Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 27 January 2022 01:48 - - {{hitsCtrl.values.hits}}

John Keells Holdings PLC (JKH) yesterday announced what analysts described as “very strong” performance for the third quarter, signalling the diversified blue chip’s resilience and recovery are gaining momentum.

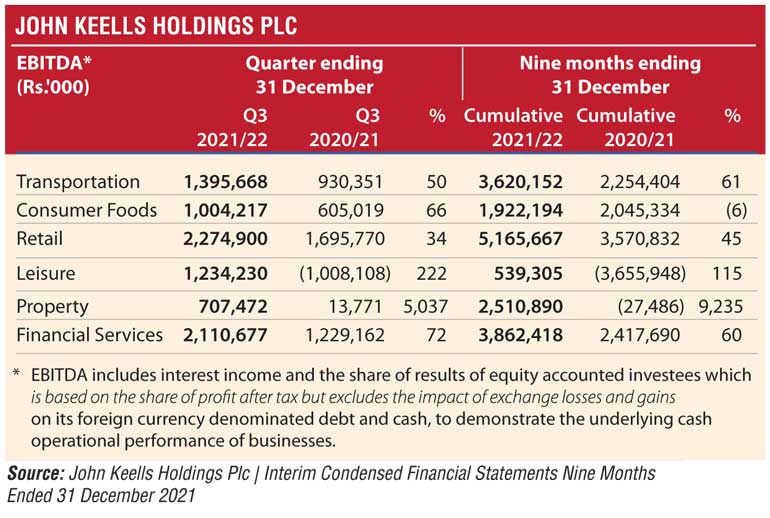

JKH Group earnings before interest expense, tax, depreciation and amortisation (EBITDA) recorded a significant increase of 126% to Rs. 9.53 billion in 3Q ended 31 December 2021 as against Rs. 4.21 billion a year ago. Cumulative first nine months Group EBITDA rose by 148% to Rs. 20.70 billion.

3Q Group revenue rose by 53% to Rs. 53.88 billion and by 60% to Rs. 142 billion in the nine months.

Group profit before tax (PBT) jumped by 311% to Rs. 6.24 billion in 3Q whilst for nine months it amounted to Rs. 10.38 billion as against a negative Rs. 275 million a year ago.

Profit attributable to equity holders of the parent was Rs. 4.91 billion in 3Q up from Rs. 992 million and Rs. 9.30 billion for nine months as against Rs. 15 million a year ago.

“The Group witnessed a strong recovery momentum during the quarter under review with the performance of our businesses reaching close to pre-COVID-19 levels with business activity and consumer trends being near ‘normal’ since the onset of the pandemic in early 2020. This positive momentum resulted in all sectors within the Group recording a strong growth in profits,” JKH Chairman Krishan Balendra said in a note accompanying interim results.

“Whilst the foreign exchange market continued to witness significant volatility and uncertainty during the quarter, the strong balance sheet of the Group and cash reserves aided in navigating this period, with operations and investments continuing, as planned,” he added.

JKH Board also declared a second interim dividend of 50 cents per share as a follow-up to the first interim dividend of similar amount.

“The declaration of this dividend during this challenging environment reflects the encouraging recovery momentum and cash generation capability of the Group’s diverse portfolio of businesses,” Balendra emphasised.

JKH Chief said the Leisure industry group, in particular, recorded a significant turnaround in performance with the Q3 2021/22 EBITDA at Rs. 1.23 billion compared to a negative Rs. 1.01 billion a year ago.

“This turnaround has continued in the month of January and a strong recovery is expected in the coming months,” Balendra added.

JKH’s Maldivian Resorts segment continued its encouraging recovery momentum where the occupancy at our hotels were at pre-pandemic levels during the quarter whilst the Colombo Hotels and Sri Lankan Resorts segments recorded a positive EBITDA in the month of December 2021 on the back of easing of restrictions from October 2021 onwards.

“It is encouraging to witness the resumption of tourist arrivals to the country, where arrivals in December 2021 was recorded at approximately 90,000 for the month; the highest figure achieved in 20 months. The r-opening of the country for tourism will be a key catalyst to drive the recovery of the economy, particularly in the context of the positive impact it will have on foreign exchange earnings,” Balendra said.

Balendra said the Consumer Foods industry group continued its strong recovery momentum with all segments recording strong double-digit growth in volumes during the quarter, with volumes of the Beverages and Frozen Confectionery businesses reaching pre-pandemic levels.

The Retail industry group recorded an encouraging performance with same store sales growth driving profitability in the Supermarket business, whilst the mobile phones business recorded a strong increase in volumes and profitability.

The residential and commercial components of the ‘Cinnamon Life’ project are now completed, with the second residential apartment tower ‘The Residence at Cinnamon Life’, ready for customer handover from February onwards.

Balendra also said the Colombo West International Container Terminal Ltd., the project company for the development of the West Container Terminal-1 (WCT-1) in the Port of Colombo, is in the final stages of fulfilling the conditions precedent in the Build, Operate and Transfer (BOT) agreement, and the handover of the site for the commencement of construction is expected to take place in the ensuing quarter.