Thursday Feb 19, 2026

Thursday Feb 19, 2026

Saturday, 4 February 2023 01:22 - - {{hitsCtrl.values.hits}}

The Ad Hoc Group of Sri Lanka Bondholders (Bondholder Group) yesterday informed the International Monetary Fund (IMF) of its willingness to engage in the efforts to restructure Sri Lanka’s external debt and restore its sustainability.

The Ad Hoc Group of Sri Lanka Bondholders (Bondholder Group) yesterday informed the International Monetary Fund (IMF) of its willingness to engage in the efforts to restructure Sri Lanka’s external debt and restore its sustainability.

In a letter to IMF Managing Director Kristalina Georgieva, the Bondholder Group said through its Steering Committee it stands ready to engage quickly and effectively with the Sri Lankan authorities to design and implement restructuring terms that would help Sri Lanka restore debt sustainability and allow the country to regain access to the international capital markets during the IMF Program period.

The Bondholder Group’s written representation is following its acknowledgment of the Sri Lankan authorities’ engagement with their official creditors towards a resolution of the current crisis and restoration of debt sustainability. Foreign private bond holders account for $ 14.5 billion or 31% of the $ 46.6 billion external debt outstanding.

The Bondholder Group further acknowledged that such engagement has recently resulted in the Government of India (in its letter to the IMF, dated 16 January 2023 (the “India Letter”)) delivering letters of financing assurances, committing to support Sri Lanka and contribute to its efforts to restore debt sustainability by providing debt relief and financing consistent with the IMF Extended Fund Facility Arrangement (the “IMF Program”) and the IMF Program targets indicated in the India Letter.

“Based on the limited information available to us at this time, including information contained in the India Letter, we understand that the IMF Program’s debt sustainability targets are identified as (i) reducing the ratio of public debt to GDP to 95% by 2032, (ii) limiting the central Government’s annual gross financing needs to GDP ratio to 13% in the period between 2027 and 2032, and central Government annual foreign currency debt service at 4.5% of GDP in every year between 2027 and 2032 and (iii) closing of the external financing gap,” the letter said.

Via the letter, the Bondholder Group confirmed to the IMF it is prepared to engage, through its Steering Committee, with the Sri Lankan authorities in restructuring negotiations consistent with the parameters of an IMF Program and the targets specified therein (the “IMF Program Targets”), which the Bondholder Group understands to be the targets identified in the India Letter; it being recognised that these negotiations will necessarily be further informed by the receipt of the forthcoming DSA.

Via the letter, the Bondholder Group confirmed to the IMF it is prepared to engage, through its Steering Committee, with the Sri Lankan authorities in restructuring negotiations consistent with the parameters of an IMF Program and the targets specified therein (the “IMF Program Targets”), which the Bondholder Group understands to be the targets identified in the India Letter; it being recognised that these negotiations will necessarily be further informed by the receipt of the forthcoming DSA.

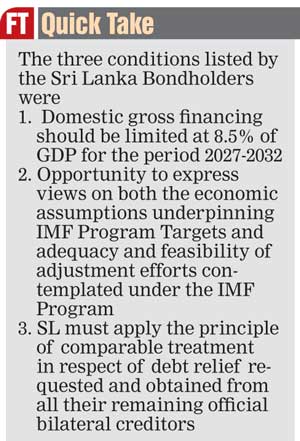

It noted that the finalisation of an agreement will also be subject to the satisfaction of the following conditions:

1. The central Government’s domestic debt – defined as debt governed by local law – is reorganised in a manner that both ensures debt sustainability and safeguards financial stability.

Assuming that annual gross financing needs should not exceed 13% of GDP in the period between 2027 and 2032, whilst allowing for central Government annual foreign currency debt service to reach 4.5% of GDP in every year between 2027 and 2032, domestic gross financing should therefore be limited at 8.5% of GDP for the period 2027-2032

2. While we recognise that the determination of the economic assumptions underpinning the IMF Program Targets is ultimately the responsibility of the IMF and that the overall design of the IMF Program is one that is negotiated between the IMF and Sri Lanka, it is nevertheless important that the Bondholder Group has the opportunity to express its views on both the economic assumptions underpinning these IMF Program Targets and the adequacy and feasibility of the adjustment efforts contemplated under the IMF Program.

When considering any restructuring proposal that is made to the Bondholder Group, it is the Bondholder Group’s intention to take into consideration the extent to which the economic assumptions and the adjustment efforts are consistent with these views

3. Recognising the important commitments made by India in the India Letter, the Sri Lankan authorities will apply the principle of comparable treatment in respect of the debt relief requested and obtained from all their remaining official bilateral creditors