Monday Feb 23, 2026

Monday Feb 23, 2026

Saturday, 2 March 2024 01:19 - - {{hitsCtrl.values.hits}}

Sri Lanka’s trade deficit widened by $ 96 million to $ 541 million in January a year earlier fuelled by higher increase in imports aided by Government policies, latest data from the Central Bank showed yesterday.

In a month-to-month comparison, the trade deficit data in January reflects an increase compared to the deficit of $ 487 million in December2023. The overall trade deficit in 2023 amounted to $ 4.9 billion.

Terms of trade, i.e., the ratio of the price of exports to the price of imports, declined by 3.6 % year-on-year (YoY), as the decline in the prices of exports surpassed the decline in the prices of imports.

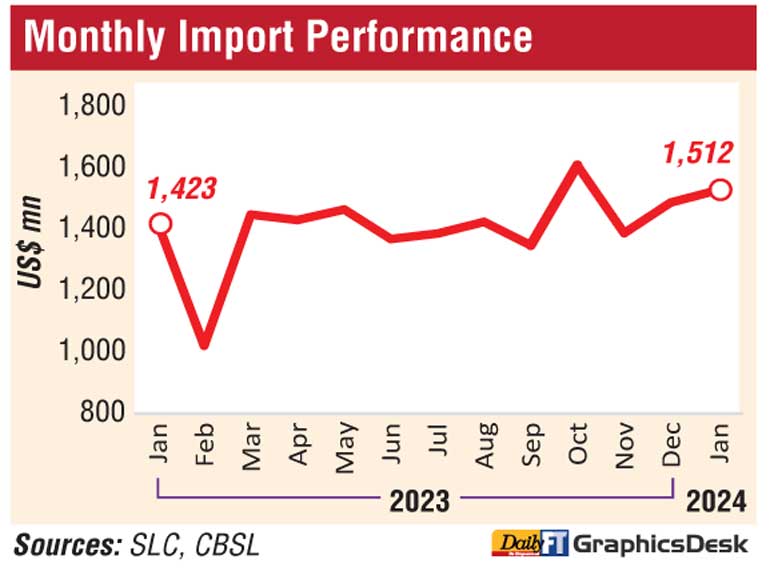

Expenditure on merchandise imports increased by 6.2% to

$ 1,512 million in January 2024 compared to $ 1,423 million in January 2023. The increase in expenditure on consumer goods and investment goods partly driven by the relaxation of import restrictions contributed to this increase.

The import volume index improved by 7.7%, while the unit value index declined by 1.4%, implying that the increase in import expenditure in January 2024 was driven by the volume effect.

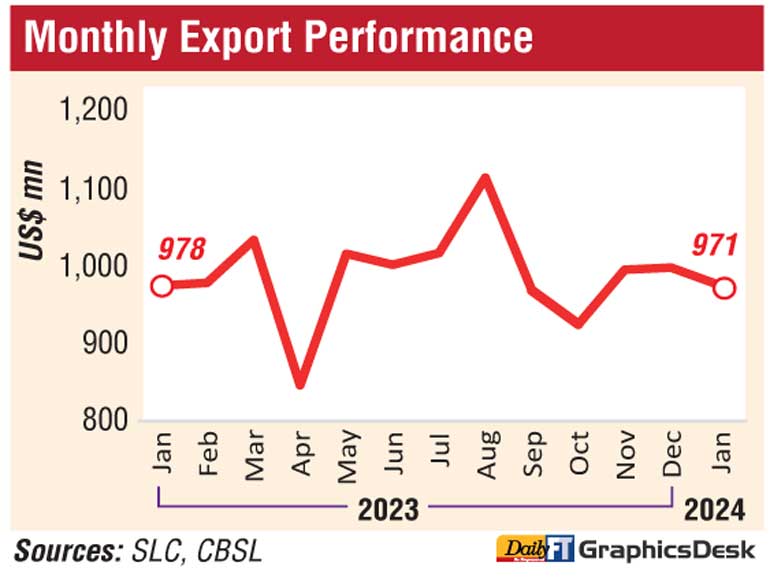

Earnings from merchandise exports recorded a marginal decline of 0.8% to $ 971 million in January 2024 compared to

$ 978 million in January 2023.

A decline in earnings was observed in industrial exports and mineral exports, while agricultural exports increased in January 2024.

The export volume index increased by 4.4%, while the unit value index declined by 4.9%, implying that the marginal decline in export earnings in January 2024 can be attributed to the lower export prices.

Detailing imports, Central Bank said expenditure on the importation of consumer goods increased by 28.8% YoY to $ 281.3 million in January 2024 compared to a year ago reflected by a broad-based increase in expenditure on both food and non-food consumer goods.

However, the expenditure on intermediate goods imports declined by 2.5% YoY to $ 980.5 million driven by lower fuel imports partly owing to higher hydro power generation. In January 2024, the total fuel bill decreased by 19.2% YoY to $ 417.5 million. In December 2023, the total fuel bill was $ 414.2 million.

In contrast, expenditure on base metals increased notably, while expenditure on textiles and textile articles imports also increased. Expenditure on investment goods increased mainly driven by higher imports of machinery and equipment while expenditure on building material imports also increased, owing to higher iron and steel imports.

Detailing export performance, the Central Bank said the industrial goods exports declined by 1.3% YoY to $ 771.5 million in January 2024 mainly contributed by garments, resulting from lower exports of garments to most major markets. However, earnings from petroleum products increased due to the increase in volumes of bunkering and aviation fuel exports.

Earnings from the exports of agricultural goods improved in January 2024 to $ 195 million compared to a year ago, mainly contribute by minor agricultural products, coconut related products, and tea. Meanwhile, earnings from mineral exports declined due to the base effect of higher exports of zirconium ores in January 2023.

Meanwhile, sea transport, air transport and computer and IT/BPO related services were the major contributors to the inflows to the services sector in January 2024. Total services sector inflows (excluding earnings from tourism) were estimated at $ 248 million in January 2024, in comparison to $ 259 million in January 2023.

The major outflows from the services sector in January 2024 were mainly attributed to air transport, sea transport, and management and consulting services. Total services sector outflows were estimated at $ 183 million in January 2024, in comparison to $ 148 million in January 2023.