Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 11 September 2023 03:31 - - {{hitsCtrl.values.hits}}

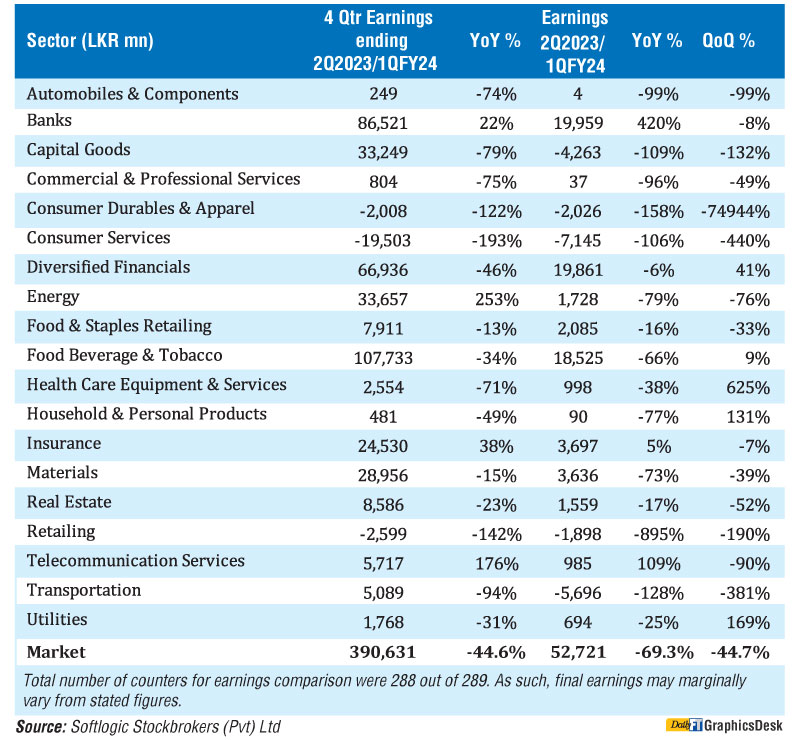

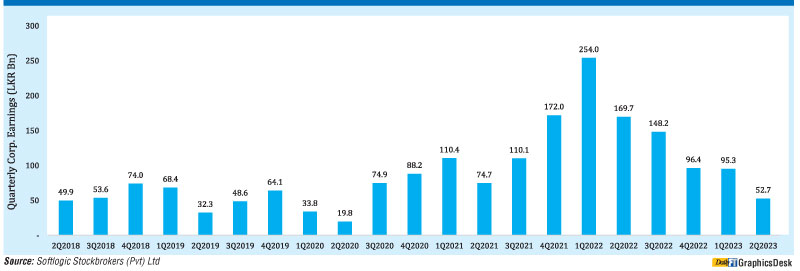

Combined earnings of 288 listed companies on the Colombo Stock Exchange in the June 2023 quarter had tumbled by 45% to Rs. 52.7 billion from the March 2023 quarter figure of Rs. 95.3 billion according to Softlogic Stockbrokers.

In comparison with the June 2022 quarter figure of Rs. 169.7 billion, the latest quarter figure is down by 69%.

The Trailing Twelve Months (TTM) earnings too had declined by a similar percentage to Rs. 390 billion.

Whilst Q2 has historically been the lowest earnings period in the CSE, the 1H 2023 earnings at Rs. 148 billion stays beyond the pre-COVID average of Rs. 117 billion, Softlogic Stockbrokers said.

It also said the market remained muted in 1QFY24 whereas the performance on a TTM basis is commendable as it excluded the all-time high quarter performance in 2Q of 2022 which was an outlier.

In its sectoral analysis, Softlogic Stockbrokers said in 2Q23 all the banking sector counters have outperformed against the quarter in 2022 whilst DFCC and COMB have seen a remarkable surge on a YoY basis.

It said lower provisioning backed by the interest rate mismatch led to earnings growth in 2Q23. However, loan book growth remains the key catalyst for the next wave of growth.

The consumer sector as a whole had diminished backed by a volume drop though alcohol and tobacco counters earnings improved.

“With other consumer companies lagging behind, the alcohol and tobacco counters have grown contributing to over 70% of total sector earnings despite a volume drop caused by the increase in excise taxes,” Softlogic Stockbrokers said.

In the Capital Goods and Manufacturing sector, earnings witnessed a slump with the impact coming from a drastic slowdown in JKH. Softlogic said the sector’s top contributor JKH showed lacklustre performance in the June quarter owing to dollar depreciation and subdued revenue. It also said significant losses incurred in SPEN and BROWN had an impact on sector results.

In the Diversified financial sector, primary dealers held a sizable stake in the earnings as CALT and FCT saw better fortunes due to the sharp decline in interest rates. “The sector overall performed well with notable growth in all counters though the depletion of LOLC led the whole sector to remain flat on a YoY basis,” Softlogic added.

The materials sector saw leaders such as DIPD and HAYC suffering sluggish momentum whilst TKYO stood out on a YoY basis. The latter’s TTM earnings recovered steeply from the loss incurred in the previous year contributing 18% to the sector’s earnings.

In the transportation sector, EXPO witnessed a sharp decline in earnings for the second consecutive quarter following the cooling off witnessed in the global air and sea freight rates. Overall the transportation sector earnings contracted for the fifth consecutive quarter dropping by over Rs. 37 billion from its peak in 1Q22.

The telecommunication sector saw DIAL stabilise in the green zone for the second consecutive quarter by recording a profit on the back of reduced finance costs and US depreciation. However SLT incurred a loss of Rs. 2 billion, Softlogic Stockbrokers added.

The insurance sector grew by 38% YoY on a TTM basis and the earnings in 2Q saw a slight improvement YoY. The insurance sector thrived with leader CINS holding around 48% of the sector’s earnings whilst JINS witnessed a strong progression YoY basis.

Softlogic Stockbrokers noted that the energy sector achieved a growth in TTM earnings of 253% YoY with LIOC posting Rs. 30 billion for TTM ending 1QFY24.

“While the economic conditions remained stiff, LIOC made profits in the quarter circumventing the constraints borne by significant volatility in the international prices and restrictions caused by fuel quotas,” Softlogic added.

It said the consumer durables and apparel sector earnings declined primarily due to the European crisis. “MGT and GREG have quite managed to remain as the leading players whilst TJL and HELA which made significant contributions before the crisis have now incurred major losses that caused the sector to record a net decline,” Softlogic said.

In the healthcare sector, hospitals performed well against the previous quarter due to high occupancy rates whilst ASIR held over half of the sector earnings.

The sector grew by 625% QoQ, ASIR continues to surpass LHCL earnings and holds the highest stake for the third time sequentially, Softlogic added.