Monday Feb 23, 2026

Monday Feb 23, 2026

Saturday, 14 September 2024 01:13 - - {{hitsCtrl.values.hits}}

|

| President Ranil Wickremesinghe |

Following the negotiations with the International Monetary Fund (IMF), the Cabinet of Ministers at a special meeting yesterday approved the amendment of the personal income tax structures.

The proposed structure effective 1 April next year is

i. Tax free threshold remains as it is at Rs. 1.2 million per annum

ii. Tax bands increase from Rs. 500,000 to Rs. 720,000

iii. Marginal tax rate at each band remains at 6% with the top tax rate remaining at 36%.

The Finance Ministry in a statement said to implement this adjustment to the PIT structure, it is necessary to amend the Inland Revenue Act, No. 24 of 2017. This adjustment would become effective from April 2025 with the new tax year.

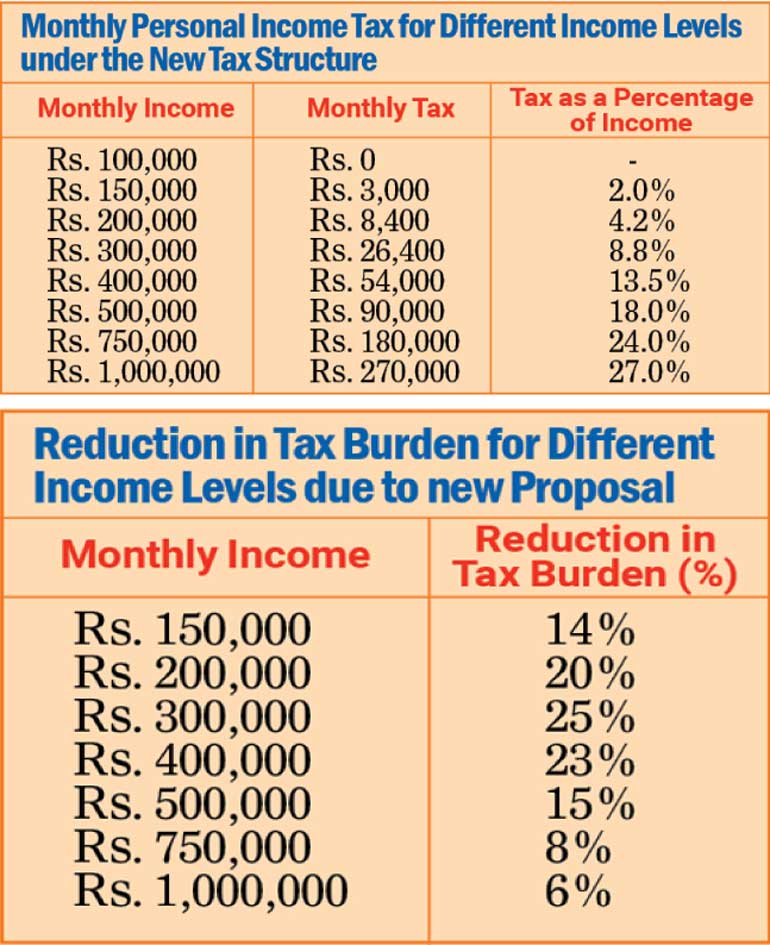

The Ministry said the adjustment is designed in a manner that provides the most relief to the middle tax bands where the income tax burden is felt most acutely. At the lower tax bands, the tax burden is limited. For instance, a person earning Rs. 130,000 per month pays Rs. 1,800 per month in tax, which amounts to 1.4% of his total income. Increasing the tax free threshold will further narrow the tax base and will have a significant adverse revenue impact. Therefore, the tax free threshold is maintained as it is.

Furthermore, those at the highest income levels who have the financial strength to afford their tax contribution therefore will have only limited relief at the higher end of the income spectrum. (See tables).

The Finance Ministry said the revenue impact of this proposed adjustment to the income tax structure is estimated at 0.07% of GDP. The Government has already discussed with the IMF compensating revenue measures, which are associated with additional revenue from vehicle imports from 2025.

“The implementation of this proposed amendment has been carefully designed so as to not undermine the overall fiscal targets under the IMF EFF program, particularly the targets for tax revenue and the primary budget surplus,” the Finance Ministry said.

“At the same time, the proposed amendment would help address a significant pain point felt by the mid-level income taxpayers, particularly amongst high skilled professionals that are needed in the country to support economic growth,” it added.

The Government introduced a number of amendments to the tax structure from mid-2022 with a view to enhance government revenue as a key reform measure to mitigate the impact of the unprecedented and deep economic crisis. A key target in the Extended Fund Facility (EFF) , supported by the IMF, is the achievement of a primary budget surplus of 2.3% of GDP by end 2025, which in turn requires government tax revenue to reach 14% of GDP by 2025 (Quantitative Performance Criteria (QPC).

The Finance Ministry said significant reforms to the Personal Income Tax (PIT) structure was a key component of this revenue enhancement effort. Accordingly, with the reforms that took effect on 1 January 2023, the income tax free threshold was set at Rs. 1.2 million per annum, the tax bands were set at Rs. 500,000 each, and each band would have a marginal tax rate of 6%, up to a maximum 36%. This significant increase in tax was necessary given the depth of the economic crisis and the urgency of revenue enhancement measures.

Explaining the necessity to adjust the tax structure, the Finance Ministry said yesterday given the sharp increase in the tax impact, there was a significant demand by the public for some relief in the PIT structure, particularly addressing the middle bands of the PIT structure.

Towards this end, the Government initiated discussions with the IMF to seek some relief in September 2023. However, such relief was not feasible at the time given the fact that revenue targets were not yet being met and an amendment to the tax structure less than one year from implementation would undermine credibility of the Government’s fiscal measures.

“As of mid-2024, revenue targets are being met and the Government has in fact over-performed on a number of fiscal targets, including the primary balance target. This provided the opportunity for the Government to re-open negotiations on the PIT structure during the IMF Staff visit in July 2024,” Finance Ministry added.