Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 25 May 2021 01:24 - - {{hitsCtrl.values.hits}}

|

JKH Chairman Krishan Balendra

|

Premier blue chip John Keells Holdings (JKH) has seen a robust fourth quarter, though its performance in FY21 was sharply down from the previous year due to COVID impact.

As per results for FY21 released yesterday, JKH has returned to pre-COVID level performances in terms of top line and pre-tax profits, whilst doing better in terms of operating profits and bottom line in 4Q in comparison to a year earlier.

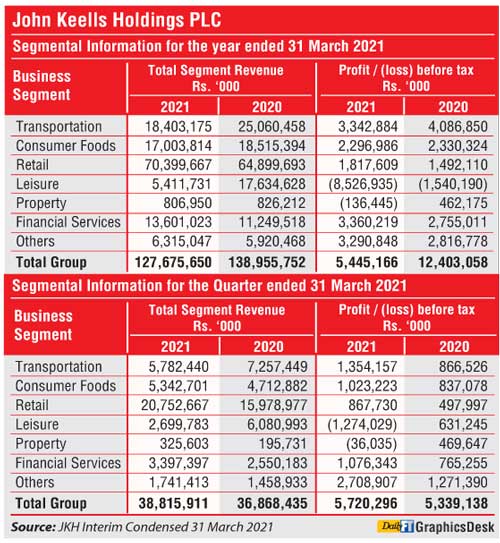

Group revenue rose by 5% to Rs. 39 billion in 4Q, whilst for FY21 it was down 8% to Rs. 127.6 billion.

Excluding Leisure, Group revenue increased by 17% in 4Q and by 1% in FY21. The decline in revenue in FY21 is primarily due to a sharp reduction in oil prices throughout most of the year, impacting the Group's bunkering business Lanka Marine Services.

The pace of recovery in Q4 was demonstrated by the recurring EBITDA of Rs. 7.21 billion in the quarter against the full year recurring EBITDA of Rs. 15.57 billion. Excluding Leisure, Group recurring EBITDA increased by 43% to Rs. 7.10 billion in Q4, up 8% to Rs. 19.16 billion in 2020/21 displaying the positive recovery momentum of the businesses, where most have reached levels of near normalcy since December 2020 onwards.

Profit from operating activities grew by 16% to Rs. 3.03 billion in 4Q but saw a 62% plunge to Rs. 2.55 billion in FY21. Pre-tax rose by 7% to Rs. 5.7 billion in 4Q but declined by 56% to Rs. 5.4 billion in full FY21. After tax was down by 59% to Rs. 3.95 billion in FY21 whilst in 4Q it was up 20% to Rs. 4.85 billion.

Profit attributable to equity holders of the parent company was down 59% to Rs. 3.95 billion in FY21, whilst in the 4Q it grew by 27% to Rs. 4.75 billion.

Excluding the Leisure industry group, recurring PBT increased by 1% to Rs. 13.95 billion, while the recurring profit attributable to equity holders of the parent increased by 3% to Rs. 10.96 billion.

“Whilst the year under review was extremely challenging on account of the COVID-19 pandemic, the Group witnessed a faster than anticipated recovery momentum with the performance of most businesses reaching pre-COVID-19 levels where business activity and consumer trends were near normal by the end of the financial year,” JKH Chairman Krishan Balendra told shareholders in the company’s Annual Report for FY 2021

“This positive momentum is reflected in the performance of the Group excluding Leisure, where recurring EBITDA demonstrated a growth of 8% over the previous year despite the headwinds during the year, including an island-wide lockdown from April to mid-May 2020 and intermittent isolation measures during other periods,” he added.

Balendra said given the positive momentum of the performance of the businesses, notwithstanding the impacts of the current outbreak, a final dividend for 2020/21 of Rs. 0.50 per share, was declared to be paid on or before 25 June.

Total dividend declared for 2020/21 amounts to Rs. 2 per share at a total pay-out of Rs. 1.98 billion. “The declaration of this dividend reflects the cash generation capability of the Group's diverse portfolio of businesses, despite the continued impacts on the Leisure business on the overall performance of the Group,” he added.

The Transportation industry group recurring EBITDA of Rs. 3.61 billion in 2020/21 is a decrease of 17% over FY20. The decline in profitability is attributable to the Group's ports business, South Asia Gateway Terminals (SAGT), and to a lesser extent the Group's Bunkering business, Lanka Marine Services (LMS), JKH said.

The Consumer Foods industry group recurring EBITDA of Rs. 3.32 billion in 2020/21 is a marginal decrease of 1% over the recurring EBITDA of the previous financial year. Excluding the significant impacts to the businesses in the first quarter of the year, the recurring EBITDA for the nine months ending March 2021 increased by 10% to Rs. 2.83 billion.

The retail industry group recurring EBITDA of Rs. 5.52 billion in 2020/21 was up 8% from FY20. The supermarket business recurring EBITDA of Rs. 4.14 billion in 2020/21 is a marginal decrease of 3% against the previous financial year [2019/20: Rs. 4.27 billion], primarily due to the first quarter of 2020/21 where the complete lockdown measures resulted in a significant impact on performance given the fixed cost base of the operations. Excluding this impact, the nine-month recurring EBITDA ending 31 March 2021 is an increase of 14% compared to the corresponding period of the previous year, although it should be noted that business was significantly disrupted towards the last two weeks of March 2020 due to the onset of the pandemic in the country.

The Leisure industry group’s recurring EBITDA of negative Rs. 3.59 billion in FY21 is a significant decrease against the recurring EBITDA of a positive Rs. 2.3 billion the previous financial year due to the continued impact of COVID-19 on tourism. JKH said that whilst the opening of the airports is expected to help revive the tourism industry in Sri Lanka and the Maldives, the performance of the Leisure business will largely depend on the pace of revival of regional and global travel, when travellers regain confidence, particularly with the vaccination drives in many countries. The performance of the Maldivian Resorts and the momentum of forward bookings have been very encouraging.

The Property industry group’s recurring EBITDA of a negative Rs. 17 million in 2020/21 is a decrease against Rs. 641 million in FY20. The decrease in profitability is mainly attributable to the fair value loss on investment property (IP) during the year under review compared to a fair value gain in the previous year. EBITDA excluding fair value gains/losses on IP amounted to Rs. 274 million, an increase of 48% over FY20.

Excluding fair value gains/losses, the EBITDA was positively impacted mainly due to the commencement of revenue recognition from the 'Tri-Zen' residential development project. However, profitability was impacted by the mall operations given the lower rentals and rent relief offered to tenants due to the pandemic. In order to repurpose and reposition the 'Crescat' mall in line with market dynamics, the property was closed for refurbishment on 31 December 2020. The revamped property is expected to be re-launched and operational in the second half of FY2021.

With the completion of the residential and office towers at ‘Cinnamon Life,’ the hand-over process of the units will commence, on a staggered basis, from the first quarter of 2021/22 onwards, resulting in the recognition of revenue and profits from ‘Cinnamon Life’. Project completion is scheduled for the first quarter of 2022/23.

The Financial Services industry group’s recurring EBITDA of Rs. 3.64 billion in 2020/21 is an increase of 22% over FY20. The JKH insurance business recorded double digit growth in gross written premiums during the year driven by an encouraging increase in regular new business premiums. The banking business recorded an increase in profitability driven by focused recovery efforts, cost management initiatives and higher investment income.

The IT sector’s recurring EBITDA rose by 6% to Rs. 363 million in 2020/21. The improved performance is on account of onboarding new clients and expanding the scope of services.

The plantation services sector’s recurring EBITDA of Rs. 356 million in 2020/21 was significantly higher than FYT20 figure of Rs. 20 million. This improvement in profitability was aided by an increase in both tea prices and volumes. The performance of the previous year included a material impairment of debtors at John Keells considering the stresses faced, at the time, by tea producers due to low tea prices and curtailing of manufacturing operations.