Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 10 September 2021 02:37 - - {{hitsCtrl.values.hits}}

In a bid to save scarce foreign exchange, the Government yesterday imposed a fresh barrier to the import of over 600 non-essential items, with the Central Bank requiring banks to impose a 100% cash margin deposit to bring down these goods.

The Central Bank said yesterday that the Monetary Board at its meeting on Wednesday decided on this move which is expected to “support the ongoing efforts to preserve the stability of the exchange rate and foreign currency market liquidity, particularly by discouraging excessive imports of speculative nature”.

All commercial banks have been directed to impose a 100% non-interest bearing cash margin deposit requirement against the importation of selected goods of non-essential/non-urgent nature made under Letters of Credit and Documents against Acceptance terms with immediate effect.

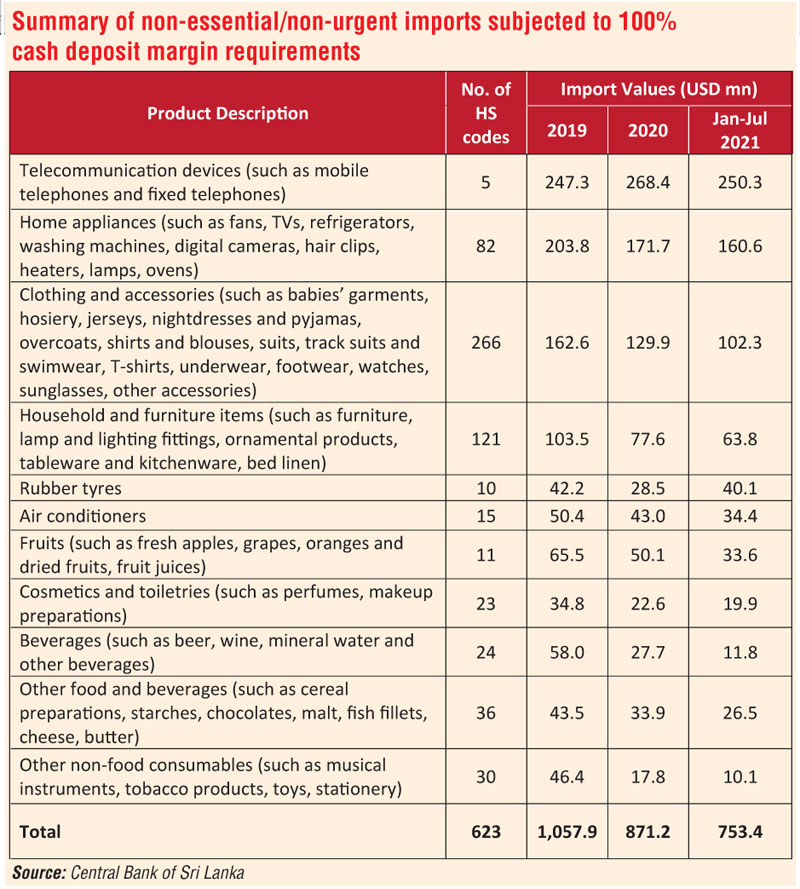

Total products amount to 623 and includes Telecommunication devices (telephones and fixed telephones); Home appliances (fans, TVs, refrigerators, washing machines, digital cameras, hair clips, heaters, lamps, ovens); Clothing and accessories (babies’ garments, hosiery, jerseys, nightdresses and pyjamas, overcoats, shirts and blouses, suits, track suits and swimwear, T-shirts, underwear, footwear, watches, sunglasses, other accessories); Household and furniture items (furniture, lamp and lighting fittings, ornamental products, tableware and kitchenware, bed linen); Rubber tyres; Air conditioners; Fruits (fresh apples, grapes, oranges and dried fruits, fruit juices); Cosmetics and toiletries (perfumes, makeup preparations); Beverages (such as beer, wine, mineral water and other beverages); Other food and beverages (such as cereal preparations, starches, chocolates, malt, fish fillets, cheese, butter); Other non-food consumables (such as musical instruments, tobacco products, toys, stationery).

Import of these products in the first seven months of this year alone had reached a high of $ 753.4 million in comparison to $ 871 million in the entirety of 2020 and $ 1 billion in 2019.

Imports in the first seven months have jumped by 30% to $ 10 billion despite restrictions. The 100% cash margin deposit move comes after the Central Bank fixed the maximum exchange rate to the US Dollar at Rs. 203 benefitting importers as opposed to Rs. 220 and Rs. 235 quoted previously by commercial banks.

Banks have been told the cash margin deposit requirements will be on the total value of the invoice, notwithstanding the fact that the same invoice includes goods which are not covered by the latest directive.

In the case of existing LCs covering the importation of goods covered by the 8 September directive, no increase in the value of such LCs shall be permitted by banks unless such increase is covered by the cash margin deposits as required from now on.

Banks have been told not to grant any advances to their customers for the purpose of enabling such customers to meet the minimum cash margin deposit requirement. Additionally banks should endorse the relevant invoice certifying whether the cash margin deposit as per latest directive has been maintained.

The margin deposit should be released on the production of documentary evidence on payments through the banking channels in Sri Lanka and Customs documents relating to clearance of imports.

Separately Sri Lanka Customs has also notified that import of tiles, furniture, motorcycles, cardamom and turmeric will not be allowed with immediate effect, according to the clearing and forward industry.