Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 29 July 2021 04:01 - - {{hitsCtrl.values.hits}}

|

JKH Chairman Krishan Balendra

|

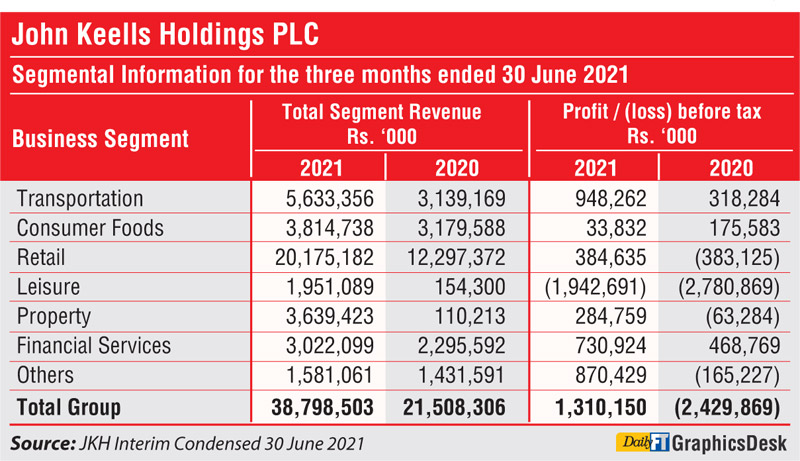

Premier blue chip John Keells Holdings PLC (JKH) yesterday announced strong performance for the first quarter of FY22 despite the third wave of the COVID-19 pandemic and its continued impact on the leisure segment.

The Group’s businesses, except for Consumer Foods, recorded an improvement in profitability compared to the first quarter of the previous year.

Group revenue was up 80% to Rs. 38.80 billion, and excluding the leisure industry group, it was Rs. 36.87 billion, up 73% from 1Q of FY21.

Group earnings before interest, tax, depreciation and amortisation (EBITDA) at Rs. 4.76 billion was up by a whopping 494%, and excluding the leisure industry group, it was up by 139% to Rs. 5.41 billion.

Group Profit Before Tax (PBT) was Rs. 1.31 billion compared to a negative Rs. 2.43 billion a year earlier. Group PBT, excluding the leisure industry group, stood at Rs. 3.25 billion as against Rs. 351 million in 1Q of FY21.

The profit attributable to equity holders of JKH was Rs. 1.53 billion compared to a negative Rs. 1.66 billion in the corresponding period of the previous financial year. JKH net finance income was Rs. 1.7 billion given the higher finance income (up 90% YoY to Rs. 3.3 billion) amidst cash reserves of Rs. 18 billion.

JKH Chairman Krishan Balendra said the quarter under review was significantly impacted due to the rapid outbreak of a third wave of COVID-19 cases in the country from late April 2021 onwards, resulting in the imposition of island-wide travel restrictions from mid-May to mid-June 2021 and many other health and safety restrictions imposed to stem the number of new cases.

“The comparative performance with the corresponding quarter in the previous year is somewhat distorted since there were varying impacts on account of the travel restrictions due to the third wave to our businesses in the current year, although the country had an island-wide lockdown for a similar length of time,” Balendra said.

“The impacts to our businesses from the recent imposition of travel restrictions were less pronounced compared to the previous year, given better insights on consumer behaviour and business momentum, which aided the businesses to better navigate through this outbreak.”

JKH said since the easing of the restrictions from early July 2021, barring inter-provincial travel for non-essential services, business activity has seen a strong recovery to “near normal” levels.

The transportation industry group EBITDA of Rs. 1.02 billion was up 159%. Balendra said the Group’s port business, SAGT, recorded an increase in profitability against the corresponding period of the previous financial year, driven by an encouraging double-digit growth in volumes, since the third wave had a limited impact on port activity and demand unlike with the onset of the pandemic in the first quarter of last year.

Further to the execution of a Letter of Intent (LOI) to develop and operate the West Container Terminal in the Port of Colombo, work is progressing well towards meeting the conditions stipulated in the LOI, including finalisation of the project design and costs and other structuring arrangements.

The performance of the JKH Group’s supermarket business continued its strong quarter-on-quarter recovery momentum with same store sales recording double-digit growth prior to the outbreak of the third wave, with the April recording higher than anticipated sales.

The retail industry group EBITDA of Rs. 1.56 billion reflects a 211% increase. The supermarkets business EBITDA of Rs. 1.09 billion also reflects a 254% rise.

The other groups’, including IT (information technology) and plantation services industry groups, EBITDA of Rs. 1.20 billion was also up 222%. The office automation business recorded a strong increase in profitability driven by a triple-digit growth in volumes in the mobile phone segment, with sales crossing over two billion rupees in June.

Balendra said the beverages, frozen confectionery and convenience foods businesses continued their strong recovery momentum, as all three segments recorded double-digit growth in volumes. The consumer foods industry group’s EBITDA of Rs. 318 million was up 35%.

While this growth in volumes and revenue translated to higher gross profits, the overall profitability of the industry group was impacted due to higher selling and distribution expenses and, to a lesser extent, increased factory-related costs due to COVID-19 health and safety protocols.

The property industry group’s EBITDA of Rs. 542 million was a significant increase over the Rs. 29 million negative EBITDA a year earlier. The handover process of the residential apartment units at ‘Cinnamon Life’ commenced, resulting in the recognition of revenue and profits from sales for the first time in the project.

The financial services industry group’s EBITDA of Rs. 770 million was up 43%. Nations Trust Bank PLC recorded an increase in profitability driven by robust loan growth and lower impairment charges despite the impact on margins. Union Assurance PLC recorded an increase in profitability driven by encouraging growth in all channels.

The leisure industry group’s EBITDA of a negative Rs. 649 million in 1Q FY22 was a significant improvement from a year earlier when it was a negative Rs. 1.46 billion.

The Maldivian resorts segment continued its recovery momentum from the previous quarter where the occupancies at JKH’s hotels were higher than anticipated during this quarter, while the forward bookings continue to be very encouraging.

“We will continue to review the trends of both international and domestic travel and expand our current operations accordingly. We remain confident that operations will recover over the next few months given the aggressive ramp up of the COVID-19 vaccination program in the country,” JKH Chairman Balendra said. “Our properties are well prepared and geared to take advantage of the pent-up demand for leisure travel from the various markets, similar to the recovery trends in arrivals witnessed in the Maldives.”