase in the pace of technological change.

The German and Japanese models for technical education, where businesses and Government work very closely in employability, is particularly pertinent in this respect.

The Chartered Institute of Management Accountants will have to play a key role in educating and training our younger generation to meet the new challenges and I am certain the institute will be up to the task.

CIMA Sri Lanka Board Chairman Manjula de Silva last night quoting global research highlighted the challenges faced by leaders in decision making in the new era.

He said in today’s world characterised by “volatility, uncertainty, complexity and ambiguity”, strategic decision making is increasingly critical for success hence the need to improve the decision making process.

De Silva said the joint study by CIMA and AICPA has found a number of major flaws in companies’ decision making based on a survey of 300 C-suite executives at major organisations around the world, it suggests that decision making in many businesses could be fundamentally improved.

Some of the key findings were

The study also calls for integrated thinking and decision making connecting the right people with the right info.

De Silva said some of the findings were applicable in Sri Lankan context too hence the study and its recommendations were highly relevant.