Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 20 June 2022 04:12 - - {{hitsCtrl.values.hits}}

By Nisthar Cassim

|

| LOLC Group Deputy Chairman Ishara Nanayakkara |

|

| LOLC Group Managing Director Kapila Jayawardena

|

|

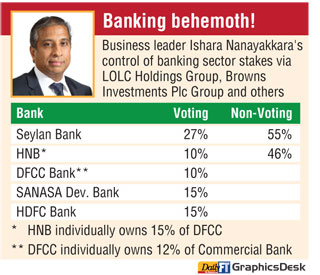

Multi-billionaire Ishara Nanayakkara is confirming he is bullish on the banking sector despite its challenges by expanding his footprint with a strategic entry into the DFCC, the country’s pioneering development finance institution-turned commercial bank.

Already the biggest financial services provider via LOLC Group and Browns Investments (BIL), Ishara has acquired 10% stake for Rs. 2.2 billion. This investment comes hot on the heels of over Rs. 5 billion investment last year in HNB, the country’s second biggest private sector bank.

DFCC also holds a 12% voting stake in Commercial Bank and is the single largest shareholder.

This is the formal LOLC Group/Browns Investment acquisition in DFCC.

As of 31 March, Ishara through Don and Don Holdings Ltd., held 3% stake. The latest acquisition of 40.235 million shares at Rs. 55 each was via LOLC Investment Holdings Three Ltd. Major shareholders of DFCC are HNB (15%), BOC (12.5%), M.A. Yaseen (10%), Sri Lanka Insurance Corporation (9%), EPF (8%), Melstacorp PLC (7.36%), Seafeld International (5.82%).

DFCC’s Rights Issue worth Rs. 6 billion involved 109,247,953 new ordinary shares at Rs. 55 each. The basis was 12 shares for 37 held. It concluded with a shortfall of Rs. 600 million.

DFCC in a separate disclosure said that it has allotted/listed 65.8 million shares worth Rs. 3.6 billion out of the 109.24 million shares (provisionally allotted) worth Rs. 6 billion.

DFCC said considering the current market conditions, it decided not to further pursue exploring avenues in respect of the balance Rights shares. The allotment of shares in excess of the single shareholding restrictions imposed under the Banking Act which was stayed in respect of a few affected existing shareholders with their consent will not be allotted and steps will be taken to return funds retained in lieu of such un-allotted shares.

Whilst HNB is the single largest shareholder of DFCC, Ishara is already the biggest shareholder in HNB via LOLC/BIL with 10% voting stake and 46% non-voting stake thereby treating HNB as an associate.

Ishara also controls 27% voting stake in Seylan and 55% non-voting stake.

Also last year, via LOLC subsidiary Iconic Property 23 Ltd., bought 15% stake in SANASA Development Bank for Rs. 1.24 billion in development banking with Sanasa Development Bank. Separately LOLC Holdings owns a 15% stake in housing financing specialist HDFC Bank.

Analysts described Ishara’s formal entry into DFCC signals his strong intent to consolidate LOLC/BIL investments in the banking sector and compliments the financial services offering. LOLC Finance and Commercial Leasing and Finance merged recently to form the largest Non- Banking Financial Institution (NBFI) in Sri Lanka with a total asset value of Rs. 311 billion.

The combined entity delivered a colossal Profit Before Tax (PBT) of Rs. 25.6 billion in FY22 and Profit After Tax (PAT) of Rs. 23.5 billion. LOLC Development Finance too reported a healthy financial year with Profit After Tax of Rs. 389 million.

LOLC General Insurance is classified as a large-size company while standing to be the fifth-largest General Insurer in Sri Lanka and LOLC Life Assurance became the first insurer within the local Life Insurance industry to achieve the Rs. 4 billion milestone within the first 10 years of operation.

Fulfilling its ambition of being a multinational, the LOLC Group recently announced a Profit before Tax of Rs. 83.8 billion and Profit After Tax of Rs. 77.8 billion for FY22 reflecting 46% increase from a year ago. It said the Total Comprehensive Income of the Group reached Rs. 161 billion, claiming it as unparalleled in the history of any Sri Lankan corporate entity.