Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 28 August 2023 04:08 - - {{hitsCtrl.values.hits}}

Central Bank Governor Dr. Nandalal Weerasinghe

The Central Bank in a directive on Friday fixed caps on maximum interest rates on customers to ensure the banking sector conforms to improving macroeconomic fundamentals to warrant a downward revision.

The directive issued under Section 104(1)(b) of the Monetary Law Act, No. 58 of 1949, was following the August monetary policy review by the Monetary Board.

CBSL said it has adopted several policy measures in the recent past such as reduction of policy interest rates and the statutory reserve ratio, thereby facilitating a reduction in market interest rates. Despite the considerable easing of monetary conditions, interest rates on lending products of certain financial institutions continue to remain excessive and are not in line with the current monetary policy stance, posing challenges for individuals and businesses.

The Monetary Board hereby issues an Order on the interest rates applicable on Sri Lanka Rupee (LKR) denominated lending products of licensed commercial banks (LCBs) and licensed specialised banks (LSBs), hereinafter referred to as licensed banks.

The directive stressed that every licensed bank shall reduce the following product-wise lending rates at least to the levels outlined herein, with immediate effect:

(i) Interest rates on pawning facilities to 18% per annum;

(ii) Interest rates on pre-arranged temporary overdrafts to 23% per annum; and,

(iii) Interest rates on credit card advances to 28% per annum commencing the next billing cycle.

Every licensed bank shall reduce the annual nominal interest rates applicable for all new and existing LKR denominated lending products, excluding credit facilities mentioned above and any other categories of lending products that may hereafter be determined by the Monetary Board, by at least 250 basis points by 31 October 2023 and further 100 basis points by 31 December 2023 in comparison to the interest rates that prevailed as at 31 July 2023.

However, if the annual nominal interest rate applicable to any rupee denominated lending products as at the date of this Order or anytime thereafter is 13.5% or lower, it shall not be mandatory to give effect to the reduction required under above. Further, in cases where the applicable annual nominal interest rate as at the date of this Order or anytime thereafter is 13.5% or less, the licensed bank shall not increase the interest rates of such lending products from the level maintained as at the date of this Order.

CBSL also requires every licensed bank to reduce the penal interest rates charged on all lending products, including credit facilities already granted, to a level not exceeding 200 basis points per annum, for the amount in excess of an approved limit or in arrears, during the overdue period, with immediate effect.

All licensed banks shall ensure the accuracy of interest rate data submitted to CBSL and maintain internal documented records electronically or manually, in relation to the reductions in interest rates in respect of each loan product to which these Orders apply.

The Monetary Board last Wednesday at its meeting took note of the downward adjustment of market interest rates in response to monetary policy easing measures implemented thus far and the need to allow space for further adjustment of market interest rates swiftly.

However, the Board observed that market interest rates of certain lending products remain excessive and are not in line with the current monetary policy stance. Moreover, the Board anticipates a faster reduction in overall market lending interest rates in line with the recent monetary policy easing measures. Accordingly, the Board decided to adopt targeted administrative measures to reduce specific lending interest rates that it considered to be excessive and direct the licensed banks to reduce overall rupee lending interest rates by an appropriate margin in the period ahead.

Following the Monetary Board meeting, CBSL Governor Dr. Nandalal Weerasinghe told journalists on Thursday: “We noticed that the market interest rates of certain lending products remain excessive and are not in line with the current monetary policy stance. Thus, we decided to adopt targeted measures to reduce the excessive lending interest rates. We hope the new circular would encourage banks to conform to its guidelines.”

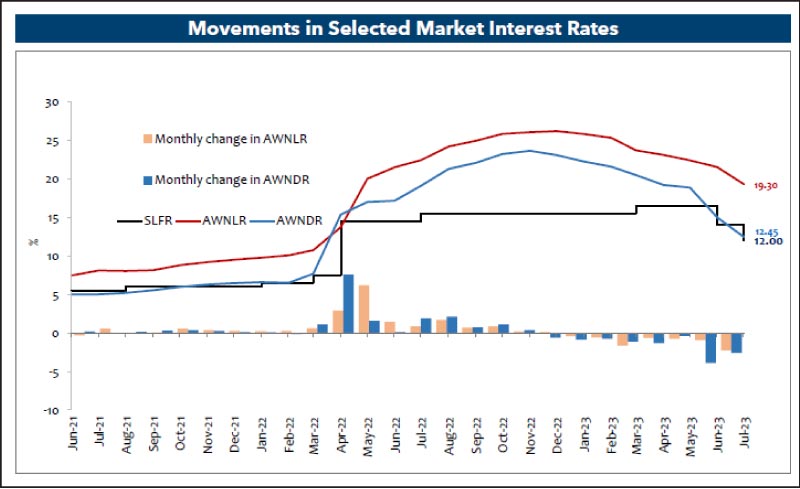

CBSL said reflecting the impact of monetary policy easing measures affected since June 2023 as well as the decline in the risk premia with the announcement of the domestic debt optimisation (DDO) operation, market interest rates have declined to a certain extent. A notable reduction was also observed in the yields on Government securities. However, the downward adjustment in market lending interest rates has been disproportionate to the reduction affected in market deposit interest rates.

Furthermore, despite the considerable easing of monetary conditions, interest rates on certain lending products of some financial institutions continue to remain excessively high posing hardships for individuals and businesses, particularly small and medium scale enterprises. The reduction in the Statutory Reserve Ratio (SRR) from mid-August 2023 is expected to have eased liquidity strains of licensed commercial banks (LCBs) and lowered their cost of funds, facilitating a further downward adjustment in lending interest rates.

Based on data available until July 2023, a sustained recovery in credit extended to the private sector by LCBs is yet to be observed. Therefore, it is essential that market lending interest rates are lowered by financial institutions in line with the eased monetary policy stance of the Central Bank, thereby boosting credit flows to the economy, which in turn would help the revival of economic activity.

Dr. Weerasinghe said the circular’s scope will apply exclusively to banks that have not revised their rates after the policy rate cut announced in July, adding that the expected reduction in interest rates has not materialised as quickly as anticipated.

He also noted that the forthcoming circular will outline a timeline for banks to implement these measures.

“If banks fail to make the necessary adjustments, the Central Bank will introduce additional directives to ensure that the overall lending interest rate structure remains in line with the monetary policy measures in the period ahead,” he said.

In response to inquiries about the potential impact of the new measures on bank profitability, Dr. Weerasinghe noted that the critical factor for profitability is the net interest margins.

He pointed out that these margins have grown throughout the Domestic Debt Optimisation (DDO) process, and the concerns surrounding it were mostly resolved, where banks also agreed to share the benefits with customers while ensuring financial stability.

“We believe banks must sustain these margins while also transferring the advantages of lowered deposit and lending rates, along with narrowing the gap between them,” he elaborated.

Dr. Weerasinghe clarified that maintaining reasonable margins will be instrumental in securing profitability in the future.