Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 31 July 2024 00:00 - - {{hitsCtrl.values.hits}}

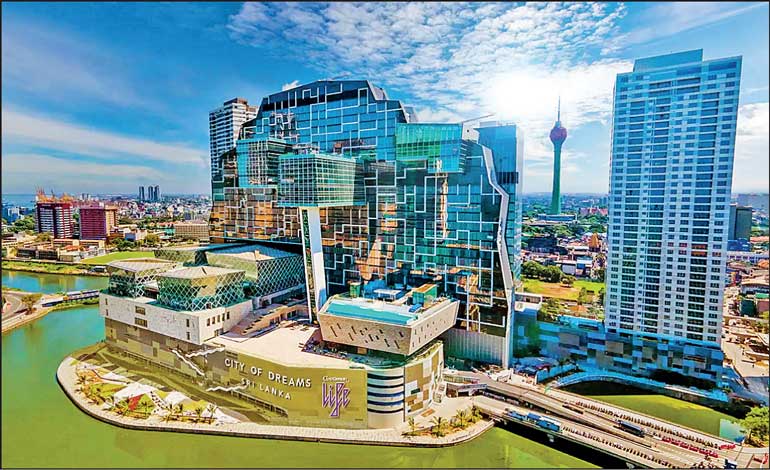

Top blue chip John Keells Holdings Plc (JKH) yesterday announced its biggest ever Rights Issue of Rs. 24 billion to support the project funding requirement at its subsidiary Waterfront Properties Ltd., developing the ‘City of Dreams Sri Lanka’ integrated resort.

The Rights Issue proposed is 1 for every 10 held at Rs. 160 each. The move will see issuance of 160.263 million shares raising Rs. 24.04 billion. JKH’s current stated capital of the Entity: Rs.91,253,863,510.96 represented by 1,502,635,957 Ordinary Shares.

Amidst bearish market sentiments, JKH share price closed yesterday at Rs. 189.25, down by 0.9%.

It is the highest Rights Issue since JKH raised Rs. 23 billion in 2013 which however included warrants contributing over Rs. 16 billion in a fund raising move worth Rs. 40 billion, also for the integrated resort project.

JKH Board of Directors also resolved that subsequent to the completion of the Rights Issue, the number of shares of the company in issue be increased by way of a 1 into 10 Sub-division of Ordinary Shares. The sub-division of shares would take place based on the number of shares upon the listing of shares pursuant to the Rights Issue. Number of shares after the Sub-division will be 16,528,995,520 Ordinary Shares.

The announcement was made after the closure of the market. Amidst bearish sentiments at the Colombo Stock Exchange, JKH share price closed yesterday at Rs. 189.25, down by 0.9%.

JKH said proceeds from Rights Issue will support the company’s financing obligations, which has increased due to the higher than anticipated equity funding requirement of the Project (previously branded as ‘Cinnamon Life Integrated Resort’) required to bridge the impacts of the delayed cash flow generation from operations due to the deferment of the commencement date, including the gaming operations.

JKH said the capital raising will result in strengthening the balance sheet of the company by reducing its levels of leverage, providing the company greater flexibility in its future investments.

The company has secured a partnership with one of the world’s leading casino and integrated resort operators, Melco Resorts and Entertainment Ltd. Melco has made a commitment to invest approximately $ 125 million in fitting out and equipping the gaming space. This partnership was finalised subsequent to the publication of regulations governing the issue of a casino license under a structured and transparent framework. The revised licencing criteria provides for a clear framework for the issuing of licences with stipulated minimum investment while also assuring Melco, as investor and operator, and WPL, as landlord, a long-term license for a casino to be operated within the project for a period of 20 years.

JKH said the time taken for the development and gazetting of this new framework resulted in a delay in finalising agreements with Melco. “While this had a corresponding impact on the timelines of commencing the gaming operations within the Project from that envisaged last year, the company is of the view that the clarity and long-term nature of the licensing framework is more beneficial to the Project,” JKH added.

The ‘Cinnamon Life’ hotel, restaurants and banquet facilities will commence operations in October 2024 while the gaming operations and retail mall will be operational, in a phased manner, with overall completion of these elements scheduled for mid-CY2025.