Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 30 June 2023 00:00 - - {{hitsCtrl.values.hits}}

CBSL Governor Dr. Nandalal Weerasinghe

Treasury Secretary Mahinda Siriwardena

Senior Advisor to the President on economic affairs R.H.S. Samaratunga and Deputy Secretary to theTreasury A.K. Seneviratne

By Nisthar Cassim

The Central Bank yesterday defended the decision to exclude the banking sector from the broader Domestic Debt Optimisation (DDO) framework saying the sector has already taken a brunt of the crisis via soaring non-performing loans, critical relief with moratorium and contributing heavily to taxation whilst aiding the economic recovery.

It was pointed out that undermining the financial system stability could be detrimental and trigger multiple crises. “We didn’t want to take the risk of a bank run,” CBSL Governor Dr. Nandalal Weerasinghe told journalists at the briefing arranged by the President’s Media Centre involving Treasury Secretary Mahinda Siriwardena, Deputy Secretary to the Treasury A.K. Seneviratne, the Deputy Treasury Secretary and Senior Advisor to the President on economic affairs R.H.S. Samaratunga.

It was pointed out that restructuring foreign debt alone wasn’t sufficient to bring down the Gross Financing Needs to 13% and large fiscal adjustments to achieve sizable surpluses in the primary balance would result in extra burden on the people and businesses. Therefore a degree of DDO with minimal or no impact on the banking sector will be helpful.

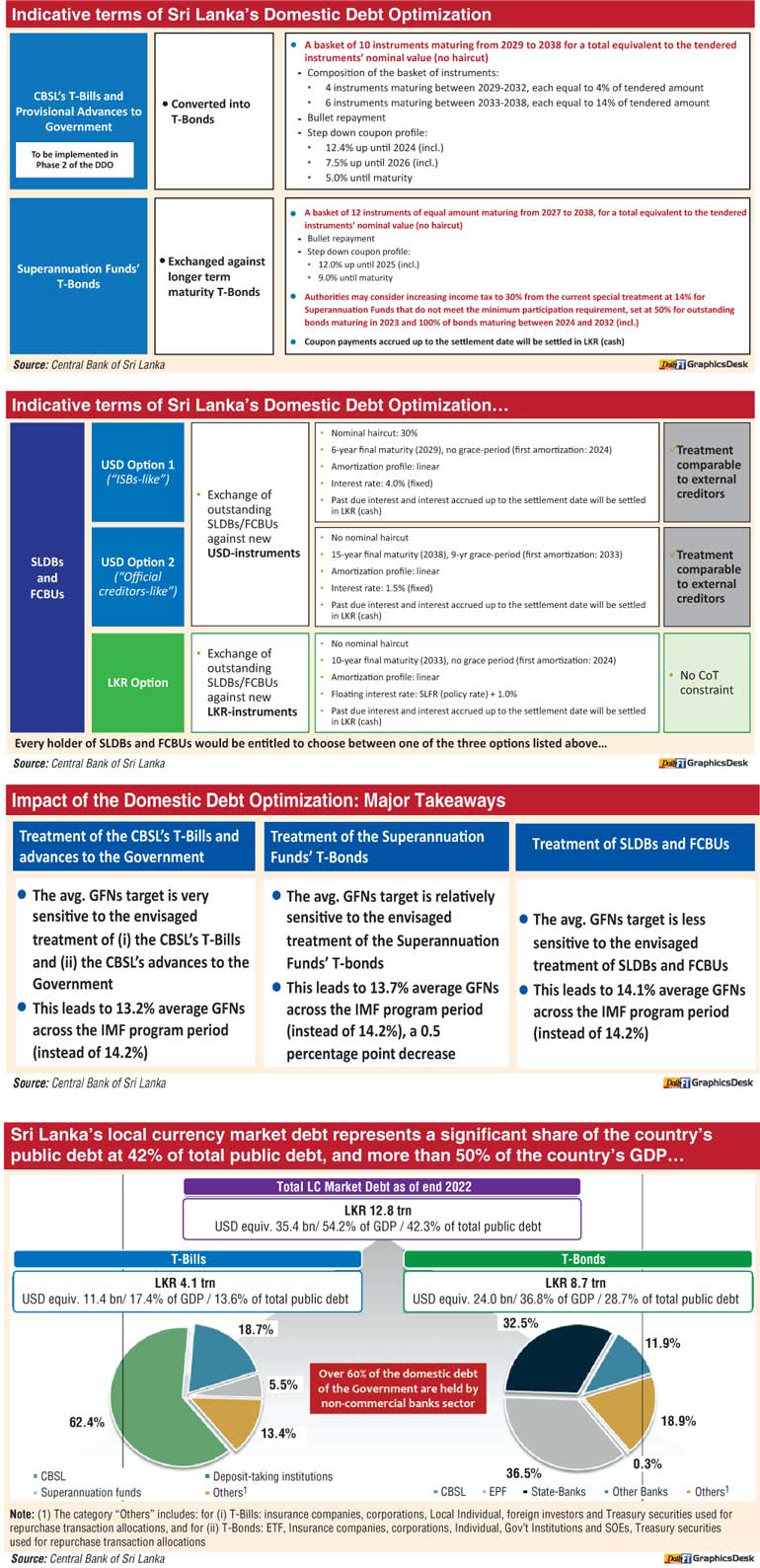

CBSL Governor Dr. Weerasinghe said DDO will help reduce the debt to GDP ratio to 95% by 2032 from 128% as at end of 2022, achieve an average GFN of 13% of GDP during 2027 to 2032 from 34.6% at present and realise a 4.5% of GDP level of forex debt servicing during 2027-2032 from 9.4% at present.

He said achieving these goals will lead to a reduction of $16.9 billion in the relief required to bridge the external financing gap.

If there were to be no debt treatment the average GFN is 16.8% whilst if there were to be only an external debt restructuring the average is 14.2%. A combined strategy brings the average to 12.7% with DDO chipping in 1.5 percentage points.

Treasury Secretary Mahinda Siriwardena stressed that with Sri Lanka’s total debt termed unsustainable, restructuring domestic debt was a necessity. “Dealing with the country’s debt is the biggest challenge in history and we are not done yet,” he added.

Local currency debt stock as at end 2022 was Rs. 12.8 trillion or $ 35.4 billion accounting for 54.2% of GDP and 42.3% of total debt. It comprises Rs. 8.7 trillion ($24 billion) in Treasury Bonds accounting for 28.7% of total debt and Rs. 4.1 trillion ($ 11.4 billion) in Treasury Bills accounting for 13.6% of total debt.

State banks hold 32.5% of the T. Bond stock and other banks 12%. Of the Treasury Bill stock all banks account for 18.7%. Commercial banks› total holding of Treasury Bonds is Rs. 3.1 trillion or 35.7% of the total stock accounting for 20.7% of total domestic debt. They also hold Rs. 847 billion worth of Treasury Bonds or 16% of the total.

The Governor said the banking sector has already borne a significant burden of the fiscal adjustment and the economic crisis in multiple ways. The tax burden on the sector is a high 50%+ and is a significant contributor to the Government revenue and fiscal consolidation efforts.

Banking sector has also shared some burden of the crisis through the

provision of debt moratoria and helped the businesses and the public since the 2019 East Sunday attacks, COVID-19 pandemic and economic crisis of last year. It includes Rs, 1.6 trillion amount outstanding of loans under concessions as at 31 March 2023 or 15.65% of total loans.

The burden on the sector is borne mainly by depositors through power return on savings. As per CBSL estimates there are 57.2 million deposits in the banking system whereas the population is 22 million.

The banking sector is already facing significant stress amidst crises. The Non-Performing Loans (NPL) ratio has risen to 13.3% by end of May 2023 from 8.1% in the first quarter of 2021. The impairment for loans and other losses has shot up to Rs. 468 billion by 2022 from Rs. 158 billion in 2021. Total impairment on the existing loan portfolio is Rs. 916 billion. Dr. Weerasinghe said these factors were affecting the banking sector performance and profitability.

Foreign currency debt restructuring will result in a notable impact on the banking sector as International Sovereign Bonds (ISBs) and Sri Lanka Development Bonds (SLDBs) account for 17% of the Government securities holdings of the banking sector. This means restructuring of foreign currency debt of the Government is expected to create a significant loss to the banking sector and a further burden on the domestic banking system could jeopardise financial system stability.

Foreign currency debt restructuring will result in a notable impact on the banking sector as International Sovereign Bonds (ISBs) and Sri Lanka Development Bonds (SLDBs) account for 17% of the Government securities holdings of the banking sector. This means restructuring of foreign currency debt of the Government is expected to create a significant loss to the banking sector and a further burden on the domestic banking system could jeopardise financial system stability.

It was pointed out that undermining the financial system stability could be detrimental and trigger multiple crises.

Dr. Weerasinghe said the aim is to complete the bond exchange or treatment within July.

With reference to the superannuation funds, which include the Employee Provident Fund (EPF) and the Employees› Trust Fund (ETF), they are subject to a 14% tax rate, which is lower than the tax rate imposed on banks. The proposal suggests retrieving all existing Treasury Bonds from these funds and issuing new bonds in return. (See table) These bonds will earn 12% interest until 2025 and 9% interest thereafter. Importantly, the amount in the EPF will not decrease, as the government guarantees a future benefit of 9% interest. The government assures that if there is any deficit, the treasury will cover it. Those who choose not to participate in the Treasury bond exchange have the option of paying a 30% tax instead of the standard 14% tax.

The Governor also assured that there is no restriction or inability to withdraw funds from the EPF.

Superannuation funds hold Rs. 3.7 trillion worth of Treasury Bonds or 42.7% of the stock accounting for 24.7% of the total domestic debt.