Friday Feb 27, 2026

Friday Feb 27, 2026

Thursday, 2 November 2023 02:46 - - {{hitsCtrl.values.hits}}

SJB MP Dr. Harsha De Silva with SJB MP, Eran Wickramaratne

By Darshana Abayasingha

The main opposition Samagi Jana Balawegaya (SJB) yesterday blasted what it described as “hopeless and hapless” Government continues to heap burdens on its citizens through excessive taxation without effectively dealing with mounting wastage in the public sector.

The main opposition Samagi Jana Balawegaya (SJB) yesterday blasted what it described as “hopeless and hapless” Government continues to heap burdens on its citizens through excessive taxation without effectively dealing with mounting wastage in the public sector.

It also said little effort is being put to better target taxes and net those evading the system.

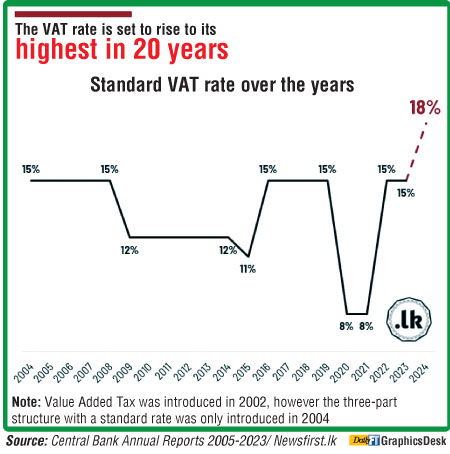

Discussing the increase of Value Added Tax from 15% to 18% come January 2024, SJB MP, Eran Wickramaratne told a media briefing yesterday that a primary balance cannot be achieved by boosting revenue alone, and the Government must pay closer attention to cutting costs and wastage.

He also noted that despite reports of a proposed salary increase to Government servants, the 3% increase in VAT is not sufficient to cover the resultant wages bill, and questioned how such measures would be funded.

“We must now work within a certain agreed framework where no money printing can be done. The SJB agrees Government revenue is below expectation and it must increase, but how taxes are directed is an issue. The increase in VAT is going to impact the poorer segments significantly. When they talk to the IMF they mustn’t agree on revenue alone. What about costs and wastage? This is not something we need external advice to achieve, it is common sense,” Wickramaratne said.

Referring to the energy price hike, the SJB MP added it was inappropriate to revise rates to cover flagging Government earnings, and noted the CEB and its operations must be benchmarked against global standards. Sri Lanka poses great potential for renewable energy, but all such efforts have been thwarted by corrupt officials, the MP remarked. Wickramaratne stated digitisation and renewables will be pursued aggressively under an SJB Government, to combat corruption and inefficiencies.

Joining the discussion, SJB MP Dr. Harsha De Silva said, voluntary Personal Income tax declarations were expected to hit Rs. 718 billion this year, but only Rs. 495 billion has been received so far. PAYE tax earnings were projected at Rs. 100 billion, but the Government has already earned Rs. 119 billion. Betting and gaming levies were expected to yield Rs. 10 billion and only Rs. 5.6 billion has been received yet, whilst Excise Tax poses a difference of Rs. 92 billion, De Silva added.

“Voluntary tax declarations are not working, and the yields are coming only from what is imposed on the working people. Rs. 553 billion was expected from VAT this year, and right now we are at Rs. 350 billion. What they are doing is Revenue Based Fiscal consolidation, and why are we not chasing those who are evading tax without fleecing those who are paying? This same Government made massive fanfare when they reduced VAT to 8% in 2019 and abolished PAYE tax and a host of others. This was a foolish move that led to this crisis. Now they are increasing taxes as if they have nothing to do with it,” he remarked.

De Silva who is also the Parliamentary Committee on Public Finance (COPF) Chairman, touched on the Alcohol Tax Stamp fraud, and noted the Justice Minister has pointed out the scam has cost the Government over Rs. 80 billion in losses. He noted excise collections will fall short of its target by about 25%, and some producers are avoiding paying tax with no action against them.

“The Excise Department said they will cancel licenses of all those who don’t pay taxes by early this week. We are yet to hear of any such cancellations. Implementation of laws and regulations is a grave issue and must be addressed. There is massive fraud taking place with alcohol tax stamps, but no action has been taken regarding the matter whatsoever. There are allegations the company concerned is selling stamps outside, but there is no action. We are allowing those evading tax to escape, and naturally this gives a right to the people to protest,” De Silva said.

The SJB MPs also stated it is imperative to appoint people with clean track records to key positions such as the Inspector General of Police, and there must be a concerted effort to improve transparency and accountability in the country. They noted the increased power tariffs will widen the gap between the haves and the have-nots, and even widening the gap in education.