Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 28 February 2022 00:00 - - {{hitsCtrl.values.hits}}

Private sector borrowings last year more than doubled aided by low interest rates and post-COVID return to normalcy.

return to normalcy.

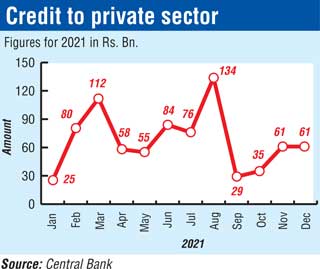

As per latest provisional data released by the Central Bank, private sector borrowing in December amounted to Rs. 61 billion bringing the full year total in 2021 to Rs. 811 billion as against Rs. 374 billion in 2020.

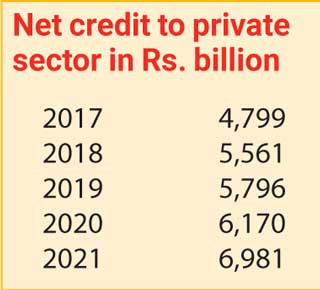

The cumulative credit outstanding to the private sector ended as at end 2021 neared the Rs. 7 trillion mark with Rs. 6.981 trillion, up 13% from end 2020.

In 2020, credit to the private sector grew by 6.5% or Rs. 374 billion. In 2019 the growth was only 4.2% to Rs. 6 trillion.

The expansion in borrowing is due to the low interest rate regime that prevailed for most part of 2021 as well as return to normalcy post-COVID induced lockdowns. However, interest rates have moved up gradually in tandem with the Central Bank’s partial tightening monetary policy in August last year followed by in January this year which saw policy rates hiked by 50 basis points. The CBSL expressed the need for a corresponding increase in interest rates, particularly in deposit rates, thereby encouraging savings, while discouraging excessive consumption, which also fuels imports.

rates, particularly in deposit rates, thereby encouraging savings, while discouraging excessive consumption, which also fuels imports.

Future direction of monetary policy as well as interest rates will be known after the Monetary Board meeting on Thursday.

According to Wealth Trust Securities, the yield on a three-year bond maturity was seen hitting 13% for the first time since March 2017 at its secondary market trading on Friday following its auction outcome.

At the auction, the three-year maturity of 01.08.2025 recorded a weighted average of 12.25% against its pre-auction yield of 11.15/25 while the 11-year maturity of 15.01.2033 recorded a weighted average of 13.14% against its pre-auction yield of 12.90/05, Wealth Trust added.