Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 29 December 2021 02:36 - - {{hitsCtrl.values.hits}}

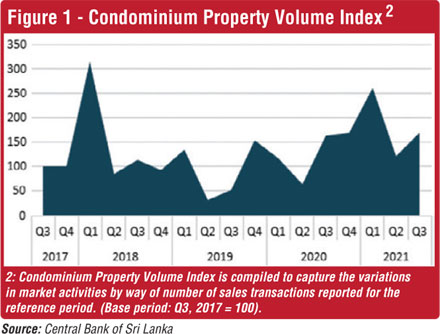

Condominium sales transactions during Q3 2021 have increased compared to a year ago as well as the previous quarter, as per the industry index compiled by the Central Bank.

Condominium sales transactions during Q3 2021 have increased compared to a year ago as well as the previous quarter, as per the industry index compiled by the Central Bank.

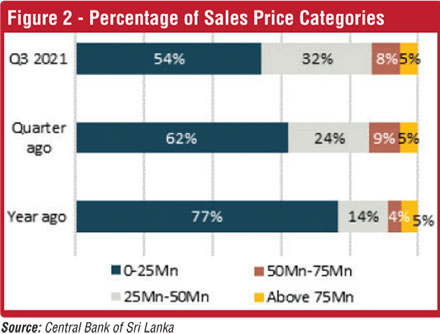

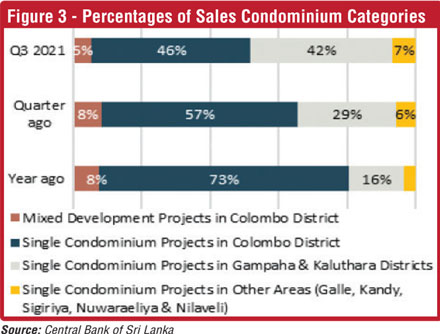

Even though the most preferred condominium units were in the single condominium project category and those below Rs. 25 million, a gradual increase could be observed in sales of condominiums priced between Rs. 25 to 50 million according to the Condominium Property Volume Index.

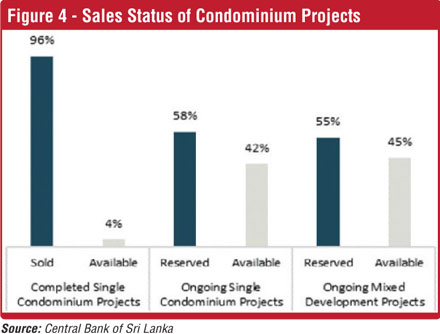

By the end of Q3 2021, majority of the units (96%) in completed condominium projects have been sold. CBSL said in ongoing condominium projects, 58% and 55% of units have been reserved in single condominium projects and mixed development projects respectively.

Pre-sale deposits, bank loans and equity were the three key funding sources for condominium developments. It could be observed that the proportions of pre-sale deposits have increased during Q3, 2021 compared to the previous quarter.

“The proportions were calculated to get an overall understanding about the funding structure of condominium developments by averaging the percentages of funds received through different funding sources provided by each developer,” CBSL said.

It said the majority of condominium buyers were Sri Lankan residents and only a few condominiums were purchased by dual citizens and foreigners. Majority of condominium purchases during Q3 2021 were for immediate or future living.

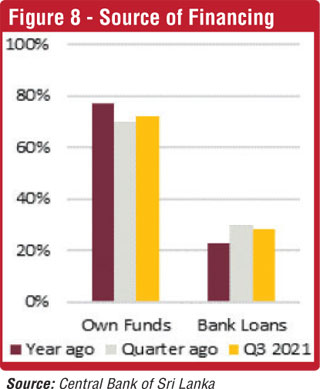

CBSL also said condominium purchases for investment and rent purposes were increased at this low interest rate environment. The prime source of funding used for condominium purchasing remained to be buyers’ own funds, while on average 28% of buyers have obtained bank loans during Q3 2021.

This market analysis is based on the Condominium Market Survey conducted by the Central Bank of Sri Lanka for Q3 2021 and 24 condominium property developers participated in this survey round.

Condominium Property Volume Index is compiled to capture the variations in market activities by way of number of sales transactions reported for the reference period. (Base period: Q3, 2017 = 100)