Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 31 October 2024 05:22 - - {{hitsCtrl.values.hits}}

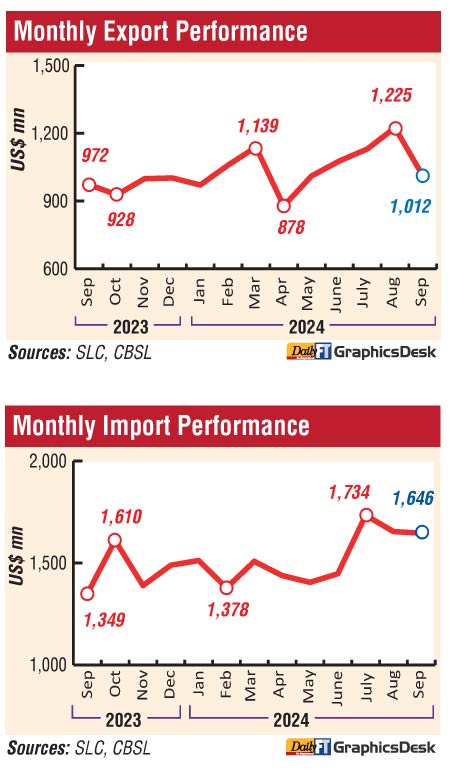

September exports grew 4.1% year-on-year (YoY), surpassing the $ 1 billion mark, while the trade deficit rose on higher imports, the Central Bank said yesterday.

September exports grew 4.1% year-on-year (YoY), surpassing the $ 1 billion mark, while the trade deficit rose on higher imports, the Central Bank said yesterday.

Despite the mixed performance, releasing the external sector report, the Central Bank pointed out reflecting continuous investor confidence, the financial account of the Balance of Payments (BOP) continued to strengthen during the month with higher foreign inflows to the Colombo Stock Exchange (CSE) and the government securities market. Subsequently, the overall balance recorded a surplus of $ 2.28 billion by end September 2024.

The deficit in the merchandise trade account widened to $ 634 million in September 2024 from $ 377 million recorded in September 2023, driven by a relatively larger expansion in import expenditure than that of export earnings.

The cumulative deficit in the trade account during January to September 2024 widened to $ 4,200 million from $ 3,341 million recorded over the same period in 2023.

Earnings from merchandise exports increased to $ 1,012 million in September 2024. Industrial exports led to this increase while agricultural and mineral exports declined.

The growth in industrial goods exports in September 2024 YoY was primarily driven by higher export earnings from textiles and garments (mainly garments), as well as petroleum products, although these exports declined compared to August 2024. Earnings from gems, diamonds and jewellery, and machinery and mechanical appliances declined.

Earnings from exports of agricultural goods declined mainly due to lower earnings resulting from lower export volumes of seafood, minor agricultural products, and tea, despite a rise in earnings from spices. Earnings from mineral exports also declined in September 2024.

Expenditure on merchandise imports recorded an increase of 22% YoY to $ 1,646 million in September 2024. Expenditure increased across all major import categories, with the largest increases in intermediate and investment goods.

Consumer goods imports increased in September 2024 compared to a year earlier, resulted by broad based increases in both food and beverages and non-food consumer goods imports.

Meanwhile, expenditure on intermediate goods imports increased primarily due to higher imports of textiles and textile articles, with a notable increase also seen in import of chemical products. However, despite import of crude oil in September 2024, expenditure on fuel declined due to both low prices and volumes of refined petroleum imports. Expenditure on investment goods also recorded an increase, driven by higher imports of machinery and equipment (mainly cranes).

Terms of trade, i.e., the ratio of the price of exports to the price of imports, deteriorated by 1.2% YoY, as the decline in the prices of exports surpassed the decline in the prices of imports.

The export volume index improved by 10.3%, while the unit value index declined by 5.6%, implying that the increase in export earnings in September 2024 compared to September 2023 can be attributed to higher export volumes.

Similarly, the import volume index increased by 27.6%, while the unit value index declined by

4.4%, implying that the increase in import expenditure in September 2024 compared to

September 2023 was driven by the volume effect.

In terms of the services sector, total inflows to the services sector, excluding earnings from tourism, were estimated at $ 311 million in September 2024 in comparison to $ 319 million in September 2023. Sea transport services and computer and IT/BPO related services were the main contributors to the recorded inflows in September 2024.

Total services sector outflows were estimated at $ 336 million in September 2024, in comparison to $ 162 million in September 2023. Major contributors to the recorded outflows from the services sector in September 2024 were overseas travel and air transport.

Foreign investments in the government securities market recorded a net outflow of $ 5 million in September 2024 resulting in a cumulative net outflow of $ 256 million during January-September 2024. Meanwhile, foreign flows to the CSE, including both primary and secondary market transactions, recorded a net outflow of $ 2 million in September 2024 and a cumulative net inflow of $ 43 million during January-September 2024.

Gross Official Reserves (GOR) stood at $ 6.0 billion at end September 2024, recording an increase of around $ 1.6 billion from end 2023. This includes the swap facility from the People’s Bank of China (PBOC), which is subject to conditionalities on usability. Net purchases of foreign exchange from the domestic foreign exchange market by the Central Bank amounted to $ 96 million (based on trade date) in September 2024. Meanwhile, import coverage of GOR (including the PBOC swap) amounted to 3.9 months of imports as at end September 2024.

The Sri Lankan rupee continued its appreciating trend. The Sri Lankan rupee recorded a notable appreciation in the month of October 2024 in line with the overall appreciation observed so far during the year. The Sri Lankan rupee appreciated by 10.3% against the US dollar during the year up to 30 October 2024.

Meanwhile, reflecting cross-currency movements, the Sri Lankan rupee appreciated against other major currencies, such as the euro, the pound sterling, the Chinese yuan, the Japanese Yen, the Indian rupee, and the Australian dollar, during the year up to 30 October 2024. In line with the nominal appreciation of the Sri Lankan rupee during the year up to September 2024, the real effective exchange rate against the basket of 24 currencies (REER 24) also appreciated. Accordingly, the REER 24 index increased from 70.2 at end December 2023 to 72.6 at end September 2024, reflecting a reduction in external competitiveness during the period.