Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 8 October 2024 00:00 - - {{hitsCtrl.values.hits}}

The rise of Sri Lanka Rupee’s strength against the US Dollar is nearing the 10% mark aided by a recent spike following the election of Anura Kumara Dissanayake as the President.

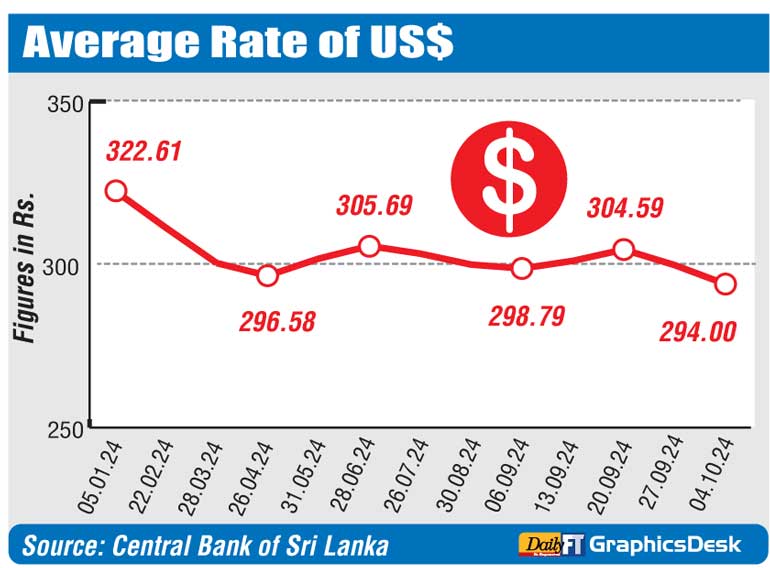

As of last week, according to the Central Bank of Sri Lanka (CBSL), the SLR has appreciated against the US Dollar by 9.6% year to date (YTD). In comparison, the YTD appreciation as of 13 September was 7.3%. Analysts said the currency has gathered strength since the 21 September Presidential election won by Anura Kumara Dissanayake.

Beginning a new week, the Rupee gathered further strength according to WealthTrust Securities.

It said in the Forex market, the USD/LKR on spot contracts continued to appreciate to close the day at Rs. 293.40/293.55 against its previous day’s (Friday) closing level of Rs. 294.00/294.35.

The average rate of the US Dollar last week was Rs. 294.00, as against Rs. 322.61 as per the CBSL. Last year, the Rupee saw an appreciation of 12.1% against the US Dollar.

The strengthening of the Rupee is largely attributed by analysts to re-rating of the currency amidst a favourable outlook and sentiment. However, leading up to the year-end festive season, the currency may come under pressure from a rise in imports.

Last week the CBSL said the external sector continued the positive momentum in August 2024 with robust inflows of workers’ remittances and a notable increase in exports, despite a slowdown in tourist earnings compared to the previous month.

Workers’ remittances increased to $ 4.28 billion in Jan-Aug 2024 compared to $ 3.86 billion in the corresponding period in 2023. Gross official reserves stood at $ 6 billion at the end of August 2024.

The merchandise trade deficit widened in August 2024 compared to August 2023, although it narrowed compared to July 2024.

Tourist earnings were estimated at $ 2.16 billion during Jan-Aug 2024 compared to $ 1.30 billion during Jan-Aug 2023. Up to September2024, the figure has improved to $ 2.34 billion.

The CBSL also said foreign investments in the CSE continued to record a net inflow in August 2024. Inflows amounted to $ 16.5 million as against $ 3.8 million outflow in August, whilst in the first eight months, inflows (to the primary and secondary market) were $ 181.5 million in comparison to outflows of $ 137 million.

The deficit in the merchandise trade account widened to $ 430 million in August 2024 from $ 307 million recorded in August 2023, driven by a relatively large expansion in import expenditure. However, the trade deficit declined compared to July 2024. The cumulative deficit in the trade account during January to August 2024 widened to $ 3.57 billion from $ 2.96 billion a year ago.

Earnings from merchandise exports recorded an increase of 9.5% year-on-year (YoY) to $ 1.22 billion in August 2024, recording the highest monthly earnings thus far in 2024.

Total inflows to the services sector, excluding earnings from tourism, were estimated at $ 327 million in August 2024, in comparison to $ 306 million a year ago. Sea transport services and computer and IT/BPO related services were the main contributors to the recorded inflows in the services sector, excluding earnings from tourism in August 2024.

Total services sector outflows were estimated at $ 322 million in August 2024, in comparison to $ 157 million in August 2023. Major contributors to the recorded outflows from the services sector in August 2024 were overseas travel and air transport.