Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 1 November 2024 00:00 - - {{hitsCtrl.values.hits}}

The Colombo stock market has seen a whopping Rs. 612 billion rise in value since the election of President Anura Kumara Dissanayake in an apparent vote of investor confidence on the prospects for listed equities.

The Colombo stock market has seen a whopping Rs. 612 billion rise in value since the election of President Anura Kumara Dissanayake in an apparent vote of investor confidence on the prospects for listed equities.

On 20 September, the day before the 2024 Presidential poll, the Colombo Stock Exchange’s market capitalisation was Rs. 4 trillion, having lost Rs. 184 billion in value year to date. Come 31 October, the market capitalisation had jumped by a staggering Rs. 612 billion to close at Rs. 4.677 trillion. Year to date the figure reflects a 10% increase.

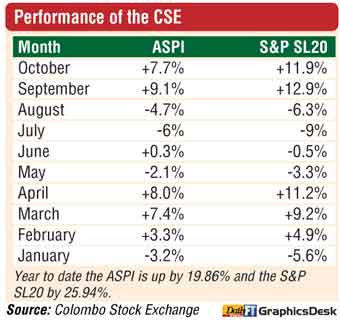

The major increase had been possible due to the sustained gain in the indices since 21 September and more sharply this week. October saw the second month of gains in indices with the active S&P SL20 enjoying double digit growth.

The benchmark ASPI gained by 7.7% in October as against 9% in September (influenced by improvement from 23 September) and the S&P SL rose by 12% in October on the back of 13% in the previous month. Since Dissanayake’s Presidential victory, the ASPI is up 16.7% and S&P SL20 by 25% bolstering the year-to-date positive return to 19.86% and 25.94% respectively.

This week’s rally has been attributed to improved investor sentiments following the release of the first set of corporate earnings prompting re-rating of outlook. Analysts expect the momentum to continue with more companies announcing their interim results in the next few weeks. However, others opined the rally was on account of expectations of a stronger victory by President Dissanayake’s National People’s Power (NPP) at the Parliamentary elections on 14 November as well as relatively low interest rates environment.

The Market P/E on 20 September was 7.44 times and by the end of October, the market had gotten slightly expensive at 8.55 times, but still attractive in comparison to peer markets.

With ASPI closing October at a 32-month high, on Wednesday the CSE turnover rose to an eight-month high of Rs. 7 billion whilst in recent days turnover has been averaging Rs. 4 billion.

The year-to-date foreign outflow is slightly over Rs. 6 billion but according to the Central Bank foreign flows to the CSE, including both primary and secondary market transactions, between January to September amounted to $ 43 million.

The CSE last week said it has been placed as the second-best performing equity index in Asia as of 25 October 2024, with the All Share Price Index (ASPI) boasting an impressive year-to-date return of 29.65% in USD (Source: Bloomberg.com).

The CSE said this outstanding performance underscores the resilience of Sri Lanka’s capital market and its growing appeal to both local and international investors. “The CSE thus remains an attractive option for investors, maintaining positive momentum and paving the way for enhanced investment opportunities,” a statement said.