Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 30 September 2024 00:00 - - {{hitsCtrl.values.hits}}

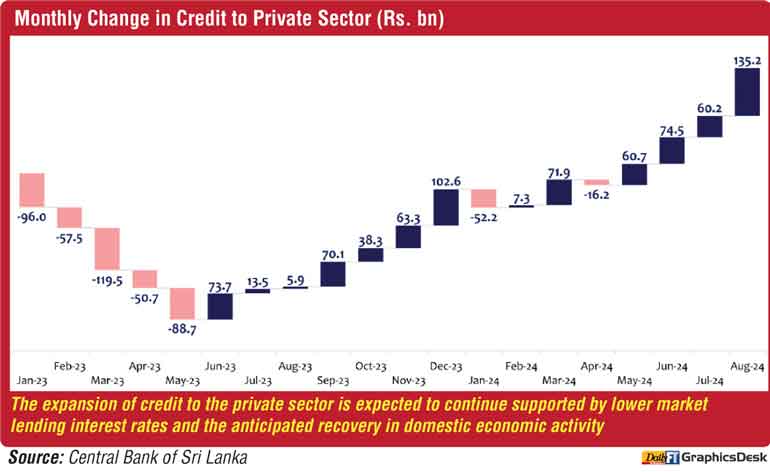

Private sector credit in August had shot up to a staggering and recent high of Rs. 135 billion, signalling its strong intent to grow amidst challenges.

The spike in August was amidst a favourable interest rate regime as well as an improved outlook.

The Central Bank said market lending interest rates continued to decline in line with the current accommodative monetary policy stance. Along with this decline, credit to the private sector by Licenced Commercial Banks (LCBs) has expanded notably since May 2024, Sectoral credit data for Q2-2024 indicates broad-based growth across all major economic sectors, it added.

“Looking ahead, the expansion of credit to the private sector is expected to continue, supported by lower market lending interest rates and anticipated recovery in domestic economic activity,” the CBSL added.

The CBSL, which kept policy rates unchanged, said as per the GDP estimates published by the Department of Census and Statistics (DCS), the economy is estimated to have grown by 4.7% (year-on-year) in Q2 2024, following an expansion of 5.3% (year-on-year) recorded in Q1 2024.

The latest economic indicators suggest that the robust growth outcome recorded in the first half of 2024 is likely to continue through the remainder of the year, resulting in a higher growth for 2024 than initially projected.