Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 29 January 2016 01:00 - - {{hitsCtrl.values.hits}}

The international management consultancy – MTI Consulting – recently concluded its 5th CEO Business Outlook Survey, collectively outlining the Sri Lankan business community’s perception for the state of business in 2016.

Supplemented by MTI’s experience as a thought leadership-oriented organization, the annual survey collated and analysed the perceptions of over 200 Sri Lankan chief executives with regard to their business’s past and expected performance, their predictions regarding the state of the local and global economy in 2016, and the main challenges - they believe - Sri Lanka and their company will face in the current year.

The results of the survey, including its supplementary analysis, will enable organizations to streamline their strategic decision making for 2016, effectively enabling them to gear their operations in accordance to the economic sentiment of their peers.

Grossly Below Expectations

CEOs entered 2015 with much greater hope for growth than the previous year, yet almost half of those surveyed reported their businesses having performed below their expectations for 2015.

Figure 1 - How did your business perform in the previous year?

As opposed to 68% in the previous year, only 53% of CEOs stated that their business performed either as expected or above expectations.

In the same vein - an analysis of the latest (September 2015) quarterly reports published by the CSE S&P 20 and a random sample of small-to-mid (S&M) cap firms revealed that 40% of the former experienced a year-on-year drop in net earnings while 25% of the latter experienced the same.

According to the Asian Development Bank, businesses that may have been among the most affected in 2015 were companies engaged in construction-based and exporting activities.

The construction industry which previously contributed significantly to annual growth slowed down notably amidst political uncertainty for existing infrastructure projects. Textile and garment manufacturers saw their exports to the European Union decline, while tea producers achieved less than the expected level of production last year.

Persistent Outlook of Weaker Global Growth

With the pessimism moving forward to 2016, a striking number of CEOs expect the global economy to remain depressed in the current year. As opposed to only 35% expecting the world economy to recover, 52% expect it to remain depressed while a further 7% expect the economy to slip even further.

Figure 2 - What will happen to the global economy in the following year?

It must be noted that there has been a drastic growth in the number of CEOs expecting the global economy to decline in the following year (59% for 2016 compared to 31% for 2014) and a synchronous drop in the number of CEOs expecting it to improve in the following year (41% for 2016 compared to 69% for 2014).

This, however, is in contrast to the forecasts by the World Bank and the IMF who expect the real value of goods and services produced globally to grow by 2.9% and 3.4% respectively in 2016 – up by 0.5 and 0.3 percentage points respectively from the previous year.

Despite the Chinese troubles to hold on to its own as its economy shifts away from investment and manufacturing to consumption and services, the IMF believes a modest global recovery will be carried upon the backs of advanced economies and currently distressed emerging market economies witnessing gradual improvement.

Both the IMF and the World Bank believe that this moderate recovery may be negatively affected in the event of an unexpected political or economic shock.

Will The Economy Finally Stabilise This Year?

Synonymous with the previous year, more than half of the surveyed CEOs expect the Sri Lankan economy to stabilize in 2016. 18% and 59% of CEOs cited acceleration and stabilization respectively, whereas 24% of CEOs (up from 15% in the previous year) stated that the economy would decline in the current year.

Figure 3 - What will happen to the Sri Lankan economy in the following year?

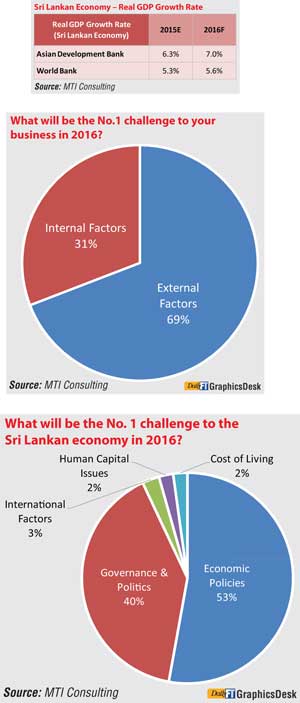

Likewise, both the Asian Development Bank and the World Bank expect a modest increase in Sri Lanka’s real GDP growth rate. The ADB expects the economy to grow by 7% this year (up from 6.3% in the previous year) and the World Bank expects the economy to grow by 5.6% (up from 5.3% in the previous year).

However, economists at the World Bank believe that the public debt burden, the economic issues in the Middle East, EU, and Russia negatively affecting exports (and thus the current account deficit), escalating currency pressures, and difficulties in increasing fiscal revenue to be the major challenges Sri Lanka will face in the current year.

With limited national savings and a necessary requirement for further investment, Sri Lankan trade delegations and business leaders will have to be on top of their game as they approach their allies and scour economic and investor forums in search of some much-needed foreign direct investment.

Great Expectations? Not This Year.

Despite performing below expectations in 2015, almost half of the surveyed chief executives expect to continue along this rate of growth in 2016.

45% of CEOs expect their businesses to grow at the same rate experienced in 2015 (as opposed to 36% stating the same last year), 38% of CEOs expect their businesses to grow at a rate higher than that experienced in the previous year (as opposed to 51% stating the same last year), and 18% of CEOs expect their businesses to experience a lower growth rate than that of the previous year (as opposed to 13% stating the same last year).

Figure 4 - How do you expect your business to grow in the following year?

With tightened regulations frustrating several major industries (banking and automobile in particular) and an amendment-packed abstruse budget, businesses will need to prepare for and gear themselves to the new economic environment that is likely to (or may already have) set in.

“We Require Far More Coherent Economic Policies”

For the previous business outlook survey (pre-election), CEOs believed political stability to be the primary challenge to the Sri Lankan economy, with economic policies falling close behind. Following a rather perplexing budget, it comes as no surprise that CEOs consider the policies and the prevailing economic and regulatory conditions to be the primary challenge for 2016, with governance and political factors considered a secondary challenge.

Figure 5 - What will be the No. 1 challenge to the Sri Lankan economy in 2016?

Less cited primary challenges were international factors or the volatilities of the global economy that are likely to impact the Sri Lankan economy, the cost of living, and human capital issues ranging from a lack of available skilled talent to destabilizing strikes by trade unions.

A closer look at the composition of responses citing economic policies as a challenge revealed that the depreciation of the Sri Lankan currency, the need for an improvement in the current account deficit, and the inconsistent, incoherent and ambiguous nature of the economic policies were considered significant issues among Sri Lankan business leaders.

The governance and politics responses were majorly comprised of concerns about the stability and direction of the coalition government, the difficulties in building (or rather re-building) investor confidence especially among foreign investors, and uncertainty regarding the government’s capability in effectively implementing the policies outlined in the new budget. Less frequently cited concerns of appreciable importance consisted of improving Sri Lanka’s standing in the international community, and the government’s lack of focus on developing important industries and promoting ease of business.

“The Problems Aren’t With Us”

In the same vein as the previous year’s results, almost 7 in 10 of the surveyed CEOs believe that their organisations’ success in 2016 will be primarily affected by factors external to their business. In contrast, only 31% of CEOs believe the problems lie either within their organizations or within their span of control.

Figure 6 - What will be the No.1 challenge to your business in 2016?

Of the external factors, roughly 63% of the responses pointed to future difficulties that would be faced by organizations having to accommodate the new economic policies, stricter regulations (or a lack of regulations or regulatory body), and political uncertainties. Competition from both foreign and domestic companies, poor levels of awareness, interest or purchasing power among target audiences and saturated markets (thus leading to a lower level of demand for goods and services), global volatilities, and environmental concerns made up the remaining composition of external factor responses.

Though few and far between, the internal factors were majorly comprised of responses citing concern towards being able to successfully pursue expansion strategies or attract further investment. Enhancing productivity, increasing efficiency and reducing costs of production were other notable points of concern. Finally a few CEOs expressed their difficulties in attracting, training and retaining good talent, and the challenges they faced when obtaining and settling corporate debt.

Conclusively: The Need for Re-strategising

2016 may be an interesting, though difficult, year for business leaders, considering uncertainties and volatilities both at home and abroad.

With a majority having performed below expectations in 2015, CEOs enter the New Year with moderate expectations for both their businesses and the Sri Lankan economy. Unlike some economic analysts, Sri Lankan business leaders do not expect the global economy to markedly recover anytime soon.

On the back of poor transparency and waning investor confidence, the business community sees the current economic policies and regulations as the biggest challenge to the Sri Lankan economy, while the very same appears to threaten the success of their businesses as well.

Sri Lankan companies, especially those export-oriented, will have to consider re-strategising and gearing their organisations to avoid the adversities of lowflation, currency devaluation, stricter regulation (if applicable), global tensions leading to reduced foreign demand, and the existing poor levels of investor confidence.

***

The CEO Business Outlook Survey 2016 was carried out by MTI Consulting in exclusive association with Wijeya Newspapers.