Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 2 June 2023 00:00 - - {{hitsCtrl.values.hits}}

|

| CBSL Governor Dr. Nandalal Weerasinghe |

Citing six compelling factors, the Central Bank yesterday announced a sharp 250 basis points cut in policy rates, first time in nearly 3 years and signalled financial institutions to follow suit.

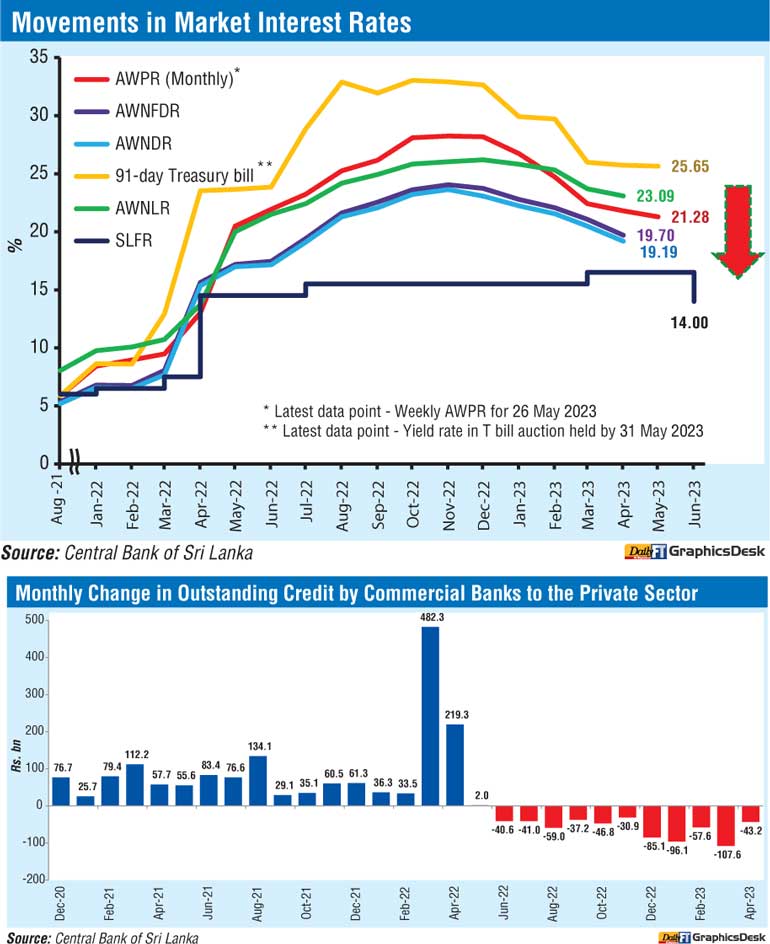

The decision to reduce the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank by 250 basis points to 13.00% and 14.00%, respectively, was by the Monetary Board of CBSL at its meeting on Wednesday. Policy rates were last revised in July 2020.

Six reasons cited by CBSL were faster-than-expected deceleration of inflation and benign inflation outlook; slower-than-expected economic recovery; limited space for downward adjustment in market interest rates; prolonged contraction of credit to the private sector; notable easing of Balance of Payment (BOP) pressures and stabilising market conditions despite certain uncertainties.

CBSL said with greater macroeconomic stability being achieved through corrective policy measures, particularly in terms of faster-than-expected deceleration of inflation thus far during 2023 and the benign inflation outlook and the easing of the BOP pressures, the Monetary Board upon carefully assessing the current and expected developments, decided to relax the stance of monetary policy and reduce the policy interest rates.

This move is expected to accelerate the normalisation of the interest rate structure in the period ahead and broadbase the recovery of activity in the economy and ease pressures in the financial markets, thereby steering the economy towards a rebound phase.

CBSL Governor Dr. Nandalal Weerasinghe said the move is the beginning of the policy easing cycle aimed at providing an impetus for the economy to rebound from the historic contraction of activity witnessed in 2022, while easing pressures in the financial markets.

“We want the financial institutions to pass the benefit of lower interest rates as soon as possible,” Dr. Weerasinghe said, adding that the move will help banks to expand their loan book. Bank lending to the private sector has declined since June 2022.

The CBSL Chief also revealed early success in containing inflation which according to him will be at single-digit level before the end of the year.

In its post-monetary policy meeting statement, CBSL said headline inflation (year-on-year), based on the Colombo Consumer Price Index (CCPI), continued the deceleration path, faster-than-projected earlier, supported by the lagged impact of tight monetary and fiscal policies, strengthening of the Sri Lanka rupee, reduction in fuel and gas prices, normalisation of food prices and the favourable impact of the statistical base effect.

The full pass-through of the large appreciation of the exchange rate observed recently is yet to be reflected in the price levels, and it would quicken the disinflation process, as the prices of imported goods are expected to decline further in the period ahead. The favourable statistical base effect due to large month-on-month inflation that materialised during the last year is expected to slow inflation significantly in the next few months as well. Accordingly, as per the latest projections of the Central Bank, headline inflation is forecast to reach single digit levels in early Q3-2023, and stabilise around mid-single digit levels over the medium term.

CBSL said the downward adjustment in market interest rates will accelerate in line with the envisaged single digit inflation, thereby supporting credit to the private sector and softening the pressures in the financial sector.

Both deposit and lending interest rates have continued to adjust downwards with the market guidance provided by the Central Bank along with the improvement in liquidity conditions of the domestic money market.

The yields on government securities are expected to decline further as risk premia are likely to subside substantially with the announcement of the domestic debt optimisation operation in the period ahead. Moreover, foreign financing inflows in the form of budget support would reduce the need for proportionately large domestic financing, thereby easing pressures on government securities’ yields further.

Credit to the private sector by licenced commercial banks (LCBs), including the SME sector, which continued to contract since June 2022, is expected to turnaround gradually with the easing of monetary conditions and the envisaged rebound of economic activity. Net credit to the Government by the banking system that notably expanded in 2022 is expected to moderate with the receipt of substantial foreign financing to the Government. Meanwhile, credit to the State Owned Business Enterprises (SOBEs) by the banking system is expected to reduce significantly in the period ahead, underpinned by the cost recovery pricing adopted by major SOBEs.

CBSL said as reflected by leading indicators, economic activity remains subdued thus far during 2023, reflecting the protracted impact of the severe economic stresses in 2022 and the resultant tighter monetary and fiscal policies needed to support the restoration of macroeconomic stability. The economy is projected to rebound gradually from late 2023, supported by the easing of monetary conditions, improvements in business and investor sentiments along with the realisation of improved foreign exchange inflows, the faster recovery of the tourism sector, and the implementation of growth promoting policy measures.

CBSL said during the four months ending April 2023, the trade deficit decreased notably, compared to a year earlier, reflecting mainly the subdued import expenditure, which outweighed the impact of moderation of external demand for merchandise exports. Inflows to the domestic forex market remain robust following the approval of the Extended Fund Facility (EFF) from the International Monetary Fund (IMF). The significant revival of workers’ remittances and earnings from tourism continued to build resilience in the external sector.

The renewed foreign investor appetite for short term government securities has also helped improve forex liquidity in the recent months. The exchange rate, which is allowed to be determined by market forces, continues to reflect positive market sentiments underpinned by the improvement in liquidity in the domestic forex market.

The Monetary Board had assessed both upside and downside risks to the inflation projections in the near to medium term and viewed that risks to the inflation projections, on balance, are tilted to the downside in the medium term.

Faster deceleration of inflation and lower probability of excessive demand pressures during the economic rebound phase creates space for a gradual policy relaxation in the period ahead. The Board underscored the need for a quicker pass through of the benefit of the relaxed monetary policy stance to the stakeholders of the economy. The financial institutions, led by LCBs, are expected to adjust the market interest rates swiftly in line with the changes in the policy interest rates. Furthermore, the Board also recommended requesting the Government to consider phasing out the remaining restrictions on most items of merchandise imports. The Monetary Board will continue to assess risks to both inflation and GDP growth projections, among others, and stand ready to take appropriate measures to ensure and sustain macroeconomic stability in the event of crystallising any risks to the baseline projections.