Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 26 March 2024 02:25 - - {{hitsCtrl.values.hits}}

Most brokers have so far recommended the Expolanka Holdings PLC's exit offer at Rs. 185 per share to minority shareholders in a deal worth Rs. 63 billion, a special resolution for which will come up for vote tomorrow at the Extraordinary General Meeting.

Despite widespread recommendation some minority shareholders are wary on the premise that a higher price is warranted. On the other hand proponents of the exit offer have been mobilising proxies in their favour.

There appears to be a consensus on the exit offer among most brokers. JB Securities Managing Director Murtaza Jafferjee, CFA declared that the exit price on Expolanka Holdings PLC is “extremely generous.” As per JB Securities’ prognosis, the loss-making Expolanka’s actual share value is between Rs. 44 and Rs. 66 CT CLSA Securities recommends Expolanka Holdings PlC’s exit offer on the basis of it being "more than fair."

SC Securities said the exit offer is “favourable" whilst John Keells Stockbrokers described it as "fair." Asia Securities said the exit offer generates a sizable premium to its estimated fair value for Expo. First Capital Research adviced minority shareholders to "accept the offer" as it is at a substantial premium.

Few minority shareholders however have expressed their disagreement with the offer and demand a much higher price. The sceptics of the exit offer mostly include those who bought Expolanka Holdings shares between Rs. 200 and Rs. 400 levels in FY22. Another reason to oppose it is that Expo’s parent SG Holdings collected shares in FY23 at much higher price than the exit offer. SG Holdings’ buying into Expolanka in 2022 was largely responsible for 10-year high Rs. 30.7 billion net foreign inflow to the Colombo stock market.

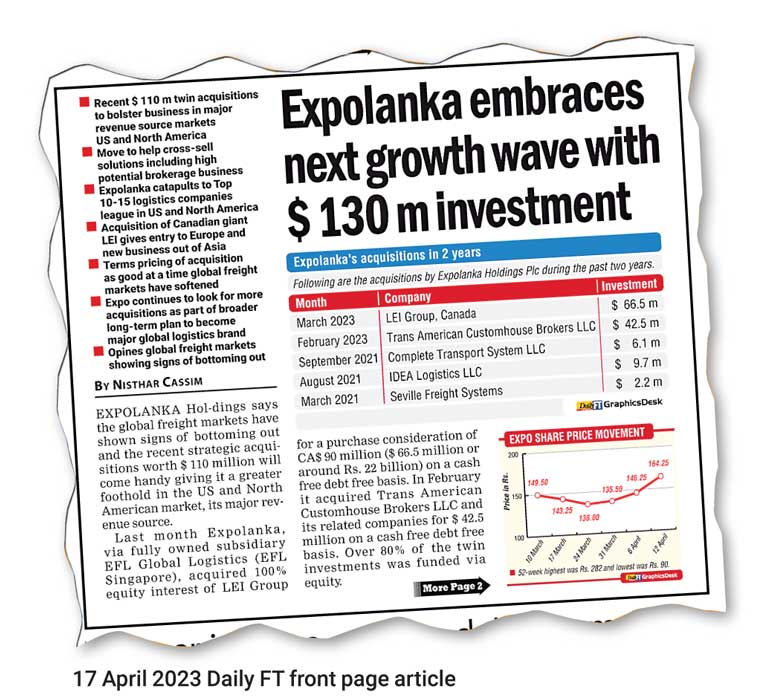

Another argument is that Expolanka invested out of shareholder funds for massive overseas expansion in FY22 and FY23.

They contend that the benefits of these investments will be reaped in the next few years whilst freight rates will see upward pressure given geopolitical tensions.

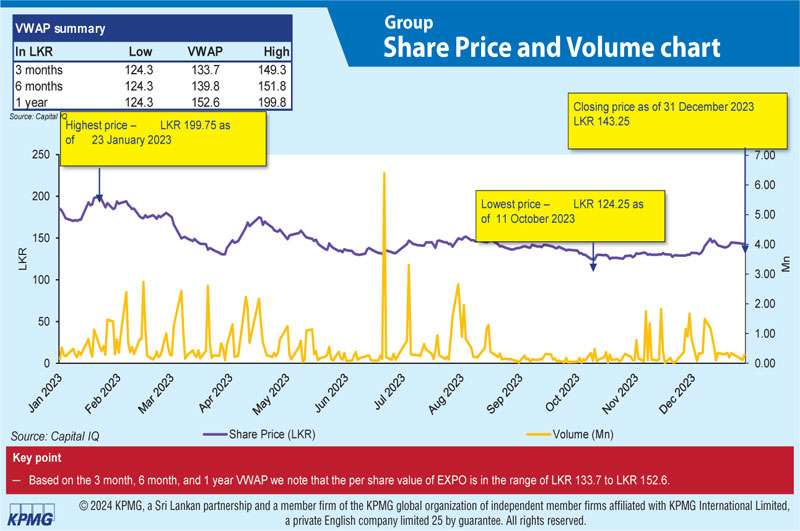

On 17 April last year, the Daily FT front page main story focussed on how shareholders were reacting to the Expo's acquisition spree worth $ 131 million from March 2021 to March 2023. Initial investor reaction to the biggest ever acquisition was somewhat muted as Expolanka share price gained by only Rs. 7.50 or 5.7% to Rs. 138 but later the stock gathered momentum. However thereafter investors lost confidence and optimism with Expo dipping to low of Rs. 124.25 on 11 October and closing 2023 calendar year at Rs. 143.25. (See charts)

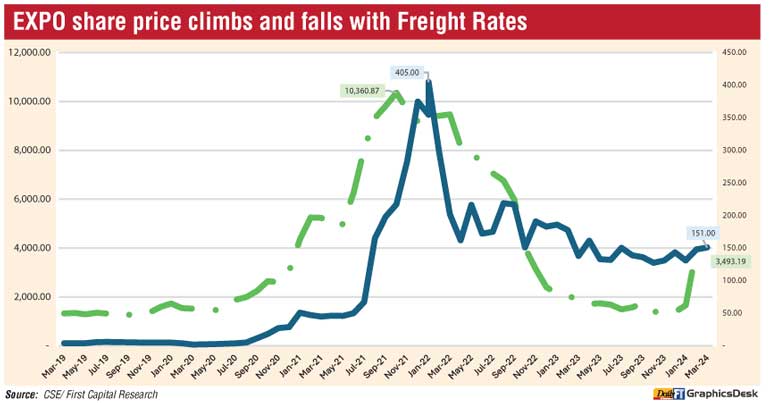

Contrary to the new found optimism post-exit offer announcement, the overall investor behaviour previously was one of indifference, analysts opined. Expo’s share price closed at Rs. 150.50 prior to suspension of trading pending the delisting announcement on 1 March. The late spike was on speculation of the exit offer.

With co-founder and CEO/Director Hanif Yusuf confirming his exit, SG shareholding is now at 90%. The balance 9.9% stake in Expolanka is held by 20,850 shares as at 31 December 2023 down from 23,169 in FY23. Seventeen of the largest public shareholders account for 35% of 194 million shares open for the exit offer.

Aided by COVID-19 pandemic triggered dynamics including hikes in freight rates Expolanka had its magical year in FY22 posting a Rs. 85.5 billion pre-tax profit and Rs. 73 billion net profit on a revenue of Rs. 694 billion. Its share price reached an all-time high of Rs. 405 in that year as well from a low of Rs. 43 and Rs. 1.70 in FY21.

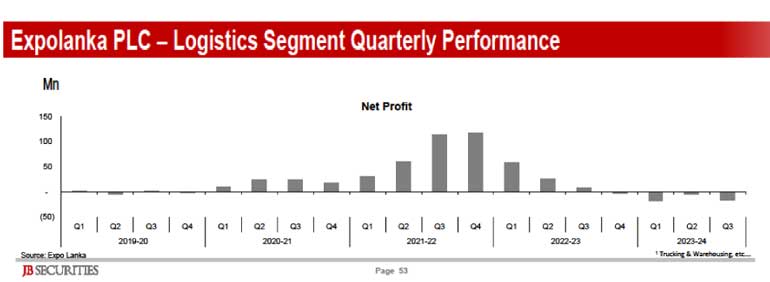

In FY23, however, in tandem with challenges in the global freight market, profit slumped to Rs. 31 billion on Rs. 546 billion turnover. For the past successive five quarters, Expolanka performance had been under severe stress whilst in 3Q of FY24 it reported a Rs. 5 billion loss and first nine months loss were Rs. 12 billion.

Furthermore, some of the opposing shareholders appear to disregard KPMG’s as well as brokers forecast on future earnings. Engaged to determine the value of Expo share, KPMG forecast Expolanka to make losses in the near term. Expo's logistics business, its biggest, is forecast to make a loss of $ 14.5 million in FY24 and $ 1.5 million in FY25. However earnings after tax are estimated to increase to $ 23.4 million in FY26 and to $ 41.6 million in FY27, according to KPMG.

References

https://www.ft.lk/top-story/Expolanka-embraces-next-growth-wave-with-130-m-investment/26-747391

https://www.ft.lk/front-page/SG-Holdings-ends-2022-with-82-4-stake-in-Expolanka-Holdings/44-743611

https://www.ft.lk/top-story/Minorities-merry-over-Rs-63-b-mega-Expolanka-exit-offer/26-759145