Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 25 December 2020 01:44 - - {{hitsCtrl.values.hits}}

By Charumini de Silva

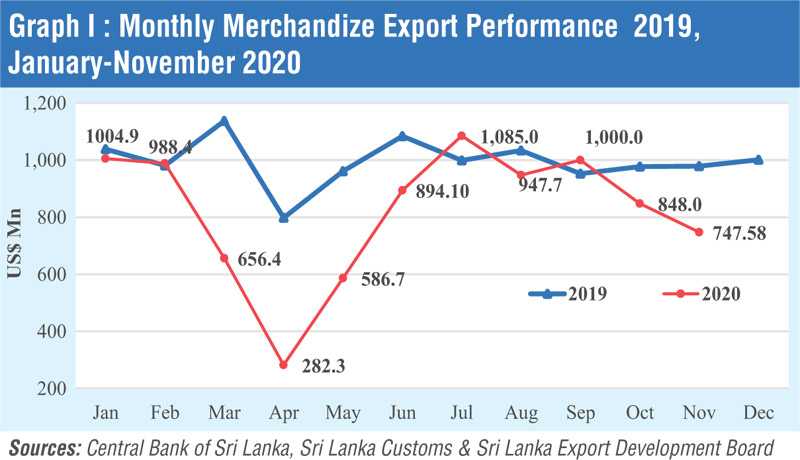

Decline in exports has intensified as per latest monthly data, reinforcing global and local challenges faced by the sector due to COVID-19 pandemic.

The Export Development Board (EDB) yesterday announced that merchandise exports in November amounted to $747.58 million, down 21% from a year earlier (Y-o-Y), whilst in October the Y-o-Y dip was 15%.

However, month-on-month (M-o-M) the decline is lesser with November reflecting a 12% dip as against 15% in October from the previous month.

The cumulative merchandise export performance for the 11 months was $8.98 billion down 17% from the corresponding period of last year.

The EDB said poor performance in November was due to the adverse impact of the second wave of COVID-19 in the country and globally. The decline recorded in October exports due to the second wave COVID outbreak in the country had a direct impact on the export products manufacturing facilities and it continued in November as well.

“The resurgence of the second wave of COVID-19 was unexpected, and it affected our key markets, as well as private sector operations,” newly appointed EDB Chairman Suresh de Mel told the Daily FT.

“Our businesses must continue to be resilient whilst facing the volatile and unprecedented COVID-19 pandemic by taking all preventive measures. The export community has been the major contributor to economic stability post-COVID by bringing in much-needed foreign exchange, and the Government has given top priority to support all export industries during these challenging times,” de Mel added.

He also said that the EDB, together with top officials of the Sri Lanka Ports Authority, Sri Lanka Customs, shipping lines along with export sector stakeholders, held a virtual meeting recently to streamline procedures and share contingency plans to overcome any future challenges.

De Mel also called for greater product and market diversification to enhance Sri Lanka’s foreign exchange earnings amidst COVID-19 challenges.

“Agriculture-based exports, such as coconut, rubber, spices as well as fruits and vegetables have performed well throughout the year. Exporters should give importance to boosting productivity and availability of crops whilst also looking at opportunities in creating new brands for organic agricultural products,” the EDB Chief emphasised.

Decreases in exports were recorded across all top 10 export markets in November compared to the same period of last year. Although, exports to CIS Region recorded a marginal increase in November Y-o-Y, exports to other regions were declined.

In terms of export earnings sector-wise, apparel and textiles declined by 32.75% to $324.92 million compared to $483.17 million recorded in the same period last year. Despite the decline in the sector, earnings from exports of made-up textile articles and other textiles increased by 71.04% and 29.86%, respectively, in November 2020 Y-o-Y, while month-on-month increase is 221.45% and 5.37%, respectively.

Export earnings from tea which comprises 12% of total merchandise exports decreased by 5.17% to $96.21 million Y-o-Y. Similarly, export earnings from tea recorded 14.21% decrease in November 2020 in comparison to October 2020.

Rubber and rubber finished products increased by 12.66% to $69.57 million Y-o-Y due to the better performance in exports of pneumatic and retreated rubber tyres and tubes (8.11%) as well as industrial and surgical gloves of rubber (39.32%). However, exports of rubber plates, sheets rods of vulcanised or unhardened rubber and baskets, sashers, seals, etc., of hard rubber decreased by 11.52% and 40.51%, respectively, in November from the corresponding period last year.

Earnings from all the major categories of coconut-based products increased in November from a year earlier. Earnings from coconut oil, coconut fresh nuts, coconut milk powder, coconut cream, liquid coconut milk and coconut flour categorised under the coconut kernel products increased Y-o-Y by 50.2%, 14.29%, 25.54%, 37.62%, 61.73% and 171.43%, respectively. Being the largest contributor to coconut-based sector, coco peat, fibre pith and moulded products, which are categorised under the coconut fibre products, increased by 43.68% to $11.71 million in November Y-o-Y, whilst earnings from activated carbon, which categorised under the coconut shell products increased by 11.76% in November compared to the same period last year.

Export earnings from spices and essential oils increased by 40.64% to $34.02 million compared to $24.19 million recorded in November 2019. This was mainly due to the increased exports of cinnamon (10.16%) and pepper (88.10%).

Electrical and electronic components (EEC) exports earnings declined by 11.71% to $25.42 million Y-o-Y. However, earnings from export of EEC increased by 24.06% in November compared to the previous month.

Revenue from export of personal protective equipment (PPE) related products increased by 47.42% to $807.63 million in the first 11 months compared to $547.85 million recorded in the same period last year. The strong performance was mainly due to the increased exports of other made-up articles (HS 630790) and articles of apparel and clothing accessories of plastics (HS 392620). As a result of increased export of articles of apparel and clothing accessories of plastics, export of plastic products increased by 151.48% to $170.35 million in the first 11 months compared to $67.74 million recorded in the corresponding period of last year.

The top five export destinations in the first 11 months were the US ($ 2,267.48 million), the United Kingdom ($842.8 million), India ($546.49 million), Germany ($519.07 million) and Italy ($406.81 million) has absorbed over 50% of exports recorded in the period.

Being the largest single export destination, the US has absorbed $178.27 million worth of exports in November, down by 33.21% compared to $266.91 million in the corresponding period of last year. The cumulative exports to the US also declined by 20.62% in the first 11 months compared to the same period of previous year.

Exports to the UK – the largest trading partner in the European Union (EU) region – recorded marginal dip by 1.45% $76.07 million Y-o-Y.

Further, exports to top 10 markets have also shown poor performance during the month of November as well as throughout the first 11 months.

The Y-o-Y exports to regions, except for the CIS region (1.19%), exports to regions such as EU, South Asia, ASEAN, African and Middle East countries declined by 12.71%, 23.85%, 43.11%, 3.58% and 29.35%, respectively.