Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 26 July 2023 00:00 - - {{hitsCtrl.values.hits}}

|

| Chairperson Krishan Balendra |

Top blue chip John Keells Holdings PLC (JKH) yesterday announced a drastic drop in profitability in the 1Q of FY24 due to rise in taxes and interest cost whilst its results a year ago benefitted from windfall exchange gains.

Group PBT at Rs. 1.40 billion in the 1QFY24 was a decrease of 91% from a year ago. JKH said 1QFY23 included Rs. 10.12 billion of net exchange gains recorded on its dollar denominated cash holdings at the Holding Company, resulting from the steep depreciation of the Sri Lankan rupee against the US dollar.

The latest quarter however recorded corresponding net exchange losses of Rs. 359 million. In addition, PBT was also impacted on account of the higher finance expenses due to the high interest rate regime and the interest charged on the convertible debentures issued to HWIC Asia Fund (HWIC) in August 2022.

The interest recorded on the debenture included a notional non-cash interest of approximately Rs. 750 million, in line with the accounting treatment, due to a significant difference between the market interest rates and the 3% interest accrued on the instrument. In 4Q of FY23, pre-tax profit was Rs. 2.3 billion.

Group revenue in 1QFY23 was down by 11% to Rs. 63.78. JKH attributed the decline to the significantly higher revenue recorded in the Group’s Bunkering business in the previous year due to the steep increase in oil prices. Group revenue in 4QFY23 was Rs. 67.8 billion.

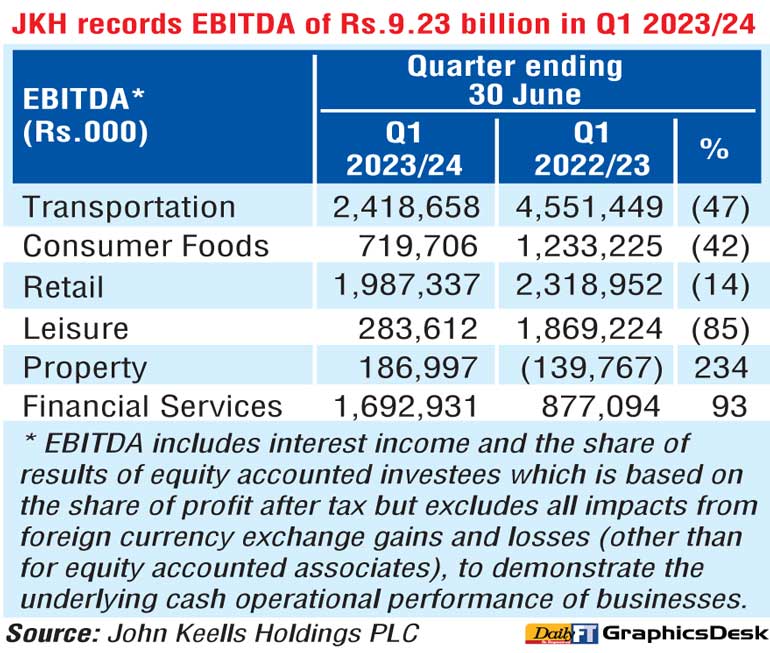

Group earnings before interest, tax, depreciation and amortisation (EBITDA) was down by 31% to Rs. 9.23 billion mainly due to the lower EBITDA in the Transportation and Leisure industry groups.

“While the business specific factors impacting Transportation and Leisure are covered under the respective industry group sections, it should be noted that both these businesses had a negative impact on the financial performance due to the translation impact on account of the appreciation of the rupee by approximately 15% over the corresponding period of the previous year,” JKH Chairperson Krishan Balendra said.

JKH’s bottom line was down by 87% to Rs. 1.47 billion. In FY23 4Q the figure was Rs. 3.3 billion.

Balendra said during 1QFY24 Sri Lanka continued to witness normal day-to-day activities with all key macro-economic indicators showing sustained improvement, with inflation and interest rates recording a decline and the rupee appreciating on the back of improved foreign exchange inflows and confidence.

Balendra said the groundwork on the West Container Terminal (WCT-1) at the Port of Colombo is progressing well with the entirety of the dredging works for both phases completed in May 2023. The construction of the quay wall has been awarded and preliminary work has commenced.

He also revealed that discussions with leading international gaming operators are progressing well, where the commercial structures and arrangements are being negotiated, with a final agreement expected shortly. A substantial amount of work has been carried out, including detailed site visits, evaluation of the business case and operating model, fit-out requirements, designs and timelines.

The JKH Chairperson said the Consumer Foods industry group EBITDA was down by 42% primarily driven by a substantial decline stemming from the Convenience Foods business which usually does not contribute materially to profitability. This is largely on account of the higher discretionary nature of the portfolio in the context of tightening consumer spend.

The Beverages business recorded a growth in EBITDA given the decline in input costs which are now translating to positive margin impacts on account of the stabilising raw material prices and the appreciation of the rupee. “The volume decline in both the Beverages and Frozen Confectionery businesses have shown encouraging recovery compared to the steep volume declines witnessed in the two previous quarters,” he said.

The Retail industry group EBITDA was down by 14% on account of both the Supermarket business and the Office Automation business.

According to Balendra, the Supermarket business recorded a strong performance in revenue during the quarter, particularly in the seasonal month of April, with same store sales recording an encouraging growth of 23%, primarily driven by customer footfall growth of 15%.

He said the increase in revenue, as witnessed during the quarter, is expected to drive an improvement in EBITDA together with the benefits accruing from various productivity and cost efficiency initiatives.

Balendra also said the profitability of the Leisure businesses was adversely impacted by the rupee appreciation during the quarter under review, particularly in the Maldivian Resorts segment and the Destination Management sector, and higher costs.

However the Colombo Hotels segment recorded a strong performance in its restaurant and banqueting operations. Occupancies of the Sri Lankan Leisure businesses recorded an improvement on the back of a gradual recovery in tourist arrivals.

The Property industry group recorded a growth in EBITDA driven by profit recognition from ‘TRI-ZEN’ and rental income from ten floors of ‘The Offices at Cinnamon Life’.

The Insurance business recorded encouraging double-digit growth in gross written premiums, driven by renewal premiums, and an increase in net investment income. Nations Trust Bank PLC recorded an increase in profitability driven by an increase in net interest margins through proactive asset liability management. Profitability in the quarter under review also benefited as it did not include impairment charges on Sri Lankan Government foreign securities given the higher provisioning adopted by NTB relative to its peers and the subsequent clarity on ‘haircuts’ as announced in the Domestic Debt Optimisation (DDO) program.