Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Saturday, 2 December 2023 01:23 - - {{hitsCtrl.values.hits}}

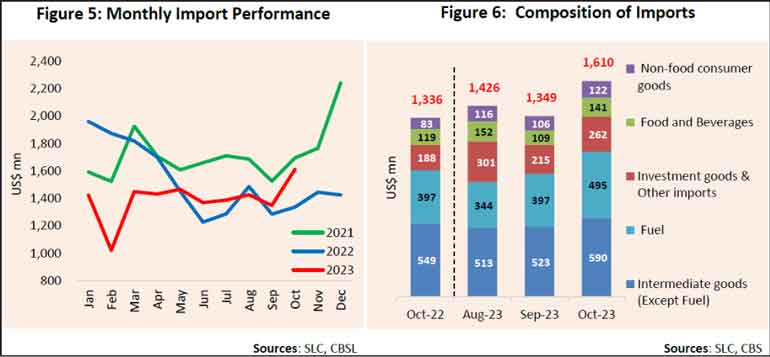

Expenditure on imports in October rose to an 18-month high of $ 1.6 billion driven by volume whilst intermediate and investment goods dominated value growth.

On a year-on-year basis October exports saw a 20.6% increase and month-on-month it was 23% rise.

The Central Bank said the October 2023 figure was the highest since April 2022.

It said expenditure of intermediate goods ($ 1.08 billion and up 15% YoY) and investment goods ($ 260 million and up 38% YoY) mainly contributed to this increase in import expenditure.

Furthermore the import volume index improved by 23%, while the unit value index declined by 1.9% in October 2023 from a year ago indicating that the increase in import expenditure in October 2023 was primarily driven by higher import volumes.

Cumulative imports in the first 10 months of 2023 amounted to $ 14 billion, down by 9.6% from the corresponding period of last year.

The jump in imports also saw the deficit in the merchandise trade account widening significantly to $ 683 million in October compared to the deficit of $ 284 million a year ago well as $ 378 million recorded in September 2023. However, the cumulative deficit in the trade account during January to October 2023 narrowed to $ 4,024 million from $ 4,377 million recorded over the same period in 2022.

As per CBSL data, expenditure on the importation of consumer goods increased 30% YoY to $ 263.4 million in October 2023, due to broad-base increases in both food and non-food consumer goods. The increase in import expenditure on food and beverages by 18.5% to $ 141 million was led by sugar and dairy products (mainly, milk powder). In contrast, expenditure on the cereals and milling industry products (primarily, rice) declined, compared to that of October 2022.

Expenditure on non-food consumer goods imports increased by 47.5% to $ 122 million mainly owing to the importation of medical and pharmaceuticals (primarily, medicaments), while expenditure on home appliances (primarily, televisions and fans), household and furniture items and telecommunication devices also increased supported by the relaxation of import restrictions since June 2023.

Expenditure on the importation of intermediate goods increased in October 2023, compared to a year ago, mainly driven by higher imports of fuel. Expenditure on fuel imports increased in October 2023 led by higher import volumes amidst the decline in the import prices of refined petroleum products and coal, compared to October 2022. Further, expenditure on base metals, diamonds and precious stones and metals, wheat and mineral products increased to some extent.

However, the importation of textiles and textile articles (primarily, yarn) declined in October 2023, compared to October 2022, although recorded a significant increase, compared to September 2023.

Expenditure on fertiliser (primarily, urea) and unmanufactured tobacco also declined during the period concerned.

Import expenditure on investment goods increased in October 2023 led by the increase in imports of machinery and equipment (primarily, turbines and office machines). Import expenditure on building material also increased, mainly owing to high imports of iron and steel (primarily, iron bars and rods), and articles of iron and steel (primarily, bridges and bridge sections). This increase was partly supported by the relaxation of import restrictions from June 2023.

Expenditure on importation of transport equipment increased due to high imports of agricultural tractors, and railway track construction material.

CBSL also said earnings from merchandise exports declined by 11.8% to $ 928 million in October 2023, compared to the corresponding month in 2022 as well as compared to $ 972 million recorded in September 2023. While the decline in earnings was observed across all main categories, industrial exports mainly contributed to the overall contraction. Cumulative export earnings also declined by 10.3% during January to October 2023 to $ 9,910 million, over the same period of the last year.

Earnings from the exports of industrial goods declined 12% to $ 723 million in October 2023, with a significant share of the decline being contributed by garments. Accordingly, exports of garments to most of the major markets (the USA, the EU, and the UK) recorded a decline. Further, a sizable decline was recorded in the exports of transport equipment (due to the base effect of exporting a cruise ship in October 2022), machinery and mechanical appliances (mainly, electronic equipment), and rubber products (mainly, household rubber gloves), among others. Earnings from petroleum products increased due to the increase in volumes of bunkering and aviation exports, despite lower prices.

Earnings from the exports of agricultural goods also declined 11.5% to $ 200 million driven by lower export earnings from tea (due to both lower export volumes and export prices), coconut related products (primarily, fibres) and spices (primarily, cinnamon, and nutmeg and mace). Meanwhile, the export earnings from minor agricultural products (mainly, arecanuts), seafood and vegetables recorded marginal increases.

Earnings from mineral exports declined in October 2023, compared to October 2022, mainly due to the decline in export earnings from titanium ores.

The export volume and unit value indices declined by 3.3% and 8.7%, respectively, in October 2023, compared to October 2022, implying that the decrease in export earnings in October 2023 was mainly due to lower export prices.

Terms of trade, i.e., the ratio of the price of exports to the price of imports, deteriorated by 6.9% in October 2023, compared to October 2022, as the decline in the prices of exports surpassed the decline in the prices of imports.