Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 10 December 2024 04:04 - - {{hitsCtrl.values.hits}}

Colombo Dockyard

Sri Lanka’s pioneering shipbuilding and repairing company, the Colombo Dockyard PLC (CDL), is seeking a strategic and majority investor-cum-management party following the announced exit of Japan’s Onomichi.

The CDL announced yesterday that its Board of Directors have been informed by Onomichi Dockyard Company Ltd., of Japan, which is the Company’s majority shareholder, that it has decided to withdraw from the management of the Company and the management agreement it has had with the Company, respecting the Company’s intention to form a new strategic investor.

The CDL Board has been assured by Onomichi that it is prepared to exit from their investment in the Company by the disposal of its shares to any strategic investor who would be willing to make a commitment towards the Company.

“Preliminary discussions are already taking place with certain parties who have expressed an interest in investing into the Company. The Company has also informed its key creditors of the exit of Onomichi and the Board’s intent to continue its operations with a potential new partner and has received an assurance of support,” the CDL said in a filing to the Colombo Stock Exchange in tandem with a trading halt.

The Board of Directors also cautioned investors against unnecessary speculation on the shares of the Company, since there is no certainty whatsoever yet on the finality of an entry of a new investor or, even more so, the terms and conditions on which such engagement could be entered into.

Post announcement, the CDL share price closed at Rs. 63.30, up by Rs. 0.30 or 0.5%, with 104,706 shares traded for Rs. 6.5 million. Its net assets per share is Rs. 52.41.

Onomichi owns 51% stake or 36.65 million shares in the CDL since 1991. Other major shareholders are the Employees’ Provident Fund (16.34%), Sri Lanka Insurance Corporation (10%), and Sri Lanka Ports Authority (3%). The public float of the CDL is 49% held by 5,326 shareholders. Onomichi has served the shipbuilding industry since 1943. It has built over 500 ships, becoming one of the most experienced shipyards in Japan.

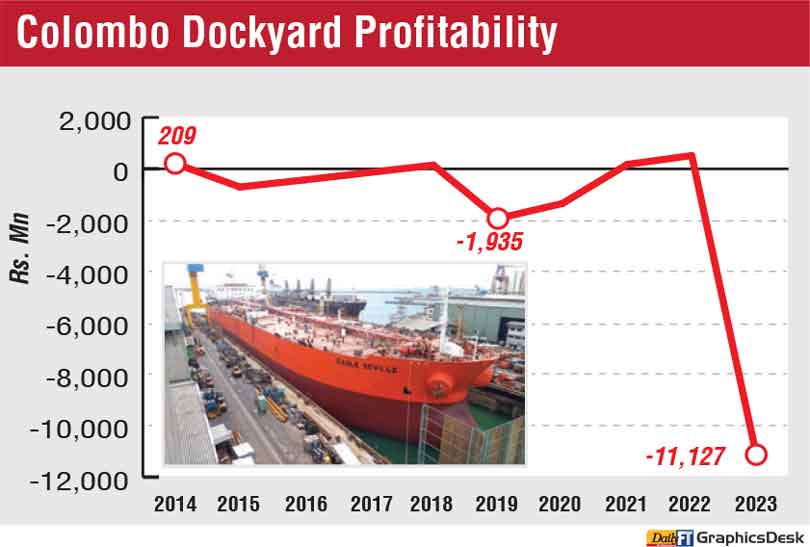

Difficult times faced by the CDL were revealed in its Annual Report of FY23, in relation to emphasis of matter on going concern. The CDL is faced with a financial crisis that has escalated over the years as a result of various external and internal factors.

“However, given the long-term potential of the Company’s business and other factors, such as the strategic advantage enjoyed by the Company by virtue of its location, the Board of Directors remains confident that it will be able to steer the Company out of the present crisis with the support and cooperation of its many stakeholders. The Board of Directors is also aware of the importance of the Company continuing its operations in the larger interests of its creditors, employees, and other stakeholders,” the CDL said in its disclosure yesterday.

The Board of Directors assured shareholders and all other stakeholders that it will keep them fully informed of any material developments that take place in the future.

In FY23, the CDL posted its worst year with a loss of Rs. 11 billion. In the first nine months of FY24, the CDL saw its revenue decline by 35% to Rs. 18.8 billion with an after-tax loss of Rs. 1.6 billion, down from Rs. 9.7 billion in the corresponding period of the last financial year.

In 2023, the total export revenue for the group amounted to Rs. 31.7 billion, marking a notable increase of 36% compared to the previous year’s export revenue of Rs. 23.3 billion. Norway emerged as the CDL’s primary overseas market, contributing 27% (Rs. 8.57 billion) to the total export revenue. India followed closely behind, accounting for 23% (Rs. 8.17 billion) while France secured the third position with 22% (Rs. 7.94 billion).

As at 30 September 2024, the CDL was saddled with a retained loss of Rs. 7.5 billion, up from Rs. 4.7 billion a year ago and Rs. 5.8 billion as at the end of FY23. Its total assets were Rs. 42.26 billion, as against Rs. 36 billion in end FY23. The CDL had long term liabilities worth Rs. 9 billion as at 30 September 2024, up from Rs. 4.4 billion as at 31 March 2024. Current liabilities were Rs. 29.5 billion up from Rs. 31 billion.

In August, in an announcement to mark the 50th anniversary, the CDL said, starting with harbour support vessels, the Company now builds complex cable layer vessels and hybrid bulkers. Its repair capabilities have expanded from small commercial vessels to larger and sophisticated vessels like VLGCs, dredgers, and offshore vessels. Additionally, heavy engineering achievements range from small-scale local projects to large steel structures and pioneering underwater restaurants.

Managing Director and CEO Thimira S. Godakumbura said the past few years have been extremely challenging for the Company. The impact from the Easter Sunday terrorist attack, the unprecedented impact from the COVID-19 pandemic, followed by the financial crisis in Sri Lanka, has been challenging and testing its limits. “Even with these troubling encounters, the CDL has demonstrated our resilience and commitment to excellence to adapt to these conditions,” he added.

Following the impending exit, Onomichi representatives on the CDL Board have resigned. They are T. Nakabe, K. Kobatake, and J. Flurukawa. L. Ganlath, who has been a Director of the Company since 1993, has been appointed Non-Executive Chairman.