Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 13 September 2021 00:00 - - {{hitsCtrl.values.hits}}

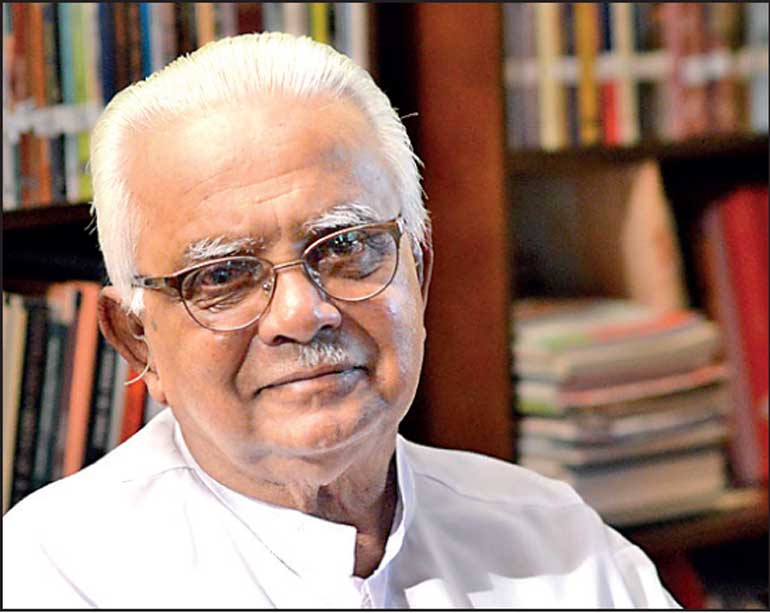

Dr. A.T. Ariyaratne

Sarvodaya Development Finance (SDF), with roots to iconic social empowerment leader A.T. Ariyaratne, is going public with a ground-breaking initiative.

SDF is bracing for a listing on the Colombo Stock Exchange with a Rs. 1 billion issue offering 30.38% stake or 45.45 million shares at Rs. 22 each.

Its net asset value is Rs. 21.28 and price to book value is Rs. 1.03 and Financial advisor NDB Investment Bank promoting the IPO as a 19% discount.

Sarvodaya Economic Enterprises Development Services (Gte) Ltd., currently owns 51.85% stake in SDF and post-IPO will hold 36%. Japan›s Gentosha Total Consulting Inc will reduce its stake from 13% to 9% and high net worth individual investor Dr. T. Senthilerl›s entity will reduce from 6.63% to 4.6%.

The IPO which has great significance to popularise the capital market among the masses is positioned as ‘A Catalyst in Creating an Economically Progressive Society, Living in Dignity’.

SDF is listing on the CSE to meet the dual objectives of fulfilling its regulatory core capital requirement and financing its ambitious growth plans. SDF is a licensed finance company formed in 2010 as the economic arm of the Sarvodaya Movement.

With a track record spanning over five decades, Sarvodaya Movement uplifts and empowers rural masses, has a strong brand presence and is a trusted name among Sri Lankans. SDF qualifies to be the first development finance company in Sri Lanka with a focus on the underserved and underfinanced rural economies.

Today SDF has transformed into a young, tech-savvy financial services specialist providing a diverse product range.

Sarvodaya Movement was founded in 1958 by Dr. A.T. Ariyaratne. At present, Sarvodaya Movement is the oldest, largest and most internationally acclaimed NGO in Sri Lanka.

SDF has 30 branches and 21 service centres. Its assets are worth Rs. 9 billion as at end FY21. Its interest income is Rs. 1.6 billion whilst profit was Rs. 183 million. Total shareholders’ funds amount to Rs. 2.1 billion with a 10.86% return on equity. It has a customer base of over 135,000 with 57% being women.

SDF has grown considerably with Micro Loans, Asset-Backed Loans, Society Loans, SME Loans, Leasing and deposit products.

It has plans to grow exponentially via a digital transformation plan. SDF’s current digital platforms will be further enhanced to make SDF a fully-fledged digital entity with seamless digital connectivity between clients and SDF offices.

This app will enable trusted and secured transactions helping them to have broad based ownership. As a result, SDF will promote economic opportunities for individuals, empowering them into micro and SME entrepreneurs, allowing workers to enjoy flexibility and freedom. SDF hopes that the ‘SDF Smart Village App’ will disrupt numerous industries and redefine the fundamentals of employment.