Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 9 December 2021 00:00 - - {{hitsCtrl.values.hits}}

Finance Minister Basil Rajapaksa on 12 November presenting the Budget 2022 as President Gotabaya Rajapaksa and Prime Minister Mahinda Rajapaksa look on – File photo

Budget 2022 has failed to achieve three critical outcomes of establishing fiscal stability, building credibility, and instilling confidence, Verite Research claimed yesterday.

Its verdict, via a special public report, comes ahead of the third reading of Budget 2022 in Parliament tomorrow.

“2022 will be a pivotal year in Sri Lanka’s external debt management and the economy as a whole. The Budget 2022, currently being debated in Parliament, provides an opportunity to map a path out of Sri Lanka’s prevailing economic troubles,” Verite Research said.

It said Members of Parliament need to vote on the budget on 10 December with responsibility, and, hence, they require a robust analysis of the assumptions and estimates that underpin the budget proposals.

Verité Research said its public report on the budget serves this need.

The report analyses the estimates and assumptions used in the formulation of the budget. It serves to assess whether Budget 2022 can achieve three critical outcomes: (i) establish stability, (ii) build credibility, and (ii) instil confidence.

Following are key findings of Verite Research’s public report.

Budget fails to establish a stable fiscal regime

▪ In January 2020, a new tax structure was established, introducing substantial reforms to major taxes, including corporate and personal income tax and VAT. The stated objective of that change was to establish a stable and predictable regime of lower taxes for at least five years. The proposed budget undermines those aspirations. Through measures such as financial VAT and surcharge tax, it introduces tax increases (reversing reductions), one-off taxes (reducing stability) and retroactive taxes (reducing predictability).

▪ The one-off taxes proposed not only create a shock in the present, but also increases uncertainty in the future. Businesses and investors are left speculating about the new tax measures that might be taken in 2023 to address revenue needs met with the one-off taxes in 2022.

▪ The budget also fuels macroeconomic instability by setting a path of high deficits. Using the Government’s own budget and economic data, Verité has projected that the budget deficits will remain around 10% and above till 2025.

Budget fails to establish credibility in its fiscal projections

▪ Verité’s 2021 Public Report on the Budget published in December 2020 estimated that Government revenue in 2021 would amount to Rs. 1,523 billion as opposed to the Government’s estimate of Rs. 2,019 billion. The Government has now revised its 2021 revenue figure to Rs. 1,556 billion, which is much closer to Verité’s estimate than the Government’s estimate at the time.

▪ Past reports by Verité Research show that the Ministry of Finance (MoF) has consistently overestimated Government revenue and underestimated the budget deficit. 2021 had the highest gap on record between forecasted and realised revenue – mainly due to unrealistic forecasts. The revenue forecasts for 2022 remain similarly unrealistic.

▪ For 2022, Verité’s estimations indicate that the total revenue and grants figure should be revised downward to Rs. 1,900 billion from the Government’s estimate of Rs. 2,321 billion. This will likely result in a budget deficit of Rs. 2,020 billion (11.1% of GDP), which is materially higher than the MoF budget deficit projection of Rs. 1,606 billion (8.8% of GDP). The report provides detailed estimates of specific taxes and key expenditure items in arriving at these projections. For example, the MoF estimates that the proposed social security contribution would realise Rs. 140 billion in revenue, whereas Verité estimates that this new tax will only result in Rs. 84 billion in revenue.

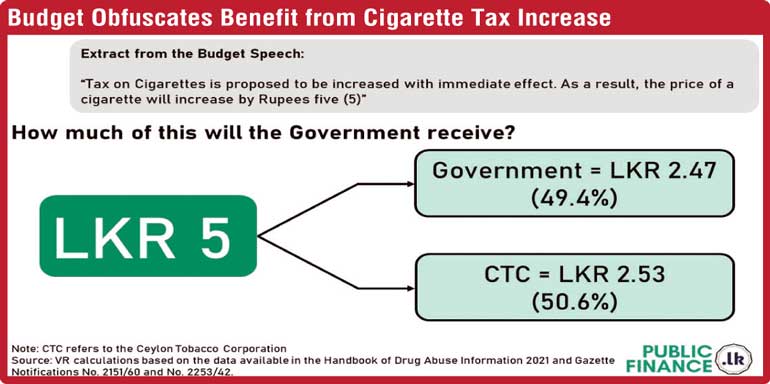

▪ Lack of integrity in figures provided was also evident in the specification of excise tax measures. Formulas announced in past budgets for increasing cigarette taxes in keeping with inflation, etc. have not been applied. The budget, which states that cigarette prices will increase by Rs. 5, was widely understood as announcing a tax increase of that amount. However, the gazette increase in cigarette excise taxes amounted to only a weighted average of just under Rs. 2.50 (half of what was understood). There was also a 50% reduction in the excise tax on the cigarette with the second highest market share, which will result in a further loss of revenue from consumption substitution to this cheapest cigarette in the market. Consequently, there is a significant overestimation of the Government’s expected revenue from cigarette taxes.

The report also highlights the multiple deficiencies in the medium-term framework (MTF) presented in the budget. The sharp divergence between the MTF presented in Budget 2021 in November 2020 and the MTF presented in this budget is again indicative of a lack of credibility in the MoF’s projections and a reflection of the weak analytical basis in arriving at such projections. Verité’s projections for the MTF suggest that the debt to GDP ratio will reach 116.1% in 2025 as opposed to the Government’s projection of 89.2%

Budget fails to build confidence for global markets and rating agencies

▪ The budget deficit, primary deficit, and MTF, in particular, are indicators closely watched by ratings agencies and global markets. By failing to sufficiently and credibly address the path of the budget deficit and public debt, Sri Lanka once again risks adverse credit rating actions. Such adverse rating action, if it does materialise, will further negatively affect Sri Lanka’s efforts to manage external debt and avoid outright sovereign default.

▪ The report also highlights multiple occasions where the executive violates the rules set out in the Fiscal Management Responsibility Act (FMRA), which is in place to build fiscal discipline. For instance, the FMRA sets an upper limit for the budget deficit of 5% of GDP whereas the proposed budget deficit in the 2022 Budget is 8.8% of GDP. Therefore, Parliament will be approving a budget that violates its laws.

The full report can be accessed here: https://publicfinance.lk/en/topics/public-report-on-the-2022-budget-assessment-of-the-fiscal-financial-and-economic-assumptions-used-in-the-budget-estimates-163895514