Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 29 May 2024 02:55 - - {{hitsCtrl.values.hits}}

Central Bank Governor Dr. Nandalal Weerasinghe

The Central Bank yesterday sounded more emphatic that a further decline in lending interest rates is warranted especially for new loans.

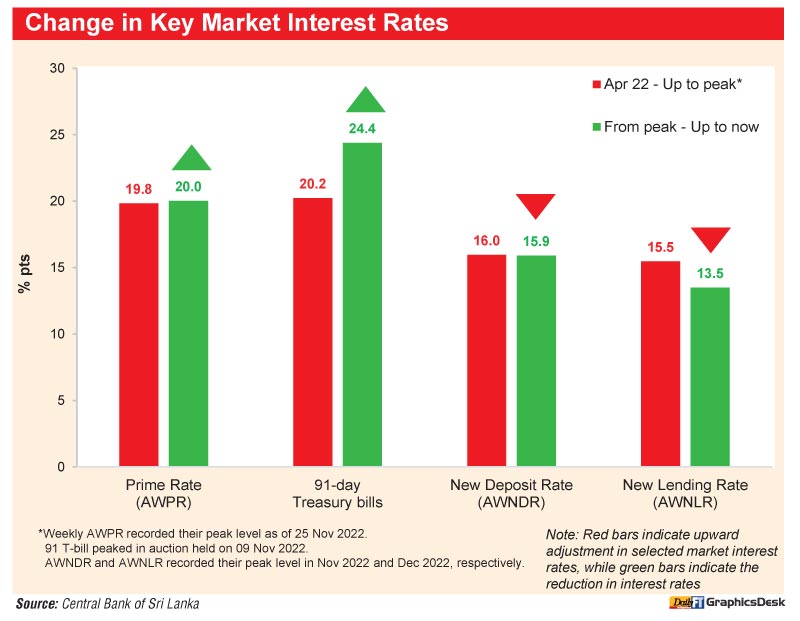

The Average Weighted New Lending Rate (AWNLR) is around 13.5% as against the Average Weighted Prime Lending Rate (AWPLR) of 9.68%.

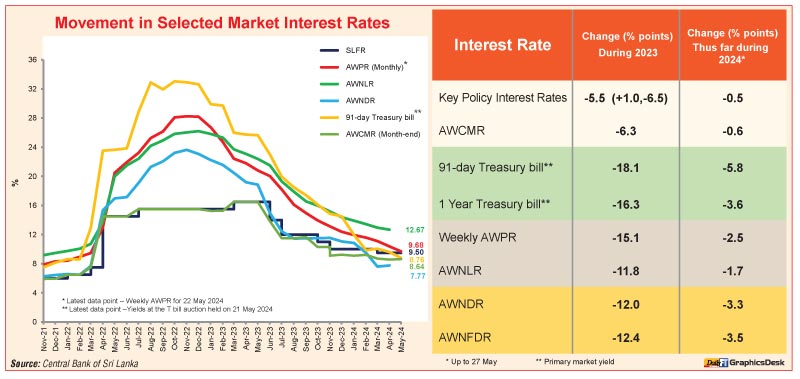

The latest assertion that lending rates should come down further, follows the Monetary Policy Board of the CBSL yesterday keeping policy rates unchanged in its May review. Between October last year and March this year policy rates have been reduced by 250 basis points.

In its statement the CBSL said the overall market interest rate structure has adjusted downwards in response to the monetary policy easing measures implemented thus far. The yields on Government securities continued to decline, further aligning with the current level of policy interest rates.

“With the decline in average deposit interest rates in the banking sector in recent months along with the moderation of benchmark interest rates, further space has been created for overall lending interest rates to adjust downwards in the period ahead,” CBSL said.

“Moreover, elevated interest rates on selected loan products are yet to be adjusted downwards in line with the overall interest rate structure,” emphasised CBSL.

It noted that flows of credit to the private sector have only recorded a marginal expansion thus far (by 3.6%) during the year, in spite of the notable monetary policy easing and the improvement in overall liquidity conditions.

“A further reduction in retail lending interest rates could facilitate the pickup in private sector credit, thereby supporting the ongoing recovery of economic activity,” the CBSL reiterated.

The Monetary Board noted that there remains space for market lending interest rates to decline further given the prevailing accommodative monetary policy stance and the continued decline in the cost of funds of financial institutions. The Board re-emphasised the need to pass the benefits of eased monetary conditions to the borrowers without further delay.

In the post-monetary policy review media briefing, CBSL Governor Dr. Nandalal Weerasinghe admitted that AWNLR being at a high 13% remains a concern and expressed the hope that banks will ensure a faster reduction. It was revealed that the single digit AWPLR is benefitting short-term lending ranging between Rs. 40-50 billion weekly. “However AWNLR and rates to SMEs have not declined,” said Dr. Weerasinghe who added that banks have been impressed upon the need to reduce rates at every monthly meeting with CEOs. He ruled out CBSL directing banks to reduce rates and the decision to keep policy rates unchanged yesterday was to provide space and time for banks to lower lending rates.

It was explained that when determining rates banks consider other factors including credit appetite and the risk profile.

In terms of credit to the private sector, though March saw a spike of Rs. 72 billion ahead of the festive season, early indications are that lending in April remained low. The CBSL Chief expressed the hope of higher private sector credit in May and June. “Private sector as of now are borrowing short and not long-term,” he said adding lending is expected to improve, aided by lower rates and a pick-up in economic activities. The CBSL forecasts the economy to grow by 3% this year as against a contraction of 2.3% in 2023.

CBSL said the Monetary Policy Board decided to keep policy rates unchanged (Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) at 8.50% and 9.50%,

Respectively) after carefully assessing the current and expected macroeconomic developments and possible risks on the domestic and global fronts with a view to maintaining inflation at the targeted level of 5% over the medium term while supporting the economy to reach its potential.

While the medium term inflation outlook remains compatible with the current level of policy interest rates and inflation expectations are well anchored, the Board observed the need for a further reduction in market lending interest rates in line with policy interest rates and other benchmark interest rates, which is imperative for the easing of domestic monetary conditions and domestic economic recovery.

Headline inflation is expected to converge to the targeted level over the medium term, despite transitory volatilities

Headline inflation, as measured by the year-on-year change in the Colombo Consumer Price Index (CCPI, 2021=100), showed some uptick to record 1.5% in April 2024 compared to 0.9% in March 2024, mainly due to an acceleration in non-food inflation. However, on a month-on-month basis, both food and non-food prices declined. Recent movements in inflation indicate that the uptick in inflation driven by the Value Added Tax (VAT) amendments in January 2024 has been partly offset by the latest price developments underpinned by the downward revisions to the electricity tariff, and fuel and LP gas prices. In addition, the moderation in food prices and the muted demand conditions also contributed to the low level of inflation. Meanwhile, core inflation, which reflects underlying demand pressures in the economy, also remained at subdued levels reflecting low demand pressures in the economy. Incoming data suggests that headline inflation is likely to be below the targeted level of 5% in the upcoming months due to the combined impact of the administered price adjustments and eased food prices, although some upside risks remain. However, inflation is expected to eventually align with and remain around the target level over the medium term, supported by appropriate policy measures.

The external sector strengthened further

As domestic economic activity gathered momentum in recent months, the cumulative merchandise trade deficit is expected to have widened during the four months ending April 2024 compared to the same period in 2023. Buttressed by tourism related inflows, the services sector recorded a notable net inflow in recent months, while workers’ remittances remained elevated.

Gross official reserves increased notably to $ 5.5 billion (including the People’s Bank of China swap) by end April 2024, supported by considerable net purchases by the Central Bank from the domestic foreign exchange market amidst increased foreign currency inflows. Meanwhile, the Sri Lanka rupee recorded an overall appreciation of around 8.0% against the US dollar thus far in 2024.

The Monetary Policy Board will continue to observe incoming data and assess risks to the inflation outlook, among others, and stand ready to take appropriate measures to maintain domestic price stability in the period ahead while supporting the economy to reach its potential.