Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 30 August 2022 02:45 - - {{hitsCtrl.values.hits}}

By Nisthar Cassim

|

Ports, Shipping and Aviation Minister Nimal Siripala de Silva |

|

SriLankan Airlines Chairman Ashok Pathirage – Pix by Lasantha Kumara

|

Saddled with nearly half a trillion rupee accumulated losses and $ 1 billion in debt and dues, SriLankan Airlines

Group is to be restructured inviting foreign operators to take up 49% equity stake and management to ensure the national carrier no longer becomes a burden on the public.

Ports, Shipping and Aviation Minister Nimal Siripala de Silva yesterday revealed the way forward for Sri Lanka’s flag carrier which he will propose to the Cabinet of Ministers for final approval. The rationale for critical restructuring and the process were shared with trade unions, industry stakeholders and media.

Minister de Silva said given the country’s financial, forex and economic crisis, the Government can no longer fund the national carrier which for the past 10 years had made a collective loss of Rs. 435 billion. Latest FY22 saw the worst performance with Rs. 165 billion loss, largely due to 40% depreciation of the rupee whilst in the past 2019 Easter Sunday and COVID pandemic impacted its performance.

SriLankan also owes $ 1 billion in foreign and domestic debt and dues. When Emirates Airlines managed and part-owned SriLankan from 1998 to 2008 the national carrier made a Rs. 22 million profit.

“The only way to rescue the national carrier is via urgent restructuring. We are proposing the best route arrived at after consultation with officials of the Ministry, the Board of Directors of SriLankan Airlines, officials of the Civil Aviation Authority and industry experts,” de Silva told journalists at a briefing along with SriLankan Airlines Chairman Ashok Pathirage, Ministry Secretary Ruwan Chandra and officials.

The staggering $ 1 billion debt and dues comprises $ 175 million Government guaranteed international bond, $ 380 million payable to the State banks BOC and People’s Bank, and $ 80 million loan taken from BOC by mortgaging shares of SriLankan Catering.

Among liabilities are $ 325 million due in arrears to Ceylon Petroleum Corporation ($ 312 million), Airport and Aviation Services Ltd., and Civil Aviation Authority and $ 80 million in arrears for aircraft leases. National carrier doesn’t own a single aircraft and the fleet of 26 is on lease.

Minister de Silva said funds realised from the 49% equity stake sales would be used to retire debt and settle dues. He said that SriLankan Airlines Group requires new capital infusion and this could be done only via restructuring.

It was pointed out that the need for restructuring and part divestment of State-owned stakes wasn’t unique to SriLankan Airlines only but referred to the privatisation of Air India. “The Government cannot write off debt or absorb losses,” added SriLankan Chairman Pathirage.

The Minister also said following the Cabinet approval Expressions of Interest (EOIs) will be sought from global operators and the exercise is also expected to bring in much needed foreign investment to Sri Lanka.

“It will be a very transparent process and we will not compromise transparency for urgency,” Minister de Silva emphasised.

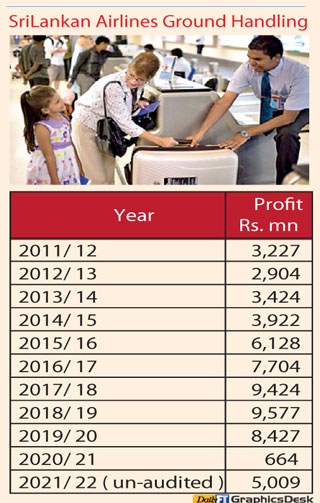

Chairman Pathirage said that restructuring entity by entity or step by step was the best practical course and said catering business will be tackled first followed by ground handling, both of which are profitable. “The sooner we complete the restructure the better it is for the national carrier,” he added.

Though justifying restructuring largely owing legacy debt and other issues, Pathirage said that between December 2021 and March 2022 the national carrier made a net profit. Last month SriLankan Airlines achieved a turnover of $ 90 million and reported a small loss of $ 1.5 million having to source jet fuel from overseas. “In August we are likely to make a profit,” he added.

In the January-March 2022 quarter the airline recorded a Group Operating Profit in dollar terms for the first time after six years. It was also the first fourth quarter profit (in dollar terms) since 2006.

Pathirage acknowledged that despite legacy issues, SriLankan offers great value being the largest foreign operator to India, the strategic location of Colombo for transit traffic, the landing rights, strong brand and goodwill among other factors. Sri Lankan Airlines presently serves 37 destinations in 23 countries being the only Asian airline which operates direct routes to Australia, France, Germany, Japan, South Korea and the UK from Sri Lanka.

Minister de Silva said that retention of the existing staff is mandatory on the part of new owners cum managers unless a Voluntary Retirement Scheme (VRS) is offered to those interested. He said that unions were supportive of the restructuring process and made several recommendations which will be considered.

Pathirage also denied the misconception that SriLankan which has 6400 employees is overstaffed and they are overpaid. He said that due to the pandemic and the resultant impact the airline lost many employees and like the global industry, is in need of additional staff in select functions.