Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 24 August 2021 02:56 - - {{hitsCtrl.values.hits}}

By Nisthar Cassim

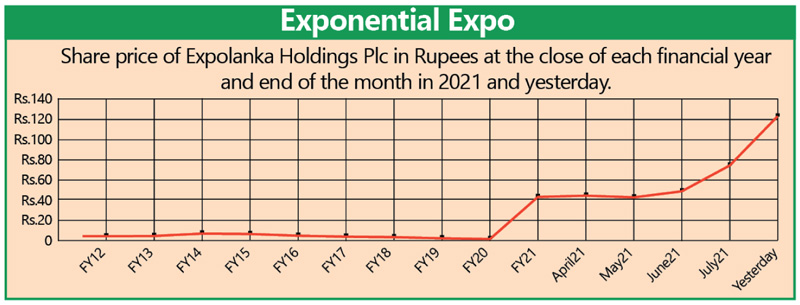

Having reached the milestone of the Rs. 100 mark for its share price on Friday, Expolanka Holdings PLC appeared unstoppable yesterday crowning itself as the most valuable on the Colombo Stock Exchange, driven by frenzied interest and trading by investors mainly retail.

|

Expolanka Holdings Group MD and shareholder Hanif Yusoof

|

Last week Expo contributed 93 points to the ASPI’s gain apart from being the most traded, with 74.7 million shares changing hands via 23,288 trades for Rs. 7 billion – 33.34% of the total at CSE. It hit an all-time high of Rs. 102 before closing at Rs. 100.50, still up Rs. 21.20. A year ago, Expo was trading at Rs. 5.20. But, yesterday, it broke several records.

Expolanka yesterday saw 34.3 million of its shares traded between a high of Rs. 128 and a low of Rs. 102.50, before closing at Rs. 122.75. Turnover was Rs. 4 billion, accounting for 37% of the day’s total, as Expolanka spearheaded an overall market rally to new records.

Its achievement yesterday earned Expo the title of new ‘Unicorn,’ while its rise has been exponential if one factors in that in FY20 share price was only Rs. 2 and yesterday’s closing was a mind boggling 6,000%.

Compared with Rs. 57 billion market capitalisation in the calendar year of 2020, Expo by yesterday had grown by Rs. 183 billion to Rs. 240 billion. In July, it was Rs. 131 billion. It rose to second most valuable, dislodging CTC and JKH on 18 August.

Expo established its mark in FY21 with stellar financial results aided by COVID-driven opportunities in the global logistics market. It has sustained the momentum into the new financial year as well. Most of the investors who bought yesterday showed they believe it would perform well beyond FY23, given its dominance in foreign exchange earnings and impressive outlook, though only time will tell.

Founded in 2003, Expolanka is the youngest to reach the top, as its history as a listed entity is only 10 years, having gone public in 2011. In contrast, CTC was listed in 1955, LOLC in 1982 and JKH in 1986. LOLC moved to second place despite a 7% gain to Rs. 491.50. Investors and analysts were betting whether come Tuesday diehards of LOLC would propel it to number one.

Japan’s SG Holdings Global Ltd. owns 75.6% stake in Expolanka Holdings while Group MD Hanif Yusoof owns 7.5%. In FY21 Expolanka Holdings PLC saw a substantial 46.5% increase in the number of shareholders in tandem with improving fortunes for the logistics-rich conglomerate and its share price. The public shareholder base rose by 4,316 to 13,592 during the financial year ending 31 March 2021, while the public float has improved to 16.5% from 16.3%. As at June 2021, the number of shareholders increased further to 13,719 while the public float was 16.6%.

Bullish investor sentiment on Expo is due to its zenith in becoming the most profitable listed entity, aided by COVID pandemic-related opportunities in the global logistics market. It ended FY21 with a hefty net profit of Rs. 14.8 billion as opposed to a loss of Rs. 438 million in FY20. Group revenue rose by 111% to Rs. 218.7 billion. In the first quarter of FY22, it saw a 259% YoY growth in Group Profit After Tax to Rs. 6.3 billion and a 165% YoY increase in Group revenue to Rs. 95.7 billion.

Expolanka Holdings is a global diversified conglomerate rooted in Sri Lanka. The group specialises in logistics, leisure and investments. Expolanka companies are known for challenging the status quo with a global vision and a strategic growth plan that places the group at the forefront of driving innovation, growth and change in every aspect of business – a successful formula that has earned Expo a place as a market leader across all three sectors.