Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 25 April 2023 00:00 - - {{hitsCtrl.values.hits}}

|

| Inland Revenue Department |

Government revenue has more than doubled to Rs. 317 billion in the first quarter from a year ago thanks to higher rates and enforcement.

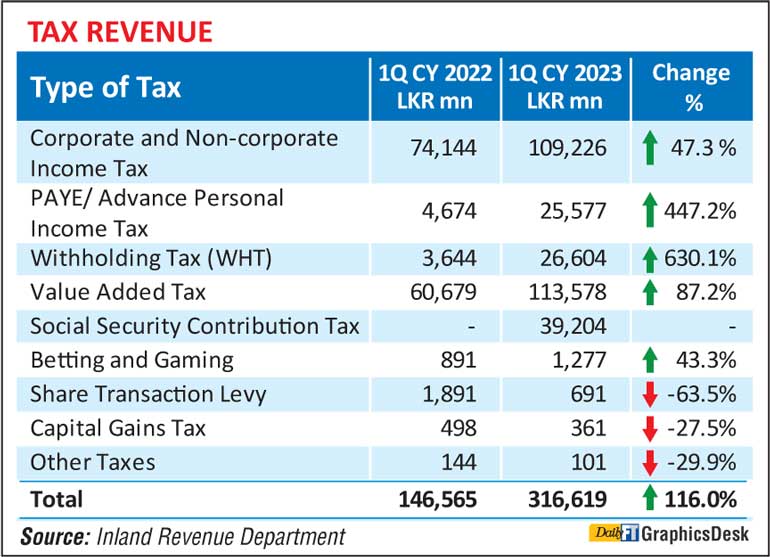

The Inland Revenue Department yesterday revealed collection of tax revenue for the first quarter at Rs. 316.6 billion as against Rs. 146.5 billion in the first three months of last year reflecting a Rs. 170 billion or 116% increase.

“The causes for this favourable growth could be attributed to things such as new tax policy, a gradual improvement of the country’s economic situation and enhanced efficiency of tax administration,” the IRD said.

Corporate and Non-Corporate Income Tax was Rs. 109.2 billion as against Rs. 74 billion a year ago and Value Added Tax was Rs. 113.5 billion up from Rs. 60.6 billion.

Pay as You Earn/Advanced Personal Income Tax had garnered Rs. 25.5 billion up from Rs. 4.6 billion. Social Security Contribution Levy brought in Rs. 39.2 billion in new revenue in the first quarter of 2023.

IRD said though the Social Security Levy (SSL) was implemented with effect from 1 October 2022, it was not relevant to the first quarter of 2022. However the drop in share market transactions resulted in a reduction in the Share Transaction Levy while the abolition of Economic Service Charge (ESC), Nation Building Tax (NBT) and Debt Repayment Levy resulted in a reduction in other taxes, the IRD added.