Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 11 November 2022 00:00 - - {{hitsCtrl.values.hits}}

|

| Hayleys Chairman and Chief Executive Mohan Pandithage

|

Sri Lanka’s most diversified blue chip Hayleys has posted exceptional performance in 2Q and 1H of FY23 despite

global and domestic challenges.

Consolidated pre-tax profit in 2Q had soared by 70% to Rs. 10 billion and by 180% in 1H to Rs. 30 billion. After tax profit improved by 62% to Rs. 7.1 billion and by 192% to Rs. 23.4 billion respectively.

Hayleys bottom line in 2Q was up 45% to Rs. 4 billion and by 193% to Rs. 14.5 billion in 1H.

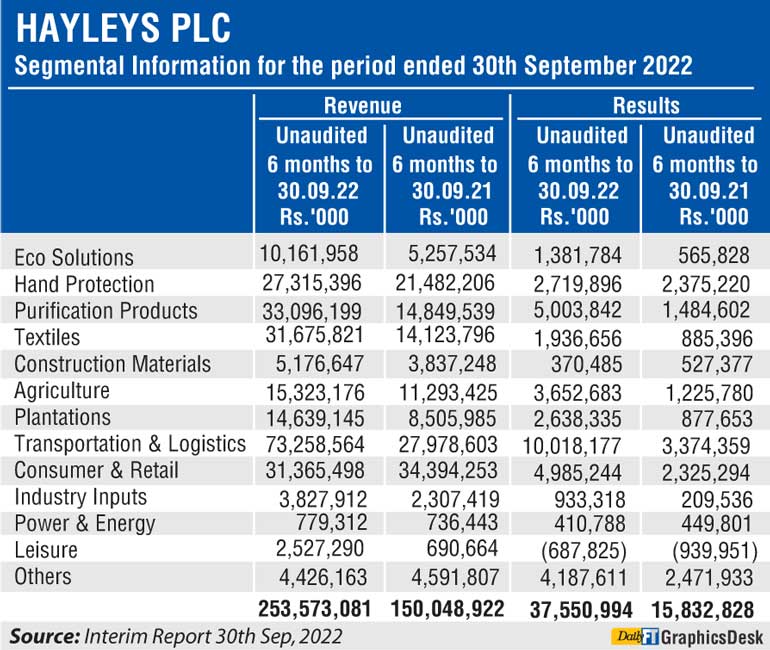

The impressive profitability comes on top of 64% increase in revenue to Rs. 130 billion in 2Q and by 69% to Rs. 253.5 billion in 1H. The performance also comes despite net finance cost increasing by 295% in 2Q to Rs. 6 billion and by 33% in 1H to Rs. 4.3 billion.

Finance income grew by 665% to Rs. 16.8 billion in 1H and finance cost rose 288% to Rs. 21.1 billion. In 2Q income rose by 159% to Rs. 4 billion and cost by 227% to Rs. 10 billion.

The main contributors for Revenue in 1H were the transportation and logistics sector Rs. 73.26 billion, purification sector Rs. 33.09 billion and textile sector Rs. 31.67 billion. In terms of profit before tax, the transportation and logistics sector accounted for Rs. 10 billion, followed by purification products Rs. 5 billion and consumer and retail Rs. 5 billion. Hayleys also saw a 36% growth in assets and EPS soaring by 193%.

Other sectors such as eco solutions, textiles, agriculture, plantations, consumer retail, hand protection, industry inputs also did well whilst the leisure sector reduced its losses.

Hayleys said with the significant rupee depreciation, cost of materials increased significantly resulting in higher working capital requirements. Further, price revisions have adversely affected consumer demand.

The rupee depreciation positively affected the export companies within the group which resulted in an increase in the top line and bottom line. However, maintaining the exchange rate at a fixed level for an extended period posed challenges in maintaining competitiveness in the international marketplace given the expected tax changes and high inflation rate.

Strategic measures were taken by Hayleys to obtain working capital funding in local currency whilst closely monitoring the currency rate movement.

Among measures taken to reduce the impact of a significant depreciation of the rupee were prudent strategies to revise price in a timely manner based on market outlook; proper mix of LKR and foreign currency working capital funding while closely monitoring the currency rate movement; Entering into forward rate contracts to mitigate foreign currency risk and invoicing in foreign currency wherever possible whilst being compliant to regulations.

Hayleys also said despite the current slowdown of the economy, the marketing and business development teams of the group continues to pursue new businesses whilst the operational teams focus on improving production efficiencies and reducing costs in order to increase the gross

profit margins.

Given the increase in interest rates, Hayleys as mitigating measures fixed the interest of short – term working capital loans for a longer period based on money market conditions and minimised borrowings by reducing credit periods offered to the customers whilst encouraging advance payments, thereby improving the liquidity of the company.

It also controlled and monitored measures taken to improve the recoveries from debtors to reduce the borrowings apart from strategic initiatives driven by the management to prioritise essential capital expenditure.