Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 25 July 2024 05:08 - - {{hitsCtrl.values.hits}}

Central Bank Governor Dr. P. Nandalal Weerasinghe – Pic by Pradeep Pathirana

By Charumini de Silva

The Central Bank of Sri Lanka (CBSL) has resumed its monetary easing cycle at the fourth review meeting for the year 2024 by reducing its policy rates, to boost the economic recovery process.

The Monetary Board which met on Tuesday, decided to cut the Standing Deposit Facility Rate (SDFR) to 8.25% and the Standing Lending Facility Rate (SLFR) to 9.25%.

The Monetary Board’s decision followed a careful assessment of current and expected macroeconomic developments, as well as potential risks and uncertainties on both domestic and global fronts. The goal is to maintain inflation at the targeted level of 5% over the medium term, whilst enabling the economy to reach its full capacity.

“Based on the forecasts, during the next six months the inflation is likely to remain below the target of 5%,” Central Bank Governor Dr. Nandalal Weerasinghe stated during the post-Monetary Policy meeting media briefing yesterday.

The Governor expressed confidence that lowering interest rates will further expedite economic revival, citing credit expansion over the past few months.

“The Board considered the need to signal the continuation of the eased monetary policy stance, thereby inducing a further reduction in market lending rates to support economic activity, amidst a benign inflation outlook,” the CBSL noted.

Headline inflation, measured by the year-on-year change in the Colombo Consumer Price Index (CCPI, 2021=100), and stood at 1.7% in June 2024. This significantly below-target inflation was driven by downward revisions to electricity tariffs, fuel and LP gas prices, and relatively weak demand conditions. Meanwhile, core inflation, which reflects underlying demand in the economy, was recorded at 4.4% (CCPI-based, year-on-year) in June, up from 3.5% in May, although sustained acceleration is not anticipated.

Noting that the inflation dropped from 70% in September 2022 to 1.7% in June 2024, Dr. Weerasinghe expressed optimism that maintaining current inflation levels would boost the economic revival efforts.

“Inflation targeted framework is best for the country. We expect that it could be transmitted through the economy,” he said.

The latest projections suggest that headline inflation is likely to remain below target in the coming months due to the combined impact of downward adjustments to electricity tariffs and domestic fuel prices, as well as a favourable statistical base. “While some upside risks remain, inflation is expected to gradually align with the target level over the medium term, supported by appropriate policy measures,” the CBSL statement added.

Dr. Weerasinghe said any evidence of demand pressure build up, the Central Bank has several ways and means to address it. “There cannot be wage pressures that will drive the inflation from 1% to 5%. Hence, we are confident about the measures taken. If you look at the last Monetary Policy Review projections versus what was realised — the risk was on the downside,” he explained.

Economy expanded for the third consecutive quarter in Q1 2024, with a year-on-year real growth of 5.3%, according to estimates from the Department of Census and Statistics (DCS). Economic indicators suggest robust real GDP growth in Q2 2024 as well. The rebound in domestic economic activity is expected to sustain, buoyed by relaxed monetary policy, enhanced supply conditions, gradual rebound in external demand, revival of tourism, and reduced uncertainties surrounding debt restructuring. The economy, which currently operates below its full capacity, is forecast to reach its potential over the medium term.

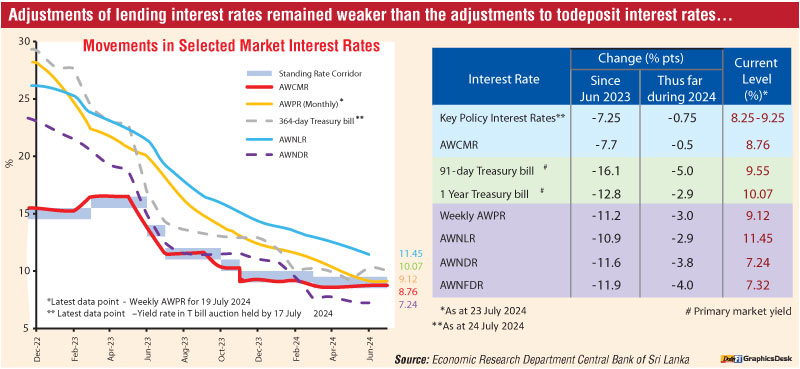

In line with the CBSL’s eased monetary policy stance, market interest rates have continued to adjust downwards. However, the adjustments in lending interest rates, particularly for non-prime lending, have been slower than adjustments to deposit interest rates. Following a contraction in April 2024, credit extended to the private sector by Licensed Commercial Banks (LCBs) expanded in May and June 2024. Sustained credit growth will require further declines in market lending interest rates in line with the accommodative monetary policy stance.

Despite the external current account likely recorded a surplus in the first half of the year, the cumulative merchandise trade deficit widened compared to the same period in 2023.

Earnings from tourism and workers’ remittances remained promising. Gross Official Reserves (GOR) stood at $ 5.6 billion (including the swap with the People’s Bank of China) as of the end of June 2024, compared to $ 4.4 billion at the end of 2023.

When asked if the inflow of foreign exchange has stagnated, Dr. Weerasinghe said the economy has outperformed its commitments in the first half of 2024. “I do not think we need to outperform all the time. We have built sufficient buffers compared to the targets we have agreed with the IMF. If there is some excess volatility we can use those buffers. Going forward, we intend to build and move in the same direction through a gradual process,” he stressed.

The Sri Lankan rupee experienced intermittent volatility against the US dollar in recent months but has appreciated by over 6.5% against the US dollar so far in 2024.

The CBSL expects financial institutions to continue downward adjustments in lending interest rates, reflecting the benefits of policy easing. The Monetary Policy Board will continue to monitor inflation and other macroeconomic variables and take necessary policy actions in the period ahead.