Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 19 August 2022 01:40 - - {{hitsCtrl.values.hits}}

By Charumini de Silva

|

Central Bank Governor Dr. Nandalal Weerasinghe

|

Central Bank Governor Dr. Nandalal Weerasinghe yesterday ruled out restructuring of domestic debt but assured ongoing measures will ensure overall sustainability.

“Our position is that we are not restructuring domestic debt. It will be a win-win situation for all,” he told journalists at the post-Monetary Policy Review meeting yesterday, adding that there has been no request to restructure domestic debt.

He also said the Government’s position remains that the country will only restructure its external debt, as there is a balance of payment (BoP) problem and requires time to pay the external creditors. Yesterday’s assurance by the CBSL Chief is likely to ease off concerns as well as debate within and outside the banking sector after President Ranil Wickremesinghe recently said domestic debt stock was serious and needs to be restructured as well and that external consultants were looking into it.

Dr. Weerasinghe explained that domestic debt restructuring could lead to serious implications on the banking system, economy, and funds such as Employees Provident Fund (EPF) and Employer’s Trust Fund (ETF). “If we choose to restructure domestic debt, it will not even help our external debt recovery or the economic revival. As a result, in the medium term it will have problems with capitalisation of the banks. We need to minimise any adverse impact on banking system, to maintain financial stability which will help faster economic recovery,” he stressed.

The Governor said that not restructuring domestic debt will also benefit the external creditors to recover their liabilities faster than expected with relief on dues.

He also believed that once the Staff-Level Agreement is reached with the International Monetary Fund (IMF) by the end of the month, it will give a clear picture of debt sustainability and debt targets for Sri Lanka to achieve in the next 10 years’ time.

“With these two factors, we will approach our external creditors and International Sovereign Bond (ISB) holders. Then we will present our overall macroeconomic program endorsed by the IMF and debt targets we are going to achieve going forward,” he said.

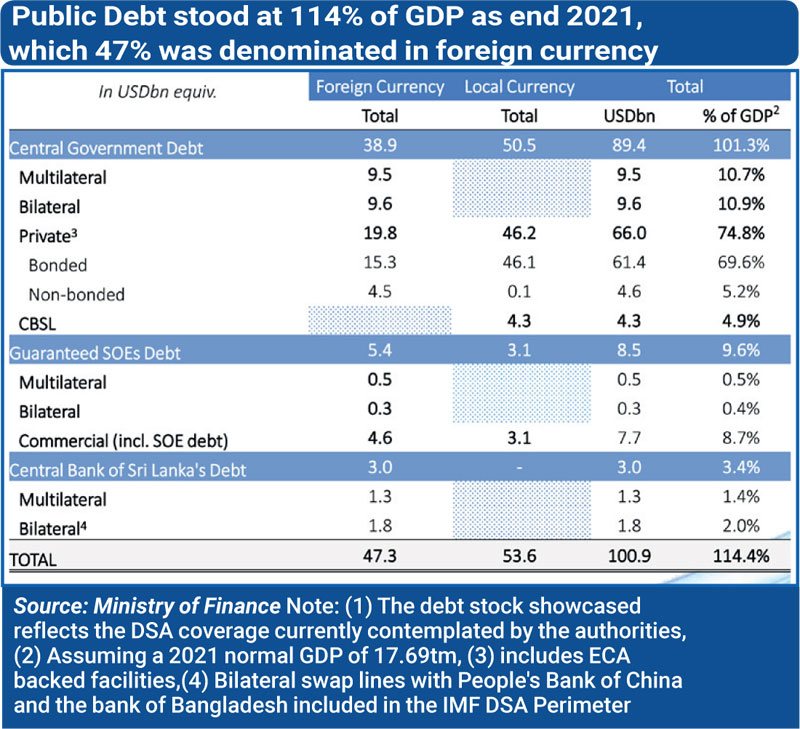

On 12 April, Sri Lanka announced a pre-emptive negotiated default of all external debt as of that date after it was realised the status was not sustainable. At the end of 2021, Sri Lanka’s external debt amounted to $ 51 billion whilst the figure is likely to have ballooned following the sharp depreciation of the rupee.

The bulk (35%) of the external debt is the expensive International Sovereign Bonds whilst the rest is held by what CBSL Governor described as the Paris Club members (including Japan, UK, US, Germany) and non-Paris Club creditors (including China and India).

Noting that Japan is a major partner of the Paris Club, he said non-Paris Club members like India and China will also be approached officially on the external debt restructuring process soon.

“We hope all creditors will support Sri Lanka once they see the macro program in the medium to long term along with the structural reforms, endorsed by the IMF which is an independent agency. There will be a lot of credibility in the approach,” he added.

On that basis, Dr. Weerasinghe Sri Lanka will give its creditors a commitment to reaching out to the debt targets.

“I hope they will recognise it as a good recovery plan and extend the relief we ask from them,” he said.