Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 27 September 2023 00:00 - - {{hitsCtrl.values.hits}}

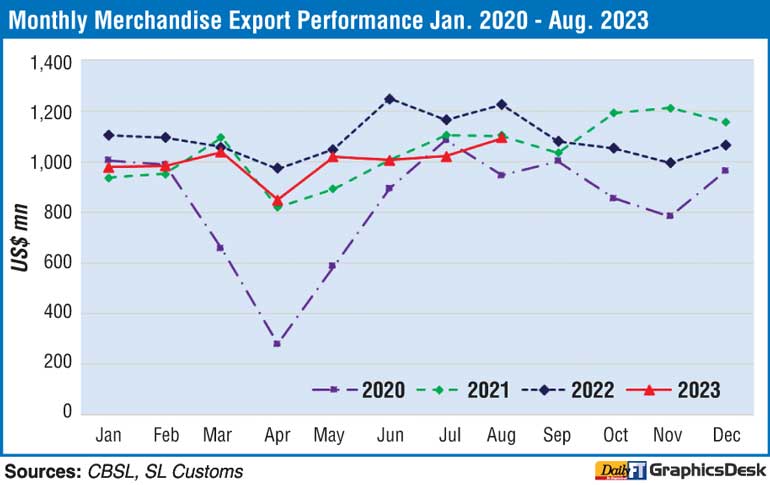

Sri Lanka’s export sector in August managed to marginally grow over $ 1 billion compared to July 2023, though on a year-on-year (YoY) basis, it fell by 11% due to sluggish demand in major markets.

As per the provisional data released by the Export Development Board (EDB) yesterday, earnings from merchandise exports increased by 6.8% month-on-month to $ 1.09 billion in July 2023, but down by 10.91% YoY.

The EDB said the decline in merchandise exports is due to decreased demand for export products, particularly in sectors such as apparel and textiles, rubber and rubber-based products and coconut and coconut-based products.

From January to August 2023, cumulative merchandise exports saw a substantial decline of 10.42% to $ 7.98 billion compared to the corresponding period of 2022.

The estimated value of services exports for the period of January to August 2023 was $ 1.4 billion, registering an increase of 12.96% over the corresponding period of 2022. The services export estimated by EDB consists of ICT/BPM, construction, financial services and transport and logistics.

The EDB has set a forecast performance of $ 18.51 billion in merchandise and service exports in 2023. This comprises $ 15.93 billion from merchandise exports up from $ 13.01 billion achieved in 2022 and $ 2.58 billion from services exports.

Major exports in August

Export earnings from spices and essential oils increased by 19.52 % to $ 47.94 million in August 2023 compared to August 2022. This increase was primarily driven by a remarkable increase in the export of pepper 176.83%.

Furthermore, the estimated value of ICT exports is expected to increase by 45.5% to $ 132.25 million in August 2023 when compared to August 2022. Additionally, the value of transport and logistics services exports is projected to increase by 26.45% in August 2023 compared to the same month in the previous year.

Export earnings from apparel and textiles have decreased by 23.06 % YoY to $ 434.98 million in August 2023 compared to August 2022.

In addition, export earnings from tea, which made up 12% of merchandise exports, decreased by 3.83 % YoY to $ 119.64 million in August 2023 compared to August 2022. Earnings from export of bulk tea decreased by 15.03% to $ 59.07 million.

Export earnings from rubber and rubber-finished products have decreased by 19.70 % YoY to $ 80.16 million in August 2023, with negative performance in exports of pneumatic and retreated rubber tyres and tubes (-17.40%) and industrial and surgical gloves of rubber (-29.92 %). In addition, export earnings from the Electrical and Electronics Components (EEC) decreased by 1.60 % YoY to $ 41.22 million in August 2023 with poor performance in exports of electrical transformers (-44.48 %).

On monthly analysis, export earnings of coconut-based products decreased by 10.30% YoY. Moreover, export earnings of coconut kernel products, coconut fibre products and coconut shell products decreased by 6.68 %, 12.80 % and 15.86 % respectively in August 2023 compared to August 2022.

Export earnings from coconut oil, desiccated coconut and liquid coconut milk which are categorised under the coconut kernel products decreased by 10.15 %, 14.32 % and 9.97 % respectively in August 2023 compared to August 2022.

Being the largest contributor to the coconut-based sector, coco peat, fibre pith and moulded products which are categorised under the coconut fibre products, decreased by 13.44 % to $ 13.59 million in August 2023 in comparison to August 2022.

Earnings from activated carbon, which is categorised under the coconut shell products decreased by 16.94% YoY to $ 10.74 million.

Export earnings from seafood decreased by 30.83 % to $ 17.66 million in August 2023 compared to August 2022. This decrease was mainly due to the poor performance in the export of frozen fish (-31.42 %), shrimps (-37.67 %) and fresh fish (-41.24 %).

Moreover, export earnings from ornamental fish decreased by 12.55 % to $ 2.02 million in August 2023 compared to August 2022.

Major exports during January - August

Earnings from export of tea, spices and concentrates, gems and jewellery and EEC increased by 6.23%, 12.91 % 13.52%and 8.45% respectively from January to August 2023 compared with the corresponding period of 2022.

Earnings from the export of tea increased by 6.23 % to $ 870.37 million due to the rise in all the subcategories of the tea sector except bulk tea and tea bags. Earnings from tea packets, instant tea, green tea and other tea increased by 13.71%,34.61 %, 40.48% and 46.09 % from January to August 2023.

In addition, export earnings from spices and essential oils increased YoY by 12.91 % to $ 264.65 million from January to August 2023. Export earnings from pepper, cloves, nutmeg and mace increased YoY by 14.87 %, 317.95% and 49.66% respectively from January to August 2023.

Meanwhile, earnings from the export of EEC increased by 8.45% to $ 337.85 million from January to August 2023 compared to the corresponding period of 2022.

Earnings from the export of printed circuits, switches/boards and panels, boilers/piston engines/ pumps and vacuum pumps and other EEC products increased by 56.27%, 13.71%and 11.43% respectively from January to August 2023 compared to the corresponding period of 2022.

The value of ICT exports is estimated to increase by 20.88 % to $ 926.05 million in the first eight months of 2023 compared to the corresponding period of 2022. In addition, construction and financial services exports are estimated to increase by 75.43 % and 15.78% respectively in the first eight months of 2023 compared with the corresponding period of 2022.

Earnings from export of apparel and textiles decreased by 18.79% to $ 3.31 billion from January to August 2023 compared to the same period of 2022. The export of Apparel declined by 19.95% and the export of textiles declined by 4.66% from January to August 2023.

In addition, export earnings from Rubber and Rubber finished products decreased by 13.67 % to $ 609.26 million in January –August 2023 compared with the same period of 2022 attributed to lower exports of Industrial and Surgical Gloves of Rubber (-26.98%) and Pneumatic and Retreated Rubber Tyres and Tubes (-7.68%).

From January to August 2023, export earnings from coconut and coconut-based products decreased by 18.51% to $ 466.67 million from the same period last year. Earnings from all the major categories of coconut-based products decreased from January to August 2023 compared with the corresponding period of 2022 due to the poor performance in the export of Coconut Oil (-23.17%), desiccated coconut (-32.92 %), coconut milk powder (-9.44 %), coconut cream (-17.14 %), liquid coconut milk (-12.01%), cocopeat (-16.22%) and activated carbon (-16.83%).

further, export earnings from seafood decreased by 11.18 % to $ 167.30 million from January to August 2023 compared to the year 2022 due to the poor performance in frozen fish (-10.16 %), fresh fish (-11.12 %) and shrimps (-38.0%).

Export performance in major markets

Out of the top 10 export markets India, Italy, UAE and France have shown strong performance during August 2023 and the period of January to August 2023 compared to the corresponding period in the previous year.

Exports to the US, Sri Lanka’s single largest export destination, decreased 21.29% to $ 252.13 million in August 2023 compared to August 2022. During the first eight months, exports to the US decreased by 18.89% YoY to $ 1.87 billion.

Exports to FTA partners

Exports to Free Trade Agreement (FTA) partners accounted for 6.5% of total merchandise exports and have increased by 23.02% YoY to $ 93.2 million.

Exports to India increased by 17.7% YoY and exports to Pakistan increased by 84.3% Y compared to August 2022.

Strong performance recorded in India led by increased exports of pepper (192.66%) areca nut (2.8%) and animal feed (37.3%). Better performance recorded in Pakistan led by increased exports of other textile articles and woven fabrics.

From January to August 2023, exports to FTA partners accounted for 7.2% of total merchandise exports increased by 0.72% to $ 627.65 million compared with the corresponding period of YoY previous year.

Exports to India increased by 0.93% while exports to Pakistan decreased by 1.84% from January to August 2023 when compared with the corresponding period of 2022.

Increased exports to India led by good export performance of animal feed (0.22 %), pepper (15.38 %), cloves (471.05%) and other textile articles(68.94 %) and decreased exports to Pakistan led by export of sheet rubber (-12.48 %) and desiccated coconut (13.88 %).

Export performance in regions

Exports to the European Union (EU) which comprised 21% of Sri Lanka’s exports during August 2023 increased by 3.78% YoY to $ 252.13 million. However, during the first eight months, exports to the EU declined by 18.89% YoY to $ 1.87 billion.

From January to August 2023, the breakdown of exports to the top five EU markets which accounted for 78 % of Sri Lanka’s total exports to the EU was; Germany›s $ 396.3 million (down by 23.01%), Italy›s $ 444.86 million (up by 7.39 %), Netherlands $ 224.96 million (down by 17.98 %), Belgium $ 150.76 million (down by 30.04 %) and France $ 227.06 million (up by 27.72 %).