Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 14 June 2018 00:00 - - {{hitsCtrl.values.hits}}

LONDON (Reuters): The World Cup kicks off in Russia today, and investors should be warned that financial markets tend to act like any emotional soccer fan during the matches - they go quiet and nervy, and don’t like losing.

More than two-thirds (43) of the 64 games in this year’s tournament will be played during European or Latin American trading hours, which has been shown to significantly change market behaviour.

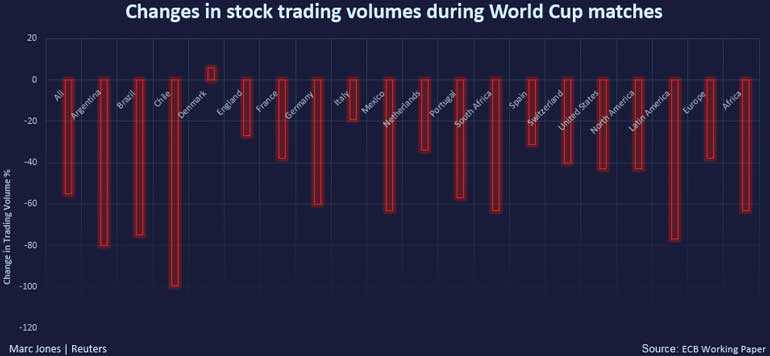

During the 2010 World Cup in South Africa - the last to have similarly timed matches to those in Russia - stock market trading volumes dropped an average of 55% when the country’s teams were playing, according to a study.

In soccer-mad Brazil and Argentina, the reduction was even more pronounced at 75% and 80%, respectively. It fell 38% in Europe and 43% in the United States, while big moments like goals cut activity a further 5%.

“People are distracted, so it is bound to happen again. That would be my take,” said European Central Bank’s Head of Monetary Policy Research and co-author of the analysis Michael Ehrmann.

Ehrmann plans to do more analysis on this tournament and with 35 games in market hours in the first two weeks alone - probably more than any World Cup in history - there will be no shortage of data to crunch.

The original study, which looked at 15 major countries, found trading volumes dropped by a third on average even when a market’s own team wasn’t playing.

When they were involved, trading activity was already down 40% by the time the pre-match national anthems played and remained subdued for 45 minutes after the final whistle.

Bond markets were also affected. German government bond trading almost halved during three of Germany’s 2006 and 2010 World Cup games.

Stock indexes became 21% less correlated than normal with global price moves as well, underscoring just how differently news and information get processed during big games.

Ehrmann’s latest World Cup research plans to show what kind of things markets do still react to even if traders are watching a match.

He expects to look at 15-20 games, but preliminary findings from the 2010 data suggest that “relatively more salient information still gets priced, but relatively less salient - stock-specific - information gets priced less”.

Other work he and his colleague have already done highlights some very acute anomalies, too.

Shares in computer chip firm STMicroelectronics, for example, which trade both in Italy and France, were priced lower in Milan as Italy got knocked out in 2010 and vice versa when France were eliminated.

That builds on other studies that have shown how influential soccer results can be on markets.

A 2007 study by three academics showed that going out of a World Cup can knock almost 50 basis points off a national index the next day, which would be worth more than 10 billion pounds ($13.4 billion) for a large global market like London.

In contrast, Goldman Sachs has proved that winning the World Cup sees a country’s index outperform a global benchmark by 3.5% on average for about a month after.

Since 1974, the winners have outperformed on all but one occasion, Goldman found - 2002 - when recession woes dampened the impact of Brazil’s victory in Japan and South Korea.