Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 27 February 2025 15:17 - - {{hitsCtrl.values.hits}}

|

Sri Lanka’s digital landscape has made significant strides in recent years, but when compared to leading nations in South Asia, there remains considerable room for growth. While countries like India have experienced rapid advancements in fintech, Sri Lanka faces challenges due to gaps in digital infrastructure, including legal, regulatory, and technological frameworks essential for the sector’s progress. Despite these hurdles, banking and non-banking financial institutions like LOLC Finance are actively driving digital adoption by leveraging available infrastructure and resources to lead this transformation.

As Sri Lanka’s largest NBFI, LOLC Finance has taken a proactive approach in driving this change. Aligning with the government’s digital roadmap, the company is spearheading a new era of digital payments, steering the nation towards a cashless economy with its strategic partnership with iPay, Sri Lanka’s premier digital payments platform.

Highlighting LOLC Finance’s journey toward digital transformation, Director/CEO of LOLC Finance, Mr. Krishan Thilakaratne, shared his perspective, “LOLC Finance’s investment in digitalization is driven by its firm belief in the transformative power of technology. As a large-scale financial institution, we operate with a vision for growth, efficiency, and scalability, and digitalization serves as the most effective tool to achieve these objectives. By embracing digital solutions across digitized products, processes, and distribution, we enhance operational efficiency, scalability, and customer experience.”

He further elaborated, “Given Sri Lanka’s relatively small population and the inherent limitations of traditional brick-and-mortar financial operations, digital transformation presents the most viable path for sustainable growth. LOLC Finance recognizes that the future of financial services lies in digital innovation, which allows for greater accessibility, convenience, and inclusivity. As part of our long-term strategy, we continue to invest in advanced digital solutions that optimize internal processes while creating seamless financial experiences for customers. By prioritizing digitalization, LOLC Finance is positioning itself at the forefront of Sri Lanka’s fintech evolution, ensuring sustained growth and leadership in the digital financial services sector.”

LOLC Finance is driving Sri Lanka’s transition to a cashless economy by digitizing the entire customer lifecycle from onboarding to loan disbursement to collections. Field agents on-board customers via mobile apps, offering a seamless, door-to-door service. Recognizing the importance of digital literacy, LOLC Finance is dedicated to educating its customer base, many of whom have limited exposure to digital tools. The company conducts workshops on digital banking, security measures such as OTP authentication, and personal finance management, empowering customers to make informed financial decisions.

As part of its digital inclusion efforts, LOLC Finance has issued over 150,000 credit cards, many to first-time users, while introducing payment cards for microfinance customers and expanding iPay’s merchant network. To support SMEs, LOLC Finance eliminates setup and annual fees on its internet payment gateway, fostering digital adoption among small businesses. The company’s omni-channel strategy integrates financial education with digital solutions, enabling businesses to scale in a digital economy. Platforms such as iPay, internet banking, mobile banking, kiosks, IVR systems, an LLM-based chatbot, and the company website enhance customer service and operational efficiency.

The post-pandemic acceleration of digital finance has driven greater consumer adoption, and LOLC Finance has capitalized on this trend by integrating digital tools across all touchpoints. Features such as digital loan top-ups, Speed Draft withdrawals, and online savings and fixed deposit account openings enhance accessibility.

Internally, continuous digital training ensures employees remain adept at emerging trends, reinforcing LOLC Finance’s belief that true transformation starts within. With a 20% market share, LOLC Finance remains a leader in Sri Lanka’s digital banking sector, committed to innovation, efficiency, and customer empowerment.

The Sri Lankan government’s introduction of LankaPay has laid a strong foundation for digital payments by enabling seamless, low-cost merchant QR transactions. Building on this, platforms like iPay have created comprehensive ecosystems that connect banks, customers, and merchants, enhancing convenience and addressing key pain points. While the focus remains on streamlining merchant payments, the broader fintech landscape holds vast potential for expansion into diverse financial services.

With iPay pioneering innovative solutions, Sri Lanka is steadily aligning with international fintech standards. The government’s digital strategy roadmap further strengthens this trajectory, ensuring continued evolution. As infrastructure improves, Sri Lanka’s fintech sector is poised for greater integration, innovation, and accessibility.

Over the past decade, digital adoption has accelerated, with advancements in digital onboarding, Know Your Customer (KYC) processes, and public service payments. The COVID-19 pandemic further propelled this shift, underscoring the importance of seamless financial solutions. Despite progress, challenges remain in reducing reliance on cash, which presents inefficiencies in handling, management, and reconciliation.

Developed in response to these challenges, iPay offers a game-changing solution in Sri Lanka’s payment landscape. Unlike traditional bank-specific gateways that restrict interbank transactions, iPay’s “One App for Any Bank” concept allows users to link multiple accounts across different financial institutions, fostering a truly interoperable digital payment system. Designed with a customer-first approach, iPay prioritizes simplicity, efficiency and security. Its intuitive interface ensures transactions are completed in just three clicks, with features such as one-click recurring payments and multilingual support enhancing accessibility.

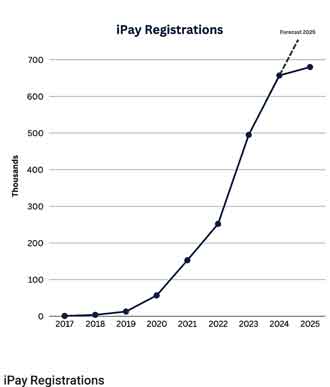

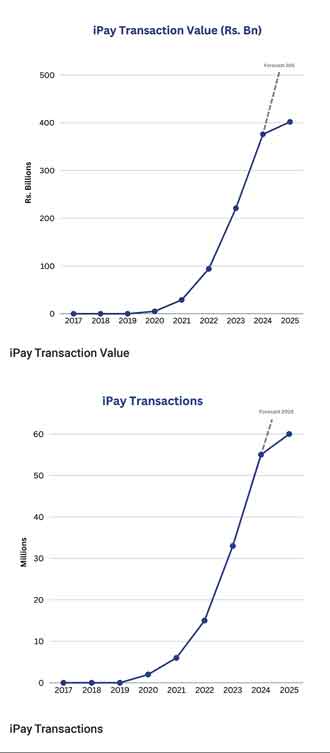

Since its launch, iPay has achieved significant milestones in bridging Sri Lanka’s digital gap. As the largest-used JustPay platform in the country, it commands over 65% market share, with more than 1,000,000 downloads and over 400,000 active users. The platform processed over Rs.60Mn transactions valued at over Rs.400Bn. Additionally, iPay has onboarded over 45,000 merchants, further expanding its reach and impact. Its leadership in digital transactions has earned iPay multiple accolades, including the Gold Award for Best Mobile Application for Retail Payments via JustPay (Banks and NBFIs) at the LankaPay Technnovation Awards 2024.

Beyond payments, iPay is also focused on promoting financial inclusion. Users can make payments to nearly 300 services, including over 170 government services via GovPay, open digital savings accounts or fixed deposits, receive automated bill reminders, enjoy exclusive merchant discounts, book doctor appointments, and track spending with real-time transaction insights. With its commitment to innovation and strategic partnerships, iPay continues to redefine Sri Lanka’s fintech landscape, offering an all-in-one solution that simplifies payments while driving the nation toward a cashless future.

Built on a dynamic technological foundation, iPay continuously evolves to integrate the latest advancements in digital financial solutions. Rather than relying on a single advanced technology, the platform adopts a strategy of continuous innovation, ensuring its technology stack is regularly upgraded to enhance security, efficiency, and user experience. From inception, iPay has placed cybersecurity at the forefront, making significant investments to safeguard transactions and protect customer data. This commitment to security remains a cornerstone of the platform, enabling users to engage in digital payments with confidence and peace of mind.

As a mobile-first platform, iPay is designed to offer an intuitive and accessible user experience, catering to a diverse audience from tech-savvy youth to older generations. Future updates will introduce specialized features for differently abled individuals, reinforcing its dedication to inclusivity. iPay’s seamless onboarding process simplifies registration and transactions, while adjustable font sizes enhance usability. Optimized for Android, iOS, and Huawei, iPay ensures a consistent and frictionless digital payment experience across all devices.

Unlike conventional wallets, iPay operates as a pass-through platform, facilitating direct bank-to-bank transfers without storing funds. Beyond payments, it offers bill settlements, fund transfers, and digital banking features such as savings accounts and fixed deposits. With advanced security measures to prevent fraud, iPay serves as a comprehensive financial management tool. Future expansions will include loan accessibility, mobile top-ups, and direct account openings with partner banks, empowering users with seamless financial control.

As the first platform integrated with JustPay, iPay plays a pivotal role in strengthening Sri Lanka’s digital payment ecosystem. Through continuous research and development, it remains ahead of the curve, setting new benchmarks in digital financial solutions. Its assurance to improvement is driven by direct user engagement, with a dedicated iPay community providing valuable feedback through regular webinars such as “A Dialogue with the Founder”. With an enhanced version on the horizon, iPay remains steadfast in its mission to deliver a seamless, user-centric digital experience.

Sharing his foresight into iPay’s future prospects, Chairman of LOLC Finance and Founder of iPay Mr. Conrad Dias asserted, “LOLC Finance anticipates exponential growth for iPay in the coming years, driven by Sri Lanka’s strong focus on digital transformation. As one of the first platforms to integrate with Govpay, Sri Lanka’s digital government services platform, iPay is at the forefront of supporting the government’s digital initiatives, which aim to streamline payments and enhance revenue collection. This partnership aligns with the efforts of the Digital Ministry of Sri Lanka, the Ministry of Finance, and the Central Bank of Sri Lanka, reinforcing iPay’s pivotal role in the country’s digital ecosystem. Looking ahead, iPay plans to continue supporting government digital initiatives and introduce innovative features that cater to the evolving needs of citizens and communities.

Mr. Conrad further remarked, “Technologically, iPay is exploring the integration of Artificial Intelligence (AI) to enhance its capabilities and improve integration with other platforms. With advancements in Android, iOS, and other platforms, iPay is focused on enabling customers to make the most of these technologies, ensuring that the app stays ahead of market trends and delivers an even more seamless and intelligent user experience in the future. iPay is primed for its next phase of growth, strategically positioned to expand and infuse with banks, financial institutions, and merchant ecosystems, further enhancing its reach and delivering seamless digital payment experiences.”

By balancing cutting-edge security measures with an intuitive and efficient user experience, iPay ensures that customers can complete transactions quickly while maintaining the highest standards of security and reliability. This continuous innovation solidifies iPay’s position as Sri Lanka’s leading digital payment platform, empowering users with a smarter, faster, and more secure financial ecosystem.