Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 4 October 2021 04:13 - - {{hitsCtrl.values.hits}}

|

CB Governor Nivard Cabraal – Pic Lasantha Kumara

|

Despite criticism, concerns and questions over its findings of hoarding, the Central Bank is going ahead with tougher measures to ensure timely repatriation of export proceeds including by those engaged in export of services.

Recent revelations by the CBSL that nearly $ 3 billion worth of export earnings in the first eight months of 2021 were hoarded overseas by exporters without repatriation sparked widespread rebuttal by leading private sector export lobbies including the Joint Apparel Association Forum (JAAF), the Ceylon Chamber of Commerce-linked Exporters Association of Sri Lanka (EASL) and the Sri Lanka Association of Manufacturers and Exporters of Rubber Products (SLAMERP).

They also questioned the accuracy and credibility of CBSL’s assertion, as well as generalising thereby that the monetary authority was disrespectful of sectors and exporters who were not unscrupulous. The Daily FT learns several international banks overseas raised fresh concerns as the CBSL statement confirmed a new dimension to Sri Lanka’s foreign exchange crisis.

However, when unveiling CBSL’s Short Term Roadmap, Governor Nivard Cabraal responded to some of the criticism. He justified the statement on hoarding saying CBSL had enough data. “If earnings are being repatriated then fine, there is absolutely no issue. We (CBSL and exporters) are on the same page,” Cabraal said, adding that the concern was about those who hadn’t. “An export only becomes an export when proceeds are realised as converted rupees in Sri Lanka,” he added.

It was revealed that CBSL has got technical expertise from several countries to understand how they ensure timely repatriation of export proceeds. This was in response to export lobbies’ refutation of some of the Asian examples cited by CBSL. He also acknowledged that some exporters require imported inputs and new rules will facilitate the same.

At present there are no requirements on the repatriation of ‘export proceeds’ in trade in services, hence that too will come under new rules.

To ensure repatriation of export proceeds within the stipulated periods, CBSL via its Short Term Roadmap came up with specific measures.

Exporters will have to convert repatriated export proceeds into LKR after deducting the permitted amounts of forex for intermediate and investment inputs.

Exporters are also required to convert export proceeds already accumulated in forex deposits with banks from 2020 onwards in accordance with the Central Bank directions. For this CBSL exporters to proportionately convert accumulated balances within six months. Furthermore, the introduction of dedicated non-interest-bearing foreign currency accounts for export proceeds will encourage conversions.

Services exporters including IT/BPO sector must ensure repatriation and conversion of proceeds and adhere to systems that monitor forex flows related to services.

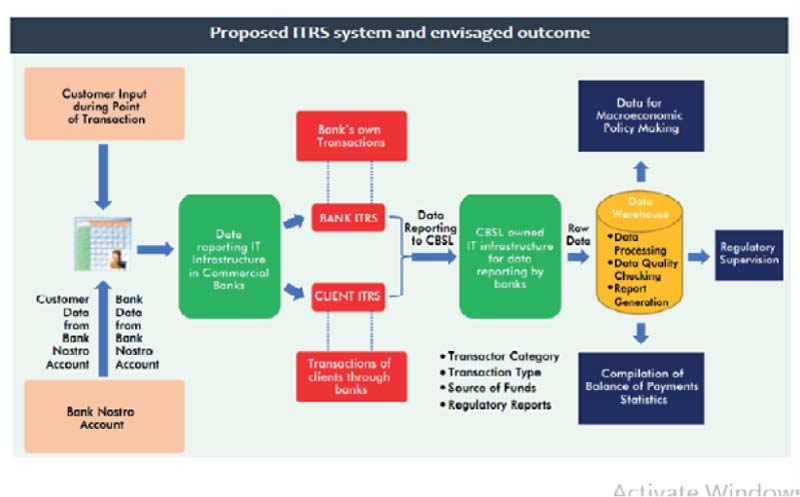

Cabraal said the CBSL had already initiated the implementation of an International Transaction Reporting System (ITRS) to track banking sector forex inflows and outflows with effect from 1 January 2022. The ITRS system would track performance of different export-oriented sectors, their funds repatriations and conversions. It would provide better data that would enable informed-decision making related to the external sector.

He also claimed that the band within which (Rs. 199 to Rs. 203) US Dollar exchange rate had to be traded until December 2021 was competitive for exporters. To back his position, Cabraal said: “A gap of around Rs. 32 per US Dollar exists between the current exchange rate and Real Effective Exchange Rate (REER) of Rs. 167.75 as per implied exchange rate of 24 competitor countries.”

In his remarks at the Short Term Roadmap unveiling, Cabraal recalled that a wide gap existed between the goods flow and financial flow of exports. Due to an undue speculation on exchange rate movements, there had been a reluctance to convert export earnings, thereby limiting inflows to the domestic foreign exchange market. He argued that inadequate repatriation/conversion of proceeds by exporters capitalising on interest rate arbitrage had constrained Government efforts to support the economy and the export sector itself. (For original CBSL statement see https://www.ft.lk/top-story/Exporters-hoarding-2-76-b-in-earnings-overseas-CB/26-723545).

In that context there was a necessity to ensure that the foreign exchange generated through export activities are duly repatriated into the country and converted to Sri Lankan Rupees.

To read more of the private sector response, access these links. https://www.ft.lk/front-page/Apparel-industry-refutes-CBSL-allegations-of-hoarding-foreign-currency-earnings/44-723710

https://www.ft.lk/front-page/Exporters-Association-perturbed-by-CBSL-allegations-of-hoarding-foreign-currency/44-723708

https://www.ft.lk/front-page/Rubber-product-exporters-express-concern-over-CBSL-allegation-on-repatriation-of-earnings/44-723648

Reaffirming its resilience, the export sector has achieved the fourth consecutive month of over $ 1 billion performance in September. Export earnings in the first nine months have grown by 19% to $ 8.8 billion. Services exports grew by 33% to $ 2.18 billion in the first eight months.

Officials have expressed confidence that exports in the remaining three months of 2021 would be well above $ 1 billion, and if it turned out to be so, Sri Lanka would have achieved the set target of $ 12 billion for exports this year. With services exports the total exports target is $ 16 billion.