Thursday Feb 26, 2026

Thursday Feb 26, 2026

Wednesday, 28 February 2024 00:00 - - {{hitsCtrl.values.hits}}

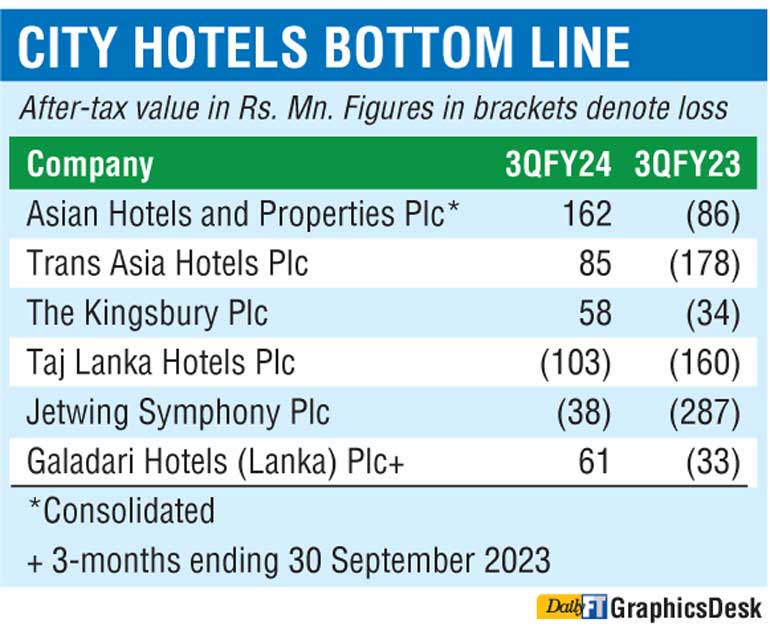

City hotels have enjoyed a good quarter ending on 31 December 2023 aided by influx of tourists as well as the introduction of minimum room rate from October.

A review of interim results released by listed city hotel companies reveal not only healthy top line growth but improvement in operating profit and to some better bottom line. Several also reported reduced losses due to the improved operating environment though cost escalation (except interest cost) remains a common concern, according to tourism industry and stock market analysts.

Top blue chip JKH subsidiary Asian Hotels and Properties PLC flagship of which is the bustling Cinnamon Grand posted a Rs. 162 million profit in 3Q in FY24 as against Rs. 56 million profit in 2Q. This is as against loss of Rs. 86 million in 3QFY23 and Rs. 281 million loss 2QFY23. Profit from operating activities grew by 108% to Rs. 314.4 million in 3QFY24 as against Rs. 193 million in 2QFY24. Revenue rose by 19% to Rs. 3 billion in 3QFY24 from a year ago.

The other JKH subsidiary Trans Asia Hotels Plc reported a profit of Rs. 85.5 million in 3QFY24 as against Rs. 13 million in 2Q. In contrast the Company suffered a loss of Rs. 178 million in 3QFY23 and Rs. 91.6 million loss in 2QFY23. Profit from operations in 3QFY24 grew year on year by 166% to Rs. 168 million.

Hayleys PLC subsidiary, the Kingsbury PLC saw a 3Q net profit of Rs. 57.5 million up from Rs. 37.6 million in 2Q. A year ago, 3Q saw a Rs. 34.4 million loss and Rs. 154 million loss 2Q of FY23.

Taj Lanka Hotels PLC has reduced its net loss to Rs. 103 million in 3QFY24 from Rs. 160 million a year ago and first nine months loss to Rs. 338 million as against Rs. 1.4 billion a year ago.

Profit from operations in 3QFY24 was Rs. 58.5 million as against a loss of Rs. 37.4 million a year ago. In 2QFY24, operating loss was Rs. 0.4 million as against Rs. 162 million in 2QFY23.

Its revenue rose 32% to Rs. 1 billion in 3Q and by 73% to Rs. 2.7 billion in the first nine months.

Galadari Hotels reported a profit of Rs. 61.4 million in 3Q as against a loss of Rs. 33 million in 2Q and a loss of Rs. 33 million in 3Q FY22. First nine months loss has been reduced to Rs. 58 million from

Rs. 118 million in the corresponding period of FY22. Galadari benefitted from Rs. 117 as finance income in 3Q. Operating loss was Rs. 21.3 million in 3Q as against a loss of Rs. 100.6 million a year ago.

Renuka Hotels PLC saw its revenue in 3QFY24 increase by 61% to Rs. 130 million and for nine months by 66% to Rs. 321 million. Renuka City Hotels saw a revenue increase of 102% to Rs. 72 million in 3QFY24 and for nine months by 84% to Rs. 168 million. Operating profit amounted to Rs. 26 million as against a loss of Rs. 6 million. Its revenue amounted to Rs. 427 million in 3QFY23 up from Rs. 261 million a year ago.

Jetwing Symphony, owning Jetwing Colombo 7, saw its operating profit increase by 121% to Rs. 256 million in 3QFY24 and first nine months by 106% to Rs. 700 million. Loss has been reduced to Rs. 38 million in 3QFY24 from Rs. 287 million a year ago and first nine months loss is down to Rs. 269 million from Rs. 1 billion in corresponding period of FY23.

During October to December 2023, tourist arrivals jumped by 277,301 or 143% to 471,047 from the corresponding period of 2022. The December quarter also had a record haul of 210,352 tourists for the month. Overall, 2023 saw 1.48 million tourists up 107% from 720,000 in crisis-hit 2022.

As per the Central Bank, earnings from tourism in 2023 rose by 82% to $ 2 billion, of which $ 611 million was netted in the October-December quarter.

Earnings in December peaked to $ 269 million whilst in October the value was $ 136.7 million, down from $ 152 million in September 2023.

Effective October 2023, the following Minimum Room Rates were fixed for the prices for corporate and free independent tourists (FIT). $ 100 for 5-star hotels, $ 75 for 4-star establishments, $ 50 for 3-star accommodations, $35 for 2-star hotels and $ 20 for one-star tourist hotels. The prices for airline crew rooms are; $ 75 for 5-star hotels, $ 55 for 4-star establishments, $ 40 for 3-star accommodations, 30 for 2-star hotels and $ 20 for one-star tourist hotels.

This year, Sri Lanka aims to lure 2.3 million tourists and earn over $ 4 billion, according to Tourism Minister Harin Fernando.

Year to date (25 February), tourist arrivals amounted 399,271 with January drawing 208,253 and first 25 days of February attracting 191,018 tourists. Forecast is that by yesterday, cumulative tourist arrivals have crossed the 400,000 mark. Earnings from tourism in January amounted to $ 342 million.

Some industry analysts were sceptical about achieving the high targets for 2024 if the Minimum Room Rate is persisted with. With room only is priced at $ 135 and if breakfast added, the cost in Colombo for a night is over $ 150 per person.

Their argument is Colombo is overpriced already and the high potential meetings, incentive, conference and exhibition (MICE) market from India may look at other more attractive regional destinations. Troubles associated with national carrier SriLankan Airlines which is the biggest foreign operator to India are another concern in terms of negative press. Furthermore limited seat capacity and exorbitant air cost is a deterrent for long-haul European tourists

Pro-growth proponents are upbeat saying that Colombo and Sri Lanka’s attractiveness remains intact if not elevated especially for Indians who are shunning the Maldives due to political and other issues. They opined that until the 2024/5 winter season, there is a window for MRR.