Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 24 January 2024 00:00 - - {{hitsCtrl.values.hits}}

|

| Central Bank Governor Dr. Nandalal Weerasinghe - Pic by Lasantha Kumara |

By Charumini de Silva

The Central Bank said yesterday it has sought explanations from several banks that have not swiftly complied with policy rate cuts, as mandated by an order issued last year.

“We have called for explanations from several banks that did not comply with the interest rate cuts,” the Central Bank Governor Dr. Nandalal Weerasinghe revealed yesterday.

Despite some banks initiating the process of reducing interest rates, he said others lag behind, prompting the Central Bank to request a 350 basis point reduction by December.

Dr. Weerasinghe expressed disappointment that the overall rate reductions have not met the initial expectations set when the order was issued in August.

“We are closely monitoring the banks and we want all the banks to follow the instructions we have issued,” he said, insisting the importance of adherence to the mandated policy rate cuts.

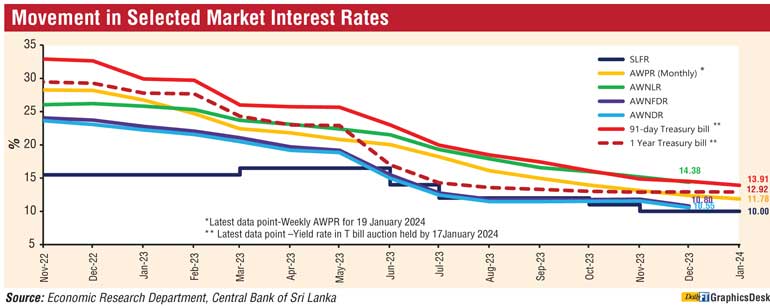

Acknowledging that T-bill rates have not decreased as anticipated, Dr. Weerasinghe admitted that the Central Bank had expected more substantial declines in various market rates, including yield rates.

The CBSL said there is further space for market interest rates, especially the lending interest rates and yields on Government Securities to decline in the period ahead, in line with the reduction in policy interest rates implemented in the recent past.

The Governor stressed that lowering interest rates would expedite economic recovery.

“By maintaining the current policy rates provides room for banks to further reduce interest rates for borrowers and individuals hoping to seek credit facilities. We hope the banks will promptly pass on these benefits to businesses and individuals,” he added.

CBSL said outstanding credit to the private sector by the banking sector continued to expand on a month-on-month basis from May 2023 and as per available data there has been a notable increase in December. As at November 2023, credit to the private sector amounted to Rs. 7.268 trillion, up from Rs. 7.206 trillion in October and Rs. 6.528 trillion in May. However, year on year, November 2023 data reflected a 3% decline as against Rs. 7.5 trillion in November 2022.

CBSL said yesterday it expects expansion in credit to the private sector to be sustained in the period ahead, supported by the further easing of monetary conditions.